0

409

General Configuration of the Market Structure

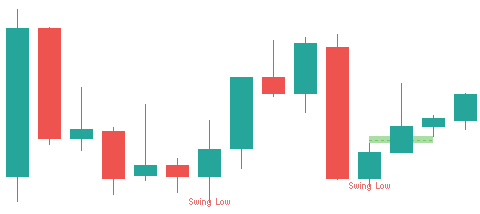

Swings

Swings are basic concepts that represent high or low prices, usually defined by two previous and two subsequent candles.

- Swing high:

- Swing low:

General swing parameters

- Swing find mode: This parameter defines how the indicator detects market swings. Two modes are available:

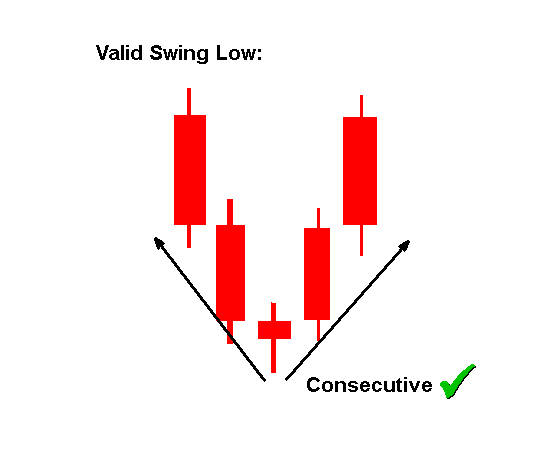

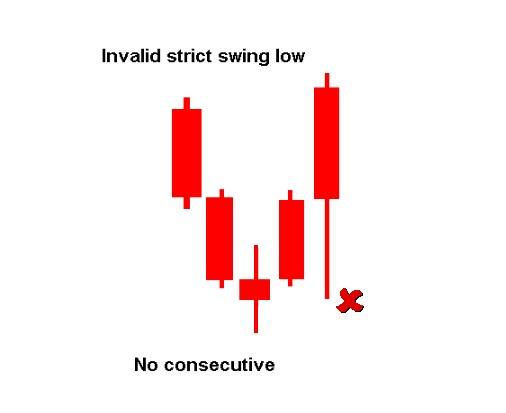

- Strict Mode / "Strict search mode":

In this mode, the evaluated candlestick is verified to have consecutive preceding and succeeding candles that are lower (for a swing high) or higher (for a swing low). For example, if the low of a candlestick is found to be lower than that of the preceding and succeeding candles, the first verification cycle is complete. This process is repeated "x" times, where "x" is the number of candlesticks required to define a swing, with two candlesticks typically being considered valid. - Valid example for a strict 2-candle swing low:

- Invalid example for a strict 2-candle swing low:

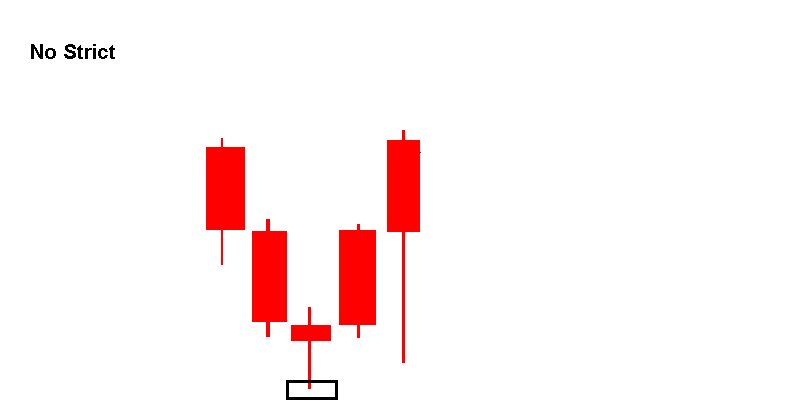

- Non-strict search mode: This mode offers a simpler way of determining whether a candlestick is a swing candle; it's enough for the candlestick being evaluated to be smaller (or larger) than the reference candles, without such a rigorous analysis of consecutiveness. This method is faster, although it may include some "noise" depending on the number of candlesticks being evaluated.

- High and Low Swing (Number of Candles):

This parameter indicates the number of previous and subsequent candles used to verify whether a candle is a swing high or swing low. For example, in some images, two candles were used before and two after, so this parameter would be set to 2 to confirm the condition.

- Swing Low Color y Swing High Color:

These parameters allow you to define the colors that will be used to visually mark the swing low and swing high points on the chart.

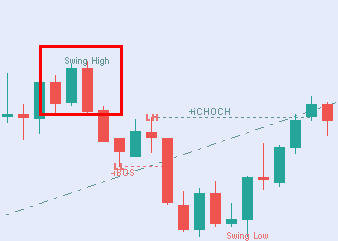

Bos y Choch

- choose the color of the bullish bos (line and text):

Choose the color that will be used to represent the bullish BOS, both in the line and in the text.

- choose the color of the bullish Choch (line and text):

Choose the color that will be used to display the bullish CHOCH, both in the line and in the text.

- choose the color of the bearish bos (line and text):

Defines the color for the bearish BOS, applicable to the line and text.

- choose the color of the bearish Choch (line and text):

Select the color to be used for the bass CHOCH, both in the line and in the text.

- Choose the maximum wait for the bos and choch (in bars):

This parameter indicates the number of candles that must be considered to confirm the appearance of a BOS or CHOCH. Typically, the indicator requires the previous candle's close to be greater than a swing low or less than a swing high to determine if the swing has been "broken." If a very old swing is used, the signal may lose relevance. Therefore, assigning a higher value allows for more BOS and CHOCH signals to be detected on the chart.

- Choch and Bos Line Style:

Allows you to choose the line style used to draw both the BOS and CHOCH on the chart. See the post: Types of lines in MT5.

HH / HL / LL / LH

- HH Color: Choose the color for the HH.

- HL Color: Choose the color for the HL.

- LL Color: Choose the color for the LL.

- LH Color: Choose the color for the LH.

Note: In the market structure configuration, there are two similar sections, except that one is for configuring the internal structure and the other for the external structure. The parameters in both sections are the same.