Forum on trading, automated trading systems and testing trading strategies

Discover everything about the MetaTrader 5 mobile applications in 2 minutes

MetaQuotes Software Corp., 2016.11.02 09:34

Watch two new videos about MetaTrader 5 mobile platforms on our YouTube channel. The videos will guide you through the MetaTrader 5 for iOS and Android in just 2 minutes.

The MetaTrader 5 mobile platforms feature everything you need for successful trading on the Forex market and global exchanges: full-fledged technical analysis, powerful trading system with all types of orders and the depth of market. We actively develop our applications releasing new builds regularly. After watching our videos, you will learn about all MetaTrader 5 mobile features, including the latest innovations. These videos are the ultimate visual guides for the MetaTrader 5 applications presenting everything you wanted to know but were too afraid to read in the Release Notes.

Did you like the videos? Visit our official MetaQuotes Software YouTube channel to find more videos about the MetaTrader 5 platform and its built-in

services. The channel already has 40 tutorial videos organized into playlists for your convenience.

How to Create a Trading Robot in the MQL5 Wizard of MetaTrader Platforms

Even if you are not a programmer, you still may develope your own trading robots and technical indicators in MetaTrader Trading Platforms. Using MQL5 Wizard you can assemble a robot without writing a single code string.

This is the 1st video in a series on economic reports created for all markets, or for those who simply have an interest in economics. In this and the next lesson, we cover the Employment Situation Report, also known as Non Farm Payroll.

============

Non-farm Payrolls (metatrader5.com)Non-farm Payrolls is the assessment of the total number of employees recorded in payrolls.

This is a very strong indicator that shows the change in employment in the country. The growth of this indicator characterizes the increase in employment and leads to the growth of the dollar. It is considered an indicator tending to move the market. There is a rule of thumb that an increase in its value by 200,000 per month equates to an increase in GDP by 3.0%.

- Release Frequency: monthly.

- Release Schedule: 08:30 EST, the first Friday of the month.

- Source: Bureau of Labor Statistics, U.S. Department of Labor.

============

MQL5 economic calendar :

- Source : Bureau of Labor Statistics

- Measures : Nonfarm Payrolls present the number of new jobs created during the given month, in all non-agricultural sectors. It is one of the key labor market indicators allowing to determine the current state of economy. Increase of the figure is seen as positive for the US dollar.

- Usual Effect : Actual > Forecast = Good for currency

- Frequency : Released monthly, usually on the first Friday after the month ends

- Why Traders Care : Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity

- Also Called : Non-Farm Payrolls, NFP, Employment Change

mql5 forum thread : Non-Farm Employment Strategy

============

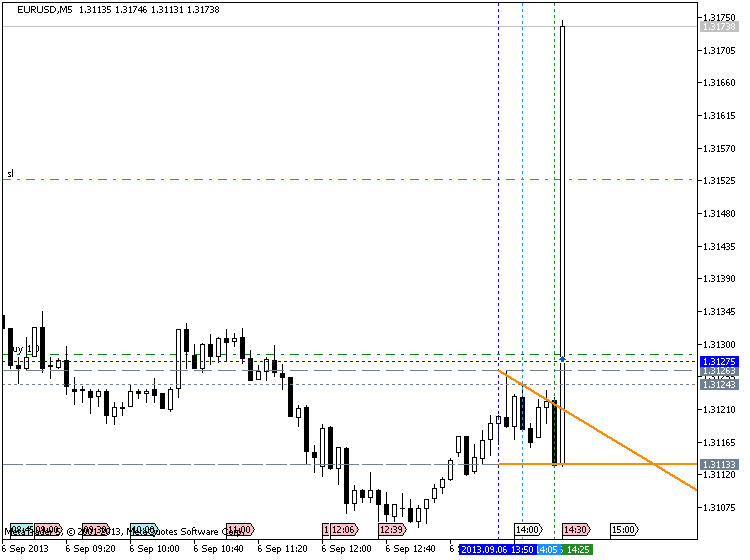

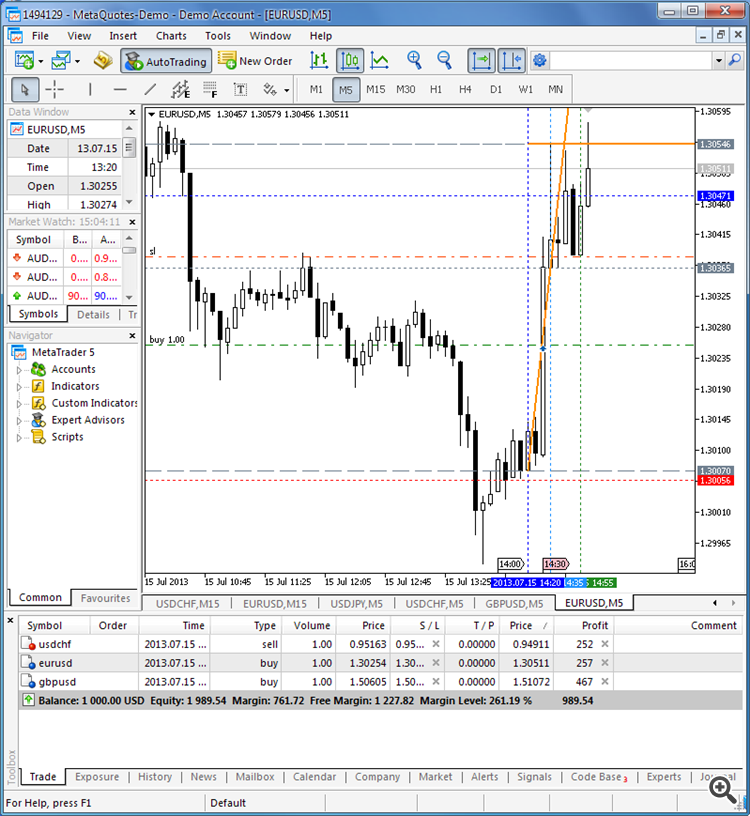

Trading EURUSD during NFP :

============

- www.metatrader5.com

NON FARM PAYROLL (Part 2)- ECONOMIC REPORTS FOR ALL MARKETS

How To Trade News Events: Two Trading Mistakes Which Destroy Your Account

- One of the most common mistakes is sticking in a trade where you know your forex trading strategy is correct, but the market continues to move against you. Famous economist John Maynard Keynes once said: “The markets can remain irrational longer than you can remain solvent”.

- People’s strong desire to be right will often times keep them in trades that they should have moved on from even though the market may eventually prove them correct. Many times when the market touches a support or resistance level it will have a brief spike upwards or downwards which hits the stops of a trader looking to profit from the reversal, taking him out of the market just as it turns in his favor. Because many traders think a like, often times the level at which the trader is taken out of the market is right at his stop level as well. If the trader gets lucky and the market does turn back in his favor this only goes to support this bad habit which will eventually knock him out of the market.

- www.metatrader5.com

Technical Analysis Course - Options

Unlike any other trading derivative, options give you choices. If you trade in futures, contracts for difference, spread betting or any other financial derivative (a financial instrument that 'derives' its value from something else), you can leverage your money but you are also committed to the downside.

Profit Expectations - What Millionaire Traders Know

The first step in understanding and building a solid money management plan, the key component in successful trading, is setting realistic profit expectations. All too often I see people open trading accounts with balances of $10,000 or under expecting to make enough money to support themselves from their trading profits within a short period of time. After seeing all of the hype that is out there surrounding most trading education, trading signal services, etc it is no wonder that people think this is a reasonable goal, but that does not make it a realistic one.

As most any truly successful trader will tell you, the stock market has averaged somewhere in the neighborhood of 10% a year over the last 100 years. What this basically means is that if you would have invested in the 30 stocks that make up the Dow Jones Industrial Average, the index which is designed to represent the overall market, you would have earned about 10% on your money on average over the last 100 years. With this in mind, what most any truly successful trader will also tell you, is that if you can consistently double that return, on average, over the long term, then you will be considered among the best traders out there.

Introduction to the Australian Dollar

A look at what forex traders need to know about the currency of Australia, the Australian Dollar.

Why Traders Hold On to Losing Positions

A lesson on how the ability and willingness to take losses when trading the forex, futures, or stock markets is one of the key factors that differentiates successful traders from unsuccessful ones.

In our last lesson we introduced the concept that money management and the psychology of money management as the most overlooked but most important component of trading success. In today's lesson we will begin to look at one of the most important components of the psychology of money management: a willingness to be wrong.

Humans in general grow up being taught by their environment of the importance of always being right. Those who are right are envied as the winners in society and those who are wrong are cast aside as losers. A fear of being wrong and the need to always be right will hold you back in general, but will be deadly in your trading.

With this in mind lets say that you have been watching my videos and feel that I am an intelligent trader, so you want me to give you a method to trade. I say fine and give you a method and tell you that the method will trade 100 times a year with an average profit of 100 points for winning trades and an average loss of 20 points for loosing trades. You say great and take the system home to give it a try.

A few days later the first trade comes and quickly hits its profit target of 80 points. Great you say and call a bunch of your friends to tell them about the great system you've found. Then a few days later the next trade comes but quickly takes a loss. You hold tight however and then the next trade comes, and the next trade etc until the trade has hit 5 losers in a row and amounting to 100 points in loses on the losers so you are now down 20 points overall, and all your trader buddy's who started following the system after the first trade are now down 100 points.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Please upload forex video you consider as interesting one. No direct advertising and no offtopic please.

The comments without video will be deleted.