Welcome to the AOT Community – where robots do the heavy lifting, and we sip coffee while watching charts. ☕📈

Hey there, trader! 👋 Whether you’re new to the forex game or a seasoned pro who’s survived a few market tsunamis, you’ve probably had questions about automated trading systems like:

-

“Why do some bots take big losses?”

-

“How do they bounce back?”

-

“What’s with the tiny Risk:Reward ratio?”

Let’s dive into two key trading concepts—Edge and Expected Value—the nerdy (but powerful) stuff that separates consistent traders from random clickers. We’ll use the AOT MT5 bot as our guide. 🥷💸

🎯 What’s a “Trading Edge”?

A trading edge is your superpower in the markets—a mathematical advantage that stacks the odds in your favor over the long run.

Think of it like a casino: they don’t win every hand, but they still build giant hotels in Vegas.

A solid strategy doesn’t win every trade either, but it wins enough to grow your account.

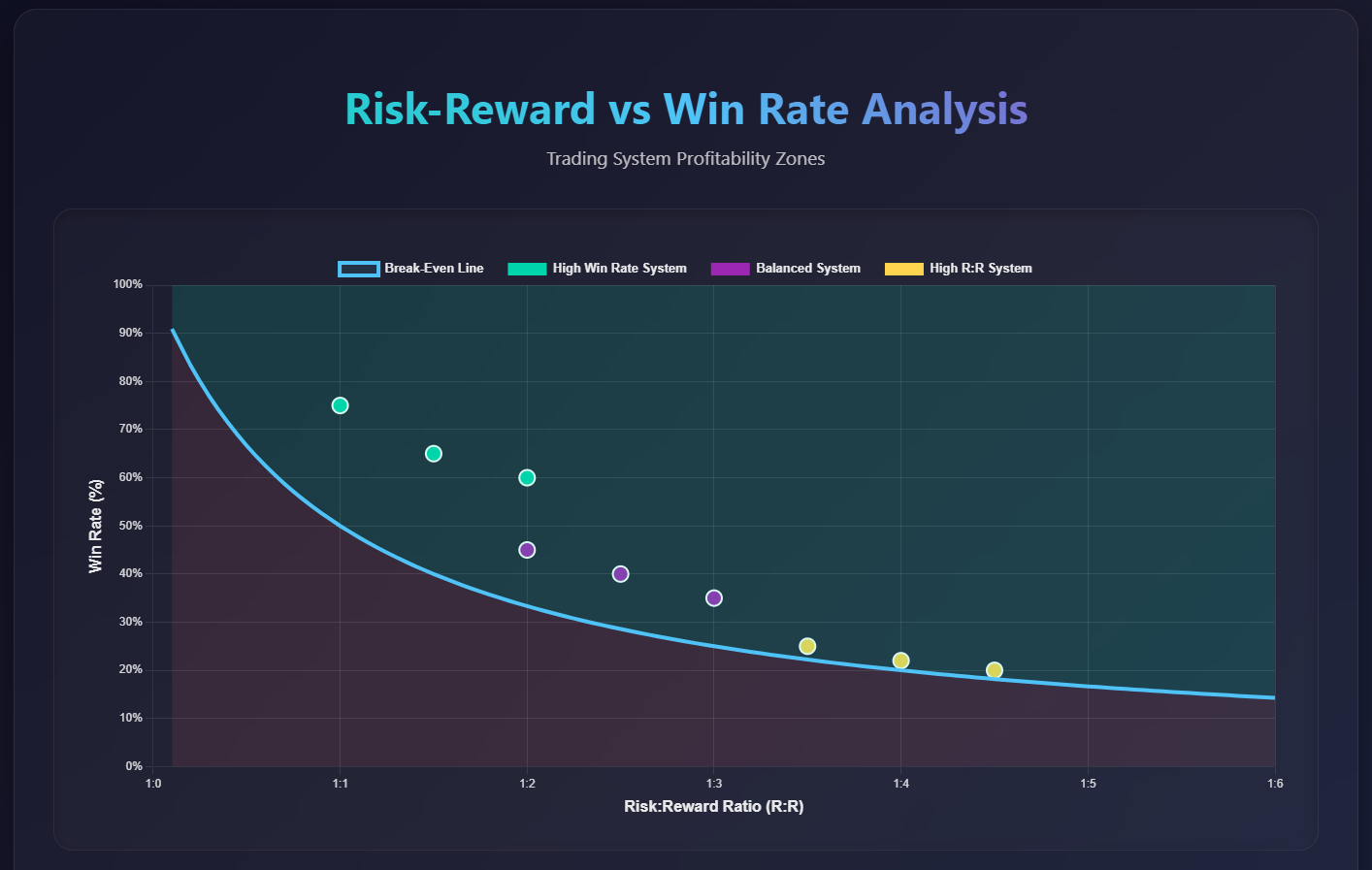

💡 What’s Expected Value (EV)?

Expected Value tells you how much you can expect to make (or lose) per trade, on average. Here's the simple formula:

EV = (Win Rate × Avg Win) – (Loss Rate × Avg Loss)

❌ Example 1:

-

Win Rate: 50%

-

Avg Win: $100

-

Avg Loss: $100

EV = (0.5 × 100) – (0.5 × 100) = 50 – 50 = 0

Result: Breaking even. Snooze. 😴

✅ Example 2:

-

Win Rate: 83%

-

Avg Win: $100

-

Avg Loss: $300

EV = (0.83 × 100) – (0.17 × 300) = 83 – 51 = +32

Result: Positive EV of $32 per trade. Now we’re talking! 💰

🤔 Low Risk:Reward Ratio? Yep, On Purpose

AOT doesn’t chase giant Risk:Reward ratios. Instead, it plays the high-probability game:

-

🛡️ Wider Stop Losses – gives trades room to breathe.

-

💸 Smaller Take Profits – locks in quick, frequent wins.

It’s all about consistent base hits, not swinging for the fences. Think: the forex version of Moneyball. ⚾📊

📋 Risk Management Tips

-

💡 Lot Sizes: Use fixed or auto-adjusted sizes that suit your account size.

-

🧐 Monitor: Check your account regularly.

-

🌐 Diversify: Spread risk across multiple pairs.

-

📆 Be Patient: Edges take time to shine—don’t judge a strategy on a short period of time.

🤷 Is This Style Right for You?

✅ Yes, if: You like steady wins, high win rates, and a chill, controlled approach.

❌ No, if: You’re chasing huge 1:3+ trades and don’t mind more frequent losses.

-

✔️ Real edge via mean reversion strategy

-

✔️ Positive EV with a high win rate

-

✔️ Losses? Rare—and recoverable

-

✔️ Robot brain = No emotions = Good vibes

Happy trading, and may your pips always land in your favor! 🚀

Disclaimer: This post is for informational purposes only and does not constitute financial advice. Trading involves risk, and past performance doesn’t guarantee future results. Always do your own research before trading.