You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read December 2016

Muhammad Syamil Bin Abdullah, 2016.12.14 10:48

Arbitrage: The authoritative guide on how it works, why it works, and how it can work for you : Chris Green

Arbitrage is the practice of taking advantage of a price difference between two or more markets, striking a combination of matching deals that capitalize upon the imbalance, the profit being the difference between the market prices. This is the complete, authoritative, and exhaustive manual outlining the Arbitrage business model. It has been compiled and made available to anyone interested in buying products to be resold online. In this book, Chris Green will give you the keys to the Arbitrage Kingdom with the mindset of unlimited opportunities and abundance and not one of scarcity. Empires are being built by using powerful new programs like ScanPower to source and evaluate items for resale. Pair this with Amazon's amazing fulfillment program called Fulfillment By Amazon (FBA) to outsource the storage, shipping, and customer service of your items, and you have a completely scalable, nearly risk-free business model with a near-zero entry cost. The techniques described in this book can be used by anyone, anywhere to build a small side business or large empire. The only limit is you imagination.

Mastering Hurst Cycle Analysis: A modern treatment of Hurst's original system of financial market analysis

In 2011 the work of J. M. Hurst, considered by many as the father of modern cyclic analysis, enjoyed sudden and renewed interest by the trading community. This translated into several works approaching Hurst's methods from three different angles.

Just as stated by the author, it will help readers get a better grasp and understanding of Hurst's work, at a fraction of the the cost of his original private course. It will even provide buyers with the relevant code for Tradestation and Updata. This way, if you're tech savvy and already own one of these charting packages, or don't mind the additional investment needed to use them, you will be able to experiment further with the concepts covered in the book. Since it contains the code for all the different cycles, channels and other indicators, the author spares the reader the math details of Hurst's work, which may be for the best, since this has always been one of the stumbling blocks in applying Hurst's methods.

The self-proclaimed goal of the author is to lead the reader to a stage where he can perform his own cyclic analysis. The bottom line is that how well you master Hurst's methods after reading this book, as with so many other things in life and trading, will depend solely on how much work you're willing to put into experimenting with the concepts.

The book ends with a concise summary of the different theories explaining the causes of cycles, which should stimulate even further research into this fascinating subject.

Mr Grafton mentions the Sentient Trader software, by David Hickson, which covers similar ground. The author of that software has, understandably, undertaken a different approach: there is no code sharing, but instead a sleek black box, which generates trading signals based on Hurst's original work.

There is also the OddsTrader app, by CIT Dates, which is currently the only mobile app that allows users to chart Hurst channels and to use them as the basis for several different trading strategies. It even includes a built-in risk management and position sizing tool.

In summary, if you're interested in cycles and cyclic analysis, there has hardly been a better time for delving into and exploring the subject.

The Global Economic Collapse of 2015

A SUDDEN ECONOMIC COLLAPSE IS ON THE WAYIt is more critical than ever in our history to hedge against economic collapse, especially this year of 2015 and the autumn of this year.

Seven experts from around the world agree with this impending collapse, and they include The Jerome Levy Forecast, John Ing, Bill Fleckenstein, Paul C. Roberts, Phoenix Capital, Gerald Celente and Ron Kirby.

You have a once-in-a-lifetime opportunity to profit and survive when a sudden economic collapse arrives in 2015. Great chaos and confusion is going to accompany the crash. There are 3 primary ways you can profit from it. One is investing into gold shares, coins and bullion. The second is investment into silver. The third is that you can diversify a percentage of your holdings into an inverse Exchange Traded Fund (ETF).

When the crash occurs it will be too late to invest in the ETF market. The financial sector of the market will be virtually destroyed. Inverse ETFs , gold and silver will skyrocket to highs that you’ve never seen before.

You need to know the timing since it’s critical to invest at least 2 weeks prior to the event itself. The shadow government knows that the $18 Trillion in U.S. debt and the 1 Quadrillion in derivatives in the market are not manageable, nor can it ever be repaid. Their only plan is for a crash, to be followed by a devaluation. The end result is a financial tsunami the likes of which you have never seen before.

The Global Economic Collapse of 2015 book covers the history you need, the facts you need and a detailed description of the 2015 strategies you must employ. This book provides you with the tools you need, and the precise timing of the engineered crash to occur later this year.

The Great Depression of 2015 is going to happen, but you can profit from it. In this book Investigative Journalist David Meade explains how. A chilling look at the facts, graphs and cycles behind America’s next economic collapse.

There is a pattern of economic crashes occurring approximately every seven years dating back to the Great Depression. The Great Depression suffered its worst year in 1931, then later we have the Arab Oil Embargo, the S&L crisis, Black Monday, the 1994 Bond Massacre, the 2001 NASDAQ crash, and the 2008 Financial Collapse. Each occurred at the very end of a 7-year economic cycle.

There is an additional mystery to this cycle which makes it absolutely extraordinary. This seven year cycle also lines up with the 7 and 49 year cycles of land rest and jubilee debt forgiveness that God commanded the Israelites. This is called the Schmita Cycle. We’ll cover this. It is the “cycle of cycles” that economists have been looking for. We are on the verge of the greatest depression in history, and with it the most opportunity to profit.

There is a plan to destroy the US Dollar and not to pay back the 100 Trillion in unfunded liabilities. The elite would prefer to simply transfer their personal holdings to Euros and gold. Their plan is to divest American assets, sell the dollar, renege on all debts and start with a brand new currency. That plan is revealed here.

This book will show you the cycles, analyze the inevitable outcome and give you the information you need to profit from the coming economic collapse. Get ready for the most amazing buying opportunity of your lifetime. Gold strategies, Silver strategies, gold stock strategies and much more are covered in this one-of-a-kind manual.

=========

INTRODUCTION – FROM THE AUTHORS

- Oil & Geopolitics

- The Timing and Cause of the Global Economic Collapse of 2015

- World Gold Shares

- The History of Gold

- How to Develop a Gold and Silver Portfolio

- Silver Investing

- Creative Non-Paradigm Planning and Thinking

I have not found any other books that allow the investor to safely re-balance their portfolio from their home office, without leaving there. It is written as an eBook, for ease of search ability (just enter Ctrl F and you can find any search term or topic you want), and for ease of research ability.I am an Investigative Journalist, a cryptographer and have been employed at the Pentagon and Fortune 500 Companies. I’m the author of close to 10 books. Enjoy this one!

David Meade and Chris Vermeulen

========

The Global Economic Collapse Of 2015

TABLE OF CONTENTS

The Geometry of Stock Market Profits

by Michael Jenkins

This book is about Jenkins' proprietary techniques, with major emphasis on cycle analysis, how he views and uses the methods of W. D. Gann, and the geomery of time and price. Among the many topics, you will learn:

1. Which angles are important and how to draw them correctly.

2. How professional traders think and the types of strategies they use day to day.

3. How to place stops correctly.

4. How to construct and use Gann Squares for analysis and forecasting of individual stocks and commodities.

5. How long the basic trend can be expected to last.

6. When and where to buy and well

7. How to utilize Gann angles and methods that predict exact turning points with high probability.

8. The numerological interrelationships of price and time forecasting.

9. Ten trading tips to make you rich

Momentum, Direction, Divergence : William Blau

In this latest volume, technical expert Bill Blau shows you how momentum, direction, and divergence form the basis of most technical indicators and how they can work for you to provide a considerable competitive advantage. Clearly, concisely, and with a minimum of complex mathematics, Blau shows you how to understand and apply them. Integrating the latest financial insights with more than 75 easy-to-follow graphics, Blau describes the uses and limitations of many of today's most notable technical indicators. He then demonstrates a variety of ways in which the principles of momentum, direction, and divergence can be used to create a versatile new set of technical indicators or to improve the effectiveness of the most widely used traditional indicators.

Focusing on the groundbreaking double smoothing concept, which he introduces for the first time in this book, William Blau:

==========

William Blau's Indicators and Trading Systems in MQL5. Part 1: IndicatorsThe first part of the article "Indicators and Trade Systems in MQL5 by William Blau. Part 1: Indicators " is a description of indicators and oscillators, described by William Blau in the book"Momentum, Direction, and Divergence".

The article describes the following groups of indicators:

one of the very few who could see the financial crash of 2008 coming, Michael Hudson is President of The Institute for the Study of Long-Term Economic Trends (ISLET), a Wall Street Financial Analyst, Distinguished Research Professor of Economics at the University of Missouri, Kansas City and author of J is for Junk Economics (2017) amongst many must read others...

His new book is about to be released (November 2018) - probably again a must read book if you want to understand Economics properly... and forgive them their debts: Lending, Foreclosure and Redemption — From Bronze Age Finance to the Jubilee Year ...

by Nicolas Darvas and Steve Burns

How did a world-famous dancer with no knowledge of the stock market, or of finance in general, make 2 million dollars in the stock market in 18 months starting with only $10,000? Darvas is legendary, and with good reason. In this new edition: How I Made $2,000,000 in the Stock Market: Now Revised & Updated for the 21st Century Steve Burns uses his experience to offer explanations as to why the methods are still reliable. Updating a classic book is a monumental task. The basic philosophy of the writer cannot be changed. Steve Burns approach this work with the eye of a master restorer who looks at a classical painting that is being refurbished. He carefully studied the text to bring Nicolas Darvas wisdom into the twenty-first century. Steve Burns illuminate the dramatic changes in the market to show how Nicolas Darvas principles are more useful now than ever.

----------------

Darvas Box - indicator for MetaTrader 5

Darvas Boxes - indicator for MetaTrader 4

SymmetricDarvasBoxes - indicator for MetaTrader 5

Forum on trading, automated trading systems and testing trading strategies

Indicators: Darvas Box

Sergey Golubev, 2013.09.19 19:40

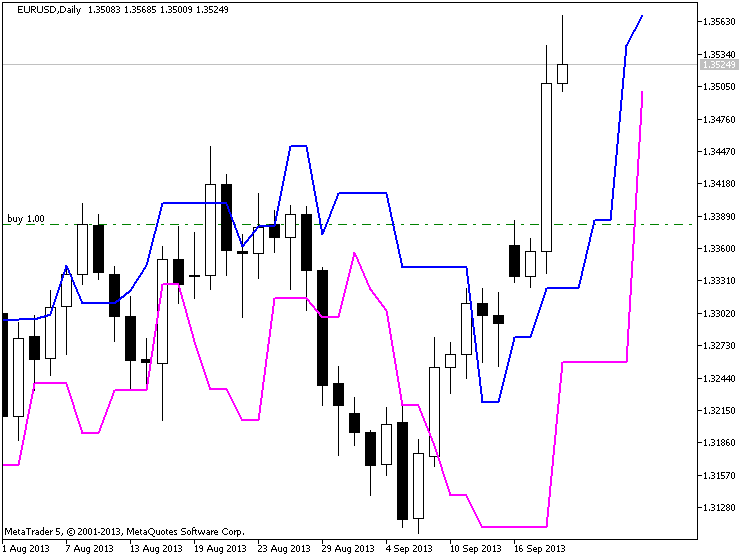

Darvas Box Technical Indicator

Developed by Nicolas Darvas

Nicolas Darvas is a famous Forex trader who made 2 million dollars trading the stocks market. Darvas started with an account of 10,000 dollars and made a profit of over 2 million dollars.

This is one of the trading methodologies that Darvas combined to form his stocks trading system. Along with this trading methodology Darvas made accurate trading decisions.

Technical AnalysisThis trading method is used to generate trading signals based on a simple breakout strategy of the Darvas Box lines.

Bullish Signal

If the price of a currency pair breaks out at the top box line , then this is a bullish signal

Bearish Signal

If the price of a currency pair breaks out to the lower line, then this is a bearish trading signal.

The example below shows a bearish signal generated from the Darvas Box Indicator.

The Complete Guide To Point & Figure Charting : The New Science of an Old Art

The aim of this book is to explain point-and-figure charting to European investors and traders, and to show why it is the most reliable technical tool for timing entry and exit points in stocks, indices and other securities.

The book is written for all levels of trader, from the novice to the experienced. It starts by explaining the basics of point-and-figure, and by showing its advantages over other types of chart. Readers are then given step-by-step instructions on how to start a point-and-figure chart from simple price data, and how to add to it day-by-day using simple rules based on end of day highs and lows.

The emphasis is on simplicity and clarity. The section on chart interpretation introduces the basic buy and sell signals, and goes on to explain the more complex signals, in each case illustrating the pattern, and the precise entry and exit points, with colour charts from FTSE stocks and indices. It also shows how trend lines are incorporated into a chart. The latest point-and-figure trading techniques are covered in depth.

The authors show how to: use horizontal and vertical counts to estimate the size of price moves, use stop-orders to protect positions, use pyramiding to maximise profitable trends, and use swing trading in combination with p&f. They also show how to adapt your trading style to the amount of capital you have available and to your risk tolerance. In the later sections of the book, the authors concentrate on optimisation of p&f trading and the avoidance of the most common trap - 'over-fitting' - and on analysis of the profitability of p&f trading. They demonstrate conclusively that point and figure, correctly applied, produces consistent and reliable profits across a variety of markets. In summary, Heinrich Weber & Kermit Zieg's book is the definitive guide to the theory and application of point-and-figure charting. It is especially welcome for UK and European traders, since it uses recent charts of FTSE and European securities as examples, and includes hitherto unpublished research on p&f's applicability to European securities.

Forum on trading, automated trading systems and testing trading strategies

Book: Expert advisor for MT4 for one evening

Evgeniy Zhdan, 2018.12.01 12:24

Hello dear traders! I want to present you a book for novice programmers: Expert advisor for MT4 for one evening.

The reader along with the author will independently write an advisor for the MetaTrader-4 trading terminal. The book describes the basic actions that are performed when developing 95% of trade experts. Thanks to the knowledge gained, immediately after reading the book the reader will be able to write a simple expert himself.

Amazon: https://www.amazon.com/dp/B07F85MNCG

Currency Trading For Dummies

by Kathleen Brooks (Author), Brian Dolan (Author)

Currency Trading For Dummies is a hands-on, user-friendly guide that explains how the foreign exchange (ForEx) market works and how you can become a part of it. Currency trading has many benefits, but it also has fast-changing financial-trading avenues. ForEx markets are always moving. So how do you keep up? With this new edition of Currency Trading For Dummies, you'll get the expert guidance you've come to know and expect from the trusted For Dummies brand—now updated with the latest information on the topic.

Inside, you'll find an easy-to-follow introduction to the global/ForEx market that explains its size, scope, and players; a look at the major economic drivers that influence currency values; and the lowdown on how to interpret data and events like a pro. Plus, you'll discover different types of trading styles and make a concrete strategy and game plan before you act on anything.

Whether you're just getting started out in the foreign exchange market or an experienced trader looking to diversify your portfolio, Currency Trading For Dummies sets you up for trading success.