Virtual (Hidden) Stop Loss & Take Profit in Forex: The Real Benefits, the Real Risks, and How to Use It Like a Pro

Virtual SL/TP (also called “hidden stops”) is one of the most misunderstood tools in retail trading. Some people treat it like a magic shield. Others reject it completely. The truth is simple: virtual SL/TP is not a strategy — it’s a trade-management method. Used correctly, it improves discipline and consistency. Used incorrectly, it can leave you unprotected.

Goal of this post: explain what virtual stops really do, why traders use them, when they make sense in FX, and how to build a robust workflow (including safety fallbacks).

1) First, why SL/TP matters (before we even talk “virtual”)

If you remove the marketing noise, the job of Stop Loss and Take Profit is brutally practical:

- Stop Loss defines how much you can lose when you’re wrong.

- Take Profit defines how you get paid when you’re right.

- Both define the only thing that matters long-term: your expectancy.

Even a simple model shows why exits are the core:

- Expectancy ≈ (WinRate × AvgWin) − (LossRate × AvgLoss)

- Stops shape AvgLoss. Targets/trailing shape AvgWin.

So when traders say “entries are everything”, they’re coping. In real trading, exits are where the money is made (or lost).

2) Server-side SL/TP vs Virtual SL/TP (what changes technically)

Let’s define the difference in a way you can’t misunderstand:

A) Server-side SL/TP (classic)

- Your SL/TP is stored on the broker’s trading server.

- The broker knows the exact levels.

- If your terminal/VPS is offline, the broker can still execute SL/TP.

B) Virtual SL/TP (client-side)

- Your SL/TP is stored inside your terminal/EA/panel.

- The broker does not see those levels in advance.

- The EA monitors price and closes the trade when your virtual level is hit.

- If your terminal/VPS is offline, your virtual protection is not active.

That’s the whole game. Everything else is a consequence of these two architectures.

3) The real benefits of Virtual SL/TP (why people pay for this)

Benefit #1 — Privacy / discretion (your exact exits are not visible in advance)

Some traders simply don’t want their precise exit levels sitting on the server. Regardless of what you believe about “stop hunting”, the practical fact is: virtual stops keep your exit levels on your side until the moment of execution.

Important nuance: privacy does NOT guarantee better fills. It only changes what is revealed ahead of time.

Benefit #2 — Rule stacking: SL + TP + Break-even + Trailing becomes one system

Most traders fail not because they lack tools, but because they manage trades inconsistently: moving stops emotionally, forgetting SL/TP, trailing too early, etc. Virtual management lets you define a repeatable “exit stack”:

- Initial protection: define SL/TP distances or place them manually.

- Break-even logic: when price proves itself (trigger), move SL to entry (optional offset).

- Trailing logic: choose ONE trailing philosophy and keep it consistent.

The key benefit is not “more features”. The benefit is standardization. Your exit rules become boring — and boring is what keeps you alive.

Benefit #3 — Auto-protection for manual traders (“I forgot to set SL” insurance)

If you trade manually, you already know the pain: you open a position fast, spreads move, and you forget SL/TP. Auto-assignment is a real productivity and safety tool: as soon as a trade appears without exits, the manager attaches virtual SL/TP based on your rules.

Benefit #4 — Flexibility across symbols & workflows

Many traders run multiple pairs or multiple strategies. A good virtual manager can apply rules only to the symbols you choose (instead of touching everything). This avoids “one EA controls all” chaos and keeps your account organized.

Benefit #5 — Better control of “when” the stop logic runs (tick vs timer)

In practice, virtual managers watch price using tick updates or a timer interval. That gives you control over responsiveness and CPU usage. Done right, it’s stable and predictable. Done wrong (too aggressive), it can overload your terminal.

4) The real risks (and how professionals neutralize them)

Risk #1 — If your platform/VPS is off, you have no virtual protection

This is non-negotiable. Virtual stops require your platform or VPS to keep running. If you are not willing to run a stable VPS, do not rely on pure virtual protection.

Risk #2 — Slippage and fast markets (virtual is not immune)

Stops (server-side or virtual) are not guaranteed fills at the exact price in fast markets. When price moves quickly, execution happens at the best available price — slippage is normal. Virtual stops can be slightly later depending on quote arrival and scan interval.

Practical fix: do not place virtual stops ridiculously tight. Give the market room, and accept that extreme volatility means imperfect fills.

Risk #3 — Gaps and weekend opens

If price gaps beyond your stop level, your close will happen at the first tradable price after the gap. This is not a “virtual problem” only — it’s a market reality. But with virtual stops, you must ensure your platform is alive at the open.

Risk #4 — Single point of failure (one chart/one EA attachment)

If your tool is attached to one chart and that chart freezes or the EA is removed, protection may stop. A robust manager should persist data and restore control after restarts.

5) The “Professional Hybrid” approach (recommended for real money)

Here is the approach used by many serious traders:

- Virtual SL/TP for your real trade-management logic (precise, flexible, private).

- Emergency server-side SL far enough away to protect against disasters (terminal crash, internet outage).

This gives you:

- Precision and flexibility most of the time (virtual logic).

- Basic survival in worst-case events (server emergency stop).

Yes, it means the broker can still see the emergency stop — but it’s intentionally placed far enough to be “catastrophic protection”, not your real tactical stop.

6) Three practical exit templates you can actually use in Forex

Template A — Beginner-friendly: fixed SL/TP + break-even

- Auto SL/TP: e.g., SL = 50 pips, TP = 100 pips (1:2 baseline).

- Break-even: trigger at +20 pips, offset +5 to +10 pips.

- No trailing until you can execute this consistently for weeks.

Template B — Trend-following: break-even + R-multiple trailing

- Initial SL behind structure (not too tight).

- Move to BE only after you reach a meaningful profit threshold.

- Trail by R-levels: 1R, 2R, 3R… so you stop “random trailing”.

Template C — Volatile symbols: ATR-based trailing

- Best for noisy markets (gold, indices, crypto CFDs).

- ATR trailing expands/contracts with volatility, reducing “death by random spikes”.

- Combine with later break-even (volatile markets love shakeouts).

7) A simple checklist before you use Virtual SL/TP live

- Are you running a stable VPS or a reliable always-on setup?

- Do you have an emergency server-side stop (optional but smart)?

- Are your SL distances realistic for spread + volatility?

- Have you tested during high volatility (news) and market opens?

- Do you have persistence/restore so a restart doesn’t wipe protection?

If you can’t answer “yes” to the first one (always-on setup), stop here. Do not rely on virtual-only protection.

8) If you want a ready-made tool (soft mention, not a sales pitch)

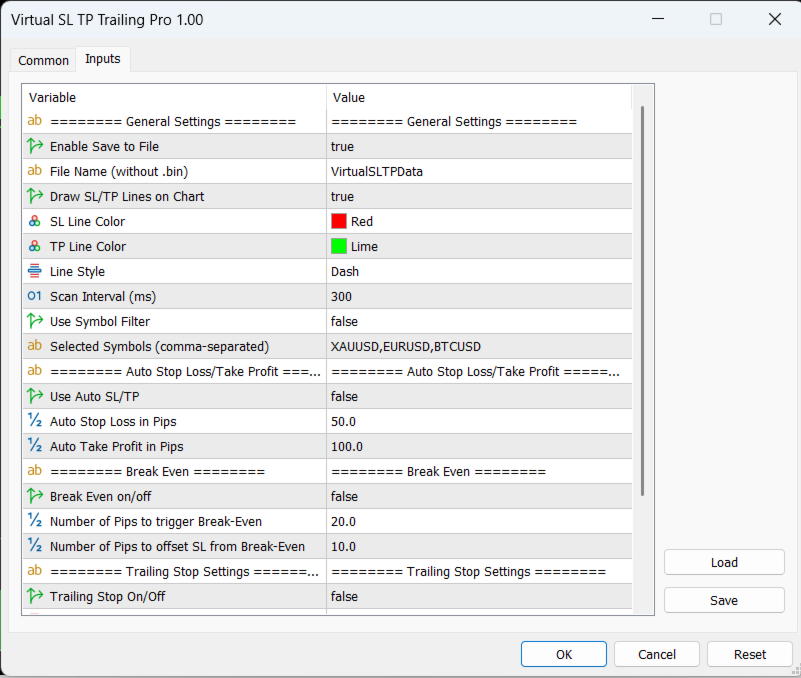

You can code a virtual stop manager yourself, but most traders want a clean panel and predictable behavior. That’s why I built a focused utility that does one job: trade management (no entry signals, no direction prediction).

It monitors open positions (and optionally pending orders), can auto-assign virtual SL/TP for trades opened without exits, supports break-even (trigger + offset), and offers two trailing modes (Risk-Reward R-multiple and ATR). Virtual levels are drawn as draggable lines and can be saved/restored across terminal/VPS restarts, with symbol filters for multi-pair setups.

If you want the full walkthrough + demo files (demo account only), read: User Guide & Demo (MT4/MT5)

Screenshots (click to open the product page)

Final words

Virtual SL/TP is not about “secret tricks”. It’s about execution discipline. If you accept the only real limitation (you must keep your platform/VPS online), virtual trade management can make your exits consistent, structured, and much harder to mess up emotionally.

Disclaimer: This is not financial advice. Trade management tools do not guarantee profit and do not remove trading risk.