You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

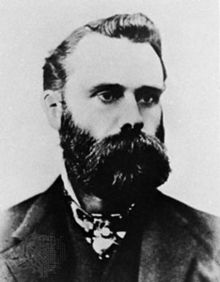

Dow Theory

Charles Dow never wrote a book containing his theory, rather it was set out in a number of editorials published in the Wall Street Journal. In 1903 S.A. Nelson compiled the essays into a book called The ABC of Stock Speculation. Dow Theory provided the foundation and cornerstone of the field of technical analysis.Dow Theory has 6 basic tenets:

1. Markets have 3 trends. (1) Uptrends are characterized by higher highs and higher lows. (2)Downtrends are defined by lower lows and lower highs. (3) Prices moving sharply in one direction, retracing, and then continuing in their original direction.

2. Trends have three phases: an accumulation phase, a public participation phase, and a distribution phase. The accumulation phase is the smart money is buying (selling) stock against the general opinion of the market. During this phase, the stock price does not change much because these investors are in the minority absorbing (releasing) stock that the market at large is supplying (demanding). Eventually, the crowd follows (phase 2). This is when trend followers and other technically oriented investors participate. This phase continues until rampant speculation occurs. At this point, the astute investors begin to distribute their holdings to the market (phase 3).

3. The market discounts everything. The market takes all fundamentals into account and this is reflected in price in real time. Dow Theory is consistent with efficient market hypothesis.

4. Stock market averages must confirm each other. To Dow, a bull market in industrial could not occur unless the railway average rallied as well, usually first. The two averages should be moving in the same direction. When the performance of the averages diverge, it is a warning that change is imminent.

5. Trends are confirmed by volume. While Dow considered volume a secondary indicator, he believed that volume confirmed price trends. Volume should increase in the direction of a major trend. When prices move on low volume, there could be many different explanations why. An overly aggressive seller could be present for example. But when price movements are accompanied by high volume, Dow believed this represented the “true” market view. If many participants are active in a particular security, and the price moves significantly in one direction, Dow maintained that this was the direction in which the market anticipated continued movement. To him, it was a signal that a trend is developing.

6. Trends exist until definitive signals prove that they have ended. Dow believed that trends existed despite “market noise”. Markets might temporarily move in the direction opposite the trend, but they will soon resume the prior move. The trend should be given the benefit of the doubt during these reversals. As with the physical law of motion, stating that an object in motion continues in the same direction until an external force causes it to change direction.

A Traders Quick Guide to Position Sizing:

A 20% position of your total trading capital gives you a potential 5% stop loss on your position to equal 1% of total trading capital.

A 10% position of your total trading capital gives you a potential 10% stop loss on your position to equal 1% of total trading capital.

A 5% position of your total trading capital gives you a potential 20% stop loss on your position to equal 1% of total trading capital.

The average true range (ATR) can give you the daily range of price movement and help you position size based on your time frame and your stocks volatility. If your entry is $105, your stop is $100, and the ATR is $1, then you have a five days worth of movement against you as a stop.

Start with your stop loss level and volatility to give yourself your position size. The more room you want on your stop determines how big of a position size you can take.

If you only risk losing 1% of your trading capital when you are wrong, then every trade can become just one of the next 100 with little emotional impact. Ultimately, you can survive losing streaks and increase your odds of prosperity.