Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video May 2014

Malacarne, 2014.06.01 01:40

Not really a "new video", but a very interesting one... It's about the "flash-crash" of the Dow Jones index on May, 2010.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.01 10:50

Silver forecast for the week of June 2, 2014, Technical AnalysisThe silver markets fell during the course of the week, testing the absolute lows that the market has had recently. With that being the case, silver really looks weak here, and as a result we don’t really feel comfortable buying it at this point in time. If we got a supportive candle down there, we can’t think of a better place to do so, but we just don’t have it so therefore we are more than comfortable just sitting on the sidelines as this market looks far too dangerous to be on the long side of. However, fresh new lows could lead to a nice selling opportunity for a move down to about $15.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.01 10:51

Gold forecast for the week of June 2, 2014, Technical AnalysisGold markets fell rather hard during the week, testing the $1250 level. It’s obvious to us know that the market has a bit of support in that general vicinity, and there is certainly a lot of support down near the $1200 level. With that, we are a bit hesitant to sell this market, especially with a longer-term mindset. If we get below the $1200 level, we feel that this market then will head to the $1000 level. As far as buying is concerned, we do not have a buy signal at this point in time.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.01 10:52

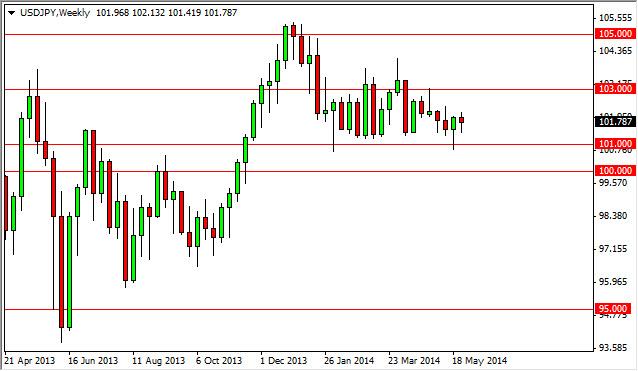

USD/JPY forecast for the week of June 2, 2014, Technical AnalysisThe USD/JPY pair had a back-and-forth week, ultimately settling on a negative candle. However, this candle is shaped a bit like a hammer, so we feel that the market will ultimately go higher from here. On top of that, we are in a larger consolidation area and as a result we expect that to continue. The market should hit the 103 level fairly soon, and therefore we think buying as appropriate. We also recognize that there is a significant amount of support at the 101 level, extending all the way down to the 100 level.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.01 10:53

USD/CAD forecast for the week of June 2, 2014, Technical AnalysisThe USD/CAD pair fell slightly during the course of the week, as we continue to press against the 1.08 level. This area has been supportive lately, but ultimately we believe that the real support is lower. A supportive candle below this current area would be reason enough to start buying, and as you can see on the chart we also have an uptrend line that we are nowhere near yet. That being the case, we feel that this market will probably fall, but quite frankly are not very interested in it at the moment.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.01 10:55

NZD/USD forecast for the week of June 2, 2014, Technical AnalysisThe NZD/USD pair went back and forth in a fairly wild week over the last 5 sessions, ultimately settling near the 0.85 handle. It appears that we are finding enough support in this general vicinity to keep the market somewhat afloat, but we recognize that the support goes all the way down to the 0.84 handle. Down there, things could get ugly, but at the end of the day we believe that the buyers will continue to step in and push the market higher. With that, we are bullish on a supportive candle.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.01 10:56

GBP/USD forecast for the week of June 2, 2014, Technical AnalysisThe GBP/USD pair went back and forth during the course of the week with a slightly negative tone to it. At the end of the day though, the market seems to have found a little bit of support at the 1.67 level, so we think that this market will continue to go higher, and ultimately test the 1.70 level yet again. That area getting broken to the upside would be very bullish, and as a result it would become a buy-and-hold market at that point in time. The “floor” in this market is down at the 1.65 level.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.01 10:57

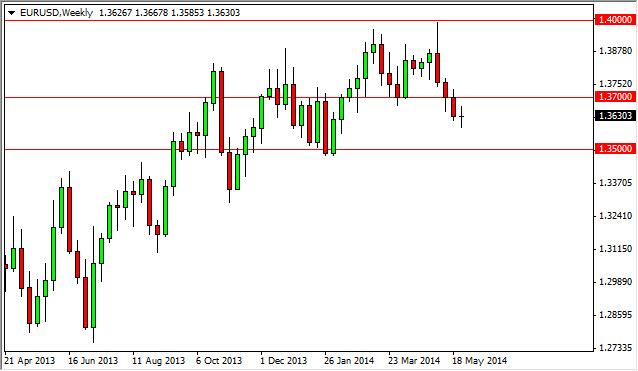

EUR/USD forecast for the week of June 2, 2014, Technical AnalysisThe EUR/USD pair went back and forth during the course of the week, essentially settling nothing. We are finding the 1.36 level to be somewhat supportive though, and that is a positive sign. Ultimately though it appears that the real support probably closer to the 1.35 handle, therefore it is not possible by with any type of real confidence at this moment in time. However, if we broke above the 1.37 handle, at that point in time we feel that this market and its tone would be changing.

Steven Primo

Steven Primo has been actively involved in trading the markets for over 32 years. His trading tenure began in 1977 when he was hired to work as a Floor Reporter, or "runner", on the floor of the Pacific Stock Exchange. Primo reached the pinnacle of his floor-trading career when he became a Stock Exchange Specialist for Donaldson, Lufkin, and Jennrette. As a Specialist he was responsible for making markets in over 50 stocks, a position Primo held for 9 years. Primo left the Stock Exchange floor in 1994 to focus on managing money and to teach his own unique approach to trading the markets. Scores of students, from beginner to advanced levels, have gone on to become successful traders after being introduced to Primo's proprietary methods of trading.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.05 19:44

EUR/USD Outlook Remains Bearish Below Former Support

- EUR/USD Remains Capped by Former Support as ECB Ventures Into Uncharted Territory

- USD/CAD Breakout Gathers Pace Ahead of Canada Employment Report

Despite expectations for seeing another 215K rise in U.S. employment, the jobless rate is expected to increase to an annualized 6.4 percent from 6.3 percent in April, and a mixed batch of data print may continue to produce range-bound prices in the greenback as the Federal Reserve sticks to its current approach for monetary policy. At the same time, Average Weekly Earnings are projected to increase an annualized 2.0 percent during the same period following the 1.9% expansion the month prior, but we would need to see a marked pickup in wage growth to see a more material shift in the Fed’s policy outlook as Chair Janet Yellen retains a dovish outlook for inflation.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Trading and training video (from youtube for example) about forex and financial market in general.

Please upload forex video you consider as interesting one. No direct advertising and no offtopic please.

The comments without video will be deleted.