Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.03.31 08:45

Trading the News: Euro-Zone Consumer Price Index (CPI) (based on the article)What’s Expected:

Why Is This Event Important:

Signs of sticky price growth may encourage the ECB to endorse a wait-and-see approach at April 21 interest rate decision, and President Mario Draghi may adopt a less-dovish tone over the coming month as the series of non-standard measures work their way through the real economy.

However, waning confidence accompanied by subdued factor-gate prices may drag on the CPI, and a softer-than-expected reading may generate a near-term pullback in EUR/USD as it fuels bets for a more accommodative policy stance.

How To Trade This Event Risk

Bullish EUR Trade: Core Rate of Inflation Edges Higher

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD.

- If market reaction favors a bearish Euro trade, buy EURUSD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

- Need red, five-minute candle to favor a short EURUSD trade.

- Implement same setup as the bullish Euro trade, just in the opposite direction.

EURUSD Daily

- Even though the diverging paths for monetary policy fosters a long-term bearish outlook for EUR/USD, the may work its way back towards the top of the 2015 range as it breaks out of the descending channel formation from earlier this month.

- Interim Resistance: 1.1510 (50% retracement) to 1.1520 (61.8% expansion)

- Interim Support: Interim Support: 1.0380 (78.6% expansion) to 1.0410 (61.8% expansion)

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.03.31 10:18

EUR/USD Intra-Day Fundamentals: German Unemployment Change and 10 pips price movement

2016-03-31 08:55 GMT | [EUR - German Unemployment Change]

- past data is -9K

- forecast data is -6K

- actual data is 0K according to the latest press release

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - German Unemployment Change] < Change in the number of unemployed people during the previous month.

==========

EURUSD M5: 10 pips price movement by German Unemployment Change news event :

Trading the News: Euro-Zone Consumer Price Index (CPI) (based on the article)

Why Is This Event Important:

Signs of sticky price growth may encourage the ECB to endorse a

wait-and-see approach at April 21 interest rate decision, and President

Mario Draghi may adopt a less-dovish tone over the coming month as the

series of non-standard measures work their way through the real economy.

However, waning confidence accompanied by subdued factor-gate prices

may drag on the CPI, and a softer-than-expected reading may generate a

near-term pullback in EUR/USD as it fuels bets for a more accommodative

policy stance.

How To Trade This Event Risk

Bullish EUR Trade: Core Rate of Inflation Edges Higher

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD.

- If market reaction favors a bearish Euro trade, buy EURUSD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

- Need red, five-minute candle to favor a short EURUSD trade.

- Implement same setup as the bullish Euro trade, just in the opposite direction.

EURUSD M5: 17 pips price movement by Euro-Zone Consumer Price Index news event :

Forum on trading, automated trading systems and testing trading strategies

Market Condition Evaluation based on standard indicators in Metatrader 5

Sergey Golubev, 2016.03.30 18:50

Forecast for Tomorrow - levels for EUR/USD and GOLD (XAU/USD)

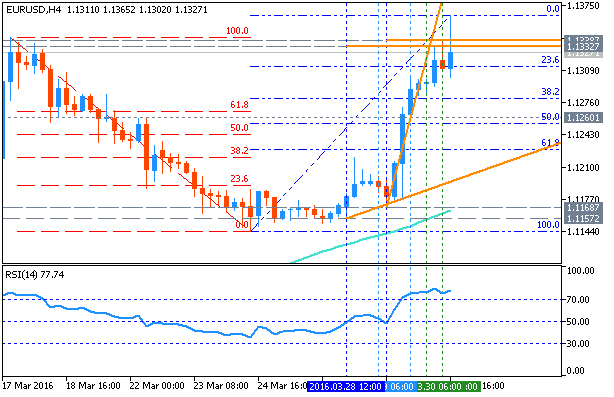

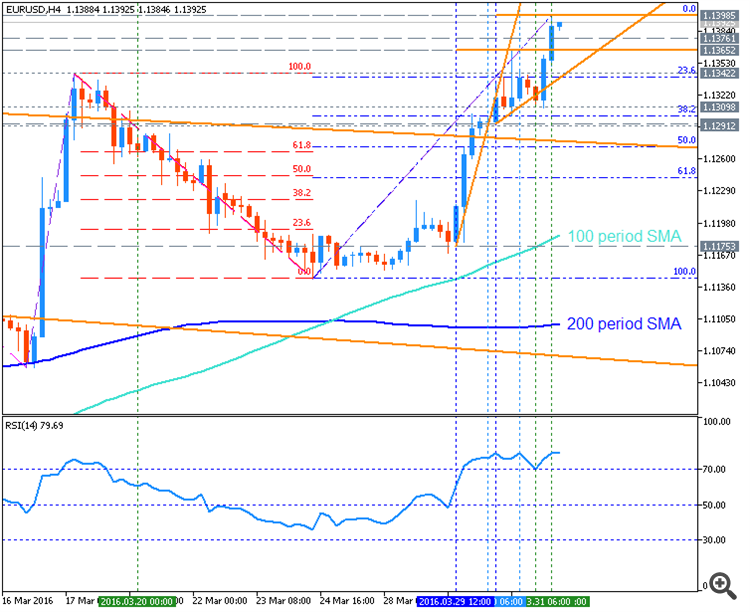

EUR/USD: ranging below 50.0% Fibo support level. This pair on intra-day H4 price is located to be above 100/200 period SMA for the bullish market condition. The price was on bullish breakout, and it is started to be ranging within Fibo resistance level at 1.1364 and 50.0% Fibo support level at 1.1254.

- if the price breaks Fibo resistance level at 1.1364 so the primary bullish trend will be continuing;

- if the price breaks 50.0% Fibo support level at 1.1254 so the local downtrend as the secondary correction within the primary bullish will be started;

- if not so the price will be moved within the channel.

| Resistance | Support |

|---|---|

| 1.1332 | 1.1254 |

| 1.1364 | 1.1143 |

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.01 09:07

Ahead of NFP: Fundamental Forecasts by Bank of America Merrill Lynch, Nordea Bank AB and Skandinaviska Enskilda Banken (adapted from the article)

2016-04-01 08:55 GMT | [USD - Non-Farm Employment Change]

- past data is 242K

- forecast data is 206K

- actual data is n/a according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

- BofAML:

"The March employment report likely showed another strong month for the

labor market. We anticipate a healthy 190,000 gain in nonfarm payrolls,

with the private sector contributing 185,000."

- Nordea: "We expect a 200k gain in nonfarm payrolls in March after the surprisingly strong 242k rise in February, consistent with a continued healthy labour market improvement."

- SEB: "We take the lowside on this one and forecast a 180k on the headline, 170k on private employment, 0.1% on average hourly earnings and 4.9% on the unemployment rate."

==========

EUR/USD M5: bullish reversal. Intra-day M5 price broke 100/200 period SMA for the bullish market condition: the price is breaking 1.1390 resistance level to above for the bullish trend to be contin uing with 1.1411 level as the nearest bullish target. On the other hand, if the price breaks 1.1376 support level so the bearish reversal will be started with 1.1366 level as the nearest bearish target in this case.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.01 11:36

Trading News Events: U.S. Non-Farm Employment Change (based on the article)Another 205K expansion in Non-Farm Payrolls (NFP) may heighten the appeal of the greenback and spur a near-term pullback in EUR/USD as it puts increased pressure on the Federal Open Market Committee (FOMC) to further normalize monetary.

What’s Expected:

Why Is This Event Important:

Market participants may pay increased attention to Average Hourly Earnings as the U.S. economy approaches ‘full-employment,’ and the ongoing weakness in private-sector wages may push the committee to further delay the normalization cycle as central bank officials highlight the downward tilt in inflation expectations.

Nevertheless, waning business confidence paired with the rise in planned job-cuts may drag on labor market dynamics, and the dollar may face further losses over the near-term should the NFP report dampen the outlook for growth and inflation.

How To Trade This Event Risk

Bullish USD Trade: NFP Expands 205K+ Accompanied by Sticky Wage Growth

- Need red, five-minute candle following the NFP print to consider a short trade on EUR/USD.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in the opposite direction.

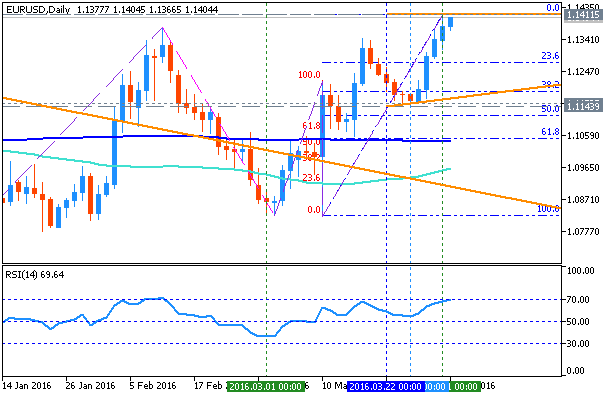

EURUSD Daily

- Despite the divergence paths between the Federal Reserve and the European Central Bank (ECB), EUR/USD stands at risk of a further advance and may revisiting the highs from 2015 as it breaks above the February high (1.1375).

- Interim Resistance: 1.1510 (50% retracement) to 1.1520 (61.8% expansion)

- Interim Support: Interim Support: 1.0380 (78.6% expansion) to 1.0410 (61.8% expansion)

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.01 14:50

EUR/USD Intra-Day Fundamentals: Non-Farm Employment Change and 49 pips range price movement

2016-04-01 13:30 GMT | [USD - Non-Farm Employment Change]

- past data is 245K

- forecast data is 205K

- actual data is 215K according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

"Total nonfarm payroll employment rose by 215,000 in March, and the unemployment rate was little changed at 5.0 percent, the U.S. Bureau of Labor Statistics reported today. Employment increased in retail trade, construction, and health care. Job losses occurred in manufacturing and mining."

==========

EURUSD M5: 49 pips range price movement by Non-Farm Employment Change news event :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.01 16:31

EUR/USD Intra-Day Fundamentals: U.S. ISM Manufacturing PMI and 49 pips range price movement

2016-04-01 15:00 GMT | [USD - ISM Manufacturing PMI]

- past data is 49.5

- forecast data is 50.7

- actual data is 51.8 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ISM Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

"Manufacturing expanded in March as the PMI® registered 51.8

percent, an increase of 2.3 percentage points from the February reading

of 49.5 percent, indicating growth in manufacturing for the first time

since August 2015 when the PMI® registered 51.0 percent. A

reading above 50 percent indicates that the manufacturing economy is

generally expanding; below 50 percent indicates that it is generally

contracting."

==========

EURUSD M5: 49 pips range price movement by U.S. ISM Manufacturing PMI news event :

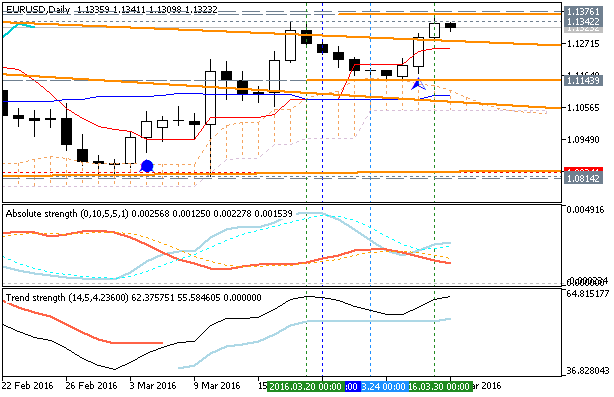

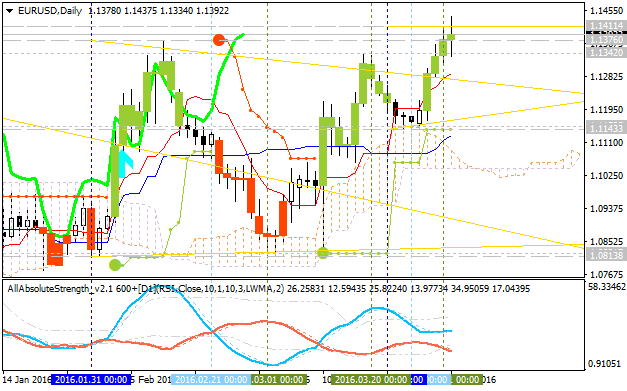

EURUSD Technical Analysis 2016, 03.04 - 10.04: bullish breakout to be continuing, or the ranging trend to be started

Daily price is on bullish market condition located above Ichimoku cloud and Senkou Span line which is the virtual border between the primary bearish and the primary bullish trend on the chart. Price is on bullish breakout with 1.1411 resistance level, Absolute Strength indicator and Trend Strength indicator are estimating the bullish trend to be continuing.

If D1 price will break 1.1143

support level on close bar so the bearish trend reversal will be started with the secondary ranging condition.

If D1 price will break 1.1411

resistance level on close bar from below to above so the primary bullish trend will be continuing.

If not so the price will be on ranging within the levels.

- Recommendation for long: watch close D1 price to break 1.1411 for possible buy trade

- Recommendation

to go short: watch D1 price to break 1.1143 support level for possible sell trade

- Trading Summary: bullish

| Resistance | Support |

|---|---|

| 1.1411 | 1.1143 |

| 1.1713 | 1.0813 |

SUMMARY : bullish

EURUSD Price Action Analysis - ranging bullish with ascending triangle pattern to be formed

D1 price is located above 200-day SMA (200 SMA) and 100-day SMA (100 SMA) for the primary bullish market condition with the secondary ranging within the following s/r levels:

- Fibo resistance level at 1.1437 located far above 100 SMA/200 SMA in the primary bullish area of the chart, and

- 61.8% Fibo support level at 1.1057 located near 200 SMA in the beginning of the bearish area of the chart.

RSI indicator is estimating the ranging bullish trend to be continuing.

If the price will break Fibo resistance level at 1.1437 so the primary bullish trend will be continuing.

If the price will break 61.8% Fibo support level at 1.1057 from above to below so the reversal of the price movement from the primary bullish to the primary bearish market condition will be started.

If not so the price will be ranging within the levels.

Trend:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Forum on trading, automated trading systems and testing trading strategies

Market Condition Evaluation based on standard indicators in Metatrader 5

Sergey Golubev, 2016.03.30 18:50

Forecast for Tomorrow - levels for EUR/USD and GOLD (XAU/USD)

EUR/USD: ranging below 50.0% Fibo support level. This pair on intra-day H4 price is located to be above 100/200 period SMA for the bullish market condition. The price was on bullish breakout, and it is started to be ranging within Fibo resistance level at 1.1364 and 50.0% Fibo support level at 1.1254.