The Art of Stock Market Manipulation: Why Retail Investors Often Lose Out

The stock market, while an integral part of global finance, isn’t immune to manipulation. Many times, retail investors, or everyday individuals investing personal capital, find themselves at a disadvantage when matched against bigger institutional players. This article sheds light on how market manipulation occurs and why private individuals often bear the brunt of these tactics.

Original link: https://medium.com/@baranes.dorian/the-art-of-stock-market-manipulation-why-retail-investors-often-lose-out-2f7f93783228

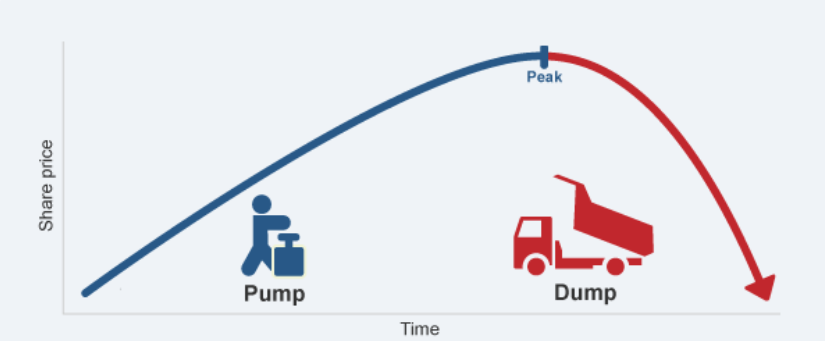

1. Pump and Dump Schemes

Perhaps the most well-known of manipulative strategies, a “pump and dump” entails artificially inflating (“pumping”) the price of a stock, often using misleading or false information, and then “dumping” the stock after the price has risen to benefit from the inflated price.

Impact on Retail Investors: Often, it’s the private individual who’s lured into these schemes. By the time they realize the stock’s value is artificially inflated, the price has already crashed.

2. Short and Distort

The opposite of the “pump and dump,” in a “short and distort” scheme, manipulators short sell a stock, betting its price will go down. They then spread negative rumors about the company to drive down the stock price. Once it drops, they cover their short position at a profit.

Impact on Retail Investors: Retail investors, without access to the vast informational networks that professionals might have, can easily fall prey to such false rumors and sell their stocks at a loss.

3. Wash Trading

Wash trading refers to a form of market manipulation where an investor simultaneously sells and buys the same financial instruments.

This can create a misleading appearance of heightened activity around a stock or instrument, making it seem as if there’s more demand or interest than there really is.

Mechanism:

- Simultaneous Buying and Selling: The trader (or entity) buys and sells a stock or other financial instrument almost simultaneously.

- No Change in Ownership: Even though there are trades being executed, there’s essentially no change in the beneficial ownership of the stock or instrument.

- Artificial Volume: This strategy creates artificial volume, which can attract other traders to the instrument, believing it’s an active or trending stock.

Reasons for Wash Trading:

- Misleading Other Traders: As mentioned, the increased volume can attract unsuspecting traders looking for active or trending stocks.

- Price Manipulation: In some cases, wash trading is used to manipulate the price of a stock upwards or downwards to achieve some gain.

- Generate Commission: For brokers, more trades mean more commission. Unscrupulous brokers might engage in or encourage wash trading to boost their commission earnings.

Impact on Retail Investors:

- False Confidence: Retail investors might interpret the high trading volume as genuine interest or activity in the stock and might decide to buy into it.

- Unexpected Losses: As the perceived demand or interest is artificial, the stock price can suddenly drop when wash trading stops, leading to unexpected losses for those who bought the stock at artificially inflated prices.

- Increased Transaction Costs: If lured into the artificial activity, retail investors may find themselves incurring unnecessary transaction costs from buying and selling.

4. Quote Stuffing and High-Frequency Trading (HFT)

With advances in technology, manipulators can flood the market with orders in milliseconds, only to cancel them. This “quote stuffing” can mislead other traders about the demand for a stock. Similarly, HFT can exploit minute price differences at speeds impossible for a human trader.

Quote stuffing is a type of market manipulation in which vast numbers of buy or sell orders (quotes) for shares are placed and then almost immediately canceled. The intent behind this rapid placement and cancellation of orders is to flood the market with noise.

How It Works:

- Massive Order Placement: A trader or entity rapidly sends thousands of orders.

- Immediate Cancellation: Almost as quickly as they’re placed, these orders are canceled.

- Market Confusion: This rapid-fire placement and cancellation can cause confusion, clogging the trading systems and creating an environment in which it’s harder for other traders to discern genuine trading interest.

Impact on Retail Investors:

- Market Lag: The sheer volume of rapid orders can slow down trading systems, allowing the quote stuffer to gain a fractional time advantage.

- Distorted Perception: It creates a facade of activity, misleading other traders about the real demand or supply.

Protecting Yourself as a Retail Investor

While the market will always have its risks, retail investors can take steps to protect themselves:

- Educate Yourself: Knowledge is power. By understanding the basics of stock market manipulation tactics, investors can better avoid potential pitfalls.

- Diversify: Don’t put all your eggs in one basket. A diversified portfolio can act as a buffer against losses.

- Be Skeptical: If a stock or investment seems too good to be true, it probably is. Always conduct your research.

- Seek Trusted Advice: A reputable financial advisor can be an ally in navigating the complex world of investing.

Conclusion

In conclusion, while market manipulation does pose risks to retail investors, a cautious and informed approach can minimize potential losses. Remember, investing is a marathon, not a sprint — consistency and knowledge are key.