You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

You want... I mean, you want...

Absolutely not -- I don't want anything at all -- I'm just making my points, which if someone doesn't like them or thinks they're absurd -- they can ignore them altogether.

"Wanting" and "suggesting" -- there is a difference in those terms.

The signal provider's responsibility is not to get future subscriptions.

This is not responsibility -- but irresponsibility as a way to make money. And there are several examples of this kind of earning -- Gonchar's signal, this signal -- they are all signals for a single influx of subscribers -- and there is no purpose in these signals to "live" for months.

Enter "at all" with a stop loss equal to a stop out of 60 points - such strategies "live" only by accident. Parsing and analyzing such signals is nothing more than a study of "systematic survivor error".

And to tell you, as the provider does -- that you can live with such risks for years and earn hundreds of percent a year, as long as you follow his unique " money management system" -- is to look "comical" at every legitimate stop-out, which, of course, was caused by a suddenly changing market.

The responsibility of the signal provider is that he will not get a future subscription.

The signal provider is misleading in his description of the signal. He trades with a constant lot for half a year, for example, a constant stoploss. But in the description he writes "only with constant lots and no more". Then a series of stoplosses occurs and he takes a position with an equal lot and uses a martingale, has no success, and loses one more time.

Subscribers trusted him, but he cheated them. Do you think this is normal?

The subscriber lost a lot of money, he got into trouble, is that normal?

The reason is that the "description" tab has been implemented by MQL5 service and, consequently, it is designed for something. For what? For spam? For flooding? For cheating? Is it used for hype?

So MQL5 is responsible for providing a "platform for deceiving".

I've already said it more than once, and even created a thread about it. https://www.mql5.com/ru/forum/232889

Let me repeat: to solve the question about the area of responsibility once and for all, one of two things is required:

1. Regulate the "description" tab

or

2. Remove this tab.

To regulate means to introduce an offer of what the signaller will be obliged to adhere to and specify it in the tab:

a) Position volume, how much will be the maximum risk per trade: fixed number, non-fixed number. If the latter, then what is the maximum risk that will be accepted in relation to your deposit.

b) Prohibition on deposit during open trades.

c) Number of trades open at the same time, the maximum aggregate stop loss.

d) Leverage.

OTHER - open a new signal! This one cannot be changed. The signalist will think twice and prepare well before opening it.

Removing the tab means leaving the responsibility on the subscribers. This is the easiest way and will be followed by lazy company policy. Developing the service in terms of subscriber protection and security policy, on the other hand, is the regulation of the "description" tab.

This will increase subscribers' trust in the service and increase its attractiveness.

Since technically, as I understand it, trading cannot be restricted, because the service does not have agreements with brokers in this regard, then non-compliance with what the signaller has written and promised in the tab "description", a strict money management, will entail sanctions, which should negatively affect the signaller's interests, here already to the choice of service (requires analysis):

1. Ban on the sale of the signal.

2. Temporary prohibition to sell the signal.

3. Denial of seller's rights.

4. Temporary deprivation of seller's rights.

Signaller will think twice before opening the signal.

The provider is misleading in his description of the signal. He trades six months with a constant lot, for example, a constant stoploss. But in the description it says "only with constant lots and no more". Then a series of stoplosses occurs and he takes a position with an equal lot and uses a martingale, has no success, and loses one more time.

Subscribers trusted him, but he cheated them. Do you think this is normal?

A subscriber lost a lot of money, got into trouble, is that normal?

The reason is that the "description" tab has been implemented by MQL5 service and, consequently, it is designed for something. For what? For spam? For flooding? For cheating? Is it used for hype?

So MQL5 is responsible for providing a "platform for deceiving".

I've already said it more than once, and even created a thread about it. https://www.mql5.com/ru/forum/232889

Let me repeat: to solve the question about the area of responsibility once and for all, one of two things is required:

1. Regulate the "description" tab

or

2. Remove this tab.

To regulate means to introduce an offer of what the signaller will be obliged to adhere to and specify it in the tab:

a) Position volume, how much will be the maximum risk per trade: fixed number, non-fixed number. If the latter, then what is the maximum risk that will be accepted in relation to your deposit.

b) Prohibition on deposit during open trades.

c) Number of trades open at the same time, the maximum aggregate stop loss.

d) Leverage.

OTHER - open a new signal! This one cannot be changed. The signalist will think twice and prepare well before opening it.

Removing the tab means leaving the responsibility on the subscribers. This is the easiest way, and will be followed by lazy company policy. Developing the service in terms of subscriber protection and security policy, on the other hand, is the regulation of the "description" tab.

This will increase subscribers' trust in the service and increase its attractiveness.

Since technically, as I understand it, trading cannot be restricted, because the service does not have agreements with brokers in this regard, then non-compliance with what the signaller has written and promised in the tab "description", a strict money management, will entail sanctions, which should negatively affect the interests of the signaller, here already to the choice of service (requires analysis):

1. Ban on the sale of the signal.

2. Temporary prohibition to sell the signal.

3. Denial of seller's rights.

4. Temporary deprivation of seller's rights.

Signaller will think twice before opening the signal.

And all because the "description" tab was introduced by the MQL5 service, and hence it is for something. For what? For spam? For flooding? For cheating? Is it used for hype?

Besides the Description tab -- there's also the News tab -- anyway, you can't prohibit an ISP from speaking officially in Signals.

What can be implemented is to prohibit provider to guarantee profits in any way -- there is such a prohibition in the marketplace:

IV.3. Prohibited in the Product:

The number of subscribers acts magnetically on many.

I had a thread on this too, as in this one - there were specific suggestions too.

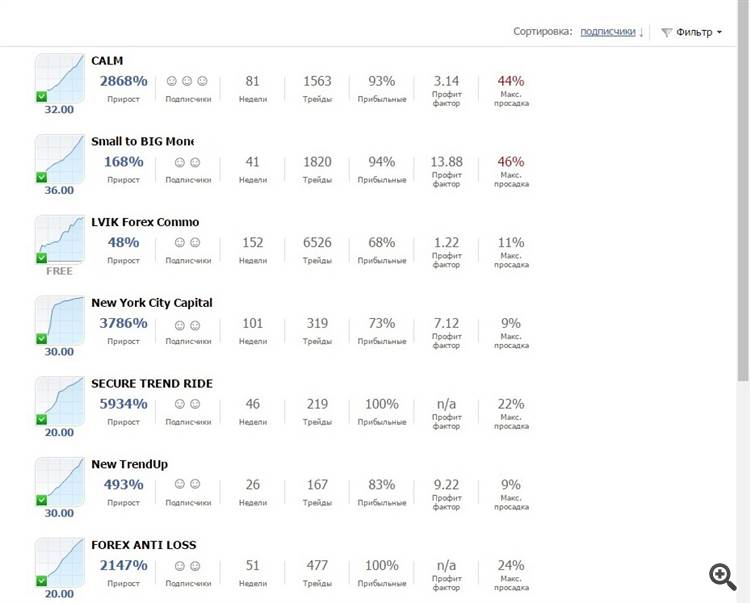

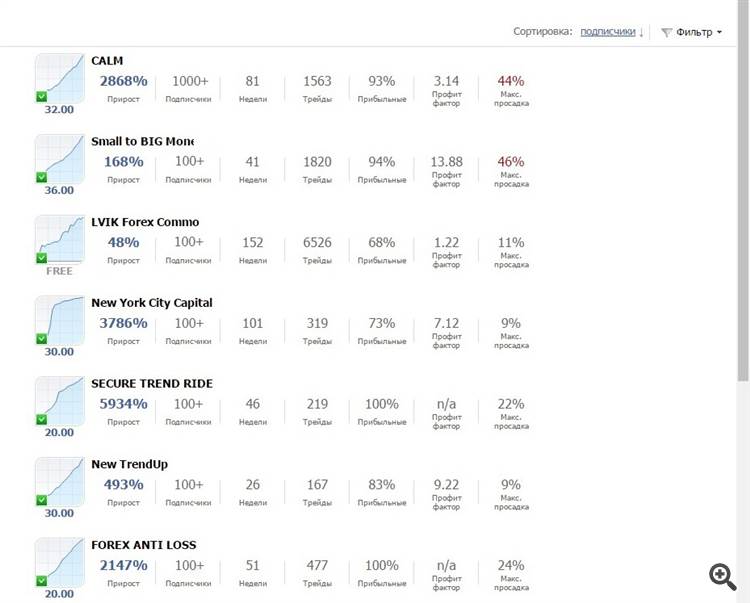

Let me quote you on that (note the pictures, in particular the subscribers column)

https://www.mql5.com/ru/forum/167677/page4

It's very simple. There are canonical trading rules that were written by experienced and successful traders long time ago, and today only lazy of modern and successful ones will not write about them in a book or blog. Based on them, we can give weight to those criteria in the formula that will pull the Signal to the top. Namely:

1. The higher the profit factor, the more points this signal gets in relation to others.

2. The higher % of profitable trades, the more points this signal receives in relation to others.

3. The lower the equity drawdown, the more points this signal receives relative to others.

4. The lower the equity drawdown, the more points this signal receives relative to others.

5. The higher the profit percentage, the more points this signal receives in relation to others.

6. The longer trades the more points this signal receives in relation to others.

7. The higher the average size of TP relative to SL (proportion in favor of TP), the more points this signal receives in relation to others.

8. Remove or modify the information about the number of subscribers.

How to count?

So, we take ALL signal sellers and count each criterion. The important thing is that each successive criterion pushes a lower-quality Signal to the bottom places of the quality table. Summing up all the criteria, we will have the safest and the most stable signals on the first places. If the subscriber does not want stability, but needs wild percentages, for example, here is a filter that allows you to sort by percentage.

We sort the sellers by all indicators and compare them with each other:

In first place would be the seller who has all the key indicators combined better than the others. In second place would be a salesman who has all 6 indicators combined better than the others except for the first. In third place will be a salesman who has all 6 indicators combined better than all the others except the first and the second. And so on.

Explanation by example:

We have two Signals. One is a simple trend indicator, the other is a pure martingale (which has a balance line with waves, not troughs, i.e. first the plus ones are closed, then the minus ones).

1.Signal A has a profit factorof 10, Signal B has a profit factor of2. Signal A rises above Signal B in the rating table.

2.Signal "A" has10% of profitable trades, while Signal "B" has90%. Signal A is worse than Signal B by this indicator, both Signals are equal. But we cannot have equal signals, so we consider the following criterion

3.Signal A has a maximum equity drawdown of10%, while Signal B has a maximum equity drawdown of90%. Signal A is better, so it rises above Signal B in the ranking table.

4.Signal A has a max equity drawdown of30%, while Signal B has a max equity drawdown of10%. Signal B is better, so the signals are equal in points. There can not be equal, take the following parameter.

5.Signal "A" has1000% increase in balance, Signal "B" has100%. Signal A is better, so it rises above Signal B in the rating table.

6.Signal A has100 trading days, while Signal B has200. Signal B is better, so the signals are equal in points. There can be no equal, we take the next parameter.

7.Signal "A" hasTP=100 SL=10 (10:1), Signal "B" has TP=20 (or dynamic) andno SL. Signal A is better, so it rises above Signal B in the ranking table.

We have 2 trending Signals.

1.Signal A has a profit factorof 10, Signal B has a profit factor of10. Equals

2.Signal "A" has10% of profitable trades, while Signal "B" has10% of profitable trades. Equals .

3.Signal "A" has a max equity drawdown of10%, while Signal "B" has a max equity drawdown of10%. Equals .

4.Signal "A" has a max equity drawdown of30% and Signal "B" has a max equity drawdown of30%. Equals

5.Signal "A" has a1000% increase in balance, while Signal "B" has1000%. Equals

6.Signal "A" has100 trading days, Signal "B" has100. Equals

7.Signal "A" has TP=100 SL=10 (10:1), Signal "B" has TP=100 SL=10 (10:1). equal

8.the creation time of the signal, for example. Can't be at the same time. Well, this is either an ideal case, which cannot be, or one seller created two identical signals. One of the signals created earlier. That one is higher.

In practice it is much more complicated, because the seller may change his tactics during the trading session, trade by martin for half a year, trade by trend strategy for half a year, and trade by conservative medium-term strategy for another half a year.

Or, for example, on the first day he has risked half of the deposit and branded himself with a 50% drawdown rate, and the next year the drawdown has not even reached 10%.

And in this case a solution can be found:

1) Warn the seller (informative aspect: an offer or just a reference) that if he changes his trading style and cares about the rating, he must create a new signal and trade on it already according to new (his) rules.

Rationale: possibility to mislead the subscriber by low-loss trading for a long period, and then, without warning, to open large lots or simply change the trading rules: increase the SL and so on. And it doesn't matter whether the seller warned about it or left the "news" field blank. There is a story and it will work for the seller, but it can also work negatively for the subscriber. So, if the seller has 'messed up' by taking a couple of dangerous and risky risks, you'd better recreate the Signal and play it safe until the end, in case you care about the rating.

2) Add more averages to the calculation. Median. I.e. which numbers appear more frequently: thus, if there was a 50% drawdown once a year, and a 10% drawdown the rest of the time, then 50 is simply thrown out, and the median becomes 10. Then we have one more figure added to the calculation.

I.e., there will be max drawdown and median drawdown, for which rating points will be given.

As far as subscribers are concerned, we can see how the crowd effect works, using a vivid example. When a number plays on you more and more with each new subscriber, speeding up the acquisition of new ones, mistakenly believing that subscribers have looked through and compared all the results. listened to their inner independent self and decided what matters to them: conservatism, moderation or aggressiveness.

Therefore, I still propose to consider the following options, again, more or less leveling the playing field for prospective salespeople. We're not sitting here for statistics, but for subscribers' money, otherwise what's the pointof paid public monitoring with the ability to connect? Any seller wants passive income from sellers, that's why they create a signal, otherwise - "FREE" - give it away for free. It's all reasonable, all logical here.

Here's an alternative, an approximate one (see pic // It's photoshop, I didn't hack the site). The first one is filler.

One smiley - up to 100 subscribers.

Two smiles - from 100 to 1000.

Three smiles - more than 1000.

The second one is numeric.

Thus, when a Subscriber sees two Signals with two smilies or 100+, he/she will not know who has more, and will just look at the numbers he/she is interested in. I.e. as practice shows, from two Signals, one with 101 subscribers and other with 999, subscriber will choose with 999. And so, the site will promote and advocate the highest quality trade. I.e., in the tops to put primarily stability, safety, profitability, efficiency. And all these indicators should tend to an equal proportion, without slack in trading, stagnation, sharp rushes and drops. No foul play.

And the subscriber will decide for himself what he needs: the "opinion of the editorial board" (rating) or personal preferences. Without infringing on the rights in terms of missing subscribers of other promising Signals.

So everything is possible if you want it. Take the competitors for example - they removed that column there altogether.

It's just... You have to work on it, and it's a headache.

I had a thread on that too, as did this one -- there were specific suggestions too.

I'll quote about it (pay attention to pictures, in particular the column of subscribers)

Here, too, you can take it "as in the market" - in the market, you don't see the number of sales.

If you use the market analogy, you can remove the "number of subscribers" indicator from the signals.

It's obvious that "subscribers' choice" is all signals with the lowest reliability and not the best rating -- it's clear that such signals are not chosen based on signal performance, but because others have chosen this signal.

In this case -- "number of subscribers" becomes the indicator that is the easiest and fastest to manipulate -- it is even easier to manipulate than the gain.

I noticed that with the advent of the "choice of subscribers" rating -- they even stopped discussing "increment" on the forum.

Here, too, you can take it "as in the market" - in the market, you don't see the number of sales.

If you use the market analogy, you can remove the "number of subscribers" indicator from the signals.

It's clear that "subscribers' choice" is all signals with the lowest reliability and not the best rating -- it's clear that such signals are not chosen based on signal performance, but because others have chosen this signal.

In this case -- "number of subscribers" becomes the indicator that is the easiest and fastest to manipulate -- it is even easier to manipulate than the gain.

I've noticed that with the advent of the "subscriber selection" rating -- the forum has even stopped discussing "increment".

I asked the forefather of all rodents what to do if a margin call went off. He honestly said to report his + 3 months to restore the deposit. But the description doesn't say a word about it.

If I remember correctly, Market was announced in 2012.

In 7 years -- Mechanic has released a dozen of his most popular products, so to speak -- he regularly demonstrates in his signals how his advisors "live" -- in 7 years of very active trading and trading experience -- not one of his products, not one of his product customers -- has shown that his products are capable of profitable trading.

So don't ask him "what to do" -- he doesn't and never has the answer.

His products are a quest.

The qualitative step was to create a " money management system" in the signal under discussion -- but in fact it turned out to be "wishful thinking".

She wrote to subscribers right away that she is playing in a casino, so the plum sooner or later will happen. But subscribers did not believe it, they believed in the golden Eldorado.