Zone Recovery Hedge

- Utilidades

- Shokhboz Mamarasulov

- Versión: 1.0

- Activaciones: 5

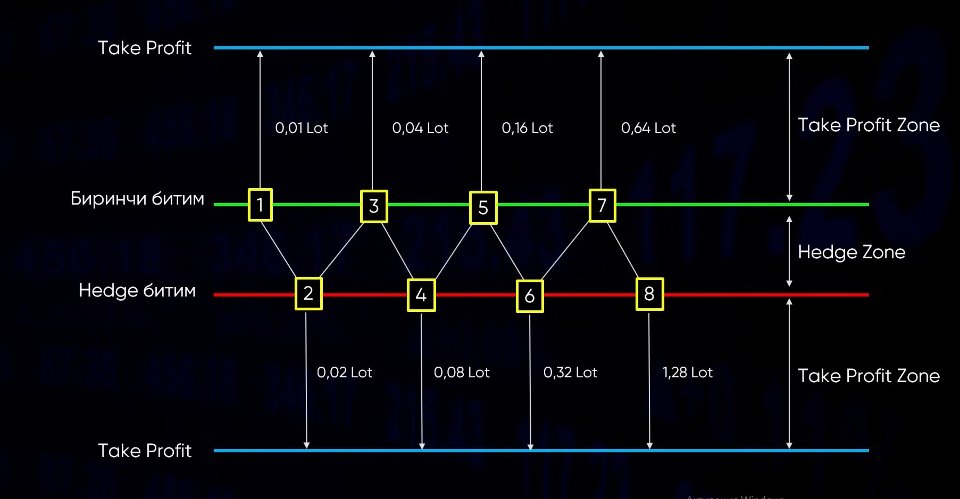

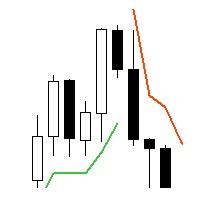

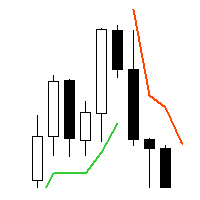

La estrategia Zone Recovery Hedge funciona creando una zona de precios entre dos niveles (por encima y por debajo del precio de entrada actual). En lugar de cerrar una posición perdedora con un stop loss, el sistema abre una posición opuesta (de cobertura) cuando el precio se mueve en contra de la operación. Esto crea una "zona" en la que los movimientos futuros pueden ayudar a recuperar la pérdida.

-

Operación inicial: Se coloca una orden de compra o venta.

-

Definición de zona: Se establece una distancia fija (en pips) desde la entrada para activar una orden de cobertura en la dirección opuesta.

-

Operación decobertura: Si el precio se mueve hacia la zona opuesta, se abre una operación de igual o mayor tamaño de lote en la dirección opuesta.

-

Mecanismo de recuperación: A medida que el precio continúa moviéndose dentro o fuera de la zona, se pueden estratificar operaciones de cobertura adicionales. El sistema pretende obtener beneficios cuando el precio salga de la zona, cubriendo las pérdidas flotantes anteriores.

-

Tamaño del lote: A menudo utiliza martingala (aumento del tamaño de los lotes) o volúmenes de cobertura fijos para acelerar la recuperación.

-

Condición de salida: Cuando las operaciones combinadas alcanzan un beneficio neto, se cierran todas las posiciones.