You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

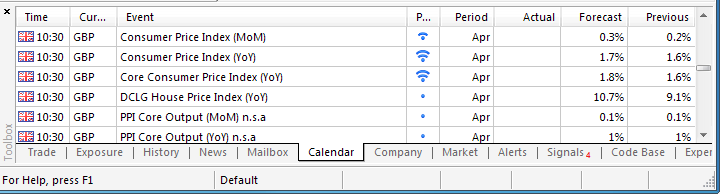

Trading the News: U.K. Consumer Price Index (based on dailyfx article)

A marked rebound in the U.K.’s Consumer Price Index (CPI) may pave the way for fresh highs in the GBP/USD as it puts increased pressure on the Bank of England (BoE) to normalize monetary policy sooner rather than later.

What’s Expected:

Why Is This Event Important:

Indeed, the BoE Minutes may reveal a growing dissent within the Monetary Policy Committee (MPC) as U.K. officials anticipate a stronger recovery in 2014, and heightening price pressures may boost the bullish sentiment surrounding the British Pound as it spurs a more material shift in the policy outlook.

The ongoing pickup in household sentiment along with the resilience in retail sales may push U.K. firms to ramp up consumer prices, and a sharp uptick in the headline reading for inflation should foster a bullish reaction in the GBP/USD as it fuels interest rate expectations.

Nevertheless, efforts to cool the house paired with the persistent slack in the real economy may continue to dampen the outlook for price growth, and a dismal CPI print may generate a larger correction in the GBP/USD as market participants scale back bets of seeing higher borrowing costs ahead of schedule.

How To Trade This Event Risk

Bullish GBP Trade: U.K. CPI Climbs 1.7% or Higher

- Need green, five-minute candle following the release to consider a long British Pound trade

- If market reaction favors buying sterling, go long GBP/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish GBP Trade: Headline Reading for Inflation Disappoints- Need red, five-minute candle to favor a short GBP/USD trade

- Implement same setup as the bullish British Pound trade, just in opposite direction

Potential Price Targets For The ReleaseGBP/USD Daily

- Retains Ascending Channel from 2013- Higher Low in Place?

- Interim Resistance: 1.7000 Pivot to 1.7030 (100.0% expansion)

- Interim Support: 1.6730 (61.8% expansion) to 1.6720 (50.0% retracement)

Impact that the U.K. CPI report has had on GBP during the last release(1 Hour post event )

(End of Day post event)

March 2014 U.K. Consumer Price Index

GBPUSD M5 : 60 pips price movement by GBP - CPI news event

U.K. consumer prices increased an annualized 1.6% in March after expanding 1.7% the month prior, while the core rate of inflation grew 1.6% during the same period to match the slowest pace of growth for 2014. Despite the slowdown, the in-line CPI prints pushed the GBP/USD back above the 1.7000, with the pair ending the day at 1.6723.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.05.17 11:35

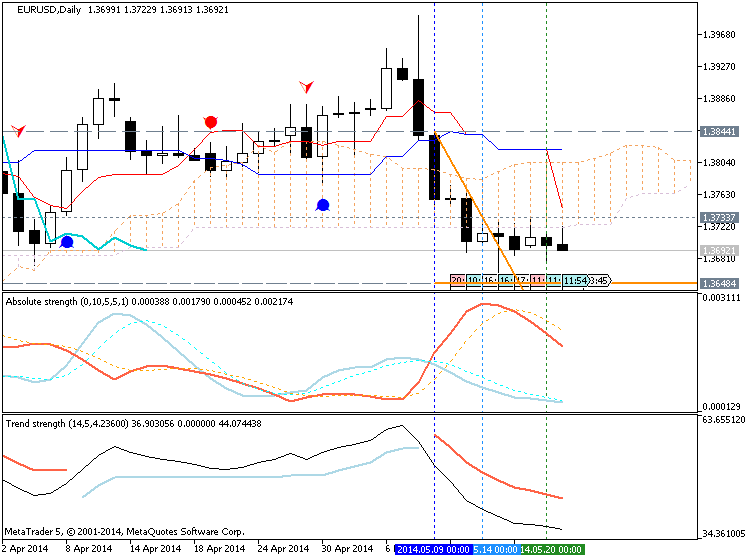

GBPUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Pound: BearishThe British Pound pulled back further from multi-year highs as a drop in UK yields and a broader US Dollar reversal produced the second-consecutive week of GBPUSD declines. Key economic data may need to impress to spark a larger GBP bounce.

A highly-anticipated Bank of England Inflation Report showed officials are likely to keep interest rates unchanged for some time to come. The disappointment sent UK yields considerably lower, and the interest rate-sensitive GBP followed in kind.

Those same interest rate and FX traders will watch upcoming UK Consumer Price Index inflation figures, Retail Sales results, and Q1 GDP growth numbers for greater clarity on the future of domestic interest rates.

Risks to the British Pound seem weighed to the downside as the BoE dashed hopes that strong growth figures would be enough to force the bank into action on interest rates. And indeed short-term government bond yields matched their largest single-week drop on the year. Given strong correlations between interest rates and the GBP, any further deterioration could sink the Sterling for the third-consecutive week.

Consensus forecasts for upcoming inflation, consumption, and growth figures are relatively tame; the recent tumble in yields suggest we need to see strongly positive surprises to force a material Sterling bounce. From a technical perspective it’s important to note that the GBPUSD trades near pivotal support, and its next moves could guide price action for some time to come.

It’s shaping up to be an important week for the previously high-flying GBP. And though it remains relatively close to multi-year peaks, continued failure at these levels suggests that the uptrend may be over.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.05.20

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 34 pips price movement by GBPUSD - CPI news event

Recently, I came across an interesting trading strategy, intended for futures trading but theoretically applicable to retail Forex trading. The strategy’s author claims that even with completely objective and straightforward rules, a simple and complete “trend-following” strategy traded across a widely diversified group of liquid futures markets has produced an average annual return of approximately 20% per year over the past two decades, significantly outperforming global stock markets and equating to the kind of returns produced by professionally managed trend-following managed futures hedge funds.

As a Forex professional, I took a closer look at the strategy to see what kind of edge it might have historically provided to retail Forex traders. The results make interesting reading because they illustrate exactly why it can be so difficult for retail traders to exploit edges that exist within markets.

For the sake of full disclosure I reproduce the strategy rules in full:

- Risk: the 100 day ATR (Average True Range) should equal 1 unit of risk.

-

Entry: long at the end of any day which closes above the highest close

of the previous 50 days; short at the end of any day which closes below

the lowest close of the previous 50 days.

- Entry

Filter: long entries only when the 50 day SMA (Simple Moving Average) is

above the 100 day SMA; short entries only when the 50 day SMA is below

the 100 day SMA.

- Exit: A trailing stop should be used

of 3 times the 100 day ATR from the highest price since the trade was

opened (for longs), or the lowest price since the trade was opened (for

shorts). The trailing stop must be recalculated constantly as a

“chandelier stop” and it should be a soft stop: an exit is only made

when a daily close is at or beyond the stop loss.

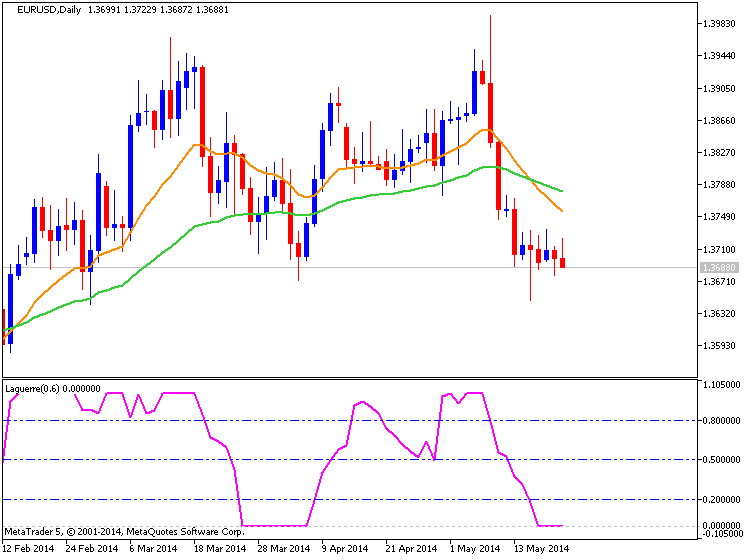

This strategy was tested against the most liquid and popular spot Forex currency pair, the EUR/USD, over a long and recent period of time (from September 2001 to the end of 2013), using publicly available spot EUR/USD data with the daily open and close at Midnight GMT.Euro Rallies against the Dollar, Ending Two-Week Run of Losses (based on Forexminute article)

The euro rose against the dollar, ending two weeks of losses as investors awaited market data that points towards monetary easing in the euro zone.

The euro advanced 0.1 percent to $1.3702, ending a run of losses of more than 1 percent over the last two weeks. The shared currency advanced to 138.99 yen before edging lower to 138.77 yen, a three-month low.

The euro has been hurt by speculation that the European Central Bank may ease its monetary policy when it meets in June. Commodity Futures Trading Commission’s data that was released last Friday indicated that there were 2,175 net short contracts on the common currency in the week ended May 13, down from net long positions of 32,551 a week earlier, reported Reuters.

"There seems to be so many reasons to short the euro," said Bart Wakabayashi, a Tokyo-based head of forex at State Street Global Markets. "The ECB seems to be the one [central bank] under the most pressure to act the soonest."

The ECB is expected to roll out a raft of measures such as a reduction in all interest rates and policy that seeks to increase lending to small and mid-sized enterprises. Hence traders will be keenly monitoring purchasing managers’ surveys of the euro zone that will be released this week.

"Given the low euro zone inflation, interest will be on the input/output price subcomponents of the PMIs," analysts at Commonwealth Bank told clients.

The dollar index fell to 80.017, down from last week’s peak of 80.338 that it touched on Thursday. The dollar fell 0.1 percent to 101.44 yen, which is close to 101.31 yen, a two-month low that it also hit last Thursday.

Two North Carolina Senate committees unanimously voted on Tuesday to approve a law that will see the ban on fracking lifted in summer. The bill is expected to be tabled before the Senate this week.

The bill will see the ban on shale gas drilling lifted on July 1, 2015, potentially paving the way for the Department of Environment and Natural Protection to award permits to energy firms for horizontal drilling and fracking, reported the News & Observer.

The move was welcomed by pro-fracking activists who argue that the method boosts local economy and creates thousands of jobs. However, environmentalists argue that the measure goes against the promise not to remove the fracking moratorium until the necessary safety regulations are in place.

This is the second time that the state is attempting to remove the moratorium, after an earlier bid to remove it collapsed in the NC House after the public opposed the move, forcing lawmakers to promise that they will not remove the moratorium until the necessary rules and laws were in place.

The bill was approved by the Senate Finance Committee and the Senate Commerce Committee. The bill was forwarded to the Senate Rules Committee for a debate tomorrow and Thursday, before being tabled before the House for a hearing.

Republican Sen. Buck Newton was quoted as saying that the energy companies are waiting to see whether North Carolina is committed to shale gas exploitation, and that he expects drilling to begin in mid-2015.

"We are not sure the industry will be anywhere near ready to go at that time," Newton said. "The industry hasn't explored here yet because we haven't finished what we're doing now."

The bill made several adjustments in order to attract energy firms, such as lower severance taxes and a much more favorable baseline water testing rule.

Trading the News: Bank of England Minutes

The Bank of England Minutes may generate a more meaningful advance in the GBP/USD should we see a growing number of central bank officials show a greater willingness to normalize monetary policy sooner rather than later.

What’s Expected:

Why Is This Event Important:

The policy statement may show a growing dissent within the BoE as the fundamental developments coming out of the U.K. raise the prospects for a stronger recovery, and the fresh batch of central bank rhetoric may pave the way for fresh highs in the GBP/USD should the committee adopt a more hawkish tone for monetary policy.

Sticky price pressures paired with the ongoing pickup in private sector activity may put increased pressure on the BoE to raise the benchmark interest rate ahead of schedule, and the GBP/USD may continue to carve higher highs & higher lows in the second-half of the year as the central bank moves away from its easing cycle.

However, the persistent slack in the real economy may keep the BoE on the sidelines as Governor Mark Carney retains a cautious outlook for the region, and the GBP/USD may face a larger correction in the days ahead should the policy statement drag on interest rate expectations.

How To Trade This Event Risk

Bullish GBP Trade: BoE Shows Greater Willingness to Normalize Policy

- Need green, five-minute candle following a hawkish statement to favor a long British Pound trade

- If reaction favors buying British Pound, long GBP/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; need at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish GBP Trade: MPC Retains Neutral Bias for Policy Outlook- Need red, five-minute candle to consider a short GBP/USD trade

- Implement same setup as the bullish British Pound trade, just in the opposite direction

Potential Price Targets For The ReleaseGBP/USD Daily

The BoE voted unanimously to retain its current policy in April as the central bank sees a stronger recovery in 2014, but the British Pound failed to benefit from the meeting minutes as the MPC talked down the threat for inflation. In turn, the GBP/USD slipped back below the 1.6800 handle, with the pair trailing lower throughout the North American trade to end the day at 1.6779.

2014-05-21 06:30 GMT (or 08:30 MQ MT5 time) | [JPY - BOJ Press Conference]

JPY BOJ Press Conference = It's among the primary methods the BOJ uses to communicate with investors regarding monetary policy. It covers the factors that affected the most recent interest rate decision, the overall economic outlook, inflation, and clues regarding future monetary policy

==========

BOJ’s Kuroda says they are not linking growth rate with monetary policyYep, the lad’s still at it

USDJPY 100.87

Add:

EUR/USD still immune for stock market volatility

On Tuesday, the eco calendar was again thin. In Europe, equities were unable to give trading on other markets a clear guidance. The euro remained slightly under pressure as were peripheral bonds. However, the key 1.3643 support stayed well out of reach. USD/JPY was initially slightly higher off Monday’s low but the a new selling wave of US equities after the close in Europe pushed the pair again lower in the 101.00 big figure. EUR/JPY tested again the key 138.55/70 support but a break didn’t succeed.

This morning, Asian equities are mostly in the red except for China. However, the losses are contained compared to the correction in the US. Yesterday evening, Fed hawk Plosser repeated its assessment that rates may be raised sooner rather than later. His comments might have caused some nervousness on the US equity markets. However, they didn’t help the dollar. On the contrary, USD/JPY is creeping back to this week’s low at 101.10. EUR/USD is again not at all affected, not by the Fed comments and not by the correction on the US and Asian equity markets. The BoJ as expected kept its policy unchanged. There is no indication that the bank is preparing for additional stimulus anytime soon. An optimistic tone from BOJ might keep the yen well bid.

Later today, there are again few eco data in the US and in Europe. Consumer confidence from the European commission is expected to improve slightly from -8.6 to -8.3. This report probably won’t be a game changer for EUR/USD trading. After a chorus of ECB speakers recently, the focus turns to the Fed today. A long series of Fed governors will speak and the Fed will publish the minutes from the April meeting. Fed’s Yellen already elaborated on the Fed decision in an appearance before the JEC of Congress earlier this month. Even so, it will be interesting to see the thinking within the Fed on the next steps to scale back policy stimulation. Indications that this next step is coming closer might be slightly positive for the dollar. Even so, currency trading will probably again be driven by technical considerations and by global sentiment on risk. How will European markets react to the correction in the US yesterday? Will intra-EMU spreads continue to widen? If so, it might at least cement the topside of EUR/USD. The picture in the yen cross rates remains very interesting, too. EUR/JPY is struggling to hold above a first resistance (138.55/70 area). USD/JPY is testing the key 101.20/100.75 support. The process is going very slowly, but a break below these levels would be highly significant and may also be a negative for the euro. For now this is nothing more than an hypothesis.

After the May ECB press conference, we reinstalled a sell-on-upticks bias for EUR/USD ahead of the June ECB meeting. Of course, the reasons for recent dollar weakness haven’t disappeared all at once. So, the downside correction in EUR/USD will probably develop in a gradual way. A first support at 1.3673/43 was tested last week but no sustained break occurred. The next high profile level is the 1.3477 April correction low. We maintain a sell-on-upticks approach. A break above 1.40 would suggest that the markets doubt the credibility of the ECB commitment and thus warrants stop loss protection.

Hot News in Audio : Currency Markets with John Kicklighter

Chief currency strategist at DailyFX.com, John Kicklighter joins Merlin for a look at some of the events and data impacting currencies around the world. First comes the Euro, which has been flirting with a strong supply level, yet unable to break! John offers his thought on the ECB’s actions and why this is the line in the sand for the Euro. Later, the duo breaks down the current trajectory in the Pound and the Yen, both of which offer some great trading opportunities. Merlin also looks at some tools, such as the SSI, which helps traders

understand where the money is flowing in a variety of instruments

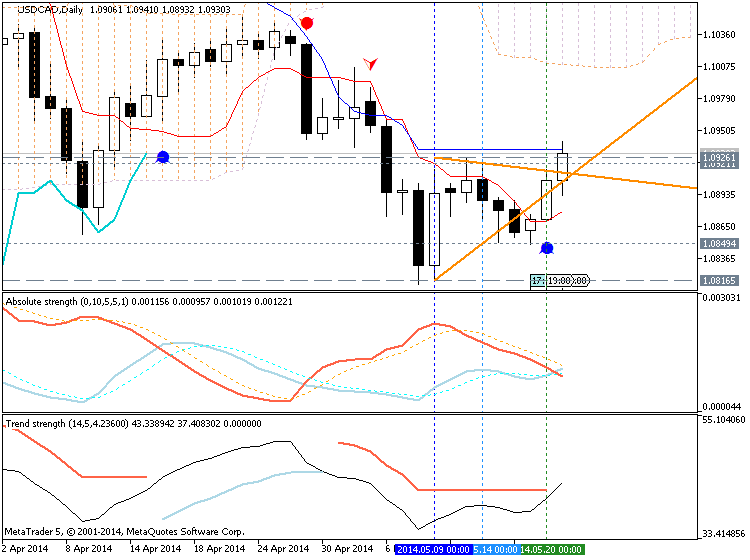

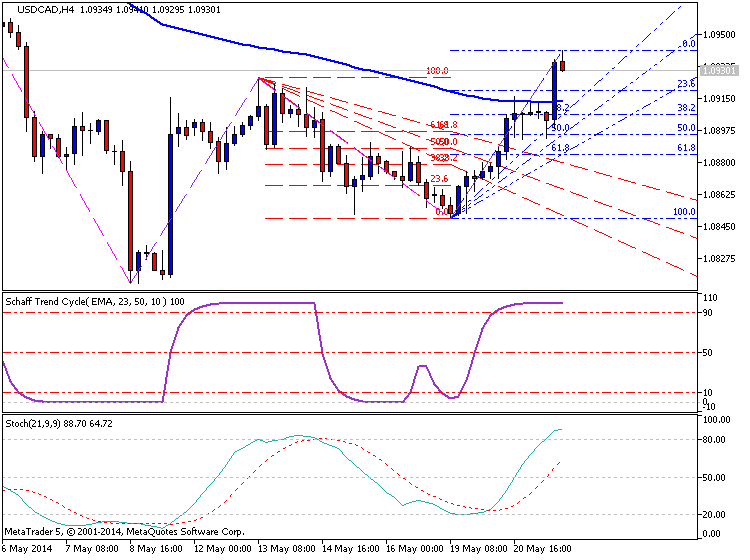

USD/CAD eases up to 1-week high before Fed minutes

The U.S. dollar eased up to one-week highs against the Canadian dollar on Wednesday as investors awaited the minutes of the Federal Reserve’s latest meeting later in the session for fresh insight into when U.S. borrowing costs might rise.

USD/CAD touched highs of 1.0918, the most since May 14 and was last up 0.09% to 1.0914.

The pair was likely to find support at 1.0870, Tuesday’s low and resistance at 1.0959.

Investors were turning their attention to of the minutes from the Fed’s latest monetary policy meeting for insight on the central bank's view of the economy.

Recent U.S. economic reports indicating that the recovery remains uneven have weighed on U.S. Treasury yields, pressuring the dollar.

On Tuesday, New York Fed President William Dudley reiterated the central bank’s dovish stance, saying the pace of rate hikes was likely to be “slow”.

Market participants were also looking ahead to Canadian data on retail sales due for release on Thursday and a report on consumer inflation on Friday.

Elsewhere, the loonie, as the Canadian dollar is also known, was higher against the euro, with EUR/CAD down 0.18% to 1.4915.

The euro remained under pressure amid expectations that the European Central Bank will ease monetary policy at its next meeting in June and after data last week showing that the euro zone economy grew at a slower than forecast rate in the first quarter.

Previously confidential correspondence between Google GOOGL +0.92% and the SEC released this week shows the search giant has no intention of bringing some of its overseas cash hoard back home and plans to use up to $30 billion of its stockpile for dealmaking.

In a letter dated December 20, 2013, responding to questions from regulators regarding its Form 10-K for fiscal 2012, Google wrote that it expects “a significant portion of our future expansion will continue to be driven by foreign operations outside the U.S.” For that reason, Google expects to have capital needs of $20 to $30 billion for M&A activity and $2 to $4 billion for capital expenditures.

Google pointed to its $1 billion acquisition of traffic Waze as one of more than 20 strategic acquisitions it made in 2013, and one that was funded entirely by the non-U.S. earnings piggy bank. The company also said it was in pursuit of a $4-$5 billion overseas deal that didn’t come to fruition.

The company has also used overseas cash to acquire foreign technology rights of U.S. targets, as it did when buying Motorola Mobility for $12.4 billion in 2012.

On the other spending front, Google expects to use $2-$4 billion to add additional data center assets outside the U.S. as the business “evolves to include more ‘cloud’ and content based offerings.” In recent years, the company has invested billions in both new data centers and replacements for older equipment. The company noted that it has shifted to buying property rather than leasing, including buildings in Dublin, a research center in France and a new office space in London.

Google’s letter makes it clear the company has no interest in repatriating overseas cash holdings, an area of focus among regulators given the massive foreign cash hoards companies are sitting on and keeping out reach from U.S. taxes.

Apple AAPL -0.19%, for instance, has opted to tap the debt market, raising tens of billions in the last few years to fund increased share repurchases and dividends without disturbing its massive cash pile outside the U.S. Google has done something similar, to lesser extent, having issued $3 billion in bonds in 2011 at low interest rates and maintained a $3 billion commercial paper program to maintain liquidity in the U.S. without tapping their overseas cash.

While the trend has certainly been on the side of Google and Apple, not all companies are declining to repatriate foreign cash though. In late April eBay EBAY -0.65% said it would take a $3 billion tax hit in order to bring $6 billion of overseas cash back home. Judging from the correspondence released this week, Google has no plans to follow suit anytime soon.

Google shares were up 0.8% to $544.79 Wednesday morning.