Market Condition Evaluation based on standard indicators in Metatrader 5 - page 130

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Gold is Reaching at 1270

Sergey Golubev, 2013.07.01 21:04

How can we know: correction, or bullish etc (in case of using indicator for example)?

well ... let's take AbsoluteStrength indicator from MT5 CodeBase.

bullish (Bull market) :

bearish (Bear market) :

ranging (choppy market - means: buy and sell on the same time) :

flat (sideways market - means: no buy and no sell) :

correction :

correction in a bear market (Bear Market Rally) :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.12 08:56

EUR/USD: calm before storm - Barclays (based on efxnews article)

Barclays made a fundamental forecast for EURUSD expecting big volatility for this pair and for USD/JPY as well:

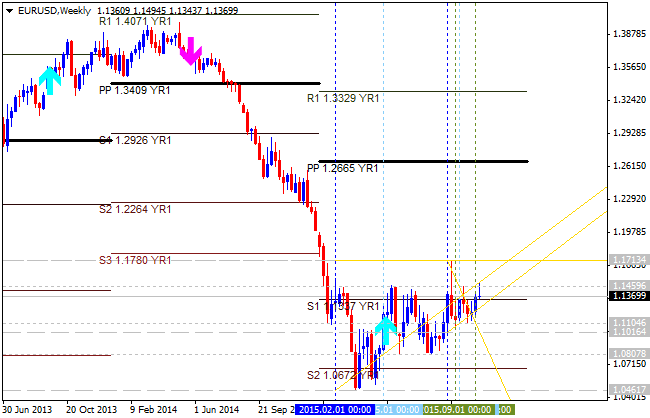

So, Barclays is still keeping sell position with 1.0460 take profit and stop loss as 1.1562. And as we see from the chart above - the price is on bearish market condition for the secondary ranging within 1.0461 key support level and 1.1713 key resistance level, so 1.0460 may be the real bearish target at year-end for example.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.13 08:57

EURUSD Intra-Day Fundamentals - ZEW Economic Sentiment (based on efxnews article)

Credit Agricole made a fundamental forecast concerning ZEW news event - German ZEW Economic Sentiment and ZEW Economic Sentiment. It's a leading indicator of economic health - investors and analysts are highly informed by virtue of their job, and changes in their sentiment can be an early signal of future economic activity:

From the technical point of view - EURUSD price is on bullish market condition in intra-day basis for the ranging within 1.1396 key resistance level and 1.1343 key support level. The 'reversal' level for this pair is 1.1270 so if the price breaks this support level from above to below - the reversal from the primary bullish to the primary bearish market condition may be started.Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.14 09:47

EURUSD Intra-Day Fundamentals - USD Into Retail Sales (based on efxnews article)

BNP Paribas made fundamental forecast concerning Retail Sales news event for today:

From the technical points of view - the price is located to be above 200 period SMA and above 100 period SMA for the bullish breakout: the price broke key resistance levels in intra-day basis and stopped near 1.1469 level. If the price will break this 1.1469 resistance level from below to above so the bullish breakout will be continuing, otherwise - ranging bullish.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.15 11:11

Outlooks For EUR/USD: Sell Signal - SEB (based on efxnews article)

Skandinaviska Enskilda Banken made a technical forecast for EUR/USD pair related to intra-day and day basis:

Thus, SEB is estimating two key levels for this pair: 1.14 in intra-day base and 1.15 on long term situation. Anyway, the bearish AB=CD pattern was formed on W1 timeframe together with the bearish retracement pattern so we can expect more bearish situation with this pair in the few coming weeks for example.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.16 09:35

3 reasons to sell EUR/USD - BNP Paribas (based on efxnews article)

BNP Paribas suggested to make a short with EUR/USD with 1.0900 target and 1.1630 stop loss, and it is based on 3 fundamental reasons:

"We entered a short EUR/USD position with a target at 1.0900, and a stop at 1.1630."Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.18 18:35

EUR: outlook for the coming week by Morgan Stanley (based on efxnews article)

EUR: Bullish

"We believe that EURUSD could head higher before we see pushback from the ECB. Indeed, we don’t expect anything from next week’s meeting. Our base case is for no further easing, but in the tail risk that the central bank does decide to do more, this would be likely to come in December alongside the ECB’s new forecasts. With further action from the ECB unlikely in the near term, and US rates falling, EUR is becoming less attractive as a short term funder, offering it support."

From the technical point of view - the price is on primary bearish market condition for the ranging between the following key support/resistance levels:

The price may start the bear market rally by the breaking 1.1459 and 1.1713 resistance levels from below to above, and we may see the local uptrend in this case only for example.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.19 08:08

Trading The ECB: the most likely scenario, key levels and EUR/USD forecasts (based on efxnews article)

As ECB will take center stage this week so Barclays Capital made some fundamental and technical forecasts concerning EUR/USD.

Fundamental Forecast.

Technical Forecast.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.21 06:27

Trading setup for EUR/USD by Barclays Capital (based on efxnews article)

Barclays Capital made a technical forecast for EUR/USD explaining their position opened with key targets:

So, they opened sell trade at 1.1335 with 1.1260 as an initial target having re-enter to 1.1105/1.1085 targets in case the price will move to below 1.1260. If we see from the chart above - there are the following targets for this pair:

Thus, if the price breaks 1.1086 support level from above to below so the next profit targets will be 1.0807, if the price breaks 1.1713 resistance level from below to above so profit level will be 1.1956.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.22 09:13

EUR/USD - in view of ECB meeting (based on efxnews article)

United Overseas Bank made a fundamental forecast concerning ECB’s meeting later today:

As we see from the image above - the nearest support level is 1.1305 located on the border between the primary bearish and the primary bullish on the chart, and if this level is going to be broken so we may see the bearish reversal to be started by the daily price for example.