You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

The fall in Chinese stock markets and the yuan devaluation intertwined with the crash in oil prices and currencies certainly felt it. AUD, CAD and GBP reached new multi-year lows against the dollar while the latter fell against the safe haven euro and yen. US data was not convincing and the chances of another rate hike coming in March have fallen. Yen and euro crosses have made big moves.

Forecast for the Week - levels for EUR/USD (adapted from the article)

EUR/USD: ranging below 200 day SMA. Daily price is on bearish market condition for the ranging near and below 200 SMA/100 SMA within Fibo support level at 1.0710 and Fibo resistance level at 1.0985. "EUR/USD has been holding its long term trendline support since March 2015 (even the January low is right on the line). November and December trade produced a tweezer bottom (reversal candlestick pattern…bullish in this case) as well. 2 scenarios seem most likely from the current juncture; a continued range (with roughly 1.15 resistance) or a bullish base that leads to an eventual breakout into the 1.20s. Both point higher from current levels."

Forecast for the Week - levels for GBP/USD (adapted from the article)

GBP/USD: bearish breakdown. Daily price for this pair is located far below 200 day SMA for the bearish market condition: the price broke support levels to below for the good bearish breakdown and stopped near Fibo support level at 1.4250. "Unlike EUR/USD, GBP/USD has failed to hold its trendline that originates at the 1985 low (this is the case as of noon in NY Friday…the line is at about 1.4390). The cross is on the verge of taking out the 2010 low at 1.4229, which would put GBP/USD at its lowest level since March 2009. The next market level that might stem the freefall is the 1.40…in part due to the psychological aspect of the figure but also because of the presence of a parallel (parallel to line that extends off of the 1992 and 2007 highs)."

GBP/USD Intra-Day Fundamentals: China Gross Domestic Product and 16 pips price movement

2016-01-19 02:00 GMT | [CNY - GDP]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

GBPUSD M5: 16 pips price movement by CNY - GDP news event :

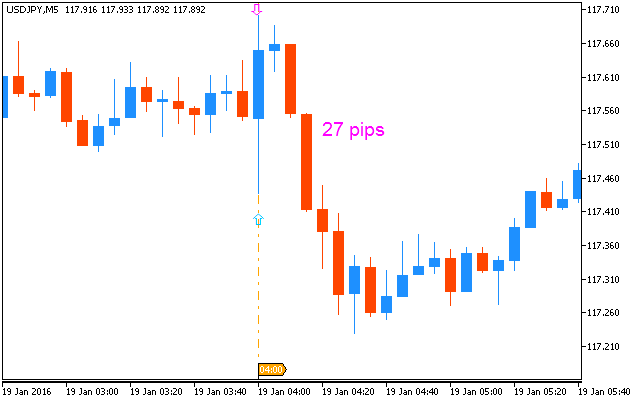

USD/JPY Intra-Day Fundamentals: China Gross Domestic Product and 27 pips range price movement

2016-01-19 02:00 GMT | [CNY - GDP]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

USDJPY M5: 27 pips range price movement by CNY - GDP news event :

NZD/USD Intra-Day Fundamentals: Consumer Price Index and 74 pips price movement

2016-01-19 02:00 GMT | [NZD - CPI]

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - CPI] = Change in the price of goods and services purchased by consumers.

==========

"In the December 2015 quarter compared with the September 2015 quarter:

==========

NZDUSD M5: 74 pips price movement by NZD - CPI news event :

Trading News Events: GBP Jobless Claims Change (based from the article)

What’s Expected:

Why Is This Event Important:

The recent comments from BoE Governor Mark Carney suggests that the Monetary Policy Committee (MPC) is in no rush to lift the benchmark interest rate off of the record-low, and the board may continue to endorse a wait-and-see approach at the next policy meeting on February 4 as the central bank head looks for signs of stronger inflation.

Nevertheless, the pickup in private-sector lending along with the rise in household spending may encourage U.K. firms to expand their labor force, and a positive development may spur a greater dissent within the BoE as central bank officials see a ‘solid’ recovery in the region.

How To Trade This Event Risk

Bearish GBP Trade: Jobless Claims Increase, Household Earnings Slide

- Need red, five-minute candle following the print to consider a short GBP/USD trade.

- If market reaction favors selling sterling, short GBP/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bullish GBP Trade: U.K. Job/Wage Growth Beat Market Expectations- Need green, five-minute candle to favor a long GBP/USD trade.

- Implement same setup as the bearish British Pound trade, just in reverse.

Potential Price Targets For The ReleaseGBPUSD Daily

Forum on trading, automated trading systems and testing trading strategies

Forecast for Q1'16 - levels for GBP/USD

Sergey Golubev, 2016.01.20 09:44

GBPUSD M5: 40 pips price movement by GBP Jobless Claims Change news event:

EUR/USD Intra-Day Fundamentals: US Core CPI and 37 pips price movement

2016-01-20 13:30 GMT | [USD - Core CPI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Core CPI] = Change in the price of goods and services purchased by consumers, excluding food and energy.

==========

"The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.1 percent in December on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 0.7 percent before seasonal adjustment.

The indexes for energy and food both declined for the second month in a row, leading to the decline in the seasonally adjusted all items index. The energy index fell 2.4 percent as all major component energy indexes declined. The food index fell 0.2 percent as the index for food at home decreased 0.5 percent, led by a sharp decline in the index for meats, poultry, fish, and eggs."

==========

EURUSD M5: 37 pips price movement by USD - Core CPI news event :

USD/CAD Intra-Day Fundamentals: BOC Overnight Rate and 133 pips price movement

2016-01-20 15:00 GMT | [CAD - Overnight Rate]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Overnight Rate] = Interest rate at which major financial institutions borrow and lend overnight funds between themselves.

==========

"The Bank of Canada today announced that it is maintaining its target for the overnight rate at 1/2 per cent. The Bank Rate is correspondingly 3/4 per cent and the deposit rate is 1/4 per cent.

Inflation in Canada is evolving broadly as expected. Total CPI inflation remains near the bottom of the Bank’s target range as the disinflationary effects of economic slack and low consumer energy prices are only partially offset by the inflationary impact of the lower Canadian dollar on the prices of imported goods. As all of these factors dissipate, the Bank expects inflation will rise to about 2 per cent by early 2017. Measures of core inflation should remain close to 2 per cent."

==========

USDCAD M5: 133 pips price movement by BOC Overnight Rate news event :

The Stocks are cheap: 10 Reasons To Buy Stocks now (based on the article)

1. Low oil prices are a transfer of wealth

2. U.S. consumers will benefit

3. The crash in oil is due to speculation and deregulation

4. The end of austerity in the U.S.

5. The budget deficit is set to grow

6. U.S. household debt service is at historic low

7. Housing starts still below average

8. Stocks are cheap – S&P 500 forward P/E is below average

9. China isn’t as important as people think

10. Even if I’m wrong, I’m probably right

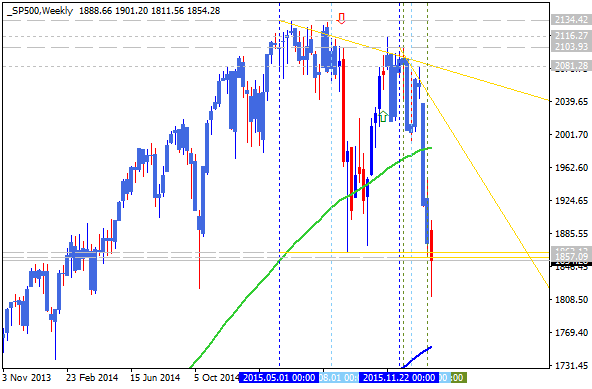

S&P 500 is on bearish breakdown for the breaking 1857 support to below for the breakdown to be continuing. Weekly price is located to be below 100 period SMA and abovr 200 period SMA in the ranging area of the chart, and if the price breaks 1752 support to below so the bearish trend will be continuing without secondary ranging.

The Strategy: buy above 1752 with 2134 target to re-enter.