You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

I think you are right.

Then it turns out that this thread (and all others) has absolutely no future at all. And Yusuf should not be offended by the flooding.

Why not? There is a grain to every topic. Whoever sees it will know which direction to look for his ))))

Why not? There's a grain in every subject. Whoever sees it will know which direction to look in ))))

I did not write for nothing, because even if you open orders from peaks, you will inevitably have to close them in order to open the next ones, and you will still lose because of the small potential. I did not waste my time writing about loss of time, because even if you open orders on peaks, you will inevitably have to close them in order to open next ones, and you will still lose due to small potential.

In short, I can say from my own experience it does not work. In short, I can tell from my experience that it does not work. And those who don't believe may try it and lose the extra money, as it seems to have already done so when trading for reversion and catching peaks, right? You were begging for the price to come back then, but the market doesn't care, it just moves and that's it.

In general any attempt to average the analysis of market fluctuations under any one model, in this case stationary stochastic processes for reverse trading is also meaningless and will only give results from time to time and then drain.

In the words of Igor Makanu it is not enough to put something on the market, even if it is the best mathematical analysis in the world.

Everyone decides for himself anyway.

I'd rather not pull it down, you'll still end up with a MA, no matter how you spin it.

Dashka )) no displacement.

If you haven't spun it, then you can't afford it.

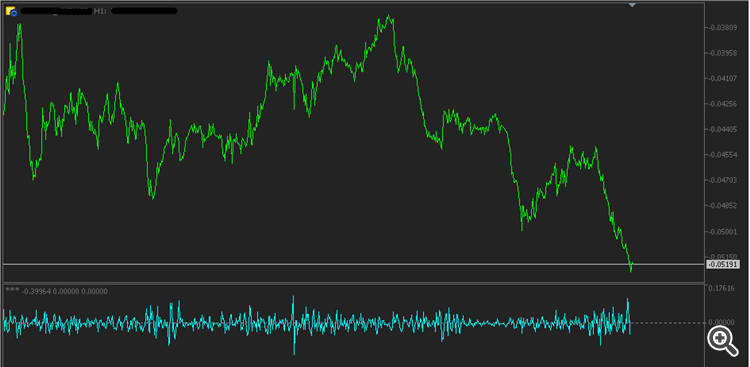

Above was a screenshot of a minute, here's an hour.

Where will the price go? Oh, my Gods! He is a clairvoyant! He makes predictions ;)))

But I don't do this shit like vanguishing! I'm trading a stochastic model that consistently makes money.

And unlike you, I don't hide my approach to the model.

It's funny) You are making stable profits on a completely crooked (sorry to be blunt) indicator, which is essentially worthless. Well, then you don't need the indicator)). Why do you need such a useless tool? ... although ... maybe it gives you false confidence...

Anyway, if you're not lying, that's cool.) I guess your intuition is like Vanga's.)

That's the thing, it's not intuition, it's a principle built on financial processes.

You still don't understand that there is no bias. And if there is a pullout, it will be in line with the price, not the bias.

And don't forget that the raw data needs to be properly prepared as well.

This model hasn't given me more than 4% drawdown yet. So I don't care what you think ))

You still don't understand that there is no offset. And if there is a takeaway, it will be in line with the price, not the offset.

yes yes, not a bad joke =D

Yes yes, not a bad joke =D

Nah, there are offsets of course, I must have misunderstood, and meant that above or below the required range the calculation will not come out.

That is, these offsets are exclusively within the range.

And if the initial series is trending, then of course, the algorithm will compress a one-way impulse within the desired range.

But when approaching a confidence interval, it will be a true reversal. It's not as simple as you think. There is more than one algorithm.

Look at the screenshot on the previous page. A clear stochastic, not below or above the required range.

That's a paradox for you ))

It is a real stochastic process, where the main feature (as well as a feature of any stochastic process in general) is a high frequency of returning to zero, rather than constantly trying to break down like you do:

Look up "Leptokurtosis" on the internet, you'll learn a lot of interesting things if you want to.

Strange that you hide the chart symbols on your screenshots...it feels like you're afraid... Just in case someone throws some standard oscillator on a chart and gets the same values as yours... I've already met someone like that)What kind of break? The terminal won't let you make a smaller chart to show a larger sample area.

I'm telling you to look at the minute chart. It's smaller, it shows more data. Can't you see the stochastic process and not the spread?

Can't you see that the algorithm is clearly producing a calculated zero? Along with the raw data.Which is consistent with a stochastic process.

And a mindless stochastic, just to bounce back and forth, is not the right approach to the problem.

As for the symbols. Well, try throwing some makdies, mash-ups and so on. I think you know what you get ))

Look at the price scale, there are negative prices. What is this about?

Yes yes, I am the kind of person who trades at negative prices. ;))))

Paradox ))

I see the probabilities and there is nothing to rely on but them.

There are always probabilities. It just depends on the input parameter settings.

And one picks up that stochastic process that corresponds to reality, not sausage back and forth ))

What's the point of that?

You say you're making a perversion of the chart?

I build the chart that I need, not what is offered to me. That's one.

Two. Does anyone here even think about the risks in this forum?

Does anyone consider them in their trading,or when building a trading system?

I build my system on risk!

I'm building my system with risks in mind! You'll get a profit anyway ))

No, there are offsets of course, I must have misunderstood, and meant that above or below the required range the calculation will not come out.

That is, these shifts are exclusively within the range.

And if the initial series is trending, then of course, the algorithm will compress the one-sided momentum within the desired range.

But when approaching a confidence interval, it will be a true reversal. It's not as simple as you think. There is more than one algorithm.

Look at the screenshot on the previous page. A clear stochastic, not below or above the required range.

Here you have a paradox ))

I looked at the picture and it seemed to me that this is Mashka of what with period =1 compressed into a range of +-100% by averaging this range over a certain period...