Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video March 2015

newdigital, 2015.03.26 19:19

How To Find The Correlation Between Two Assets Step By StepThis video explains the basics of correlation, and shows how to find the correlation between two assets step by step.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.02 05:48

EURUSD Continues to Carve Lower-Highs; 1.0710 Near-Term Support (based on dailyfx article)

EURUSD Under Pressure Amid Greek Headlines; Downward Trending Channel in Focus.

- Despite denying the headline, EUR/USD struggling to hold gains amid news that Greece will not delay its payment to the International Monetary Fund (IMF) due on April 9; may continue to see the downward trending channel take shape as the long-term bearish RSI momentum remains in play.

- String of lower-highs favors approach to ‘sell-bounces’ in EUR/USD, but need a break/close below 1.0710 (23.6% retracement) to favor a further decline in the exchange rate.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.07 05:47

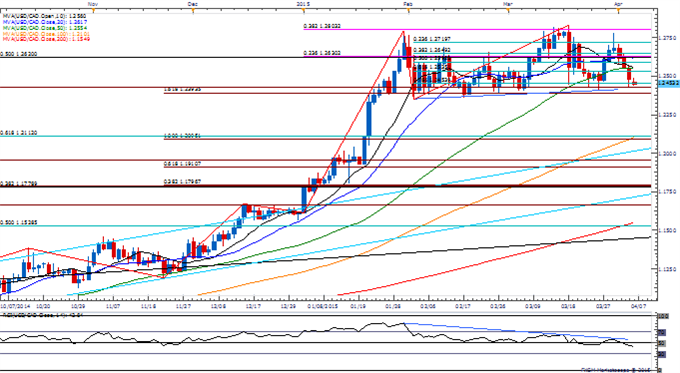

USD/CAD Retail FX Flips Net-Long at 1.2400 Support (based on dailyfx article)

- USD/CAD Retail FX Crowd Flips Net-Long; 1.2400 Support Stands Despite Dismal Ivey PMI.

- AUD/USD Rebound Vulnerable to RBA Rate Cut, Toughened Verbal Intervention.

- 1.2390 (161.8% expansion) to 1.2420 (161.8% expansion) support zone in focus for USD/CAD despite the dismal Ivey Purchasing Manager Index (PMI), which shows a larger-than-expected contraction in March.

- Even though USD/CAD looks largely range-bound, risk remains skewed to the downside as the bearish momentum in the Relative Strength Index (RSI) gathers pace ahead of Canada’s Employment report, which is expected to show a flat reading for March following a 1.0K contraction the month prior.

Trading ABC Patterns with Market Context By Suri Duddella

Suri Duddella presents his new ABC patterns research on how to detect the qualified ABC Patterns and how he finds trend and trade setups using market context. He discusses the various pattern elements like trend strength, location of the pattern, size, pattern symmetry and clarity. Suri will show how to trade ABC patterns and all its related patterns like Double Top/Bottoms, Gartleys and various other patterns with specific rules in Intraday/EOD markets. He presents price and time targets for ABC Patterns with many trading examples.

Webinar - Factor Models in Practice by Quantitative Strategist Ernest Chan

Factor models are well-known among long-term investors who favor stock selection models. But there are some exotic factors from which shorter term traders can also benefit. This webinar will discuss the various factor modeling techniques and the more exotic factors that researchers have recently discovered.

Ernest Chan:

- Quantitative Strategist

- He was a principal of EXP Capital Management

- Supervised Drexel-Burnhan-Lambert’s commodity department in Los Angeles

- Ph.D. in physics from Cornell University

- Managing Member of QTS Capital Management, LLC.

- Adjunct Associate Professor of Finance at Nanyang Technological University in Singapor

Multi-Month Consolidation Holds Ahead of Key Data (based on forexminute article)

USDCAD is squaring up within a multi-month consolidation range as we approach key fundamental data, especially Friday's Canadian employment data.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video January 2014

newdigital, 2014.01.03 12:44

Interview With Gary Dayton, Wyckoff Method Day Trader, On His Path to Trading SuccessKey points made in the video:

1. It took Gary about 6 years of diligent study before he became consistently profitable

2. Understanding the Wyckoff method -- interpreting supply and demand in the market based on price action and volume -- via a mentor was the key for him

3. Gary is an active day trader of the E-mini S&P

4. He has a win rate of about 75-80%

5. As a trained clinical psychologist, Gary understands the immense importance of maintaining the proper mindset when trading. He advocates Eastern practices like meditation and yoga, as well as the simple concept of mindfulness -- i.e. being in the moment.

======

MT5 CodeBase - NonLagDot - Nonlagdot is the supply and demand indicator that calculates a possible trend considering market forces domination.

======

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.12 17:37

EUR/USD forecast for the week of April 13, 2015

The EUR/USD pair

fell hard during the course of the week as the 1.10 level continues to

be resistive. The 1.05 level below has been supportive, but it would be

only a matter of time before we fall below there in our opinion. We

would head to the parity level at that point in time, and believe that

bounces continue to be nice selling opportunities as the European

Central Bank continues to offer significant liquidity measures that of

course can work against the value of the Euro. We have no interest in

buying.

Metatrader 4 Platform Overview

The series which covers how to use the Metatrader 4 platform to trade the forex market.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Please upload forex video you consider as interesting one. No direct advertising and no offtopic please.

The comments without video will be deleted.