Table of Contents

1. Introduction

2. Installation

3. Input Parameters

- Recovery Techniques

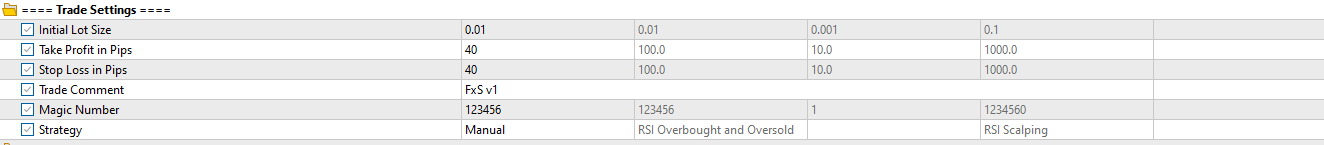

- Trade Settings

- Trailing Options

- Moving Average Settings

- Time Filters

- Dashboard Settings

4. Optimizing the EA

5. Troubleshooting

1. Introduction

Welcome to FxS RSI Pro EA, your all‑in‑one Expert Advisor built for MetaTrader 5. This guide walks you through installation, configuration of six RSI–based strategies, advanced loss‑recovery systems, trailing management, and dashboard features.

2. Installation

For a detailed guide of how to install the EA, refer to this guide installation manual.

3. Input Parameters

- Recovery Techniques

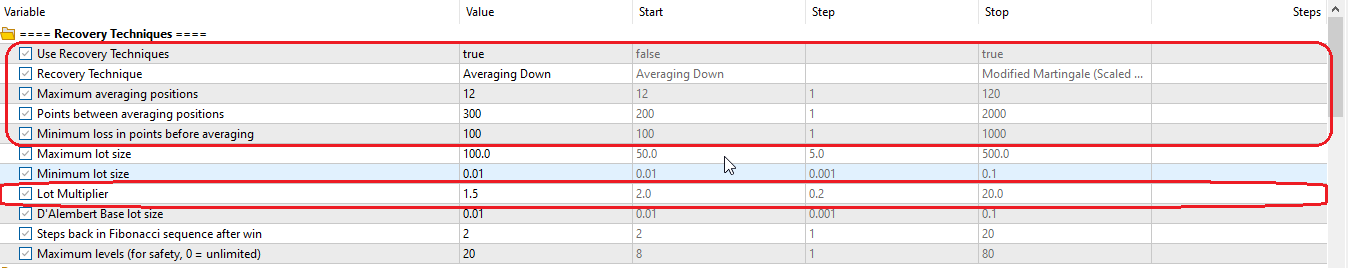

a. Averaging Down Parameters

Averaging Down: Adds positions at fixed intervals after a loss.

For Averaging Down, the relevant inputs are shown in red above.

- Maximum averaging positions : Maximum number of averaging positions allowed (for safety, default: 12).

- Points between averaging positions : Distance in points for averaging down (used in position tracking)

- Minimum loss in points before averaging : Minimum loss in points before averaging

- Lot multiplier : Multiplier for increasing lot sizes with each averaging trade

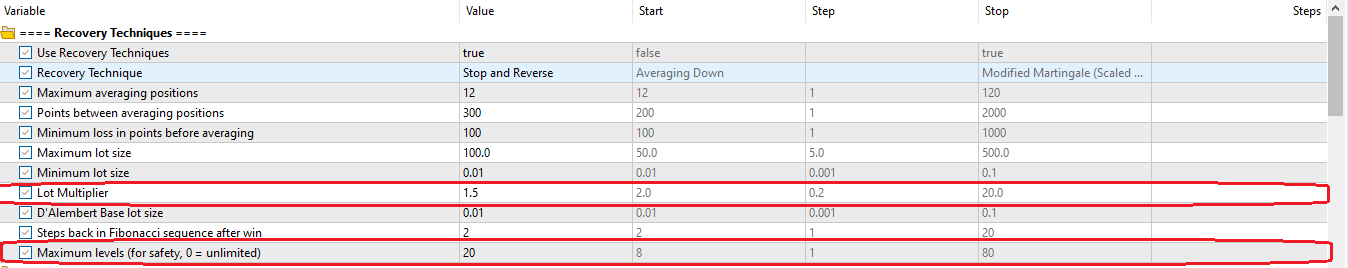

b. Stop and Reverse

Stop-and-Reverse: Closes losing position, opens opposite.

For Stop-and-Reverse, the relevant inputs are shown in red above.

- Lot multiplier: Multiplier for increasing lot sizes after each stop and reverse trade

- Maximum levels : Maximum stop and reverse positions allowed (for safety).

c. D'Alembert System

D'Alembert System: Increases lot by base after a loss, decreases after a win.

For D'Alembert System, the relevant inputs are shown in red above.

- Maximum lot size: (1.0 default) to cap the maximum lot size

- Minimum lot size : (0.01 default) to cap the minimum lot size

- D'Alembert Base lot size - The D'Alembert unit to increases the lot size by after a loss , decrease after a win

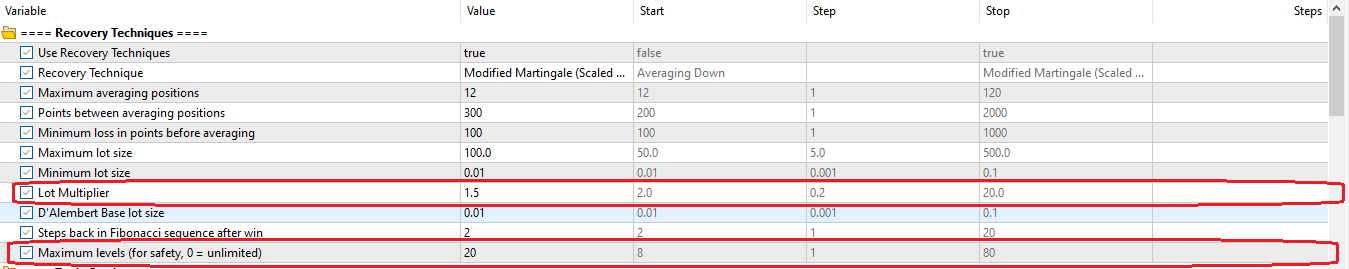

d. Modified Martingale

Modified Martingale: Adjusts martingale multiplier on wins/losses.

For Modified Martingale, the relevant inputs are shown in red above.

- Lot multiplier: Multiplier for increasing lot sizes after a loss, range (×1.1–1.9). The lot size is reset to initial after a win.

- Maximum levels : Maximum Modified Martingale levels allowed (for safety, default:8).

e. Reverse Martingale

Reverse Martingale: Increases lot only after wins.

For Reverse Martingale, the relevant inputs are shown in red above.

- Lot multiplier: Multiplier for increasing lot sizes after a win. The lot size is reset to initial after a loss.

- Maximum levels : Maximum Reverse Martingale levels allowed (for safety, default:8).

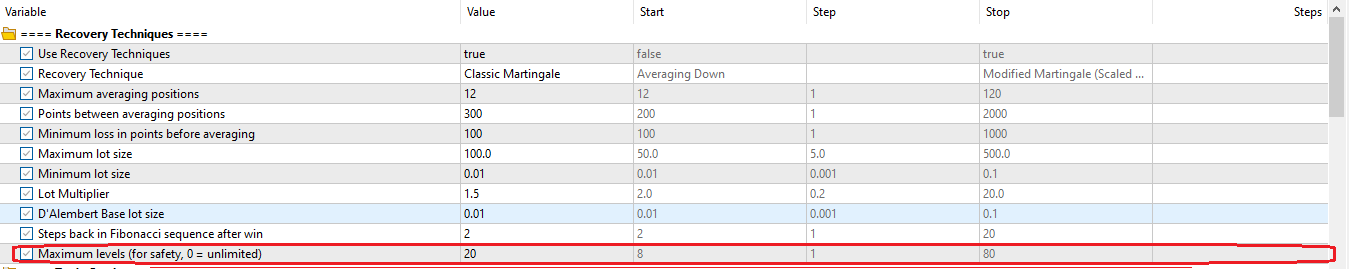

f. Classic Martingale

Classic Martingale: Doubles lot after each loss.

For Classic Martingale, the relevant inputs are shown in red above.

- Maximum levels : Maximum Classic Martingale positions allowed (for safety, default:8).

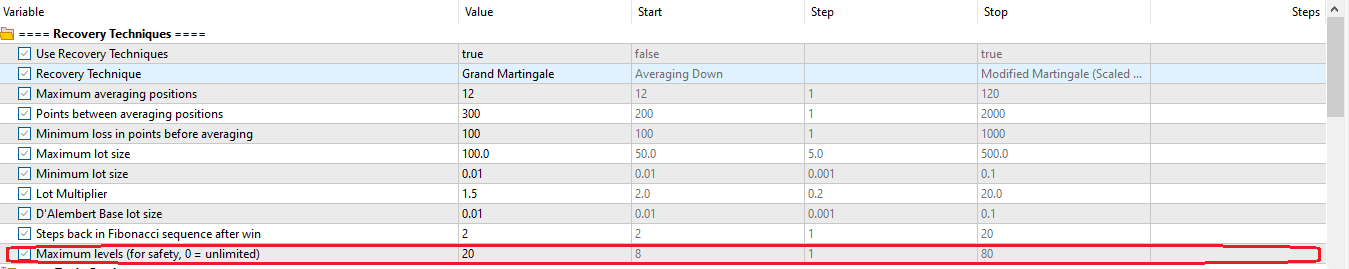

g. Grand Martingale

Grand Martingale: Adds a fixed increment to each doubling.

For Grand Martingale, the relevant inputs are shown in red above.

- Maximum levels : Maximum Grand Martingale levels allowed (for safety, default:8).

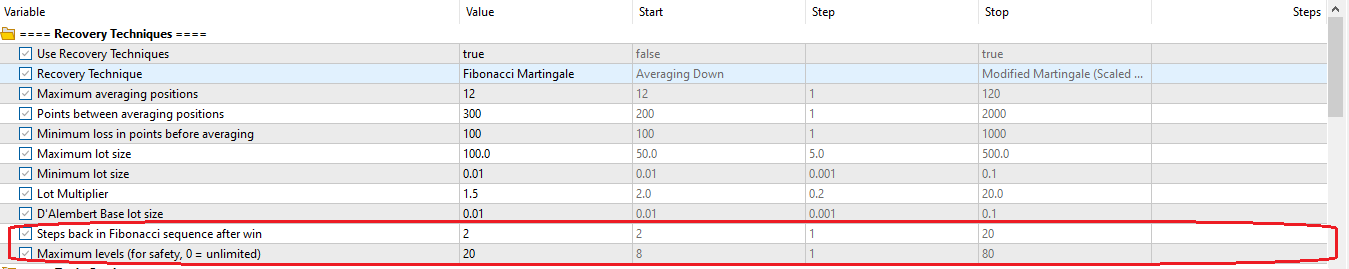

h. Fibonacci Martingale

Fibonacci Martingale: Follows Fibonacci sequence for lot sizing.

For Fibonacci Martingale, the relevant inputs are shown in red above.

- Steps back in Fibonacci sequence after win: the number of steps to move backward in the sequence after win.

- Maximum levels : Maximum Fibonacci Martingale levels allowed (for safety, default:8).

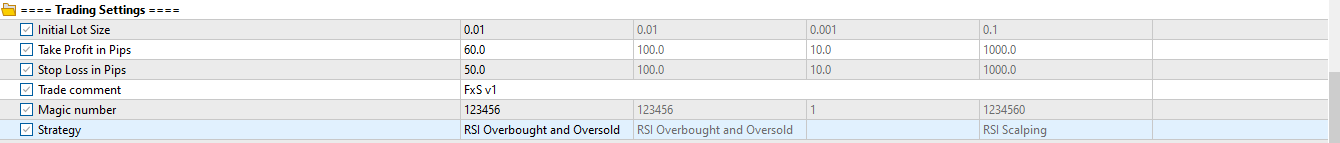

- Trade Settings

a. RSI Overbought and Oversold

Concept:

- Buy when RSI is below 30 (oversold) and starts moving up.

- Sell when RSI is above 70 (overbought) and starts moving down.

Ideal for:

- Works well in range-bound markets.

- Avoid using in strong trending markets.

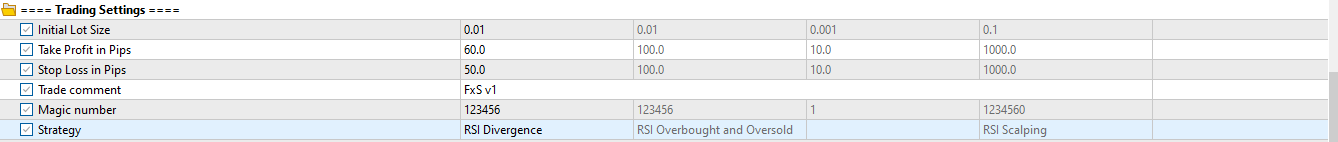

b. RSI Divergence

Concept:

- Bullish Divergence: Price makes lower lows, but RSI makes higher lows → Expect price to reverse up.

- Bearish Divergence: Price makes higher highs, but RSI makes lower highs → Expect price to reverse down.

Ideal for:

- Works well in trending and reversal markets.

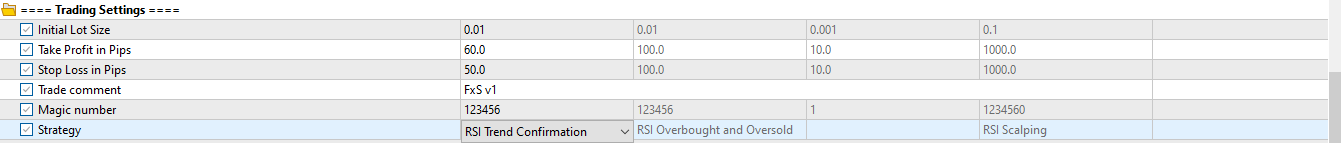

c. RSI Trend Confirmation

Concept:

- Use RSI to confirm trend strength and avoid false signals.

- Buy when RSI stays above 50 (strong uptrend).

- Sell when RSI stays below 50 (strong downtrend).

Ideal for:

- Works well in strong trending markets.

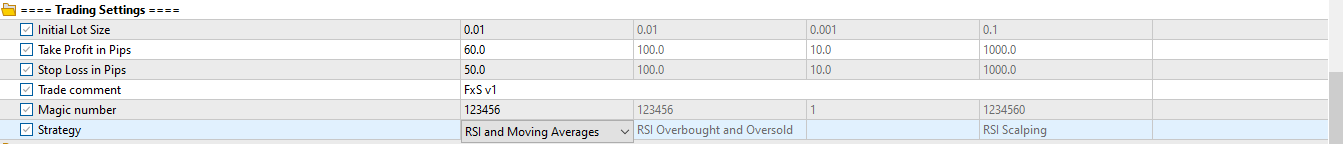

d. RSI and Moving Averages

Concept:

- Combine RSI with a moving average crossover to confirm trade signals.

Ideal for:

- Works well in trending markets.

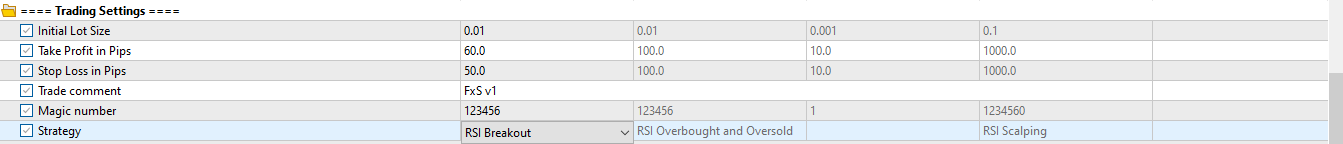

e. RSI Breakout

Concept:

- Identify RSI consolidation (flat movement) before a breakout.

- Look for RSI to break above 60 for a bullish breakout.

- Look for RSI to break below 40 for a bearish breakout.

Ideal for:

- Works well before major price breakouts.

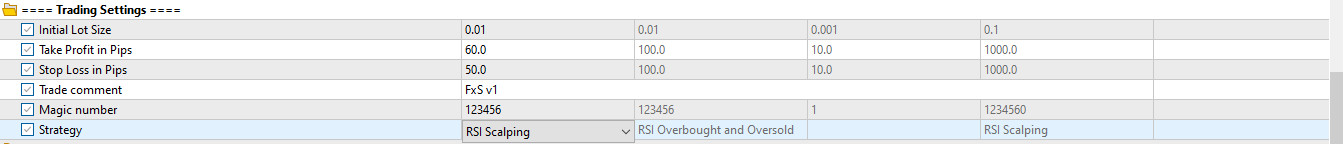

f. RSI Scalping

Concept:

- Use a short RSI period (e.g., 5 or 7) for quick entries and exits.

- Focus on M1 or M5 timeframes.

Ideal for:

- Works well in high volatility periods.

g. Manually Place Orders

Open buy/sell order or close all orders.

- Trailing Stop Loss or Take Profit

Parameter Explanation:

- Use Trailing Stop Loss - Toggle to enable/disable using trailing stop

- Trailing Stop in pips - The distance to maintain between price and stop loss

- Trailing Step in pips - Minimum step to move the stop loss

- Use Trailing Take Profit - Toggle to enable/disable using trailing take profit instead of trailing stop

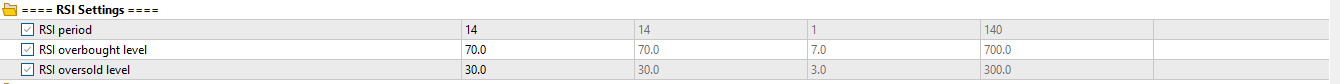

- RSI Settings

Parameter Explanation:

- RSI period - Relative Strength Index period, default is 14

- RSI overbought level - Overbought level, period default is 70

- RSI oversold level - Oversold level, period default is 30

- Time Filters

Parameter Explanation:

- Use time filters - Toggle to enable/disable using time filters

- Trade on Friday - Toggle to enable/disable trading on Friday

- Don't trade on Monday - Toggle to enable/disable trading on Monday

- When To Trade (Server Time) - Select which session should trading be allowed

- Dashboard Setting

Parameter Explanation:

- Show Dashboard - Show dashboard can be either Yes or No

- Dashboard Style - Dashboard Style options are Default, Dark or Classic

4. Optimizing the EA

For a detailed guide of how to optimize the EA, refer to this guide Optimization Settings.

5. Troubleshooting

- Troubleshooting Guide

Issue Possible Cause Solution / Fix EA not visible in Navigator You may have purchased an EA for MT5 but are running MT4, or vice versa. Double-check whether your EA is designed for MT4 or MT5 and make sure you are using the correct platform. EA attaches but won’t trade Live trading disabled or magic number conflict In EA Common tab, enable “Allow live trading”. Verify unique Magic Dashboard does not appear Show Dashboard` disabled Set `Show Dashboard = Yes` in Inputs and reload EA. Orders opened but closed immediately Broker requotes, spread too high, invalid SL/TP Check spread filters, increase `Stop Loss / Take Profit`, enable time filters. EA performance slow / laggy Chart objects overload or heavy optimization load Disable dashboard; reduce number of chart indicators; limit optimization input ranges. Connectivity/VPS issues Unstable internet or MT5 session lost Use reliable VPS provider; enable auto-reconnect.

Tip: Check the Experts and Journal tabs for detailed error logs.

- Frequently Asked Questions (FAQ)

- Frequently Asked Questions (FAQ)

Q1: Can I run multiple instances on different symbols?

A: Yes. Attach one FxS RSI Pro EA per chart/symbol; ensure each uses a unique Magic Number to avoid trade interference.

Q2: How do I load my optimized settings?

A: Save your optimized `.set` file in `\MQL5\Presets`. In the EA’s Inputs tab, click Load and select your file.

Q3: Does the EA support hedging accounts?

A: Yes. FxS RSI Pro EA is compatible with both hedging and netting account types.

Q4: What timeframes work best?

A: Default strategies perform well on H1–H4. Use optimization to test other timeframes for your symbol.

Q5: How can I disable recovery for a specific strategy?

A: In Inputs, set `Use Loss Recovery = false`. The EA will trade only standard RSI signals.

Q6: My broker uses 5-digit pricing—do I need to adjust inputs?

A: The EA auto-detects digit format and adjusts pips accordingly. No manual changes needed.

Q7: What should I do if backtests look different from live results?

A: Ensure backtest spread, slippage, and execution model mirror your broker’s live conditions. Consider tick data import for accuracy.

Q8: How often will I receive updates?

A: Updates are released quarterly or as needed for bug fixes and new features. Check the MQL5 Market page under Updates.