Why is your advisor losing money? The secret to flexible adaptation to any market.

In the world of algorithmic trading on the MetaTrader platform, it's not just the trading logic that's important, but also the flexibility to manage it. One key aspect of management is limiting the types of trades executed. This allows the expert advisor to be adapted to the current market situation, the trader's personal preferences, or to work as part of a trading system with multiple robots. In this article, we'll discuss how to properly use trading modes in an expert advisor Samurai WIN .

The concept of a trade regime

Trading mode is a rule that restricts the EA's actions, allowing it to open only certain types of positions: only buys (ONLY BUY), only sells (ONLY SELL), or both (ALL). This simple yet powerful feature increases control over the EA's operation.

Examples of use in real trading.

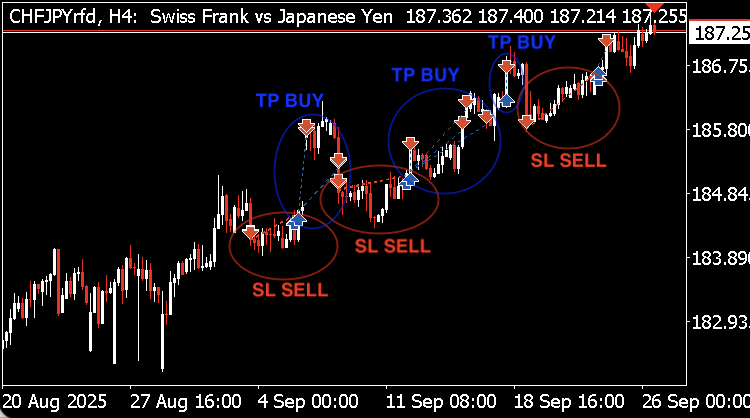

Working in a sustainable trend:- Scenario: The market is clearly trending in one direction, but the correction is weak and unstable. In this situation, it makes sense for the advisor to follow the trend exclusively, minimizing losing trades, which would occur more frequently if trading against the trend.

Unprofitable sell trades could have been avoided if we had switched the trading mode to ONLY BUY.

- Action: Install

Trading mode = ONLY BUY or ONLY SELL

The advisor will ignore sell signals, which is ideal for following a bullish trend, if set to ONLY BUY. Conversely, it will ignore buy signals, which is suitable for following a bearish trend, if set to ONLY SELL. Once a stable uptrend is broken and significant corrections occur, you can return to ALL mode.

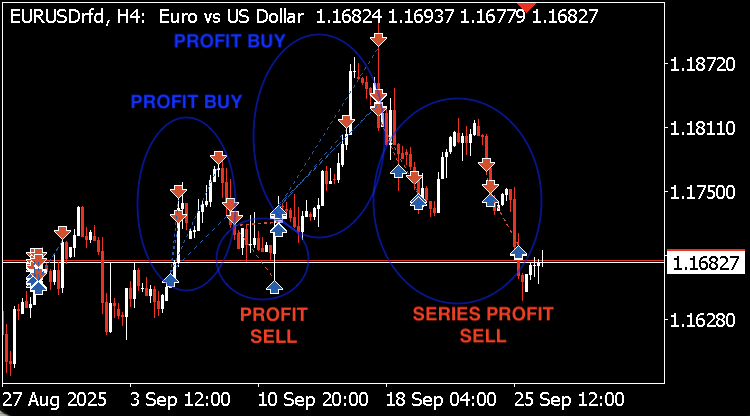

- Scenario: Uncertain sentiment prevails in the market; any attempts to form a trend end in a reversion to previous values. If the channel is sufficiently broad and wide (high volatility), both buying and selling can yield good profits; the odds are almost equal.

As we can see, the advisor used both sell and buy signals, and all of these trades turned out to be profitable.

- Action: Install

Trading mode = ALL

The advisor will monitor all signals to ensure you don't miss any opportunities to make money.

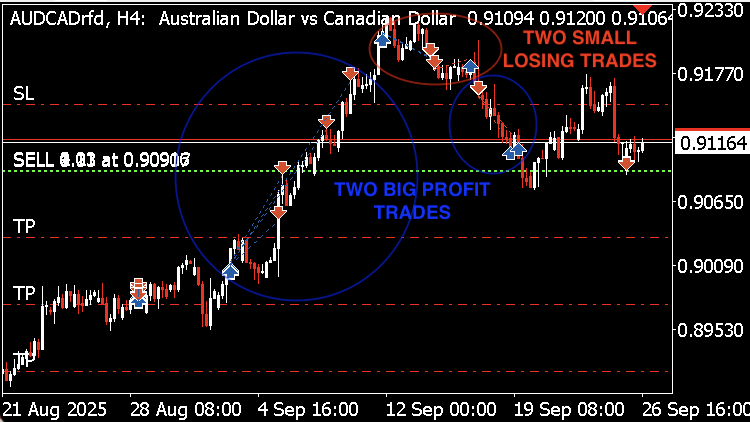

- Scenario: There is a clear trend movement in the market, but it is accompanied by fairly strong and prolonged corrections, forming a wide and sweeping channel along the trend. In this situation, it makes no sense to trade only in line with the trend, since Samurai WIN Advisor has 3 levels of capital protection, then counter-trend transactions will take place with minimal risks.

Two very profitable trades versus two with a small loss, the broad trend provides an opportunity to make money.

- Action: Install

Trading mode = ALL

The advisor will monitor all signals to ensure you don't miss any opportunities to earn money with minimal risk.

These tips are relevant for both the single mode of the advisor's operation Samurai WIN, as well as for multiplayer mode. You can learn more about using multiplayer mode, its capabilities, and the correct settings in the article: The key to stability is diversification and control . You can change the EA's trading mode parameters at any time, adapting its performance to the market situation. This setting is designed to maximize profits and minimize potential losses.

Conclusion

Implementing a trading mode system isn't just a simple functionality addition, but a strategic enhancement to the trading robot. As we've seen in the examples, simply switching between ONLY BUY, ONLY SELL, and ALL allows for flexible adaptation Samurai WIN Advisor to any market conditions: from a strong trend to a volatile sideways movement.

This approach transforms a static robot into a dynamic tool that the trader controls consciously. Instead of waiting for the market to adjust to the algorithm, you can fine-tune the algorithm to the market. Ultimately, it's this kind of granular control that transforms automated trading from a "black box" into a predictable and reliable tool for achieving your financial goals. Putting trading modes into practice is a key step toward increasing the effectiveness and control of automated trading.