Rejoignez notre page de fans

- Vues:

- 6508

- Note:

- Publié:

-

Besoin d'un robot ou d'un indicateur basé sur ce code ? Commandez-le sur Freelance Aller sur Freelance

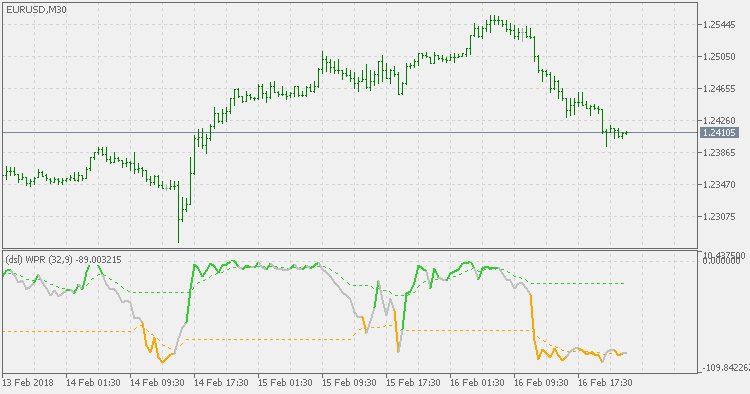

Williams' Percent Range Technical Indicator (%R) is a dynamic technical indicator, which determines whether the market is overbought/oversold. Williams' %R is very similar to the Stochastic Oscillator. The only difference is that %R has an upside down scale and the Stochastic Oscillator has internal smoothing.

- Indicator values ranging between -80% and -100% indicate that the market is oversold.

- Indicator values ranging between -0% and -20% indicate that the market is overbought.

To show the indicator in this upside down fashion, one places a minus symbol before the Williams' Percent Range values (for example -30%). One should ignore the minus symbol when conducting the analysis.

The DSL version of Williams' Percent Range does not use fixed levels for oversold and overbought levels, but is having a sort of dynamic (discontinued signal lines) calculated to identify those levels. That makes it a bit more responsive to market changes and volatile markets.

Nonlinear Kalman filter

Nonlinear Kalman filter

One more from the creations of John Ehlers - nonlinear Kalman filter.

Kalman bands

Kalman bands

This is a conversion of Kalman bands originally developed by Igor Durkin. Values are the same as MetaTrader 4 version except that we are using possibilities that MetaTrader 4 does not have to make the indicator easier to use.

DSL - stochastic

DSL - stochastic

The DSL (Discontinued Signal Line) version of Stochastic does not use a moving average in a classical way for signals, but is instead calculating the signal lines depending on the value(s) of the stochastic. Thus, we are having two things : a signal line and a sort of levels that can be used for overbought and oversold estimation.

DSL - extended stochastic

DSL - extended stochastic

The usual average that is used for stochastic calculation is simple Moving Average (SMA). This (extended) version allows you to use any of the 4 basic types of averages (default is SMA, but you can use EMA, SMMA or LWMA too) - some are "faster" then the default version (like EMA and LWMA versions) and SMMA is a bit "slower", but this way you can fine tune the "speed" to signals ratio.