Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video November 2014

newdigital, 2014.11.30 08:15

How to Trade the Wedge Chart Pattern Like a ProThe Falling Wedge:

The falling wedge pattern is characterized by a chart pattern which forms when the market makes lower lows and lower highs with a contracting range. When you find this pattern in a downtrend it is considered a reversal pattern as the contraction of the range indicates the downtrend is loosing steam.

The Rising Wedge:

The rising wedge pattern is characterized by a chart pattern which forms when the market makes higher highs and higher lows with a contracting range. When you find this pattern in an uptrend it is considered a reversal pattern as the contraction of the range indicates that the uptrend is loosing steam.

USD/JPY Remains Overbought- Weighed by Risk for Higher JGB Yields

Risk for higher-yielding Japanese Government Bonds (JGB) may further cloud the outlook for USD/JPY especially as the December 14 snap election looms.

Eric Hunsader of NANEX - High Frequency Trading - interviewed by Max Kaiser

In this episode of the Keiser Report, Max Keiser and Stacy Herbert discuss the fact that we are all Jack Johnson now - bankrupted by those we trust or, in the case of the central banks - distrust - all in the name of property speculation and other non-wealth producing speculative pursuits. In the second half Max interviews the founder of Nanex, Eric Hunsader, about high frequency trading, market making and scalping markets.

Invalid Kumo Breakouts

Here's a look at a few Kumo Breakouts and why they are not valid breakouts.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.03 10:38

EUR/USD & USD/JPY in focus, Crude lower, US30 near record as US macro dataPeter Hug is talking about the many headlines affecting gold prices.

How does he see gold set up? “In this short term – and by short term I mean over the next few days, especially with the Thanksgiving holiday and the Swiss gold referendum on Sunday – I think the market is very hesitant to be aggressively short,” he says. “I suspect the risk to the market might be to the upside in the very short term until we get some of these news items out of the way early next week.”

Hug also shares his insights on a recent MarketWatch opinion story saying that the Federal Reserve relies on ‘misleading indicators’ to determine whether or not to raise rates: unemployment and inflation. “I may agree somewhat on the basis of the employment rate…[it] may not be as a significant indicator for the Fed as it maybe was 10 years ago,” he says. “But I don’t agree with the writer on the inflation argument. I do think that is very important for the Fed to watch, [but] I don’t see that being an issue in the short term.” Tune in now to hear what ranges Hug is looking at for gold this week.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.03 16:37

EUR/USD Nears Week Long Range Break; JPY-crosses Continue Run (based on dailyfx article)

- EURUSD H4 MACD nears sell point below signal line.

- JPY-crosses see broad continuation in BoJ-inspired trend.

Event risk is at its lowest point of the week on Tuesday, but it's shaping up to be the 'calm before the storm' if anything. Numerous 'medium' and 'high' rated events will help unleash volatility starting tomorrow, including the European Central Bank meeting on Thursday and the November US labor market report on Friday.

Ahead of then, we're starting to see the ranges that persisted around the holiday trading conditions last week start to bend, just not yet break. One of these instances is occurring in EURUSD, where the closing highs and lows on H4 charts going back to November 27 are starting to be probed.

Elsewhere, the big theme at present is the ongoing Japanese Yen depreciation. USDJPY's triangle/flag going back to November 17 is on the verge of cracking higher; and the momentum in EURJPY and GBPJPY sees continuation higher as well, irrespective of event risk.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.04 05:45

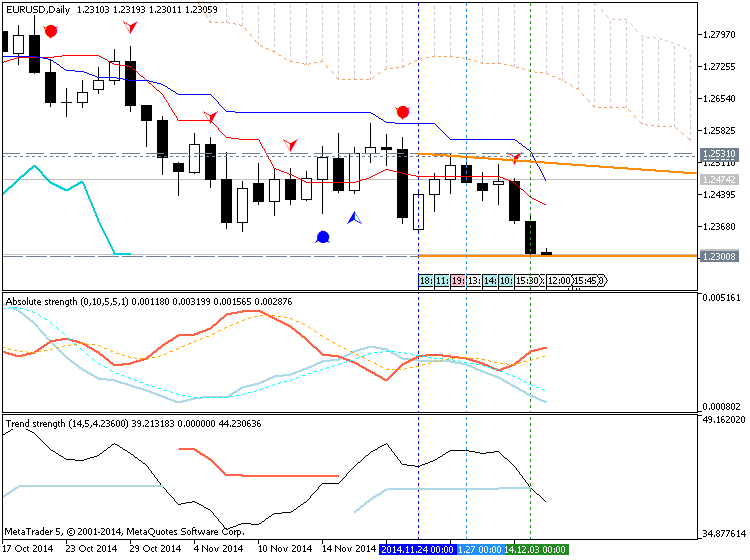

Key EURUSD Scalp Targets Heading Into ECB / NFPs (based on dailyfx article)

- EURUSD Weekly opening range break keeps near-term focus lower

- Shorts at risk heading into interim support / key event risk

Technical Outlook

- EURUSD continues to respect TL resistance off the October high

- Initial support at 2012 low week close 1.2315 (now testing)

- Break eyes susbsequent support objectives at 1.2202, 1.2145 & 1.2095

- Key resistance now at monthly/weekly opening range high- 1.2500

- Daily RSI holding sub 50- bearish

- Momentum resistance trigger pending- breach to mark correction

- Event Risk Ahead: ECB Rate Decision tomorrow morning & US NFPs on Friday

A lesson on how the central banks of the world participate in the foreign exchange market and move the forex market up and down for their economic benefit.

Trading Video: EURUSD, GBPUSD and USDJPY Look to Open Next Week with a Bang (based on dailyfx article)

- A large NFP payrolls beat Friday leveraged the Dollar sharply higher to fresh five-year highs

- Many of the majors head into next week on the verge of critical breaks on long-term technical patterns

- While the data on tap more volatility-prone, special attention should be paid to the RBNZ and SNB

The FX market has positioned itself for an exciting open next week. Driven by a better-than-expected NFP payroll report, the Dollar Index extended its run to a more than five year high. On market-wide basis, the currency looks unencumbered technically to keep status quo momentum. However, among the crosses, we see a range of important technical levels that could take the wind out of the currency's sails. Some are scalable like GBPUSD and others are critical like EURUSD. Will we be ushered into the next phase of larger currency move or will the year-end seasonal drain throw the breaks on this remarkable financial market performance? We look at the trading landscape for the week ahead in this Trading Video.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Please upload forex video you consider as interesting one. No direct advertising and no offtopic please.

The comments without video will be deleted.