Join our fan page

- Views:

- 3155

- Rating:

- Published:

- Updated:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

This is a simple analytical (non-signal, one-time calculated) indicator that allows you to test the hypothesis that price timeseries represent a "random walk", specifically Gaussian "random walk". This can help to construct a parametric transformation of price increments into evenly distributed, more stable and predictable time series, at least in terms of volatility.

As you may know, the distance that a "random walk" variable is expected to cover after N steps is estimated by its standard deviation multiplied by sqrt(N), or N^0.5.

This indicator calculates statistics of "average" price change (per bar) for predefined subranges of bars. The "averaging" is performed over the distance (number of bars up to given N) taken to the power of F — a factor, which is enumerated from 0.1 to 1 with the step 0.1.

All bars available on current chart are used for collecting statistics in sliding windows of up to N bars.

Then the indicator finds most "regular" uniform distribution of the statistics among different F's, and displays a histogram for this factor (considered optimal), usually 0.5 or 0.6. Each column of the histogram is the "average" delta of points per bar for corresponding trade duration (number of bars), where "averaging" is made by N^F (when F=1 you'll get standard averaging).

The indicator can use different methods for automatic detection of the "regularity" (flatness) of the statistical curve:

- minimum of variance;

- minimum of difference between triple M's (Mean, Median, Mode), as squared error;

- minimum of Gini coefficient;

Knowing the optimal factor can be useful for:

- normalization of input data (price changes) for neural networks and other machine learning algorithms;

- estimation of sufficient number of bars for sampling into a single input vector for analisys in volatility trading systems;

- detection of symbols and/or timeframes with anomalities (non-standard F or singularity in the distribution curve);

Inputs

- MaxDistance — maximal distance in bars (N) to use for collecting price range statistics, by default 200;

- Factor — exponent for "averaging" over distances, by default 0 - means autodetection, you can enter a custom value between 0.0 and 1.0 for estimation, for example, 0.525;

- Method — one of the methods of estimation of uniformity: variance, triple_M, Gini;

- MaxBars — a limit of bars to calculate statistics on, by default 0 - means all available bars;

Outputs

The indicator shows a blue histogram of average price change per bar for each distance in the range of distances (1..Period) and for selected factor of uniformity.

Also a continuously increasing number of bars (distance) is presented as the second histogram (orange), just for reference.

A complete table of tested factors and corresponding metrics of current timeseries are printed in the log.

XAGUSD.c D1, Max.Distance: 500, Bars: 2641 Factor: 0.4, Result: var(0.4) mmm(0.4) gini(0.4)* [factor] [mean] [variance] [skewness] [kurtosis] [median] [mode] [mmmse] [gini] [0] 0.10000 1.85217 0.21976 -0.87694 0.07751 1.95822 2.30853 0.33811 0.13930 [1] 0.20000 1.07575 0.04083 -1.12699 0.96219 1.12715 1.25786 0.13285 0.10093 [2] 0.30000 0.62887 0.00525 -1.54472 3.00927 0.64878 0.68616 0.04114 0.05943 [3] 0.40000 0.37043 0.00021 -2.90499 13.36923 0.37546 0.37502 0.00394 0.01753 [4] 0.50000 0.22015 0.00028 1.53459 1.38333 0.21532 0.21461 0.00426 0.03779 [5] 0.60000 0.13222 0.00064 1.98696 4.05157 0.12372 0.10902 0.01661 0.09162 [6] 0.70000 0.08041 0.00072 2.60714 8.60950 0.07122 0.05862 0.01551 0.15135 [7] 0.80000 0.04964 0.00065 3.39070 15.85717 0.04099 0.03149 0.01289 0.21637 [8] 0.90000 0.03119 0.00054 4.37643 27.17457 0.02359 0.01692 0.01018 0.28652 [9] 1.00000 0.02002 0.00044 5.57319 43.86448 0.01358 0.00909 0.00787 0.36126

Screenshots

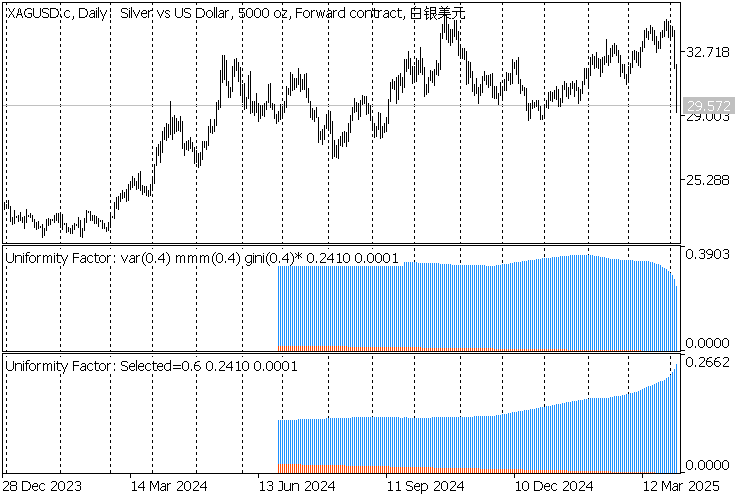

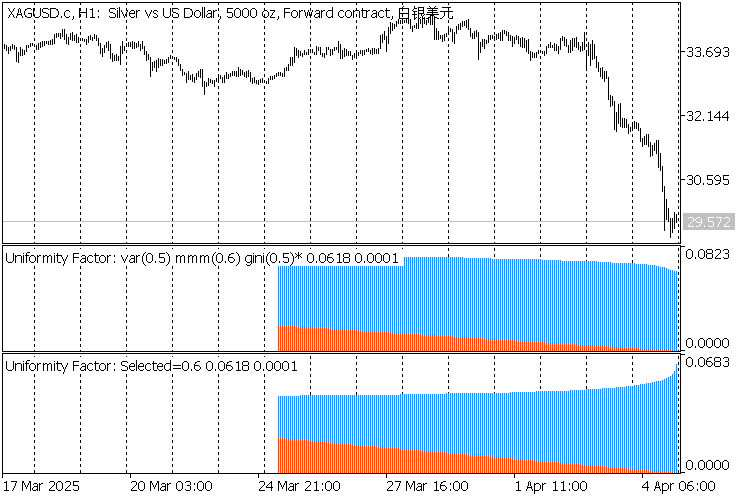

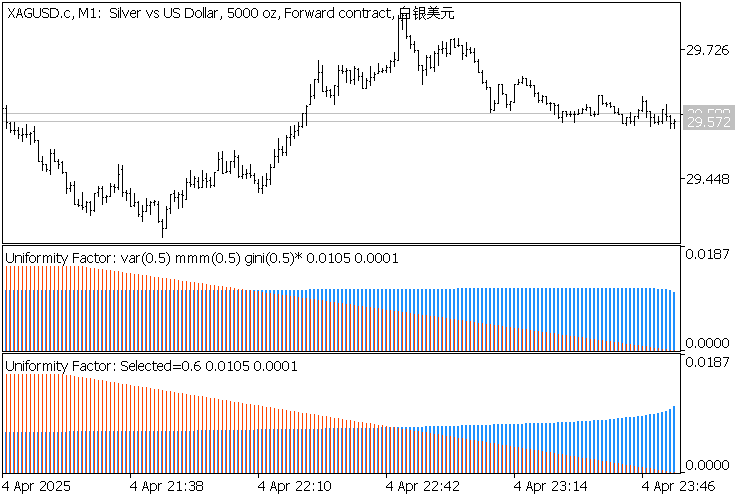

The following screenshots demonstrate the indicator on 3 timeframes: D1, H1, M1.

Each chart contains 2 instances of the indicator:

- upper one is configured for F autodetection by Gini, and the found value (varied between 0.4 once, and 0.5 twice) is displayed in the title, marked by asterisk;

- lower one is configured for predefined F=0.6;

2 indicators Uniformity Factor on XAGUSD,D1

2 indicators Uniformity Factor on XAGUSD,H1

2 indicators Uniformity Factor on XAGUSD,M1

Angle and Speed

Angle and Speed

The indicator shows the angle or average speed of price change.

MT4Orders QuickReport

MT4Orders QuickReport

Fast JavaScript version of Report library from fxsaber for MT4-style trading commands implemented via MT4Orders or Virtual. Works up to 10 times faster, NTML file size is smaller, can upload and display up to 5.4 million report lines.

Second Bars

Second Bars

The indicator draws an arbitrary second timeframe on the chart.

PriceChanges

PriceChanges

changing character prices on an interval