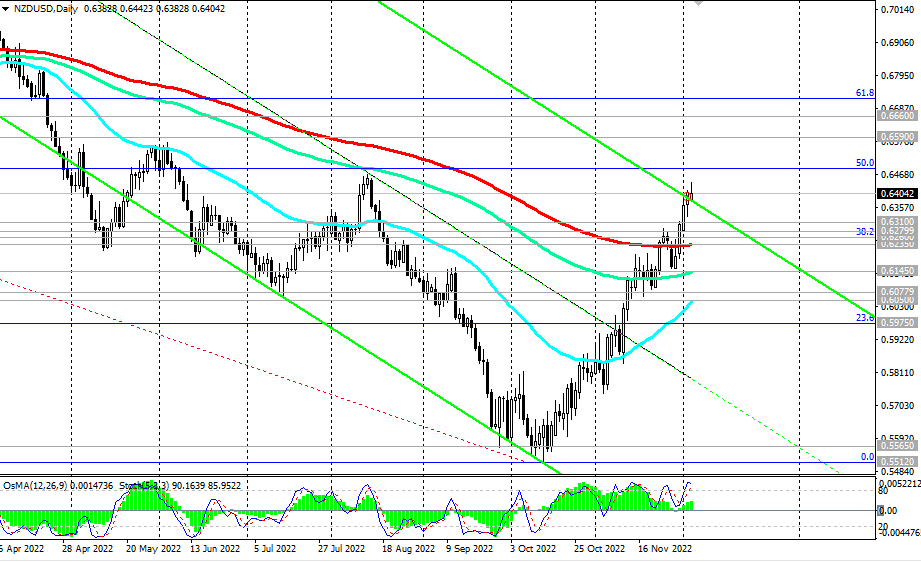

NZD/USD: in the direction of "north" and marks 0.6590, 0.6660

Today, attention should be paid to the publication (at 14:45 - 15:00 GMT) of PMI indices for the US and tomorrow - the publication (after 14:00 GMT) of the Global Dairy Trade (GDT) dairy price index. The indicator is expected to rise slightly (by +0.2%), which should support the NZD quotes (for more information about upcoming events, see the Key economic events of the week 12/05/2022 - 12/11/2022).

From a technical point of view, NZD/USD has broken through the key resistance levels 0.6310 and 0.6235 and continues to move towards the resistance levels 0.6590, 0.6660. If the US dollar continues to weaken (and today its DXY index remains below the 105.00 level for the third trading day in a row, which many economists so hoped that it would hold), then achieving these goals (0.6590, 0.6660) will be a matter of a couple of months

In an alternative scenario, NZD/USD will return to the area below the support level 0.6235 and head inside the descending channel on the weekly chart, the lower border of which is close to 0.5400. In a negative scenario for NZD and NZD/USD, this mark will become a long-term target for the pair to decline.

The earliest signal to resume short positions in the alternative scenario is a breakdown of support levels 0.6380, 0.6330.

see details -> https://www.instaforex.com/ru/forex_analysis/328981/?x=PKEZZ

· signals -> https://www.mql5.com/en/signals/author/edayprofit

· see also “Technical analysis and trading recommendations” -> https://t.me/fxrealtrading