Market Condition Evaluation based on standard indicators in Metatrader 5 - page 166

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.12 07:35

Trading News Events: U.K. Consumer Price Index (CPI) - to be ranging on 200 SMA for direction of the trend (based on the article)What’s Expected:

Why Is This Event Important:

- "Even though the Monetary Policy Committee (MPC) is widely expected to preserve the record-low interest rate ahead of the U.K. Referendum in June, heightening price pressures may prompt Governor Mark Carney to adopt a more hawkish tone over the coming months as the BoE sees a risk of overshooting the 2% inflation-target over the policy horizon."

- "Nevertheless, U.K. firms may increase their efforts to draw domestic demand amid the slowdown in private-sector lending accompanied by the weakening outlook for the global economy, and a soft inflation report may spur a near-term selloff in the sterling as market participants push out bets for a BoE rate-hike."

How To Trade This Event RiskBullish GBP Trade: Headline & Core Inflation Upticks in March

- Need green, five-minute candle following the print to consider a long GBP/USD trade.

- If market reaction favors buying sterling, long GBP/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bearish GBP Trade: U.K. CPI Report Falls Short of Market Expectations- Need red, five-minute candle to favor a short GBP/USD trade.

- Implement same setup as the bullish British Pound trade, just in reverse.

Potential Price Targets For The ReleaseForum on trading, automated trading systems and testing trading strategies

Forecast for Q2'16 - levels for GBP/USD

Sergey Golubev, 2016.04.08 11:19

GBP/USD M5: pips price movement by U.K. CPI news event :

Forum on trading, automated trading systems and testing trading strategies

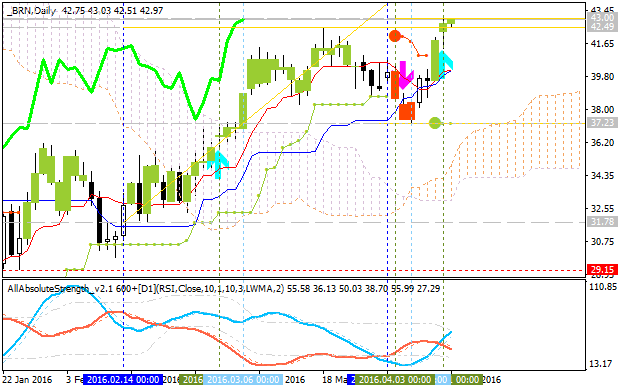

Forecast for Q2'16 - levels for Brent Crude Oil

Sergey Golubev, 2016.04.12 09:47

Crude Oil Technical Analysis 2016, 10.04 - 17.04: bullish daily breakout with 43 resistance as the bullish target to re-enter

Daily price is on bullish breakout to be located above Ichimoku cloud and Senkou Span line which is the virtual border between the primary bearish and the primary bullish trend on the chart. The price is breaking 43.00 resistance level to above for the bullish trend to be continuing. The bearish reversal level at 37.23 is located to be inside Ichimoku cloud, but, anyway - Absolute Strength indicator is estimating the bullish trend to be continuing in the near future so the bearish daily reversal is very unlikely in this situation for example.

If D1 price will break 37.23 support level on close bar so the reversal of the price movement from the primary bullish to the ranging bearish market condition will be started with 31.78 level to re-enter.

If D1 price will break 43.00 resistance level on close bar from below to above so the bullish trend will be continuing.

If not so the price will be on ranging within the levels.

SUMMARY : daily bullish breakout

TREND : bullishForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.13 07:14

EUR/USD Intra-Day Fundamentals: U.S. Federal Budget Balance and 26 pips price movement

2016-04-12 18:00 GMT | [USD - Federal Budget Balance]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Federal Budget Balance] = Difference in value between the federal government's income and spending during the previous month.

==========

EUR/USD M5: 26 pips price movement by Federal Budget Balance news event :

Forum on trading, automated trading systems and testing trading strategies

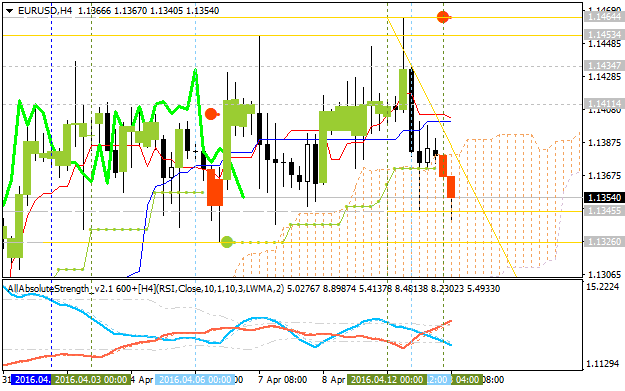

Forecast for Q2'16 - levels for EUR/USD

Sergey Golubev, 2016.04.13 10:06

EURUSD Intra-Day Technical Analysis - ranging correction to the bearish reversal

H4 price is located to be inside Ichimoku cloud for the ranging correction condition inside the primary bullish trend: the price is testing 1.1345 support level together with descending triangle pattern for the ranging correction to be continuing up to 1.1326 support bearish reversal level. Chinkou Span line crossed the price to below for the bearish breakdown, and Absolute Strength indicator is estimating the intra-day bearish condition to be started in the near future.

If H4 price will break 1.1326 support level on close H4 bar so the bearish reversal will be started.

If H4 price will break 1.1454 resistance level so the primary bullish trend will be continuing.

If not so the price will be ranging within the levels.

SUMMARY : bearish reversal

TREND : breakdownForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.13 16:28

USD/CAD Intra-Day Fundamentals: BoC Overnight Rate and 71 pips range price movement

2016-04-13 14:00 GMT | [CAD - Overnight Rate]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Overnight Rate] = Interest rate at which major financial institutions borrow and lend overnight funds between themselves.

==========

"The Bank of Canada today announced that it is maintaining its target for the overnight rate at 1/2 per cent. The Bank Rate is correspondingly 3/4 per cent and the deposit rate is 1/4 per cent."

"Growth in the global economy is expected to strengthen gradually from about 3 per cent in 2016 to 3 1/2 per cent in 2017-18, a weaker outlook than the Bank had projected in its January Monetary Policy Report (MPR). After a slow start to 2016, the US economy is expected to regain momentum, but with a lower profile and a composition that is less favourable for Canadian exports. Financial conditions have improved, partly in response to expectations of more accommodative monetary policy in some major economies."

==========

USD/CAD M5: 71 pips range price movement by BoC Overnight Rate news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.14 07:55

AUD/USD Intra-Day Fundamentals: Australian Employment Change and 32 pips price movement

2016-04-14 01:30 GMT | [AUD - Employment Change]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Employment Change] = Change in the number of employed people during the previous month.

==========

==========

AUD/USD M5: 32 pips price movement by Australian Employment Change news event :

Forum on trading, automated trading systems and testing trading strategies

Forecast for Q2'16 - levels for GBP/USD

Sergey Golubev, 2016.04.14 10:06

GBP/USD Intra-Day Technical Analysis - primary bearish condition near intra-day ranging area

M5 price is located below SMA with period 100 (100 SMA) and below SMA with the period 200 (200 SMA) for the primary bearish market condition: the price is ranging within narrow key reversal support/resistance levels:

RSI indicator is estimating the ranging condition to be continuing in the near future.

SUMMARY : ranging

TREND : bearishForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.14 11:09

Trading News Events: U.S. Consumer Price Index (based on the article)What’s Expected:

Why Is This Event Important:

Even though the Federal Open Market Committee (FOMC) appears to be in no rush to implement higher borrowing-costs, stronger price growth may put increased pressure on the central bank to further normalize monetary policy especially as the U.S. economy approaches ‘full-employment.’

Nevertheless, waning confidence along with the slowdown in household spending may drag on price growth, and a softer-than-expected inflation report may weigh on the dollar as it increases the Fed’s scope to further delay its normalization cycle.

How To Trade This Event Risk

Bullish USD Trade: CPI Report Highlights Sticky U.S. Price Growth

- Need red, five-minute candle following the NFP print to consider a short trade on EUR/USD.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bearish USD Trade: Headline & Core Rate of Inflation Fail to Meet Market Forecast- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in the opposite direction.

Potential Price Targets For The ReleaseEURUSD Daily

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.14 16:02

EUR/USD Intra-Day Fundamentals: U.S. Consumer Price Index and 42 pips range price movement

2016-04-14 12:30 GMT | [USD - CPI]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers.

==========

"The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1 percent in March on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 0.9 percent before seasonal adjustment."

==========

EUR/USD M5: 42 pips range price movement by U.S. Consumer Price Index news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.15 07:34

USD/CNH Intra-Day Fundamentals: China GDP and 38 pips range price movement

2016-04-15 02:00 GMT | [CNY - GDP]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

==========

USD/CNH M5: 38 pips range price movement by China GDP news event :