Every trader seeks a way to improve the efficiency and reliability of their trading system. One of the most effective methods for achieving this goal is using an Expert Advisor Samurai WIN is the use of a multiple mode. This approach radically changes the principle of working with a single currency pair to a strategy covering the entire market.

What is multiple mode?

Multiple mode is an advisor feature that allows it to work simultaneously with an unlimited number of trading instruments (currency pairs). Simply manually assign the advisor to each chart of the instrument you want to use in your portfolio, configure the input parameters, and the algorithm will analyze and execute trades across multiple pairs automatically. This transforms your trading robot from a highly specialized tool into a multifunctional trading suite.

The advantages of this mode have already been discussed in the description of the advisor Samurai WIN, and here we will analyze the features of this mode and help you choose the optimal settings.

How does multiple mode work?

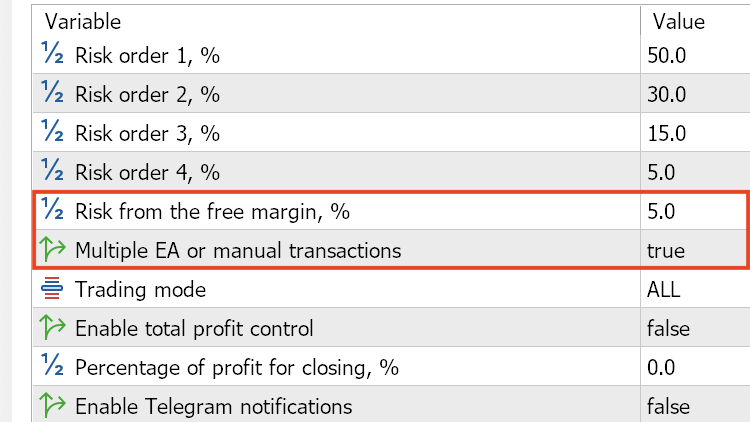

First of all, for the advisor to work correctly, enable the setting:

Multiple EA or manual transactions = true In this case, the signals will be processed correctly.

All trades are opened with a fixed risk from the free margin, which you specify in the advisor settings:

Risk from the free margin, % = 5 %

By default, this parameter is 5%, but for each instrument in the multiple mode, you can specify a custom risk amount, depending on the instrument's volatility, its trading history, and other factors. However, in general, it is recommended not to exceed this parameter more than 5%.

Which tools to choose and how to select the settings?

First of all, the choice of instruments depends on the size of the deposit and the leverage used.- If the deposit is no more than $1,000 and the leverage is no higher than 1:100, then a strategy using no more than 5 instruments is suitable.

- Average deposits of $10,000 and optimal leverage of 1:200 can process up to 20 instruments.

- For large deposits of $50,000 and optimal leverage of 1:300, you can bet on an unlimited number of instruments.

| Deposit < $1,000 | Leverage < 1:100 | Number of instruments < 5 |

| Deposit > $10,000 | Leverage > 1:200 | Number of instruments < 20 |

| Deposit > $50,000 | Leverage > 1:300 | Number of tools = unlimited |

*These calculations are approximate and are used to clearly illustrate the logic behind the relationship between leverage and free margin for making trades on an account using the multiple mode.

Next, an important factor is the strategy with which you want to use these particular tools.

This opens up a wide range of options for strategy selection; you can base your strategy on many factors. We'll describe a few of them, and then, using the same principle, you can test any hypotheses yourself on a demo account.

Important: We strongly recommend that you thoroughly test any trading strategies on a demo account before using them, especially with real money.

Trend is your friend

The advisor has a fine-tuning option for selecting a trading mode, which we have described in detail. In the article: Why is your advisor losing money? The secret to flexible customization for any market . (Please read this carefully as proper use of this setting will improve the effectiveness of any strategy).

Therefore, one of the best and less risky strategies would be to follow the trend, according to the principle “ Trend is your friend.”

With this strategy, you can change instruments daily, choosing those with a clear trend and setting the trading mode accordingly. You can also select instruments for a single account to trade in all directions of the trend. If a trend breaks on one instrument, it should be excluded from the portfolio.

In the same way, you can put together a basket of instruments that are in a strong sideways trend and trade in both directions using the "ALL" mode. Once the instrument exits the sideways trend, you can switch to trend-following trading mode to reduce risks.

Focus on currency

Another interesting strategy that is most suitable for the Forex market is the Currency Focus.

It is necessary to select all currency pairs for the portfolio, for example with the Euro: EURUSD, EURNZD, EURGBP, EURJPY, EURCAD, EURAUD, EURCNY, and others. The list can be shortened or expanded. The principle is simple: don't miss a market entry on a pronounced movement of the EUR, whether it's strengthening or weakening, due to news, or other factors. Since all these pairs can be in different phases, not all pairs may trigger corresponding signals at the same time, thus guaranteeing an entry on at least one pair. And here, another advisor setting, which we've gradually approached, comes in handy; it will be especially useful if signals trigger on most instruments in this situation.

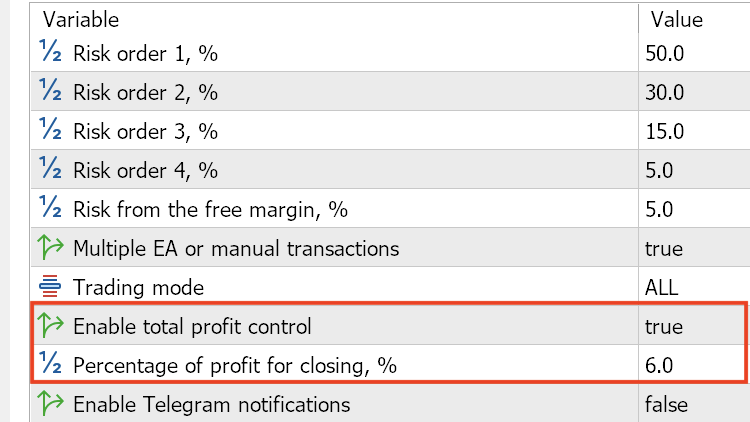

First you need to enable on each instrument:

Enable total profit control = true Percentage of profit for closing, % = 6

Note: Set the percentage to the same value for all instruments, as the lowest percentage will be the one that works for all instruments and close all profitable trades. When using this setting on a single account, you won't be able to use multiple trading strategies simultaneously. Please keep this in mind when working.

Set the percentage of profit from the current deposit at which we are willing to take all profits from the move. This parameter is selected individually and depends on your goals and trading plans, but since the market is volatile, you shouldn't set it higher than 10%. This will be painful and disappointing later when the market reverses and the robot fails to lock in a good floating profit, and it mercilessly evaporates. (Of course, you can always lock in your profit manually, but that's not what we create trading robots for.)

Big win

And of course, for very large accounts you can use the Big Jackpot strategy.

Be careful and select your parameters carefully, as a strategy that can generate high profits is a high-risk strategy.

Here you should use the maximum number of instruments that the deposit can handle.

Since the situation with different instruments is always different, and signals can appear on different instruments at any given time, regardless of other factors, the principle here is to collect the maximum number of signals to maximize profits in the shortest possible time.

And here, just as in any other multiple-mode strategy, the principle of equilibrium will operate, that is, each subsequent open transaction, with existing orders, has a lower weight, thereby maintaining a balance in the account. If some of the transactions turn out to be profitable or unprofitable, then the deposit size will tend to the average amount of profit or loss.

We can sway this value in our favor through the skillful application of the aforementioned settings: "Trading mode" and "total profit control." Don't forget to use them.

We are testing this strategy on a demo account and broadcasting the results on our Telegram channel @Samurai WIN Multiple, subscribe to follow the results and evaluate the EA's performance in real time.

‼️ Important warning:

All strategies and example settings presented in this article are for informational and informational purposes only. They are intended to demonstrate the EA's flexibility and to inspire you to consider creating your own trading system based on its signals Samurai WIN. We in no way encourage you to blindly copy these approaches. Responsibility for the final selection of parameters, risk assessment, and trading results lies entirely with the trader.

Conclusion

Multiple mode in the advisor Samurai WIN — is a qualitative transformation of the approach to automated trading. From isolated trades on a single pair to a comprehensive strategy for the entire market. Your robot is no longer just an executor, but a fully-fledged portfolio manager, simultaneously managing an unlimited number of instruments to achieve one goal: stable deposit growth.

Key points to remember:

- Deposit and leverage determine scale. Start with a small number of instruments and gradually expand your portfolio as your capital grows.

- Risk is the key parameter. A fixed risk from the free margin (recommended no more than 5% per instrument) is the key to deposit protection and the ability to process new signals.

- Strategy is your creative choice. Whether it's following a trend, focusing on a specific currency, or aggressively collecting signals, Samurai WIN's flexible settings allow you to implement virtually any idea.

- Total Profit Control is your "safety button." This setting automatically locks in profits across your entire portfolio, protecting you from market reversals.

- Testing is a must. Before investing real funds, any strategy should be thoroughly tested on a demo account.

The multiple mode opens the door to creating a truly balanced and sustainable trading system. Instead of relying on luck with a single currency pair, you gain a tool for calmly and systematically profiting from market opportunities across the entire financial landscape.

Start small, test, analyze, and gradually refine your ideal strategy. Samurai WIN provides all the necessary opportunities for this. Good luck in trading!