Forex trading is a highly dynamic market that requires traders to make quick decisions based on market trends and technical indicators. One such technical indicator that traders use to identify trends in the forex market is the MACD (Moving Average Convergence Divergence) indicator. In this article, we will discuss the Macdio trigger forex indicator for MT4, which is based on the MACD indicator and provides traders with a clear signal for entering and exiting trades.

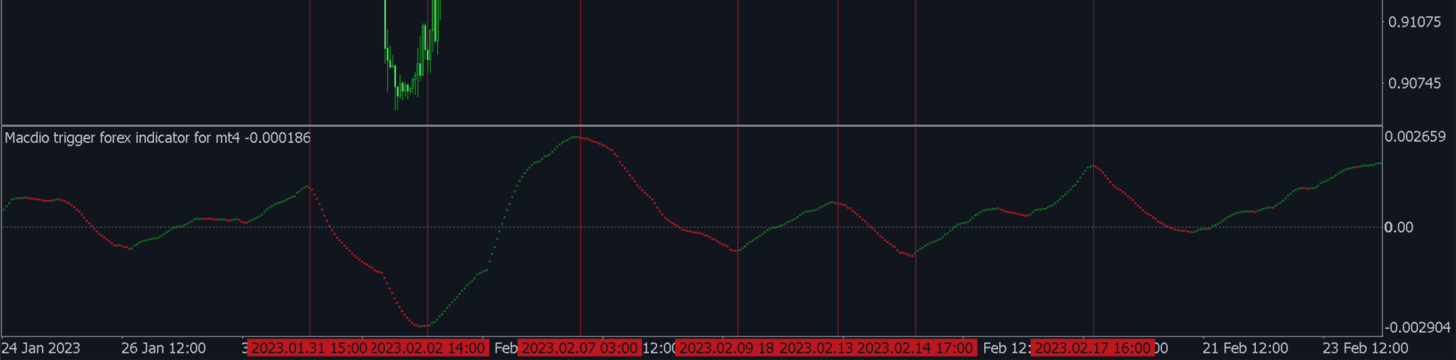

The Macdio trigger forex indicator is a trend-following indicator that displays a line on the chart. The line is red when the trend is downward, and it turns green when the trend is upward. The indicator is based on the MACD indicator, which is a popular technical analysis tool used to identify trends in financial markets.

The MACD indicator consists of two lines, the MACD line, and the signal line. The MACD line is the difference between two exponential moving averages, while the signal line is a moving average of the MACD line. When the MACD line crosses above the signal line, it is considered a buy signal, and when the MACD line crosses below the signal line, it is considered a sell signal.

The Macdio trigger forex indicator simplifies the MACD indicator by displaying only one line that changes color to indicate the trend direction. This makes it easier for traders to identify the trend quickly and take action accordingly.

Trading Strategies with Macdio Trigger Forex Indicator

Here are two trading strategies that traders can use with the Macdio trigger forex indicator.

Strategy 1: Trend Following

This strategy is based on the idea that the trend is your friend. Traders can use the Macdio trigger forex indicator to identify the trend direction and enter trades in the same direction as the trend. Here are the steps for this strategy:

- Step 1: Identify the trend direction using the Macdio trigger forex indicator. If the line is green, the trend is upward, and if the line is red, the trend is downward.

- Step 2: Wait for a pullback in the trend. This is a temporary reversal in the trend, and it provides an opportunity to enter the trade at a better price.

- Step 3: Enter the trade in the direction of the trend when the price resumes its upward or downward movement.

- Step 4: Place a stop loss order below the low of the pullback in an uptrend or above the high of the pullback in a downtrend.

- Step 5: Take profit when the price reaches the next support or resistance level.

Strategy 2: Divergence Trading

This strategy is based on the idea that divergence between the price and the Macdio trigger forex indicator can signal a trend reversal. Traders can use the Macdio trigger forex indicator to identify divergences and enter trades in the opposite direction of the trend. Here are the steps for this strategy:

- Step 1: Identify a trend using the Macdio trigger forex indicator.

- Step 2: Look for divergences between the price and the Macdio trigger forex indicator. A bullish divergence occurs when the price makes a lower low, but the Macdio trigger forex indicator makes a higher low. A bearish divergence occurs when the price makes a higher high, but the Macdio trigger forex indicator makes a lower high.

- Step 3: Enter a trade in the opposite direction of the trend when a divergence is identified.

- Step 4: Place a stop loss order above the high of the bullish divergence or below the low of the bearish divergence.

- Step 5: Take profit when the price reaches the next support or resistance level.