One of the most annoying scenarios in Forex trading is when a trade seems to be going into profit, then suddenly reverses, knocks out your stop-loss, and immediately starts moving in the opposite direction... right where you would have liked to enter.

This is not a mistake. This is not a failure. This is intentional action — so-called stop hunting, or "hunting for stop-losses."

What is stop hunting and who is behind it?

Stop hunting is price manipulation by large players (institutional traders, banks, hedge funds) aimed at artificially forcing out a mass of small positions, fixing their losses. After that, the price reverses in the direction that was initially the goal of the large participants.

These "traps" are most often set up:

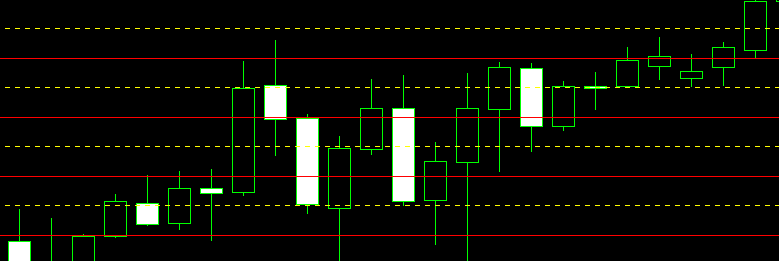

- Near key support/resistance levels — especially if there are many stop-losses accumulated there.

- At local highs/lows — after a strong movement, when traders are confident in the continuation of the trend.

- Near rounded price levels (1.1000, 1.2500, etc.) — where institutional algorithms know that stops are placed en masse.

How many times have you been knocked out by a stop-loss?

My solutions on MQL5 Market: Evgeny Belyaev’s products for traders

These levels don't work. They work for the broker!

Large players don't trade "blindly." They know where the stops of small traders are — thanks to data from liquidity aggregators, volumes, and position reports. And they use this as a tool for entry.

Why do regular stop-losses work against you?

Many beginners place stop-loss too close — "to not lose much." But in a volatile market, especially on M5–M30 timeframes, the price constantly "noises" — breaks through local lows and highs to shake out the indecisive.

If you place a stop 10 points below the support level — you risk being "knocked out" even with a normal corrective movement.

And if you use fixed percentages of the deposit — you don't account for the market structure, only your psychology.

How to protect yourself? 4 proven principles — with lessons from Larry Williams

Place stop-loss beyond a significant level, not by distance

Not "15 points," but beyond the last bar with high volume, beyond the last local low (for long) or high (for short). This makes your stop logical, not arbitrary.

As Larry Williams wrote: "The market is not random — it is cyclical." His %R indicator shows extremes, but he doesn't trade on them right away. He waits for confirmation — the closing of a bar beyond the level. The same goes for the stop: it should be beyond a real turn, not beyond random noise.

Use wide stops on small timeframes

On M5 and M15, the price can easily "bounce" by 20–50 points. Place stops at 30–70 points — this is not "more risk," but a realistic recognition of volatility.

Williams didn't trade on M1. He said: "Trade on timeframes where the market breathes, not wheezes." His recommendations — M5–H1 — are not accidental. On these timeframes, stops work because the market has already passed through "noise filters."

Avoid trading in "noisy" hours

Especially before news, at the beginning and end of the trading session (for example, 08:00–09:00 and 16:00–17:00 MSK). During these periods, liquidity is low — and hunting for stops becomes easier.

This directly echoes what I described in the Signal Histogram indicator: a time filter. Not all hours are equally useful. If you trade at times when the market "sleeps" or "twitches" — you yourself invite the stop hunters.

Trade on confirmation, not on forecast

Don't enter a trade because "it seems like the price will fall." Enter when the price has closed beyond the level, and the signal histogram (for example, Signal Histogram) has confirmed a trend change.

Larry Williams didn't believe in "predictions." He said: "Don't try to be right — try to be rich." His %R doesn't give an entry signal. It shows where the market is overheated. And entry — only after confirmation by closing. This is the philosophy of survival. Not gambling.

Psychology: "I was right!" — and why this is your trap

The most dangerous illusion is thinking that "I was right, they just knocked me out."

But in trading, the correct entry is not the one that ultimately turned out to be correct. It's the one that matches your system before entry.

If you enter without knowing where others' stops are and without considering the market structure — you're not a trader. You're a target.

Larry Williams said: "You don't have to be right — you have to be rich."

He didn't trade "on hope." He traded by rules. And stop-loss for him is not "fear," but a survival tool.

Conclusion: Stop-loss is not about loss, but about discipline

Stop hunting is not a verdict. It's a natural part of the market. Like noise on the chart. Like false breakouts.

Your task is not to avoid these movements, but not to fall into their kill zone.

Use levels, not distances.

Trade in quiet hours.

Confirm signals.

And remember: the most reliable stop-loss is not the one closest to the price, but the one in the right place.

And if you've read about Larry Williams — you understand that true profit is born not at the moment of entry, but at the moment when you decide not to enter.

Don't try to "guess" the market.

Build a system that doesn't depend on what it will do.

In the next article, I'll tell you how to properly set stop-losses. To not miss the next article, subscribe to my channel, there I'll post this link to the publication:

https://www.mql5.com/en/channels/trendscalper