Interesting and Humour - page 4855

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Curious. Maybe I'm wrong, then I'll correct the code. Let's try to calculate "Manually".

1. % per 1 month = % per year / 12 months. 5/12 = 0,41(6). I have rounded up to 0.42.

2. % for all months =% for 1 month * total number of months (we have 300) = 0,41(6)*300 = 125. You have 75,38 for some reason. Let's check. 75,38/0,41(6) = 180,912. Why 180 months if we pay 300 months? 25 years * by 12 months per year = 300 months. Hence all the further discrepancies in the numbers in our calculations. You have added interest for all 300 months to the loan amount. As a result, the total is not the same as mine. I wonder how you reasoned?

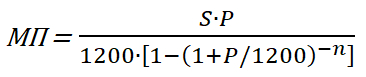

If the payments are equal throughout the term, then the monthly loan payment is calculated according to the Spitzer formula (any bank will tell you that).

, where MT is the monthly payment; S is the amount of the loan; P is the annual interest rate; n is the term of the loan in months.

, where MT is the monthly payment; S is the amount of the loan; P is the annual interest rate; n is the term of the loan in months.

The formula is:

Check the calculations according to this one and only correct formula and you will get exactly the right result. Good luck!

P.S. 75.38 - is how much interest you overpay to the bank on the original loan amount: 2661209/3530533 = 0.7538 (overpayment amount/loan amount),and the overpayment amount is the monthly payment multiplied by the number of months minus the loan amount (20639.14*300-3530533=2661209).

I am sending you and anyone else who needs it the Monthly Payment Calculation.zip. Insert any numbers (loan amount, interest, term) and you will get your monthly payment.

If the payments are equal throughout the term, the monthly loan payment is calculated using the Spitzer formula (any bank will tell you this).

Here is the formula:

where MT - monthly payment; S - loan amount; P - annual interest; n - repayment term in months.

Check the calculations by this one and only correct formula and you will get absolutely correct result. Good luck!

P.S. 75.38 is how much interest you overpay the bank on the original loan amount: 2661209/3530533 = 0.7538Let's make it simpler. Let's agree that I personally borrowed one hundred roubles from you for a period of one month at 5 per cent per month. How much money will I have to pay you back in a month? Logic says that I should return your 100 rubles + 5 rubles on top. In total, 105 rubles. Is that correct?

Now, let's put these data into your formula. Stop - you have a yearly interest, not a monthly one. Well, no problem - five percent per month - that's 5 * 12 = 60 percent per year. So according to the formula we have:

MP = (100*60)/(1200*[1-(1+60/1200) to the power of -1]) = 6000/(1200*[1-(1+0.05) to the power of -1]) = 6000/(1200*[1-x]), where x = (1+0.05) to power of -1

x = 1.05 to the power of -1 = 1/1.05 to the power of 1 = 0.9523809523809524. Substitute instead of x.

MN = 6000/(1200*0.952380809523809524) = 6000/1142.857142857143 = 5.25

And what did we get as a result? Where did the extra quarter per cent come from?

Previously posted, but I will duplicate

Unfortunately, the bank formula above is not correct! It is a cheating formula, not the only correct one. It is also confusing. According to a non-fraudulent contract, it should be like this:

Total repayments (TR) = Loan (R) + Overpayment (O).

IS = 100 + 5 = 105, but not 105.25

Everything is clear with the loan, but the concept of overpayment should be clarified.

If overpayment is a certain amount of interest on the loan amount, overpayment should be equal to the loan divided by one hundred and multiplied by that amount of interest.

P = Z/100*KP, where KP is the amount of interest.

If we have to overpay 5 per cent in 1 year, we have to overpay that 5 per cent 25 times in 25 years. That is, overpay 125 per cent.

P = 100/100*5 = 5 rubles!

P =3,530,533/100*125 = 4413166.25 rubles

IS =3530533+4413166.25 = 7943699.25

MS (Monthly amount paid) = IS/HM (Total number of months)

MS =7943699.25/300 = 26478.9975

Unfortunately, the bank formula above is not correct! It is a cheating formula, not the only correct one. It is also confusing. According to a non-fraudulent contract, it should be like this:

Total repayments (TR) = Loan (R) + Overpayment (O).

IS = 100 + 5 = 105, but not 105.25

Everything is clear with the loan, but the concept of overpayment should be clarified.

If overpayment is a certain amount of interest on the loan amount, overpayment should be equal to the loan divided by one hundred and multiplied by that amount of interest.

P = Z/100*KP, where KP is the amount of interest.

If we have to overpay 5 per cent in 1 year, we have to overpay that 5 per cent 25 times in 25 years. That is, overpay 125 per cent.

P = 100/100*5 = 5 rubles!

P =3,530,533/100*125 = 4413166.25 rubles

IS =3530533+4413166.25 = 7943699.25

MS (Monthly amount paid) = IS/HM (Total number of months)

MS =7943699.25/300 = 26478.9975

The 0.1% error does not solve anything, the main part is correct

Posted earlier, but I'll duplicate

Great, thanks, but I have one - I've been using mine for over 10 years. And I've posted it on the internet more than once. You and I got a different amount with the default figures, but the difference is insignificant. See

Let's make it simple. Let's agree that I personally borrowed a hundred roubles from you for one month at 5 per cent per month. How much do I have to pay you back after one month? Logic says that I have to pay you back your 100 rubles + 5 rubles on top. In total, 105 rubles. Is that correct?

Now, let's put these data into your formula. Stop - you have a yearly interest, not a monthly one. Well, no problem - five percent per month - that's 5 * 12 = 60 percent per year. So according to the formula we have:

MP = (100*60)/(1200*[1-(1+60/1200) to the power of -1]) = 6000/(1200*[1-(1+0.05) to the power of -1]) = 6000/(1200*[1-x]), where x = (1+0.05) to power of -1

x = 1.05 to the power of -1 = 1/1.05 to the power of 1 = 0.9523809523809524. Substitute instead of x.

MN = 6000/(1200*0.952380809523809524) = 6000/1142.857142857143 = 5.25

And what did we get as a result? Where did the extra quarter per cent come from?

You have again made an error in your calculations:

MP = 6000/(1200*0.952380809523809524) = 6000/1142.857142857143 = 5.25 - your calculation (you forgot to subtract 0.952380809523809524 from 1)

MP = 6000/1200*(1-0.952380809523809524) = 6000/1200*0.0476190476190476190 = 6000/57.142857142857 = 105 - my calculation

So you do not have to pay an extra 25 cents.

An error of 0.1% doesn't solve anything, the main part is correct

Well, we've already seen that it's not 0.1, it's 0.25. And I don't agree that it doesn't solve anything. In the mortgage example, it's almost a 9,000-ruble loss. And that's just from one family. What about a hundred families, what about a thousand, what about 10,000? 900 000, 9 000 000, 90 000 000? And then why is there an error in the formula that shouldn't be there? If we agree on a loan + overpayment, then it should be a loan and overpayment, not a loan + overpayment + margin of error.