META i11 – Technical Reference

The EA incorporates deep liquidity mapping, multi-layer cognitive supervision, and a new generation of self-correcting systems that continuously refine trading behavior in real time. META i11 expands its intelligence with each executed trade visibly and measurably.

What is new in META i11?

Additionally, META i11 integrates three newly developed core modules that significantly outperform previous generations:

(1) Tri-Core Cognitive Engine (TCE)This engine consists of three interconnected cognitive units:

• Predictive State Engine – anticipates market tendencies

• Reactive Stability Engine – monitors volatility and suppresses structural risks

• Adaptive Pattern Engine – modifies internal patterns dynamically

TCE ensures that META i11 remains stable and strategically consistent, even under extreme market pressure.

Purpose:

It identifies beneficial decision patterns and removes inefficient ones, ensuring a more intelligent and adaptive trading structure.

(2) Multi-State Dynamic Liquidity Mapping (MDLM)

MDLM models the real market liquidity structure, including:

• micro-liquidity zones

• imbalance clusters

• institutional sweep areas

• pressure-axis shifts

Unlike traditional indicators, MDLM builds a dynamic liquidity topology and identifies high-probability reversal or breakout points.

Purpose:

Enables META i11 to understand the market’s underlying liquidity behavior often before price reacts.

(3) Neural Error Immunity System 2.0 (NEIS-2)

An upgraded version of the SCTM framework used in earlier models.

NEIS-2 analyzes every decision tree for structural weaknesses and rewrites the underlying logic when inefficiencies occur.

It stores volatility fingerprints, timing deviations, and contextual anomalies to anticipate errors before they happen.

Why it works:

META i11 gradually eliminates entire categories of poor decisions, creating exceptionally stable long-term performance.

Neural Network Overview

Its neural architectures have been significantly expanded and optimized, enabling far deeper pattern recognition and a much higher number of decisions per second.

Neural Network I

Neural Network I (NN I) detects market structures and recurring patterns in real time.

It analyzes price movements, volume, and volatility to identify trend reversals and liquidity zones at an early stage.

This allows it to generate precise entry signals based on probabilities rather than fixed rules.

Neural Network II

Neural Network II (NN II) analyzes the market environment and volatility to assess the current market dynamics.

Based on this analysis, it determines how aggressively or defensively the EA should respond to market movements.

META Layer

The META Layer is the central decision-making system of META i9. It receives the signals from both neural networks,

compares and merges their results, analyzes market conditions, and generates a single, optimized trading decision.

It weighs probabilities, resolves conflicts between the models, and continuously evaluates the quality of its own decisions.

By learning from past trades, the system becomes increasingly precise, stable, and intelligent over time.

Parameters

Parameter | Value | Definition |

|---|---|---|

| [META -Settings] | ||

| Meta Noise Suppression | default, progessive, enhanced | Filters out conflicting or ambiguous AI signals. |

| Cognitive Recalibration Rate | default, progessive, enhanced | Accuracy of pattern evaluation - but with higher performance consumption. |

| Quantum-State Pattern Analysis | true, false | It analyzes price reactions, micro-liquidity shifts, volatility clusters, and implicit supply/demand pressures. |

| Show Panel | true, false | Show or hide the Expert Advisor main panel. |

| [NN -Settings] | ||

| Neural Network Model | default, supreme | 2 different neural network models. |

| Self-Correction Intensity | enhanced | Strength of automatic strategy adjustment after losses. |

| Neuro-Fractal Engine | true, false | NFE combines neural networks with fractal market analysis. |

| Event Horizon Calibration | true, false | This setting determines whether the neural network takes future and past news events into account for its analysis. |

| Show Neural Network | true, false | Show or hide the Neural Network Panel. |

| [AI - Settings] | ||

| AI Integration Control | off, default, progessive, enhanced | Controls the depth of AI involvement in trading decisions. |

| Decision Confidence Filter | true, false | Filters uncertain signals based on AI confidence level. |

| [EA Settings] | ||

| Expert Advisor Magic Number | 1717 | The Expert Advisor Magic Number is a unique ID used to identify and manage trades opened by METAi7. |

| EA Comment | META _i7 | The EA Comment is a custom text label added to each trade for identification. |

| Trading-Risk | from manual till very high | Select the Risk level. If Trading Risk is set to manual, the Manual Lot parameter will be used. |

| Manual Lot | 0.01 | Manual Lot defines a fixed trade size per position. |

Special Features

- Tri-Core Cognitive Engine (TCE)

- Neural Error Immunity System 2.0

- Multi-State Liquidity Mapping

- GPT-5.1 Supervisory Cognition

Basic Settings

| Symbol | XAUUSD |

| Timeframe | H1 |

| min. Deposit | 200$ |

| rec. Leverage | 1:20 and higher |

| Broker | all Broker |

AI Integration

Integrated GPT-5 Cognitive Control Layer META i11 includes an advanced GPT-5 supervisory module that monitors all internal systems.

It detects contextual mismatches, corrects misinterpretations, and ensures high structural accuracy throughout the trading process.

GPT-5 does not trade on its own, it acts as an intelligent meta-controller that stabilizes the EA’s internal logic.

META i9 – Technical Reference

META i9 is a fully autonomous Expert Advisor built on an advanced three-layer architecture:

QSPA (Quantum-State Pattern Analysis)

NFE (Neuro-Fractal Engine)

SCTM (Self-Correcting Trade Memory)

These modules work together to detect deeper market structures, identify trends at an early stage, and dynamically adapt decisions to changing market conditions. The SCTM learning architecture has been completely revised and now stores significantly more market data, allowing finer patterns, microstructures, and sources of error to be detected more accurately. META i9 learns from every transaction, continuously adapts its models, and constantly optimizes its decision-making logic.

Backtests show no losses because the system eliminates inefficient decision paths and, based on an adaptive memory, does not repeat previous mistakes. In addition, an integrated GPT-5 control instance monitors all signals, corrects potential wrong decisions, and ensures greater stability and accuracy. META i9 uses expanded neural networks, a multi-layer AI architecture, and quantized market analyses to make highly precise, adaptive, and forward-looking trading decisions, an EA that becomes smarter with every trade.

What is new in META i9?

(1) Quantum-State Pattern Analysis (QSPA)

This module identifies deep market structures that remain hidden to classical indicators.

It analyzes price reactions, micro-liquidity shifts, volatility clusters, and implicit supply/demand pressure.

Based on this data, QSPA identifies potential trend formations, breakout zones, and critical turning points long before they become obvious.

Purpose:

QSPA works with quantized market states and generates probabilities for future price movement rather than fixed trading signals.

The Neuro-Fractal Engine combines neural networks with fractal market analysis.

It analyzes recurring patterns across multiple timeframes, detects fractal trend stability, and distinguishes between genuine trends and random noise. This allows META i9 to precisely differentiate between trend, range, and transitional phases.

Purpose:

NFE provides a robust basis for using breakout logic in trend phases and mean-reversion logic in sideways markets.

3) Self-Correcting Trade Memory (SCTM)

Every trade is temporarily stored together with all relevant data (time, volatility, spread, price behavior, and news context) and then re-evaluated. If a decision leads to a loss, the system automatically flags the error and reduces the weighting of similar decision patterns. Thanks to the enhanced behavioral analysis and improved weighting algorithms, this process now works even more efficiently, allowing the system to correct itself faster and make progressively better decisions.

Why this works:

The system gradually eliminates inefficient decision paths.

This is why losses “disappear” in backtests - the EA truly learns from them and immediately corrects the underlying cause.

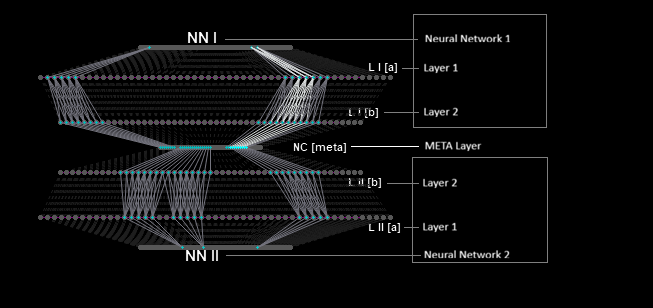

Neural Network Overview

Its neural architectures have been significantly expanded and optimized, enabling far deeper pattern recognition and a much higher number of decisions per second.

Neural Network I

Neural Network I (NN I) detects market structures and recurring patterns in real time.

It analyzes price movements, volume, and volatility to identify trend reversals and liquidity zones at an early stage.

This allows it to generate precise entry signals based on probabilities rather than fixed rules.

Neural Network II

Neural Network II (NN II) analyzes the market environment and volatility to assess the current market dynamics.

Based on this analysis, it determines how aggressively or defensively the EA should respond to market movements.

META Layer

The META Layer is the central decision-making system of META i9. It receives the signals from both neural networks,

compares and merges their results, analyzes market conditions, and generates a single, optimized trading decision.

It weighs probabilities, resolves conflicts between the models, and continuously evaluates the quality of its own decisions.

By learning from past trades, the system becomes increasingly precise, stable, and intelligent over time.

Parameters

Parameter | Value | Definition |

|---|---|---|

| [META -Settings] | ||

| Meta Noise Suppression | default, progessive, enhanced | Filters out conflicting or ambiguous AI signals. |

| Cognitive Recalibration Rate | default, progessive, enhanced | Accuracy of pattern evaluation - but with higher performance consumption. |

| Quantum-State Pattern Analysis | true, false | It analyzes price reactions, micro-liquidity shifts, volatility clusters, and implicit supply/demand pressures. |

| Show Panel | true, false | Show or hide the Expert Advisor main panel. |

| [NN -Settings] | ||

| Neural Network Model | default, supreme | 2 different neural network models. |

| Self-Correction Intensity | enhanced | Strength of automatic strategy adjustment after losses. |

| Neuro-Fractal Engine | true, false | NFE combines neural networks with fractal market analysis. |

| Event Horizon Calibration | true, false | This setting determines whether the neural network takes future and past news events into account for its analysis. |

| Show Neural Network | true, false | Show or hide the Neural Network Panel. |

| [AI - Settings] | ||

| AI Integration Control | off, default, progessive, enhanced | Controls the depth of AI involvement in trading decisions. |

| Decision Confidence Filter | true, false | Filters uncertain signals based on AI confidence level. |

| [EA Settings] | ||

| Expert Advisor Magic Number | 1717 | The Expert Advisor Magic Number is a unique ID used to identify and manage trades opened by METAi7. |

| EA Comment | META _i7 | The EA Comment is a custom text label added to each trade for identification. |

| Trading-Risk | from manual till very high | Select the Risk level. If Trading Risk is set to manual, the Manual Lot parameter will be used. |

| Manual Lot | 0.01 | Manual Lot defines a fixed trade size per position. |

Special Features

- Learns automatically from mistakes

- 2 live-connected enhanced neural networks

- Outstanding META Layer

- Integrated AI

- QSPA + NFE + STCM logic

Basic Settings

| Symbol | XAUUSD |

| Timeframe | H1 |

| min. Deposit | 200$ |

| rec. Leverage | 1:20 and higher |

| Broker | all Broker |

AI System

META i9 additionally features an integrated AI interface based on GPT-5, which serves as a additional control instance for the META Layer.

This unit re-analyzes every decision generated by the internal layer, evaluates it contextually, and optimizes it when necessary.

Through this additional verification layer, misinterpretations are further reduced while overall precision and stability significantly increase.

GPT-5 does not act as a trading system itself but as an intelligent supervisor, continuously monitoring the neural networks and assisting them in their decision-making process.

META i7 – Technical Reference

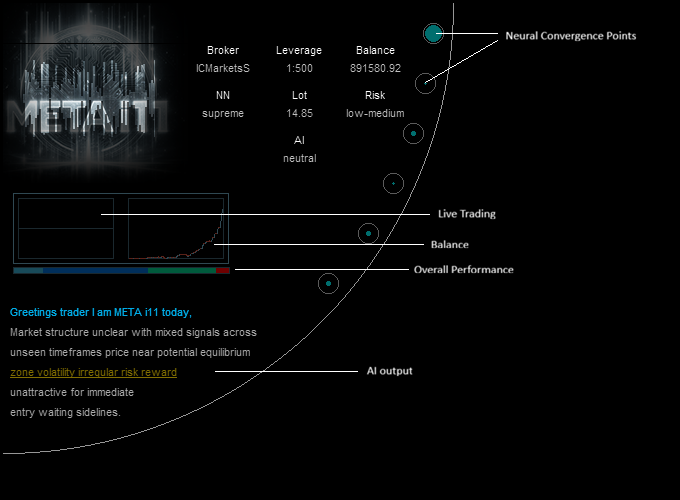

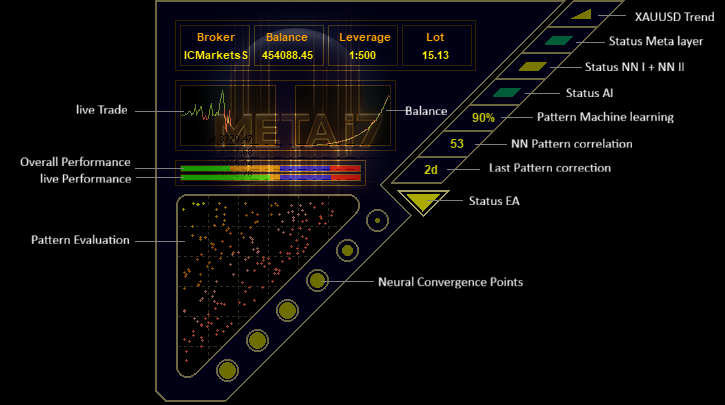

🔹 Left & Lower Section

Live Trade

Displays the currently active trade in real time, providing a detailed visualization of market movement,

trade progression, and live performance metrics.

Balance

Displays the current account balance along with a visual representation of its historical development

and performance over time.

Overall Performance

Displays the overall weighting and interaction of the EA’s core components, including Artificial Intelligence,

Expert Advisor logic, and Neural Networks.

Live Performance

Displays the live weighting and interaction of the EA’s core components, including Artificial Intelligence,

Expert Advisor logic, and Neural Networks.

Pattern Evaluation

Visualizes how the neural networks continuously analyze and interpret market structures and recurring patterns in real time,

providing a clear display of detected formations, repetitions, and structural deviations.

Neural Convergence Points

Six dynamic points that grow in size when both neural networks (NN I & NN II) confirm the same patterns.

The larger the point, the stronger the alignment.

Overall status indicator of the Expert Advisor - confirms whether everything functioning properly.

🔹 Top & Central Section

Broker / Balance / Leverage / Lot

Displays your core live trading data:

-

Broker: Current broker

-

Balance: Account balance in USD

-

Leverage: Applied leverage

-

Lot: Current trade volume

Live Trade

Displays the currently active trade in real time, including market movement and ongoing performance.

Balance

Displays the currently Balance and historical development of the account balance.

🔹 Right Section

XAUUSD Trend

Analyzes the current trend for XAUUSD.

Status META Layer (Parameter Meta Noice Supression)

Indicates the internal decision-processing layer, known as the META Layer.

This advanced system integrates, analyzes and harmonizes the outputs of both neural networks,

transforming complex data streams into a single, optimized trading decision.

Status NN I + NN II (Parameter Neural Network model)

Shows whether both neural networks are functioning correctly and producing signals.

Status AI (Parameter AI Integration Control)

Monitors the status of the AI system (GPT-5) that acts as a supervisory control, verifying and optimizing signals.

Pattern Machine Learning

Indicates whether the EA is currently processing past trade data or patterns to improve its internal model - the system’s live learning process.

NN Pattern Correlation

Measures the correlation (alignment) between patterns identified by NN I and NN II. A higher value means stronger confirmation.

Last Pattern Correction

Shows when the last pattern correction occurred - an important metric for the adaptive self-learning process.

In short:

🔸 Left side = Analysis and performance

🔸 Central section = Real-time data and core system activity

🔸 Right side = System status, AI monitoring, and learning progress

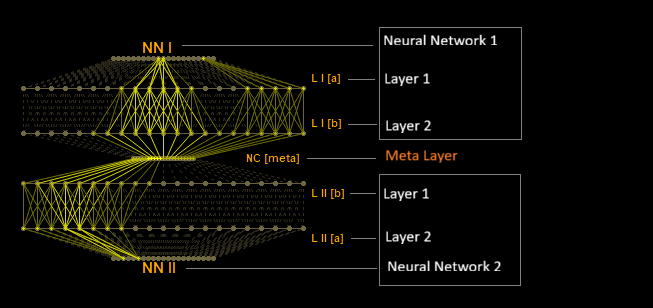

Neural Network Overview

Neural Network I

Neural Network I (NN I) detects market structures and recurring patterns in real time.

It analyzes price movements, volume, and volatility to identify trend reversals and liquidity zones at an early stage.

This allows it to generate precise entry signals based on probabilities rather than fixed rules.

Neural Network II

Neural Network II (NN II) analyzes the market environment and volatility to assess the current market dynamics.

Based on this analysis, it determines how aggressively or defensively the EA should respond to market movements.

META Layer

The META Layer is the central decision-making system of META i7. It receives the signals from both neural networks,

compares and merges their results, analyzes market conditions, and generates a single, optimized trading decision.

It weighs probabilities, resolves conflicts between the models, and continuously evaluates the quality of its own decisions.

By learning from past trades, the system becomes increasingly precise, stable, and intelligent over time.

Parameters

Parameter | Value | Definition |

|---|---|---|

| [META -Settings] | ||

| Meta Noise Suppression | default, progessive, enhanced | Filters out conflicting or ambiguous AI signals. |

| Cognitive Recalibration Rate | default, progessive, enhanced | Accuracy of pattern evaluation - but with higher performance consumption. |

| Show Panel | true, false | Show or hide the Expert Advisor main panel. |

| [NN -Settings] | ||

| Neural Network Model | default, supreme | 2 different neural network models. |

| Self-Correction Intensity | default (more coming soon) | Strength of automatic strategy adjustment after losses |

| Event Horizon Calibration | true, false | This setting determines whether the neural network takes future and past news events into account for its analysis. |

| Show Neural Network | true, false | Show or hide the Neural Network Panel. |

| [AI - Settings] | ||

| AI Integration Control | off, default, progessive, enhanced | Controls the depth of AI involvement in trading decisions. |

| Decision Confidence Filter | true, false | Filters uncertain signals based on AI confidence level. |

| [EA Settings] | ||

| Expert Advisor Magic Number | 1717 | The Expert Advisor Magic Number is a unique ID used to identify and manage trades opened by METAi7. |

| EA Comment | META _i7 | The EA Comment is a custom text label added to each trade for identification. |

| Trading-Risk | from manual till very high | Select the Risk level. If Trading Risk is set to manual, the Manual Lot parameter will be used. |

| Manual Lot | 0.01 | Manual Lot defines a fixed trade size per position. |

Special Features

- Learns automatically from mistakes

- 2 live-connected neural networks

- Outstanding META Layer

- Integrated AI interface

- PMPR + AEB + STCM logic

Overview

META i7 is a fully automated Expert Advisor based on two cooperative neural networks.

These networks are processed through the internal META Layer – an integrated interface that evaluates both models, merges their outputs, and refines them into a single, coherent trading decision.

META i7 actively learns from every trade, continuously improves its logic, and dynamically adapts its strategy to current market conditions.

The result is a system that doesn’t just react – it anticipates, thinks ahead, and optimizes itself over time.

Basic Settings

| Symbol | XAUUSD |

| Timeframe | M15 |

| min. Deposit | 300$ |

| rec. Leverage | 1:20 and higher |

| Broker | all Broker |

AI System

META i7 additionally features an integrated AI interface based on GPT-5, which serves as a additional control instance for the META Layer.

This unit re-analyzes every decision generated by the internal layer, evaluates it contextually, and optimizes it when necessary.

Through this additional verification layer, misinterpretations are further reduced while overall precision and stability significantly increase.

GPT-5 does not act as a trading system itself but as an intelligent supervisor, continuously monitoring the neural networks and assisting them in their decision-making process.

Additional System

META i7 combines three interlinked modules that work together to cover the entire market analysis process:

1. Predictive Market Pattern Recognition (PMPR)

Identifies recurring market structures, liquidity zones, and trend reversals long before they become visible to standard indicators.

2. Adaptive Equity Balancing (AEB)

Automatically adjusts risk based on market volatility and stability.

→ Defensive during uncertainty, more aggressive in stable trending phases.

3. Self-Correcting Trade Memory (SCTM)

Analyzes every trade, detects recurring errors, and eliminates inefficient decision paths.

→ Losses are actively “unlearned.”

No Losses in Backtests

META i7 uses an advanced learning framework with temporary and Big Data structures.

Each loss is immediately analyzed, its cause removed, and the behavioral pattern optimized.

As a result, the system improves over time and prevents the repetition of inefficient trading decisions.

Usage & Recommendations

-

Simply attach the EA to XAUUSD M15.

-

No indicators or additional filters required.

-

Default parameters are optimized – adjust only if you have experience.

-

For best performance: use a stable internet connection and VPS.