You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

2016-11-16 13:30 GMT | [USD - PPI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - PPI] = Change in the price of finished goods and services sold by producers.

==========

From official report:

"The Producer Price Index for final demand was unchanged in October, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices rose 0.3 percent in September and were unchanged in August. On an unadjusted basis, the final demand index increased 0.8 percent for the 12 months ended in October, the largest 12-month rise since advancing 0.9 percent in December 2014."

==========

EUR/USD M5: 14 pips range price movement by Producer Price Index news events

==========

USD/CNH M5: 46 pips price movement by Producer Price Index news events

==========

NZD/USD M5: 17 pips range price movement by Producer Price Index news events

AUD/USD Intra-Day Fundamentals: Australian Employment Change and 34 pips range price movement

2016-11-17 00:30 GMT | [AUD - Employment Change]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Employment Change] = Change in the number of employed people during the previous month.

==========

From official report:

==========

AUD/USD M5: 34 pips range price movement by Australian Employment Change news event

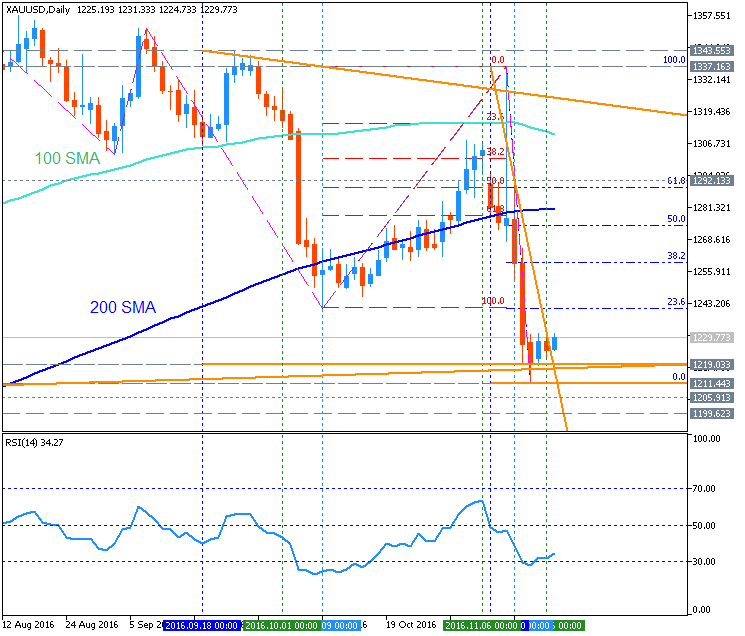

GOLD (XAU/USD) Daily Bearish Breakdown With 1.1219 Support To Continue (adapted from the article)

Daily price broke 100-day SMA/200-day SMA reversal levers to be reversed to the primary bearish area of the chart. For now, the price is on testing 1,1219 support level to below for the bearish breakdown to be continuing with 1,211 and 1,200 nearest daily bearish target to re-enter.

Most likely scenarios for the daily price movement are the following: the price will be continuing with the bearish breakdown by 1,200 psy level to be broken, or the ranging bearish condition will be started for the price to be waiting for the direction of the trend based on the future fundamental factors for example.2016-11-17 13:30 GMT | [USD - CPI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers.

==========

2016-11-17 13:30 GMT | [USD - Building Permits]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Building Permits] = Annualized number of new residential building permits issued during the previous month.

==========

From official reports:

"The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in October on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 1.6 percent before seasonal adjustment."

==========

EUR/USD M5: 38 pips range price movement by CPI and Building Permits news events

==========

S&P 500 M5: range price movement by CPI and Building Permits news events

==========

Dax Index M5: range price movement by CPI and Building Permits news events

ECB Minutes: Members Agreed December Better To Decide On Policy Stance (based on the article)

"European Central Bank policymakers widely agreed that it was better to wait until December to get a clearer picture of the inflation outlook to form a policy view, minutes of the October rate-setting session showed Thursday."

From official report:

Trading News Events: Canada Consumer Price Index (adapted from dailyfx)

Bullish CAD Trade: Canada CPI Picks Up for Second Consecutive Month

- "Need to see red, five-minute candle following the release to consider a short trade on USD/CAD."

- "If market reaction favors a long loonie trade, sell USD/CAD with two separate position."

- "Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward."

- "Move stop to entry on remaining position once initial target is hit; set reasonable limit."

Bearish CAD Trade: Inflation Report Falls Short of Market ExpectationsDaily price is on bullish ranging condition for 1.3551 resistance level to be broken on close daily bar for the daily bullish trend to be resumed. Alternative, if the price breaks 1.3399 support level to below on close bar so the local downtrend as the secondary correction within the primary bullish trend will be started.

-------

USD/CAD M5: 24 pips range price movement by Canada Consumer Price Index news events

Weekly Outlook: 2016, November 20 - November 27 (based on the article)

The US dollar continued marching forward, accompanied by clear hints of a rate hike. US Durable Goods Orders, UK GDP and the all-important FOMC Meeting Minutes stand out in the week of Thanksgiving. These are the major events on forex calendar.

Weekly EUR/USD Outlook: 2016, November 20 - November 27 (based on the article)

EUR/USD continued its deep dive and hit new lows as the dollar rally continued and euro-zone data was mixed. Another public appearance from Draghi and fresh PMIs stand out now. Here is an outlook for the highlights of this week.

OPEC might agree to limit production cuts at the end of the month boosted sentiment (adapted from the article)

Brent Crude Oil daily price is located below Ichimoku cloud in the bearish area of te chart with the secondary bear market rally. The price is trying to break 48.31 resistance level to above for the bullish reversal to be started. Alternative, if the daily price breaks 44.76 and 44.18 support levels to below on close bar so the primary beaish trend will be resumed.

Dollar Index - "While the bearings on sentiment and the Dollar’s role in the spectrum can be debated, there is little doubt that rate speculation has been a straight forward contribution to its performance. Expectations of a rate hike before the end of the year has climbed steadily and now stands at 100 percent according to Fed Fund futures. There is good fundamental evidence to support this through Fed guidance and the evolution of data; but at this degree of expectation, there is little further value to be conferred on the currency. With a hike already priced in, we are not going to see expectations of a faster pace of tightening much less a 50 bps move. Alternatively, if volatility were to rise in the capital markets; a repeat of the summers of 2015 and 2016 where the Fed decided to defer in order to avoid unsettling the markets would be very likely. This does not pose a particularly promising set of scenarios – restrained and difficult bullish continuation against a volatile and easy to spark correction. And, while quiet can offer relief from pain; it can also cool runaway optimism enough to let the troubles show through."