The Story That Started the Conversation

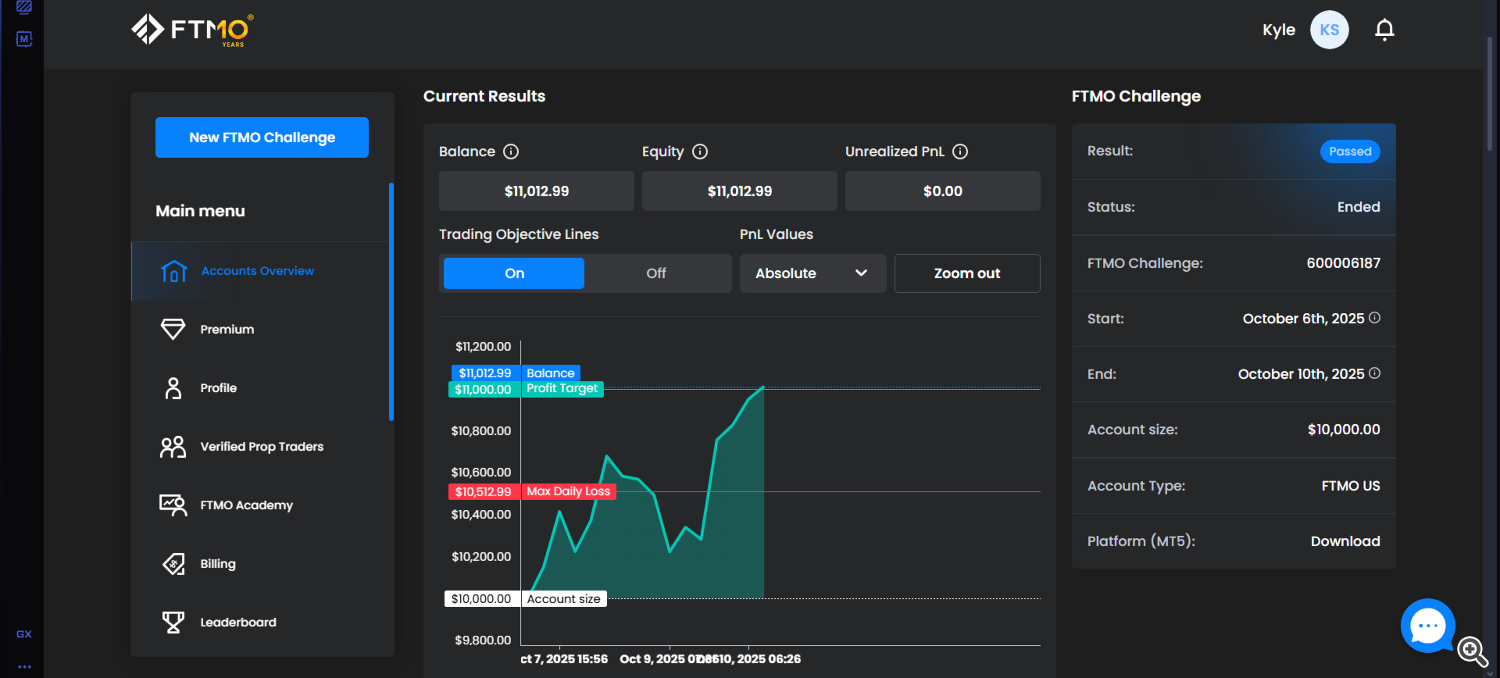

October 6, 2025: An early adopter of Alpha Pulse AI starts the FTMO $10k challenge.

October 10, 2025: Challenge passed. 4 days. 60% win rate. AI EA executed everything.

When I saw the verified results, my first reaction wasn't celebration. It was concern.

Because I knew exactly what would happen next: everyone would rush to prop firms thinking AI is their shortcut to "free money." And most would lose their evaluation fees chasing a misunderstood dream.

So let me tell you the truth about prop firm challenges with AI that nobody else will.

What Actually Happened (The Real Data)

Let me give you the verified numbers, not the hype version:

Timeline:

- Day 1 (Oct 6): Challenge started, Alpha Pulse AI configured for FTMO rules

- Days 2-3 (Oct 7-8): AI traded within session filters, mixed results

- Day 4 (Oct 10): Profit target hit, challenge passed

Performance:

- Total duration: 4 days

- Win rate: 60% (not exceptional, just solid)

- Drawdown: Stayed well within FTMO limits

- Session focus: London + NY

The Questions Nobody Asked:

Is this stable long-term? We don't know yet.

Does this mean AI guarantees prop firm success? Absolutely not.

Is 4 days enough data to validate anything? Not even close.

Should you run to FTMO right now and try this? Please don't.

And here's the most important question: Should you even start with prop firms?

The answer might surprise you.

The Prop Firm Truth They Don't Want You to Know

While YouTube is full of "I passed FTMO in 3 days!" thumbnails and $997 prop firm courses, here's what nobody tells you:

Prop firms don't make money from successful traders.

They make money from the 80-90% who fail evaluation fees.

The Business Model Reality

Let's do the math they hope you don't do:

FTMO $10k challenge costs $155. If 100 traders attempt:

- 10-20 pass (optimistic estimate)

- 80-90 fail and retry

- Revenue from failures: $12,400 in evaluation fees

- Cost of payouts to winners: Maybe $2,000 in profit shares

The house always wins. And you're not the house.

The Rules Are Designed to Eliminate You

Even if you pass, you're trading under constraints specifically designed to create failure points:

- Maximum daily drawdown (one bad day = out)

- Maximum total drawdown (one drawdown period = out)

- News trading restrictions (miss the filter = out)

- Consistency rules on some platforms (trade too well = suspicious)

- Minimum trading days (forces you to trade even in bad conditions)

These aren't "protective" rules. They're elimination mechanisms.

And here's the part that should make you pause: When you blow a funded account, they keep your accumulated profits. All of them.

The Approach Nobody Teaches (But Everyone Should Know)

Here's what's insane about the prop firm obsession:

Everyone's spending $155-$500 on evaluation fees for the chance to trade "someone else's money" (under heavy restrictions, giving away 20% of profits).

When they could take that same $500 and trade their own capital with:

- Zero rules against them

- 100% of profits

- No elimination risk

- Complete psychological freedom

Let me break down the approach that actually works:

Step 1: Own Capital First (Yes, Even Small Amounts)

Start with $500. $1,000. Whatever you can afford to lose without affecting your rent, food, or life.

"But prop firms let me trade $10k without risking my own money!"

Wrong. You're risking evaluation fees. And you're trading under rules designed to eliminate you.

With own capital:

- Trade whenever you want (no forced trading days)

- Keep 100% of profits (no 80/20 split)

- Learn from mistakes without elimination

- Build real skill, not "rule-gaming" skill

- Sleep better (no daily DD limit sword hanging over you)

"But I can't grow $500 into meaningful money!"

Yes you can. With 1% risk and consistent execution, $500 can become $2,000 in a year. Then $5,000. Then $10,000+.

Slower than the prop firm fantasy? Yes.

More sustainable and realistic? Absolutely.

Step 2: Prove Consistency Over Time (Minimum 3 Months)

Don't even look at prop firms until you can demonstrate:

- 3+ consecutive months of profitability

- Drawdowns you understand and can psychologically handle

- A system that survives different market conditions

- Discipline that doesn't require external rules (Trading Agenda helps here)

Why 3 months minimum?

Because 4 days means nothing. The early adopter who passed FTMO? Great data point. Not proof of long-term stability. Not validation of consistent edge.

Just proof that AI can follow rules for 96 hours during specific market conditions.

Step 3: Prop Firms as EXTRA (Never Your Foundation)

Only after you've proven consistency with your own capital should you consider prop firms.

And when you do, here's how to think about them:

Treat prop firms like casino promotional chips:

- Play with them knowing the house edge is against you

- Extract winnings quickly (don't let profits accumulate)

- Never fall in love with "funded" status

- Keep your own account as your real business

- Understand you WILL get eliminated eventually

It's bonus income. Side game. Extra. Never your Plan A.

Why Own Capital Wins (Every Single Time)

Let me show you the math they don't want you to see:

Scenario A: $10k Own Capital

- Risk: 1% per trade = $100

- Win rate: 60%, Risk:Reward 1:1.5

- Trades: ~20/month

- Expected monthly return: ~$600 (6%)

- Profit is 100% yours: $600/month

- No rules: Trade any session, any strategy, any timeframe

- No elimination risk: Bad month? You still have your account

- Scales with you: As account grows, so do your profits

Scenario B: FTMO $10k Funded Account

- Evaluation fee: $155

- Realistic pass rate: 20% (optimistic)

- Expected cost to pass: $775 (average 5 attempts)

- Same performance: $600/month

- Your cut after 80/20 split: $480/month

- Rules constrain you: Can't trade news, tight DD limits, forced trading days

- Elimination risk: One bad month = start over ($155 again)

- Withdrawal limits: Most prop firms cap monthly withdrawals

- Doesn't scale: Still trading $10k, profits capped

Scenario A: You keep more money, trade freely, build YOUR wealth.

Scenario B: You pay fees, give away 20%, trade under constraints, risk elimination.

And yet everyone rushes to Scenario B because of the illusion of "free capital."

There's no such thing as free capital. You're paying with constraints, profit splits, and elimination risk.

If You're Going to Do Prop Firms Despite Everything...

Look, I know the pull is strong. "Trading someone else's money" sounds amazing.

If you're going to do it anyway, here are the rules that might keep you from losing your shirt:

Rule 1: Never Your Primary Income

Always—ALWAYS—have your own capital account running. Prop firms are supplemental, never foundational.

Rule 2: Extract Profits Immediately

Don't accumulate profits in funded accounts. Withdraw as soon as allowed. You WILL get eliminated eventually—get your money out first.

Rule 3: Track Your Evaluation Costs

If you've spent $500+ in evaluation fees without passing, STOP. That's $500 that should be trading in your own account.

Rule 4: Use as Validation, Not Business Model

Passed a challenge? Cool validation of your system. Building a business model around prop firms? That's building on quicksand.

Rule 5: Understand the Statistics

Some traders make prop firms work. Most don't. The house edge is real. Know which side of the probability curve you're likely on.

What Actually Passed FTMO (With Critical Caveats)

Okay, you want to know the actual setup that passed the challenge in 4 days.

Alpha Pulse AI Configuration:

- AI Provider: One of 6 available (GPT-5.1, Claude Sonnet 4.5, Gemini 2.5 Pro, Grok, DeepSeek, or Qwen)

- Reasoning Effort: High (for better decision quality)

- Risk per trade: 0.5% (FTMO requires tight risk management)

- Session filters: London + NY active (Asian session disabled)

- Preset: Likely Intraday or ICT preset (session-specific strategy)

- News filter: Active (FTMO eliminates for news trading)

Discipline Components:

- Trading Agenda daily checklist (pre-activation verification)

- Drawdown monitoring (FTMO has strict limits)

- No manual interference (let AI execute the system)

- Daily performance review

Critical Caveats You Must Understand:

- 4 days is NOT statistically significant - Need months of data

- 60% win rate is solid but not exceptional - Not a "holy grail"

- October 2025 market conditions were specific - Different conditions = different results

- One successful pass ≠ repeatable system - Sample size of one

- AI is a tool, not magic - Requires proper configuration and understanding

- Past performance ≠ future results - Legal disclaimer AND reality

Can you replicate this? Maybe.

Should you try it immediately? No.

Should you expect the same results? Absolutely not.

Is this proof AI "prints" prop firm accounts? Not even close.

What This Post Is NOT Saying

Let me be extremely clear about what this is NOT:

❌ Run to FTMO and copy this setup

❌ AI guarantees prop firm success

❌ This is proven, stable, or guaranteed

❌ Prop firms are your path to wealth

❌ You should skip building your own capital

❌ AI trading is easy plug-and-play money

What This Post IS Saying

Here's the actual message:

✅ Own capital first, always - Even if it's small

✅ Prop firms are a side game - Not your primary strategy

✅ AI can help execute consistently - But it's not a guarantee

✅ Discipline matters more than technology - Trading Agenda builds this

✅ Prop firm business models work against you - Understand the game

✅ 4-day results are interesting, not conclusive - Need long-term data

✅ Most traders should focus on own accounts - Better odds, better business model

The Framework That Actually Works

If you're serious about trading (with or without AI), here's the realistic path:

Phase 1: Foundation Building (Months 1-3)

- Start with capital you can afford to lose completely

- Risk conservatively (0.5-1% per trade maximum)

- Focus on consistency over home runs

- Build discipline with Trading Agenda

- Track every trade, every violation, every mistake

- Learn without the pressure of elimination rules

Phase 2: Validation Period (Months 4-6)

- Prove 3+ months of profitable consistency

- Understand your system's drawdown characteristics

- Survive different market conditions (trending, ranging, volatile, quiet)

- Refine your edge based on real data

- Build psychological resilience through experience

Phase 3: Growth Phase (Months 6-12)

- Add capital (compound profits or make additional deposits)

- Consider scaling risk slightly (still conservative)

- NOW consider prop firms as potential EXTRA (if you want)

- Keep primary focus on YOUR account growth

- If you do prop firms, extract profits immediately

The Long-Term Game (Year 1+)

- Year 1: Prove consistent profitability, build small capital

- Year 2: Scale your own account significantly

- Year 3+: Prop firms as supplemental side income (maybe)

- Always: Own capital as your real business foundation

Final Reality Check

Let me end with complete honesty:

What happened: An early adopter passed FTMO $10k challenge in 4 days using Alpha Pulse AI.

Is it replicable? Too early to determine with statistical confidence.

Should YOU start with prop firms? No. Build your own capital first.

Is this a proven, stable approach? No. 4 days is not validation.

Should you consider prop firms eventually? Maybe, as EXTRA after 3+ months of proven consistency.

Where should your focus be? Own capital. Own discipline. Own growth.

Is AI the secret to prop firm success? No. Proper risk management and discipline are. AI just removes emotional interference from execution.

The Truth About Prop Firm Challenges with AI

Here it is in one sentence:

AI can help you execute consistently under prop firm rules, but prop firms are still a business model designed around trader failure, and you should build your foundation on own capital first.

AI doesn't change the fundamental economics of prop firms. It doesn't change the fact that they make money from your evaluation fees. It doesn't change the fact that rules are designed to eliminate you.

What AI can do: Execute without emotions, follow rules consistently, avoid psychological mistakes.

What AI can't do: Guarantee profits, override poor market conditions, make prop firms a sustainable business model, replace proper risk management.

The early adopter who passed FTMO in 4 days? That's a great data point. It's not a blueprint. It's not a guarantee. It's not proof that you should skip building your own foundation.

Start with your own capital. Build real skill. Prove consistency over months, not days. Then—and only then—consider prop firms as a side game.

The prop firm game is rigged in their favor. But the own-capital game? That one you can actually win.

Take the Right First Steps

Step 1: Build Trading Discipline (The Real Foundation)

Before you think about prop firms, AI, or any strategy, you need discipline.

📅 Download the Trading Agenda Start Pack (free) - The system that prevents rule violations BEFORE they happen. The DoIt Method takes 10 seconds per trade decision and has helped 500+ traders reduce violations by 30% in just 2 weeks.

This matters for prop firms (where one violation can eliminate you) AND for own capital (where discipline determines long-term survival).

→ Get Trading Agenda Start Pack

Step 2: Start With Own Capital (Even Small Amounts)

$500. $1,000. Whatever you can afford to lose. Build real skill without artificial constraints. This is your foundation.

Step 3: If You Want Consistent AI Execution (Optional)

Alpha Pulse AI with GPT-5.1 (already implemented) can help execute without emotional interference. But understand what it is: a tool that requires proper configuration, not a magic profit printer.

Coming by end of year: Gemini 3 and new OpenAI updates (your EA improves automatically with model evolution).

Reality check: It's not plug-and-play. It requires setup, understanding, and discipline.

→ Learn about Alpha Pulse AI(with realistic expectations)

Step 4: Consider Prop Firms Much Later (As Extra)

Only after 3+ months of proven consistency with own capital. And even then, treat as bonus, never foundation.

Remember: Someone passed FTMO with AI in 4 days. That's an interesting case study. It's not your roadmap. Your roadmap is building real skill with real capital, one disciplined trade at a time, focusing on YOUR account first.

Prop firms are dessert. Own capital is the meal. Don't skip dinner to eat dessert.

🛠️ Tools & Resources I Personally Use and Recommend:

🔗 Trusted Brokers for EA Trading💰 Ultra-low trading cost | 🚀 Raw spreads from 0.0 pip

🔹 Fusion Markets – Ideal for small accounts and testing: https://shorturl.at/GEMa6

💰 Ultra-low cost | 🧪 Perfect for first-time EA setups

🔹 Pepperstone – Also compatible with most EA strategies: https://shorturl.at/V41RY

🌍 Reliable global broker | 🛡️ Solid regulation

📈 Top Prop Firms

🔹 FTMO – Recommended Prop Firm: https://trader.ftmo.com/?affiliates=VWYxkgRcQcnjtGMqsooQ

🧠 Funded trader challenges trusted by thousands

🔹 US-Friendly Prop Firm (10% OFF with code DOITTRADING): https://shorturl.at/tymW3

🇺🇸 For US traders | 💸 Affordable entry | 🏆 Real funding

💻 Reliable EA VPS Hosting (Rated 4.9/5 on Trustpilot)

🔹 Forex VPS – Stable hosting for automated trading: https://www.forexvps.net/?aff=78368

🔒 24/7 uptime | 🖥️ Low latency | ⚙️ Easy MT4/MT5 setup

Some of the links above are affiliate links. If you use them, it helps supporting the channel at no extra cost to you. Thank you! 🙌