Order Flow Footprint

- Indicatori

- Pusita Worapong

- Versione: 3.0

- Attivazioni: 5

🎯 Overview

The Order Flow Footprint Indicator transforms your MetaTrader 5 charts into a professional order flow analysis tool, displaying detailed Buy/Sell volume distribution at each price level. This indicator provides institutional-grade insights into market dynamics, helping traders identify key support/resistance zones, absorption patterns, and momentum shifts.

✨ Key Features

📊 Visual Footprint Display:

- Buy and Sell volume separated at each price level

- Color-coded heatmap (Green = Buying, Red = Selling, Gray = Neutral)

- Gradient color intensity based on order flow imbalance

- Clean, professional cell-based layout

- Customizable price levels per bar (10-20 recommended)

📈 Advanced Metrics:

- Delta (Δ) - Real-time Buy/Sell difference calculation

- Imbalance % - Percentage-based strength indicator

- Volume Distribution - Precise volume at each price level

- Absorption Detection - Identify when large orders are absorbed

- Point of Control (POC) - Automatic highlighting of max volume levels

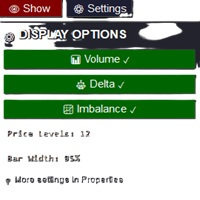

🎨 Professional Interface:

- Interactive Show/Hide button for clean chart viewing

- Settings Panel with real-time toggles (Volume/Delta/Imbalance)

- Status Bar with detailed information on mouse hover

- Responsive design that adapts to chart zoom levels

- Auto-adjusting font sizes for optimal readability

⚙️ Highly Customizable:

- Adjustable price levels (1-50)

- Custom color schemes for Buy/Sell/Neutral zones

- Configurable bar width (70-100%)

- Font size and style options

- Imbalance threshold settings

- Gradient intensity controls

🚀 Performance Optimized:

- Only renders visible bars for fast performance

- Efficient object management

- Smooth zooming and scrolling

- Works on all timeframes (M1 to MN1)

- Compatible with all instruments (Forex, Stocks, Futures, Crypto)

📊 What You Get

Order Flow Analysis:

- Buy vs Sell volume at each price

- Delta calculations showing net buying/selling pressure

- Imbalance percentages highlighting strong moves

- Volume nodes for support/resistance identification

Trading Signals:

- Absorption - Detect when price moves against volume

- Delta Divergence - Spot momentum shifts early

- Stacked Imbalances - Identify strong trending moves

- Volume Exhaustion - Catch potential reversals

- Unfinished Auctions - Find continuation patterns

Professional Tools:

- Point of Control (POC) identification

- High Volume Nodes (HVN) and Low Volume Nodes (LVN)

- Initiative vs Responsive trading analysis

- Volume profile integration

💡 How It Works

The indicator analyzes tick volume data and distributes it across price levels within each bar, simulating institutional order flow patterns. While it uses tick volume (not actual order flow), the algorithm intelligently calculates buy/sell distribution based on:

- Price direction (bullish/bearish bars)

- Volume concentration at different price levels

- Momentum and price action context

- Statistical distribution models

🎓 Use Cases

For Day Traders:

- Identify optimal entry/exit points

- Spot absorption at key levels

- Trade breakouts with volume confirmation

- Scalp with order flow direction

For Swing Traders:

- Find major support/resistance zones

- Identify trend exhaustion

- Confirm breakout validity

- Time entries with volume clusters

For Position Traders:

- Analyze institutional accumulation/distribution

- Identify major turning points

- Confirm long-term trend strength

- Find value areas for entries

📖 Trading Strategies Included

1. Absorption Trading

- Identify when price rises but selling dominates

- Fade moves at absorption zones

- High probability reversal setups

2. Imbalance Continuation

- Trade stacked imbalances (60%+ in same direction)

- Follow institutional momentum

- High win-rate trend following

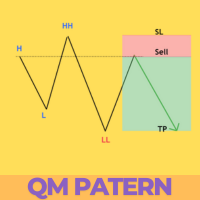

3. Delta Divergence

- Spot early reversal signals

- Price makes new high, delta doesn't confirm

- Powerful momentum shift indicator

4. Volume Node Trading

- Buy at High Volume Nodes (support)

- Sell at High Volume Nodes (resistance)

- Quick moves through Low Volume Nodes

5. Unfinished Auction

- Bar closes at high/low with strong imbalance

- Likely continuation setup

- Great for breakout trading