Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.17 08:55

Weekly Outlook: 2015, October 18 - 25 (based on forexcrunch article)

The US dollar showed weakness against most currencies as the data proved weak. Is this a change of direction? Mark Carney’s and Janet Yellen’s speeches, US Building Permits, and rate decisions in Canada and the Eurozone stand out. These are the major events on forex calendar. Here is an outlook of the top events for this week.

Last week U.S. Retail sales and Philly Fed Manufacturing Index missed expectations reducing chances for a Fed rate hike this year. Retail sales report inched up 0.1% while expected a 0.2% gain. Philadelphia Manufacturing Index contracted for the second month in October. The better inflation numbers allowed the dollar to recover, especially against the euro, which was hit by its own central bank. Commodity currencies were mixed, each to its own, with the Aussie being the weaker link.

- Mark Carney speaks: Tuesday, 10:00. BOE Governor Mark Carney will speak in London. Consumer prices have dropped 0.1% in September, putting further pressure on Bank of England governor Mark Carney to push prices up in order to reach the inflation target of 2.0%. Furthermore, additional downside risks such as Global weaknesses and domestic economy still exist. Market volatility is expected.

- US Building Permits: Tuesday, 12:30. The number of building permits edged up 3.5% in August to a seasonally adjusted annual rate of 1.17 million, following 1.13 million in July. Economists expected a smaller rise to an annual rate of 1.15 million. On a yearly base, the number of permits were up 12.5% compared to August 2014 indicating a positive trend in the housing sector, despite the slower release of housing starts. The number of permits are expected to reach 1.16 million tis time.

- Janet Yellen speaks: Tuesday, 15:00. Federal Reserve Chair Janet Yellen will speak in Washington DC. Yellen stated at the FOMC press conference that despite postponing the rate hike in September, she still sees a rate rise in 2015. However, the climate among policymakers has changed. Two FOMC members voiced their objection for a rate hike in 2015 and Yellen may have to face multiple dissents from the dovish wing of the FOMC. Market volatility is expected.

- Canadian rate decision: Wednesday, 14:00. The Bank of Canada maintained its interest rate at 0.5% on its September meeting, noting the previous two rate cuts in January and July were still boosting economic growth. However, global market uncertainty, especially in China, continues to trouble policymakers and exporters alike. Economists reduced their expectations of a rate cut in October to a 19% from a 32% chance beforehand.

- Eurozone rate decision: Thursday, 11:45. The European Central Bank kept its interest rates at record lows in September. The European Central Bank downgraded its inflation forecast to 1.1% next year, leaving the door open for an expansion of its bond-buying program. Draghi said the quantitative easing program, could run “beyond” its original deadline of September 2016. However, the Governing Council is not too concerned with the low inflation levels, claiming it is the temporary effect of the slump in oil prices.

- US Unemployment Claims: Thursday, 12:30. The number of new claims for U.S. state unemployment benefits dropped by 7,000 to 255,000 last week, the lowest level in 42 years. The better than expected release followed a 263,000 reading in the week before. The four-week moving average also hit the lowest rate since 1973 and continuing claims for the previous week fell to their lowest in 15 years, indicating the US labor market remains resilient. The number of jobless claims is expected to reach 266,000 this week.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.18 18:35

EUR: outlook for the coming week by Morgan Stanley (based on efxnews article)

EUR: Bullish

"We believe that EURUSD could head higher before we see pushback from

the ECB. Indeed, we don’t expect anything from next week’s meeting. Our

base case is for no further easing, but in the tail risk that the

central bank does decide to do more, this would be likely to come in

December alongside the ECB’s new forecasts. With further action from the

ECB unlikely in the near term, and US rates falling, EUR is becoming

less attractive as a short term funder, offering it support."

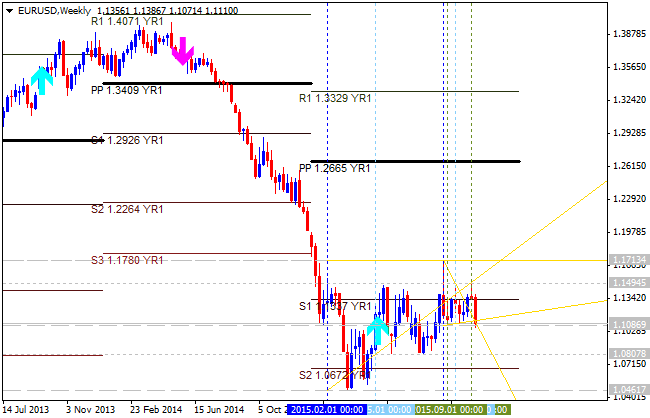

From the technical point of view - the price is on primary bearish market condition for the ranging between the following key support/resistance levels:

- 1.1956 resistance level, and

- 1.0607 support level.

The price may start the bear market rally by the breaking 1.1459 and 1.1713 resistance levels from below to above, and we may see the local uptrend in this case only for example.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.19 08:08

Trading The ECB: the most likely scenario, key levels and EUR/USD forecasts (based on efxnews article)

As ECB will take center stage this week so Barclays Capital made some fundamental and technical forecasts concerning EUR/USD.

Fundamental Forecast.

- "An increasingly cautious Fed, coupled with an uncertain EM outlook, has benefited the EUR recently, contributing to tighter euro area financial conditions. Coupled with the recent drop in inflation expectations, such tightening has significantly raised expectations for additional ECB stimulus, making this week’s ECB meeting (Thursday) the market’s key focus."

-

"The most likely

scenario, in our view, is a continuation of the dovish rhetoric,

followed by the announcement of a QE time extension in December, when

the ECB updates its Q4 15 staff economic forecasts."

- "Moreover, recent price action in front-end euro rates suggests

that the market is pricing a non-zero probability for a further deposit

rate cut. While we do not rule out this possibility, we do not think it

is an option for the next two meetings. However, we estimate

that the rates market is already pricing a 20% likelihood of a 10bp

deposit rate cut before year-end. In our view, a likely trigger for a

rate cut would be a further material appreciation of the euro, possibly

related to more signs that the Fed will remain on hold for longer.

Although a measure of last resort, such policy action would be the most

effective in weakening the EUR."

- "We expect more monetary easing before year-end. We believe that the details and magnitude matter for the price action of the EUR, as an extension and increase in the QE program would probably have less of an effect than an outright cut in the deposit rate. We think that it is just a matter of time until the ECB decides to drive EURUSD lower."

- "We believe that amid a lack of policy options, the ECB will step in in the months to come to try to fulfill its inflation mandate. As such, we expect further EUR downside. Our view should be supported by further USD strength, as monetary policy expectations in the US seem too benign compared with the healthy dynamics of internal demand in the US."

Technical Forecast.

- "We recommend buying a 3m 25delta EURUSD risk-reversal (EUR put/USD call) for a cost of 13.2bp (strikes: 1.1004, 1.1737, spot ref: 1.1357, atm vol: 9.19%), which offers a compelling risk-reward should EURUSD break below its recent range."

- "We maintain a short EUR/USD from 1.1278 targeting a move to 1.0460, with a stop at 1.1562."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.21 06:27

Trading setup for EUR/USD by Barclays Capital (based on efxnews article)

Barclays Capital made a technical forecast for EUR/USD explaining their position opened with key targets:

- "The move below 1.1335 encourages our bearish view. Our initial targets are near 1.1260. A move below 1.1260 would open our next targets in the 1.1105/1.1085 area."

So, they opened sell trade at 1.1335 with 1.1260 as an initial target having re-enter to 1.1105/1.1085 targets in case the price will move to below 1.1260. If we see from the chart above - there are the following targets for this pair:

- 1.1086 as the nearest bearish target with 1.0807 and 1.0607 as the next bearish levels;

- 1.1713 as the nearest bullish target with 1.1956 as the next bearish level.

Thus, if the price breaks 1.1086 support level from above to below so the next profit targets will be 1.0807, if the price breaks 1.1713 resistance level from below to above so profit level will be 1.1956.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.22 09:13

EUR/USD - in view of ECB meeting (based on efxnews article)

United Overseas Bank made a fundamental forecast concerning ECB’s meeting later today:

- "With daily MACD heading lower and with internal momentum showing signs of weakness, the bias appears to be greater on the downside. However, 1.1300 is a major support and this level has to break before a sustained down-move in EUR can be expected in the coming days."

- "That said, the next support is not that far away at 1.1240 and being a cluster of supports, this is clearly a major level. The next significant support below 1.1240 is closer to 1.1085."

- "Overall, a move to 1.1415/20 resistance will not be surprising but at this stage, 1.1460 appears to be strong enough to contain any EUR strength in the next couple of days."

As

we see from the image above - the nearest support level is 1.1305

located on the border between the primary bearish and the primary

bullish on the chart, and if this level is going to be broken so we may

see the bearish reversal to be started by the daily price for example.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.23 07:32

Post ECB rate decision event review - BNP Paribas (based on efxnews article)

The ECB left policy unchanged and Mario Draghi delivered the maximum level of dovishness at the press conference.

- "Specifically, he said that the degree of policy accommodation will be re-examined in December and that all policy instruments are being considered, including a further cut in the deposit rate. He also said the ECB is “vigilant” on inflation – a key word that in the past has been used to indicate imminent action."

-

"The bottom line is that the December meeting now appears more a

question of ‘how’, rather than ‘whether’, the ECB will ease policy

further."

- For the outlook for the EUR, we notes that the mention of the possibility of a further cut in the deposit rate was important as this is the policy tool that would probably have the most direct impact on eurozone front-end rates."

- "However, we would also highlight the role of asset purchases for real rates, which Mr Draghi mentioned specifically once again. A key driver of EUR weakness early this year was a consistent rise in inflation expectations which drove real rates further into negative territory and led to portfolio capital outflows. If these dynamics are restored, the EUR should return to a weakening path."

-

"EUR shorts were largely

unwound in Q2-Q3 and EUR positioning has turned the most bullish since

2013. After ECB meeting the market is likely to be biased to rebuild short positions, selling into any EUR rallies."

-

"We maintain EUR/USD short from 1.1450

targeting 1.09 and EUR/GBP short from 0.7395 targeting 0.70."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.24 17:44

EUR/USD: levels and targets by Societe Generale (based on efxnews article)

Societe Generale made a weekly technical forecast concerning the EUR/USD:

- "Considering a largely negative close this week, EUR/USD will form an evening star, a candlestick pattern that signals possibility of down move. It is noteworthy that this evening star coupled with a shooting star back in August gives bearish connotations."

- "As such, SocGen thinks that the current break below 1.1085 means a retest of multi decadal channel support at 1.05/1.04 with intermittent targets at 1.0940 and May lows of 1.08."

- "This massive channel remains the decisive level for next leg of downtrend as a move below 1.05/1.04 will confirm that the ongoing correction is not just a retracement of the up move since 2000 but in fact of the whole up cycle since the 1980s."

As we see from the chart above - the nearest support level is 1.1086, and it is going to be crossed on the weekly open bar. The next support levels as the next bearish taregts are 1.0807 and 1.0607. And the 'final' taregt si 1.0461.

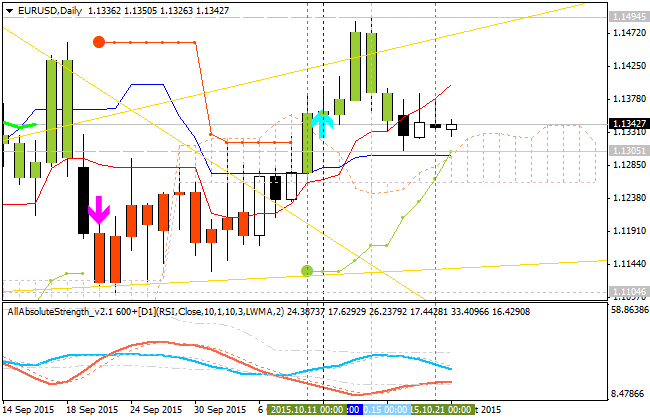

Daily price is on bullish condition located to be above Ichimoku cloud within the following key support/resistance levels:

- 1.1713 key resistance level located far above Ichimoku cloud in the primary bullish area of the chart;

- 1.1016 key support level located far below Ichimoku cloud in the primary bearish area of the chart.

Intermediate

s/r levels for this pair on the way to the key s/r are the following:

- 1.1459 resistance located above Ichimoku cloud in the primary bullish area of the daily chart, and

- 1.1171 bearish support level.

D1 price - ranging:

- Tenkan-sen line is crossed Kijun-sen line from below to above for the bullish condition.

- Absolute Strength indicator's data is estimating the secondary ranging.

- Chinkou Span line is indicating the ranging by direction.

- 'Reversal' Sinkou Span line (as the border between the primary bullish and the primary bearish on the chart) is located below the price.

- Nearest support levels are 1.1171 and 1.1016.

- Nearest resistance levels are 1.1459 and 1.1713.

If D1 price will break 1.1016

support level on close D1 bar so we may see the bearish breakdown.

If D1 price will break 1.1713 resistance level on close D1 bar so the bullish trend will be continuing.

If not so the price will be on ranging within the levels.

- Recommendation for long: watch close D1 price to break 1.1713 for possible buy trade

- Recommendation

to go short: watch D1 price to break 1.1016 support level for possible sell trade

- Trading Summary: breakout

| Resistance | Support |

|---|---|

| 1.1459 | 1.1171 |

| 1.1713 | 1.1016 |

SUMMARY : bullish

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is on bullish condition located to be above Ichimoku cloud within the following key support/resistance levels:

Intermediate s/r levels for this pair on the way to the key s/r are the following:

D1 price - ranging:

If D1 price will break 1.1016 support level on close D1 bar so we may see the bearish breakdown.

If D1 price will break 1.1713 resistance level on close D1 bar so the bullish trend will be continuing.

If not so the price will be on ranging within the levels.

SUMMARY : bullish

TREND : ranging bullish