EURUSD Technical Analysis 2015, 14.06 - 21.06: bullish ranging between 1.0915 and 1.1385 with possible breakout of key resistance levels

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.14 07:38

Morgan Stanley - Outlooks for the Coming Week for USD, EUR, JPY, GBP and AUD (based on efxnews article)

USD: EM and G10 Divergence. Neutral.

We remain medium-term USD bulls, though in the near term we see scope for retracement. The failure of the USD to rally following last week’s strong payrolls print suggests that momentum is against the currency. What’s more, recent comments from policymakers in Japan suggest that USD strength may becoming detrimental for economies, and could drive a near-term retracement, particularly given signs of long USD positioning.

EUR: Draghi Gives EUR Legs. Bearish.

EUR could see further strength in the near term as European yields continue to rise. Thus far, European equities have held up well despite the sell off in European rates – if this starts to turn around, it could counterintuitively offer further support to EUR as investors are forced to buy back their short EUR hedges. The reluctance of Draghi to push back on market volatility suggests that European bond yields could rise further. Greece remains a major risk factor for the EUR.

JPY: A Shift towards strength. Bullish.

Prime Minister Kuroda’s comments on the strength of the JPY are likely to make JPY the outperformer over coming weeks. Indeed, JPY is trading near historical lows on a REER basis, and we see scope for some retracement from recent weakness. In addition, signs of reflation in Japan reduce the probability of further BoJ easing. Higher market volatility should weigh on risk appetite, also adding to JPY support.

GBP: Data filled week. Neutral.

The rise in GBPUSD has been mainly driven by USD weakness. Should this continue then we would expect GBP to remain supported. However we continue to highlight that the performance of GBPUSD is mainly driven by rate expectations. This week’s set of data: inflation, employment and retail sales will therefore be important. We put particular emphasis on average weekly earnings in the services sector. A strong reading here should support GBP and inflation expectations

AUD: Carry and Commodities Undermined. Bearish.

We remain bearish on AUD and high carry currencies generally. As volatility rises and core yields head higher, volatility adjusted rate differentials become less attractive, removing support for AUD. The latest comments from the RBA suggest the central bank wants to support the economy but is concerned about financial stability risks associated with rate cuts, making the currency a good tool. We will watch the upcoming RBA minutes for further color.Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.14 11:02

Key Technical Levels Remain for USD-pairs as Week Ends (based on dailyfx article)

- EURUSD break through $1.1200 could mean $1.1050 next week.

- USDJPY needs to clear out ¥123.90.

"It's a much quieter day on the economic calendar, with only one event due over the next few hours that qualifies as a 'medium' or 'high' ranked event to close out the week. Instead, attention will be focused on two developing themes as the week draws to a close: the rebound in US economic data; and the negotiations surrounding Greece."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.14 18:40

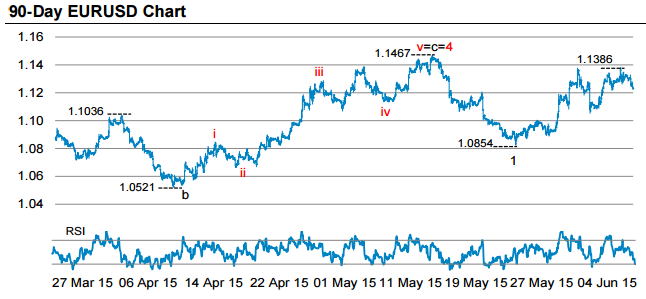

Morgan Stanley: EUR/USD Elliot Wave technical analysis (based on forexlive article)

Ian Stannard from Morgan Stanley: "despite the corrective rebound developed since early March, EURUSD remains within a long term down trend... suggests upside potential is limited for EURUSD" and the "sub-structure of the decline from June of last year has been "impulsive... the next stage of the EURUSD decline ... is now likely to unfold."

"This bearish interpretation will be confirmed by a move below 1.1005, suggesting the next impulse decline is set to take EURUSD below the 1.0854 level and back to the 1.0458 March low. This even implies a move to new lows with potential for a decline below parity over the medium term. Near-term risk to this scenario is a move above 1.1467, which would suggest another corrective leg higher before the downtrend resumes."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.15 07:51

Barclay: The Case For Staying Short EUR/USD Into FOMC (based on efxnews article)

"Markets will pay close attention to the tone of the FOMC statement on Wednesday and watch for hints on the timing of the first rate hike. Given the recent pickup in US consumption and labor market data, we think the Fed is likely to maintain its view that the winter slowdown was transitory and that the economy is likely to expand at a moderate pace. Indeed, the pace of job growth has picked up, with payrolls rising 280K in May, and the Fed’s LMCI has increased since the April meeting. Additionally, we expect the Fed to reiterate that inflation will gradually rise toward the 2% target in the medium term as the labor market continues to improve and inflation expectations remain stable," Barclays clarifires.

"Indeed, CPI data on Thursday, along with the latest import price data, should support our view that downward pressures on domestic core inflation from the lagged effects of USD appreciation will begin to wane going into the third quarter. As such, we continue to think the Fed is on track to hike twice this year (at the September and December meetings)," Barclays projects.

"Overall, we believe that the FOMC statements, along with CPI and other macro data, should support the USD," Barclays argues.

"Greek political uncertainty remains high, as the gap in negotiations between Greece and the Institutions remains substantial. The IMF is reported to have walked away from talks with Greek officials on Thursday because of the inability to find agreement on such issues as pension and tax reforms. Meanwhile, the economic and financial situation is continuing to deteriorate in Greece, with the state revenue shortfall having grown €1bn in May to reach a total of €2bn, and with the ECB having last week raised the limit on the Emergency Liquidity Assistance (ELA) to Greek banks by a further €2.3bn, to €83bn. The Eurogroup and ECOFIN meetings will be held on 18 and 19 June, respectively," Barclays notes.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.12 16:41

Forex Weekly Outlook June 15-19 (based on forexcrunch article)

The US dollar did not lick honey against most currencies despite some OK data. The focus now moves to the all-important Fed decision. In addition we have housing and inflation numbers in the US, rate decisions in Japan and Switzerland and the ongoing Greek crisis. These are among the main events on forex calendar for this week. Here is an outlook on the market movers coming our way.

The released positive economic data with better than expected retail sales figures. American consumers increased their purchases in May, especially for autos, clothes and building materials, suggesting the improvement in the labor market boosted sales. Alsoconsumer sentiment for June beat expectations, but most market analysts doubt this is enough for an early rate. In the euro-zone, Greek headlines had a growing impact on the common currency as the clock is ticking. The Aussie enjoyed a good employment report while the kiwi fell sharply on a rate cut. Where will currencies move next?

- UK Inflation data: Tuesday, 8:30. UK inflation turned negative in April, reaching -0.1%. This was the first negative figure ever recorded. Bank of England governor Mark Carney forecasted low inflation in the coming months, but expects a gradual pick up towards the end of 2015. The sharp fall in oil prices is the major reason for low inflation. However, this global trend is positive for UK households despite concerns of weaker business investments. UK inflation is expected to rebound in May and rise 0.1%.

- German ZEW Economic Sentiment: Tuesday, 9:00. German investor sentiment plunged in May, amid the Greek debacle and lack of growth. Economic sentiment fell to 41.9 from 53.3 in April considerably lower than the 48.8 estimated by analysts. Responders were concerned about the sluggish growth data of only 0.3% growth in the first quarter compared to 0.7% in the last quarter of 2014. Furthermore, Greece’s inevitable default raises fears over the Eurozone economic outlook. German investor climate is expected to decline further to 38.6.

- US Building Permits: Tuesday, 12:30. U.S. building permits edged up to their highest level in nearly 7-1/2 years in April, reaching a seasonally adjusted annual pace of 1.14 million units, following 1.04 million in March. Additional positive construction data suggest a possible rebound in the housing sector. The rise in demand for new houses is a positive trend following the harsh winter of 2015. The strong housing data is expected to have a positive effect on GDP growth in the second quarter. The number of building permits is expected to reach 1.10 million units this time.

- UK Employment data: Wednesday, 8:30. The UK labor market continued to improve in April. Unemployment fell and the number of people employed continued to rise. The number of people claiming jobless benefits declined by 12,600 in April to 764,000. Government officials were pleased with the positive data, claiming their government is working. Rising demand for workers pushed regular pay growth to 2.2%. Weak inflation and higher wages are welcome news for the UK households. This will also have a positive effect on consumer spending and economic growth.

- Fed decision: Wednesday, 18:00, press conference at 18:30. This is the first meeting that does not carry any forward guidance regarding rates. In addition, it is accompanied by fresh economic forecasts, the “dot plot” and of course, a press conference by Fed Chair Janet Yellen, all making this meeting a very big event. The baseline scenario is that the Fed will wait just a bit more before raising the rates, with economists focusing on the September meeting. However, a rate hike is possible already now and in July. On on hand, the Fed would like to start the “lift off” and prevent bubbles. On the other hand, it would not like to act prematurely, choking the recovery and having to reverse. Every word in the statement and every word that Yellen will say carry a lot of weight. Worries could send down the dollar while upbeat sentiment about the positive data in the spring could be dollar positive. A repeat of the “hike in 2015″ stance would be generally positive.

- NZ GDP: Wednesday, 22:45. New Zealand economy expanded 0.8% in the fourth quarter of 2014, in line with market forecast, following a 0.9% growth in the third quarter. Retail and accommodation edged up 2.3% in the last quarter of 2014 while international tourist spending increased by 15%. Retail trade also climbed 1.8%. Year-on-year, the economy grew 3.5%, the highest level since the fourth quarter of 2007. New Zealand Q1 GDP is expected to reach 0.6%.

- Switzerland rate decision: Thursday, 7:30. The Swiss National Bank decided to keep interest rates at negative 0.75%, waiting to see the full impact of its unexpected move in January. The change in the monetary conditions was made in an effort to depreciate the Swiss franc, but had a negative effect on household savings and pension funds becoming a matter of concern for the Swiss population. SNB President Thomas Jordan noted that the franc was still overvalued and that there was room for an even lower rate in the future. The Swiss National Bank is expected to maintain the negative rate of -0.75%.

- US inflation data: Thursday, 12:30. U.S. inflation excluding energy costs edged up 0.3% in April amid a rise in shelter and medical care costs. Analysts expected a 0.2% climb as in March. Meanwhile, the overall CPI climbed 0.1% after rising 0.2%in March. The rise was held back by a 1.7% decline in gasoline prices and no change in food prices. April’s figures support the Fed’s decision to raise rates, showing signs that inflation was moving toward the Fed’s target. CPI is forecasted to rise 0.5% while Core CPI is expected to gain 0.2%.

- US Unemployment claims: Thursday, 12:30. The number new claims for unemployment benefits increased mildly last week, reaching 279,000, still remaining below 300,000. This was the 14th week that claims held below the 300,000 threshold, indicating the labor market continues to strengthen. Economists expected the number of claims will reach 277,000. The four-week average of claims increased 3,750 to 278,750 last week. The number of jobless claims is forecasted to reach 278,000 this week.

- US Philly Fed Manufacturing Index: Thursday, 14:00. Manufacturing in the Philadelphia area weakened in May, according to responders. Philadelphia Fed’s manufacturing business outlook fell to 6.7 in May from 7.5 in April. New orders rose 0.3% following 0.7. Current shipments index also rise 3 points to a reading of 1 and Employment conditions weakened by 5 points to 6.7, from April’s reading of 11.5. The manufacturing sector in the New York region found some momentum late last week with the Empire State manufacturing survey bouncing back into positive territory. However, the 3.1 reading in May remained weaker than expected. Manufacturing sentiment in the Philadelphia area is expected to rise to 8.1.

- Japan rate decision: Friday. the Bank of Japan voted to maintain its monetary policy stance unchanged in May and continue implementing money market operations to ensure a monetary base of JPY 80 trillion a year. The decision, which was in line with market forecast. The BOJ noted that Japan’s economy is continuing to improve. Exports increased boosting growth in the manufacturing sector and increasing business investments. However, the Bank also stated that inflation is likely to remain close to 0% in the near term due to the energy price decline. No change in rates is expected.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.15 17:21

Credit Agricole - EUR: The End Of Complacency (based on efxnews article)

"EUR came off at the start of the new week after the talks between Greece and its creditors in Brussels were abandoned after only 45 minutes yesterday. Our central case is still for a compromise to be found most likely in the form of a partial bailout extension in exchange for the implementation of some of the reforms. Market uneasiness could grow ahead of the Eurogroup meeting and keep the downside pressure on EURUSD in place for now."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.16 11:11

SEB - Intraday Outlooks For EUR/USD, USD/JPY, GBP/USD, AUD/USD (based on efxnews article)

EUR/USD: Still respecting dynamic support. The high end of the (bullishly tilted) short-term "Cloud" (1.1175) remains an obstacle for bears - standing in the way for a move down to the 1.1049/36 pivot area. While nearby nitty-gritty discrepancies in range are sorted out the intraday stretches are located at 1.1150 & 1.1375.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.16 18:18

Credit Agricole- 'Where To Sell Euro Relief Rally?' (based on efxnews article)

The impact of the Eurogroup’s failure to achieve a Greek settlement over the weekend will be temporarily supplanted as investors turn their attention towards tomorrow’s FOMC announcement. We remain USD bulls as the FOMC should strike a more constructive tone raising rate hike expectations. Latest soft US data have not changed our opinion.

To the contrary, our call remains for Fed lift-off in September with a bias towards further FOMC front-loading. Such front loading behaviour post-FOMC should push USD funding costs higher thereby dragging EUR/USD lower. Even USD/JPY should be ‘pulled off the side-lines’ after Kuroda’s overnight clarification to see the pair re-test and then break 124.0 in the week ahead.

Returning to the Eurozone and the stakes surrounding the June 18 EMU finance ministers are now even higher. With many acknowledging Greece to now hold the superior bargaining position, investors will be looking for further potential creditor concessions this week to stave off fears of a default.

Are such concessions realistic? ‘Yes’ would be our answer and thus the probability of a EUR relief-rally remains high. However those bearish EUR investors with all but the shortest outlooks need not be overly worried, as such a relief-rally would likely trigger renewed selling.

Indeed we envisage such selling could quickly reemerge before 1.15 in EUR/USD and 1.30 in EUR/JPY.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.17 07:11

UBS for EUR: 'Greece Closer To The Brink' (based on efxnews article)

Should the Greek government and its international partners fail to reach an agreement in the emergency meetings scheduled for the coming days, a further escalation in the crisis would seem likely, argues UBS.

"This could well include changes to the ECB's provision of Emergency Liquidity Assistance (ELA) and capital controls, which would likely destabilise sentiment and put a heavy burden on the Greek economy, the banking system, and government finances – while not necessarily prompting the Syriza government to agree to Troika demands," UBS adds.

If D1 price will break 1.0915

support level on close D1 bar so the price will be fully reversed to the primary bearish market condition.

If D1 price will break 1.1385 resistance level so the bullish trend will be continuing with possible good breakout.

If not so the price will be on ranging between 1.0915 and 1.1385 levels.

- Recommendation for long: watch close D1 price to break 1.1385 for possible buy trade.

- Recommendation to go short: watch D1 price to break 1.0915 support level for possible sell trade.

- Trading Summary: ranging.

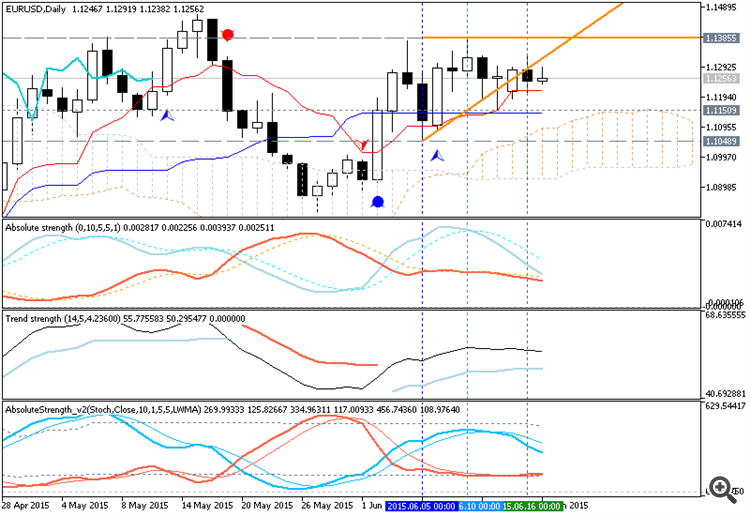

The situation was not changed so much: daily price is on primary bullish with secondary ranging between 1.0915 support and 1.1048 resistance levels for now. If the price will break trendline so the probability of breakout for the price to cross resistance levels will be very high:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is on primary bullish with the secondary ranging between 1.1385 resistance and 1.0915 support levels which was started on close daily bar in the beginning of this month. The price is located above Ichimoku cloud/kumo for primary bullish with Chinkou Span line to be crossed with the price from above to below on close bar and to below to above on open bar for now.

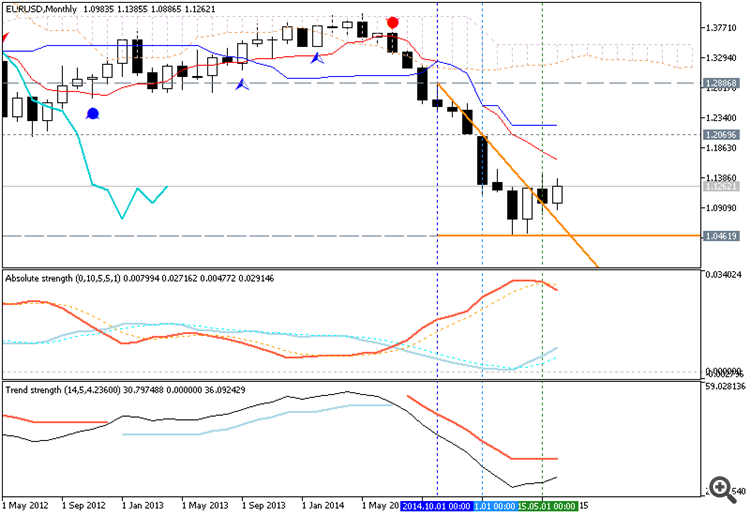

D1 price - primary bullish with secondary ranging:W1 price is on bearish market condition with secondary ranging between 1.0520 (W1) support level and 1.1466 (W1) resistance level.

MN price is on ranging bearish with 1.0461 support level.

If D1 price will break 1.0915 support level on close D1 bar so the price will be fully reversed to the primary bearish market condition.

If D1 price will break 1.1385 resistance level so the bullish trend will be continuing with possible good breakout.

If not so the price will be on ranging between 1.0915 and 1.1385 levels.

SUMMARY : bullishTREND : ranging