EURUSD: THINK GLOBAL (Monthly, Weekly, Daily) BUT ACT LOCAL (H4, H1, M30, M15)!!!

Month of May:

Forecast range: 245 PIPS

Forecast High: 1.1323

Forecast Low: 1.1078

Bull/Bear Dividing line: 1.201

==============================================================================================================================

Monthly we chart.

1. We can see price approach the Pitchfork Median BLUE Line and fail to extent above it, instead price formed an upward sloping failure and produced a price pivot. The general rule at this point is price will proceed to move lower to test the lower Pitchfork blue medium line. In order to test the lower median line price has to pass through a multi-year balancing point highlighted in the white rectangle. Price attacked the balancing point last month and was beaten back which confirms the market is aware of the multi-year balancing point.

2. The monthly bull/bear dividing line is 1.1201 and the week ended 2 pip above that level at 1.1203. It is a strong level so price making it above that level with momentum points to a move up next week in the direction of the forecast monthly high at 1.1323.

EURUSD: THINK GLOBAL (Monthly, Weekly, Daily) BUT ACT LOCAL (H4, H1, M30, M15)!!!

Week beginning 5/5/19:

Forecast range: 158 PIPS

Forecast High: 1.1282

Forecast Low: 1.1144

Bull/Bear Dividing line: 1.1213

==============================================================================================================

- The first thing that jumps out is the monthly dividing line is 1.1201 vs the weekly of 1.1213. Second is there is a bank holiday in the UK on Monday and there is no high impact news.

Scenario one:

- there may be very good scalping opportunities between 1.1201 to 1.1213 for an extended period of time. Buying bullish 5min pivots at 1.1201 with the stop loss 1 pip below the pivot low and profit target at 1.1213;

- Selling bearish 5min pivots at 1.1213 with the stop-loss 1 pip above the pivot high and profit target at 1.1201.

There is a 90% probability that either 1.1282 or 1.1144 will be touched next week.

==================================================================================================================

I'm sure we are all aware of the ugly FORMING head and shoulder pattern on the weekly. If not it is a good thing to keep in the back of your mind.

https://www.investopedia.com/terms/h/head-shoulders.asp

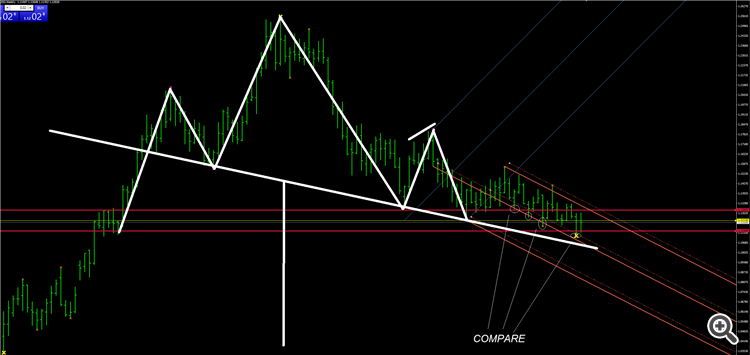

The more recent weekly bars are interesting. It is interesting the way the price action is respecting the Pitchfork like an obedient husband or wife. HOWEVER, the thing that jumps out the most to me is the price inside the circles named "compare". Each weekly low crossed over the Pitchfork media line, the penultimate bar hand a real stab at crossing over but failed BUT LOOK AT THE LAST BAR. A clear buying strength gap between the weekly bar and the median line.

Scenario two:

- there may be very good scalping opportunities between 1.1201 to 1.1213 for an extended period of time with the potential for price to eventually extend higher toward the weekly forecast high at 1.1282. Buy bullish 5min pivots at 1.1201 with the stop loss 1 pip below the pivot low and profit target at 1.1282; Close half the position each time 1.1213 is touched and buy back at 1.1201.

There is a 90% probability that either 1.1282 or 1.1144 will be touched next week.

============================================================================================================================================

So I am basically building a picture of price using the global time frames. PLEASE NOTE: using the yellow SEMAFOR starts as your guide it can be clearly seen no bullish price swings have occurred yet. Yes price has moved higher but we haven't enjoyed a period of swing higher highs and swing higher low. We are waiting for price to move higher than the last swing high to confirm the trend reversal. This is the case for all timeframes except the M1. In this context the above early scenarios are counter trend plays and a significant number of probability points have to be deducted for all counter trend plays.

Reviewing the charts the GBPUSD also has the same issue: there are good signs of a bull move but we'd need to trade against the trend.

The above scenarios are still valid for the gunslingers. However, it is prudent to move to a more accommodating pair like the USDCHF or GBPJPY until the EURUSD trading setups match the direction of the prevailing trend or in otherwards we'll only consider long plays when when we have a confirmed bullish swings. And EURUSD short are off the table until price is below 1.1201.

That's a lot of analysis for no trade but better this than a 20% to 40% drawdown, right?

USDCHF or GBPJPY will be looked at tomorrow.

I created a demo MT4 account to track random trades with a profit target of 4 pips. Let's see if this no skill random strategy can last longer and generate more return than some who claim to have 76000 hours of screen time. I'll post performance here on weekly basis.

Pitchfork scalping starts each day at 17:00 GMT. I am not sure how much I'll be able to post while scalping so let's see how it goes.

A few points to help re-establish your rationality and sanity which must have been completely screwed up following many BMWH signals.

- A drawdown greater than 10% is nuts; 10% should be the exception. Bragging about calmness under 35% to 80% drawdown pressure is for traders who will have no account balance in 3 months time. 98% will go broke, the very well funded will suffer a reduced net worth and the signal provider will have drawn profits waiting for the inevitable account blowout from BMWH trading before they restart the sucker's cycle;

- trading with no stop-loss is for suckers; virtual stop-losses are for the deluded. Do you really think a multi-trillion dollar market cares about your 0.05 lot stop? Delusions delusions...I had a so called experienced trader ranting about a well known and well capitalised broker being out to get them and their $250 dollar account!!! Give me a break already.

- Buying resistance and selling support causes stress and poverty.

- Profit targets are good if they are 2 to 10 times larger than the stop-loss on a consistent basis located where the price is likely to reverse based on support and resistance analysis.

- Trading in the direction of the trend is always a great idea, why run against the current?

- If you're wrong close your position and take the loss.

- If you're right allow the price to reach your profit target instead of inventing reasons to close early; such actions are for suckers.

- Avoid trading on high impact news unless you are a news trader. News traders do nothing except trade the news, their expertise has been developed by focusing on a very small list of high impact news.

- Ignore currency strength unless you are a currency strength trading specialist whose expertise has been developed by focusing on a very small list of currency strength relationships.

- Winning percentage should be the last thing you're concerned about, for a million and one reasons: it implies cutting profits short and allowing losses to run; a trader develops a defend the winning percentage mentality which will eventually lead to account suicide; traders develop a delusion of being a trading God and the market loves to ambush this type in the shower room;

- regardless of how well you trade: you are not special, you are not a trading God, you are not a genius and the market is waiting for you in the shower room to rape your account should you start allowing your ego to hijack your rationality. I recently had a "so called" experienced trader with an alleged +50000 hours of screen time under their belt say "I am always right, I never have a losing trade" the following day there was a meeting in the shower room between the market and this trader's two trading accounts; the market was very satisfied after having it's way with one of the accounts (unfortunately, the account didn't survive) and the 2nd account is fighting for survival...we are praying for the account!

- Placing a BMWH trade followed by prayers for divine intervention, making promises to do only good actions in the future if this trade can just move back to breakeven or to donate 50% of all future profits if you can just get out of the shower room alive are futile. Just avoid taking the BMWH trade in the first place.

- Demo trading and real account trading are completely different due to emotions. HOWEVER, demo trading is invaluable to develop trading routines. Anyone suggesting demo trading is a complete waste of time will eventually meet a messy end in the shower room. The Investment bank industry and established reputable proprietary trading houses use trading simulators and demo account so why shouldn't you. Ignore ego driven fools telling you otherwise. If I screw a trade up, I will punish myself by a number of hours on a demo account; replaying the screwed up trade and to find similar setups from the past to trade using a free trade simulator. Do you think the greatest athlete of all time (Usain Bolt) says "you know man, me not going to practice the 100m this season man; running the 100m live is not the same as practicing man." Use your common sense and stop listening to ego driven suckers unless you want a sadistic Ménage à trois in the shower room involving the sucker's account, your account and the market. In summary, if Elite performers from the SAS, SEALS, Usain Bolt, NASA, Fighter pilots to Goldman Sachs, Morgan Stanley and Deutsche Bank use demos/simulators, don't you think you should as well? Stop listening to the ego driven, self-important, self-proclaimed +50000 hours of screen time fools.

- Just because you've limited your drawdown to less than 10% doesn't mean you can't have fantastic account growth; if you are trading using a Pitchfork stop-loss of between 2 to 15 pips it means the position size can be quite large. Suckers will say a stop-loss of 2 to 15 pips is too small and I will rebuke by saying it is not too small, you just do not know how to trade the Pitchfork.

- No matter how well a BMWH trades in the short term, it is still a BMWH meaning it is a zero sum game with no edge, akin to trying to profit from betting on heads in a coin flipping exercise; it is amazing the long runs of heads one can enjoy in such a coin flipping exercise.

- Final point: ALWAYS, YES ALWAYS!! Make sure you have ALL of your accounts setup in the WebTerminal. If you're with a reputable broker, it is very unlikely MT4 will freeze because the broker is trying to capture $250 from the account of a 75000 hours screen time trader. You can see this by simply switching to the WebTerminal after MT4 freezes; the switch can be done within 5 seconds. Better yet, have your accounts in a browser ready to go should your trading account suddenly become victim to extreme trading incompetence of a signal provider you had the misfortune of subscribing to. Never give 100% control of your hard earned financial resources to a signal provider; make sure you have a safe guard. When some of the Sharks in the water are more than happy to earn $30 while blowing $30 or $300 or $3000 or $30000 of a subscriber's funds without giving it a 2nd thought, it is of paramount importance that web-terminal safeguards are in place.

I hope the above points resonate with a few of you.

I'm still finding my feet, remember the market is the boss. The market gives us the direction and we follow, normally the market will pay you a very generous salary. HOWEVER, if you try to direct the market, the boss will invite you to the shower room!!

What you should be asking yourself is: "why the f*&k have these fools got me in position without any stop-loss protection when it is easy to only risk 2 to 5 pips for a 15 to 30 pip payout." Well, that is what the smart are thinking.

THE OBJECTIVE OF THE GAME IS NOT TO MAKE MONEY REGARDLESS OF RISK!!! THE OBJECTIVE OF THE GAME IS TO BE IMMEDIATELY IN A PROFITABLE POSITION, TO MOVE THE STOP TO BREAK EVEN AS SOON AS THE MARKET TELLS YOU THEN TO MAKE 2 TO 2O TIMES WHAT YOU RISKED IN THE FIRST PLACE...WAKE UP!!!!!

Stopped out!!! Who cares? A few pips lost for a good setup to gain a potential 30 pips. Thank you Mr. Market for the opportunity to gain from such a wonderful setup.

Controlled loss accepted.

The thing about trading for 10 times your risk, the small losses really become a triviality. The price may then turn and go in the correct direction but who cares? There will be dozens of these opportunities each week. No point beating yourself up for protecting your capital and then watch the price move to what was your profit target, no point at all. This is part of the low risk trading game. Would you prefer no stop-loss and to hope and pray price will move in your direction? If yes, the market is waiting for you in the shower-room, don't miss the appointment.

It is worth repeating: below the monthly pivot of 1.1201 and weekly pivot at 1.1213 and daily pivot at 1.1192 = NO LONG TRADES WILL BE TAKEN AT THIS LEVEL. EYEBALLS ON THE POTENTIAL LOW OF THE DAY AT 1.1157!!!

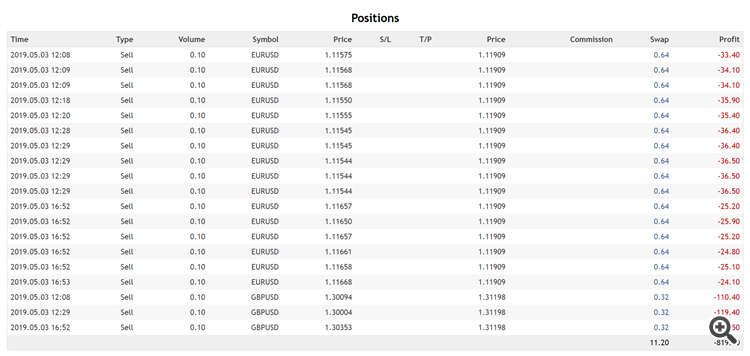

NOT MY ACCOUNT: This is the sort of thing that happens when traders haven't learn to be comfortable taking losses or have the misguied notion that being right is more important than protecting capital: 68% drawdown:

21% Drawdown - I cannot begin to understand why anyone calling themselves a "trader" would allow a position to move 400 pips against them for a potential 60 pip gain; 20 PhDs not require to understand that right? Fear of taking losses and more important to be right then to protect capital even if that means losing all the capital:

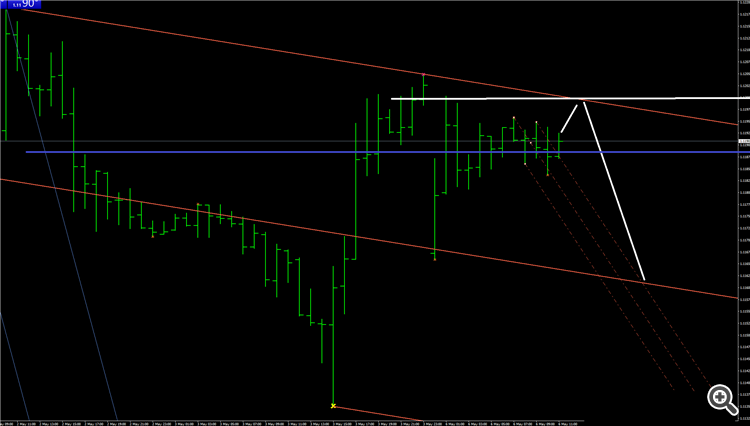

Draw the dotted micro pitchfork for short-term clarity and scenario generation. Price may break for the horizontal white line then reverse downwards.

However, below 1.1188 (blue line) short has to be entered. Well after price breaks then retests it.

FOR THE SWINGERS:

- WHILE PRICE REMAINS BELOW 1.1201 YOU SHOULD BE SHORTING TO 1.1078;

- ABOVE 1.1213 YOU SHOULD BE LONGING TO 1.1323.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

I used to be a manual trader for a long time: https://www.mql5.com/en/forum/179446

However, I no longer enjoy the relentless screen time and general stress that goes hand in hand with manual trading. My solution was to become very good at translating my manual trading knowledge to the creation of automated trading systems. Most good and a few bad: 90% good, 10% bad.

A second approach I recently attempted was to diversify some manual traded signals for sale on this website: MQL5.COM. I subscribed to them and was quite shocked. I was not shocked by the drawdown, which was more than I am used to, but I was shock by the absence of the foundations of trading skill:

· No stop-loss;

· No risk to return mentality

· an absence of the significance of support and resistance

· no awareness of market structure encapsulated in the notion of the higher high, higher low, lower high lower low.

The list is very long and I do not want to bore you...too much.

Probability theory alone tells you a blind Monkey with Herpes can have a run of trading success for months if trading with no stop-loss and a relatively small profit target between 5 to 100 pips. The run of success will end of course, normally in a painful way.

This thread is educational and the aim is to educate thread members in the correct way to manually take pips from the market. It will be suited to all grade and types of trader.

· It will suit the busy professional who only has 15 minutes before breakfast to place his/her trade before leaving for the office;

· It will suit the busy mother/father who has to be up and down feeding the baby and cleaning the house;

· It will suit the trader who has the commitment but has never been shown the direction;

· It will suit those who are tired of getting their account blown by service providers;

· it will suit those who are tired of blowing their own account.

It will not suit those with large egos who have an irrational desire to feel more important than others; if you fit into this group, please find another thread...you know who you are!

Basically, this is a course for all. You know the old clique that goes something like: "Give a (wo)man a fish, and you feed (her) him for a day. Teach a (wo)man to fish, and you feed (her)him for a lifetime." Allow me to teach you how to fish for pips so you don't have to suffer ridiculously high draw downs by the trading hands of another.

====================================================================================================================================================================================================================

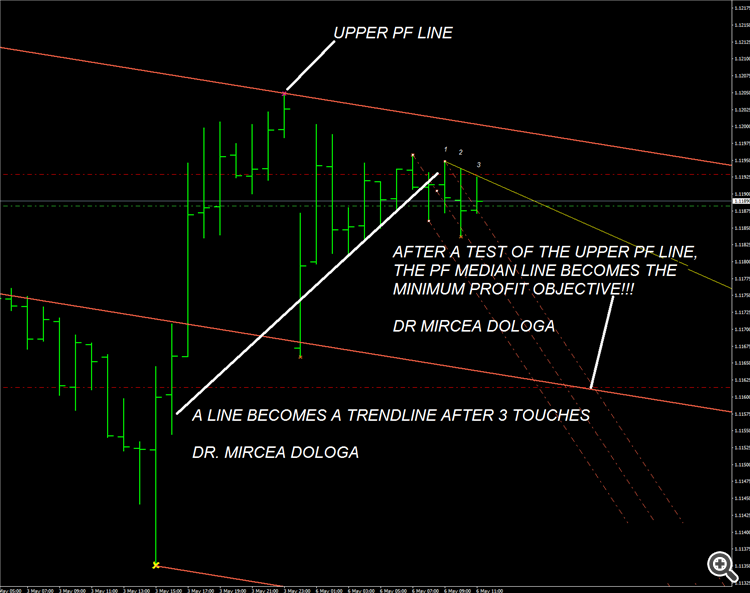

There are methods and techniques the professional use to fish for pips. One of these methods is the Andrews Pitchfork. I am a long-term student of Dr. Timothy Morge and Dr. Mircea Dologa; they are in turn long-term students of Dr. Alan Andrews the father of the Andrews Pitchfork. This will be a fast-paced blog and this is the only acknowledgement I can give to the three trading mentors.

====================================================================================================================================================================================================================

Normally, course on the Andrews Pitchfork start off by explaining how to correctly draw a Pitchfork. I find that students lose valuable time starting at this point and it is something you will pick up as you watch my analysis and trades. I draw my Pitchforks using the manual tool supplied in MetaTrader. For this course, I will be using the FREE JJN-AutoPitchfork found at this location: https://www.mql5.com/en/code/10213

Market structure visuals will be draw using the semafor indicator attached to this post.

It will be good for you if you spend 5 minutes downloading the JJN-AF & Semafor and attaching it to a chart. You don't have to understand it at this point, just find out how the indicators works.

====================================================================================================================================================================================================================

The analysis that leads to trading decisions will be conducted here. The trades made will be tracked here in a signal. . You will get the most from the posts if you subscribe to the signal so you are able to read the posts then see the trades executes in real time ; this approach will truly embed the material in your mind. A less effective alternative is not to subscribe and review the trades after they appear in the history; there will be a lag between the posts and the trades using the second approach which may lead to the reader always trying to catch up. The choice is yours.

The trading focus will be the following pairs in this order: EURUSD, GBPUSD, GBPJPY, USDCHF. I normally just look at the EURUSD but if no opportunity exists on the Pitchfork we may have to look elsewhere. However, we deliberately keep the pair list small so we can develop analytic expertise that relates to this small group. Development of expertise would not be possible with a large list.

We are small stop-loss traders:

· we say thank you to the market when it presents us with an opportunity to lose 2 pips but gain a high probability 10 to 20 pips gain;

· we say thank you to the market when it offers us terms of 5 to 10 pip loss for a high probability 20 to 50 pip gain;

· we say thank you to the market when it offers us terms of 10 to 15 pips loss for a high probability 50 to 100 pip gain;

· on rare occasions the market will offer 1 to 2 pip loss terms for 100+ pip gain.

As Pitchfork traders we take those trades and when stopped out chuckle and say "wow that was one good offer" I am looking forward to the next one. We know the stop-loss is just part of this lucrative game and we disassociate from traders who think having a winning percentage of 95% with a drawdown percentage of 60% to 95% is the way to enduring wealth. The only one who gets wealthy from such a percentage is the signal provider; in many cases if you sum the gains of the subscriber winners with the losses of the subscriber losers it will equal zero minus commission and swaps.

When our PLANNED stop-losses are hit, we pat each other on the back. We have no time for the 95% winning percentage gang in here.

Pitchfork traders take steps to control their emotions. The primary step I use is to trade a very small balance account between £50 to £100, I then use a free trade copier on a VPS to copy my small balance trades to my main account using the money management scheme of 15 pips stop-loss and risk 1.5% a trade. Again, trading is not an ego game; it is a psychological money game. I have no interest in viewing my real-time gains and losses on my main account because it increases the probability of influencing my trading decision; I am interested in having the correct trading plan and accepting the best terms, the market offers.

============================================================================================================================================================================================================

At the beginning of each month, I'll will post scenarios for the month.

On Sundays, I will publish the week ahead scenario clearly stating the Pivot above which is long only and below which is short only. Each day I will give the bull bear dividing price and two levels, one above and one below price; the price will touch one of these levels 90% of the time.

The above is a simple introduction to this education thread. I hope you enjoy the journey and I would be grateful if we all can be respectful and polite. I am not here to compete or play big ego games, such things just get in the way of pip generation.

View the signal subscription fee as a monthly course fee; subscribers' get preferential treatment with regard to the speed of direct message replies etc. I am a capitalist after all.

Max

Price pivots general exist at the swing low and swing high. However, they appear in many other places as well.