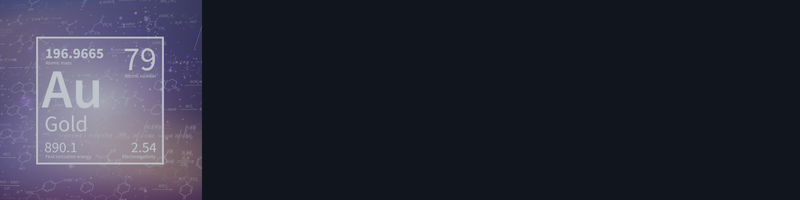

Here we encounter another interesting method of applying the trend line is the fan principle (see Fig. 4.11a-c). Sometimes prices fall slightly after breaking an upward trend line, and on the next rise they reach this old trend line from below (now it becomes a resistance line). In Fig. 4. You can clearly see how prices on the rise reach this line 1, but they never manage to overcome it. Now we can draw the second trend line (line 2 in the picture), but it is also broken. After an unsuccessful attempt of prices to overcome it, a third line (line 3) is drawn as it rises. A break of this third trend line usually indicates that the trend is going downward.

An example of the fan principle. A breakout of the third trend line is a signal of a trend reversal. Note that trend lines 1 and 2 become resistance lines after breakouts.

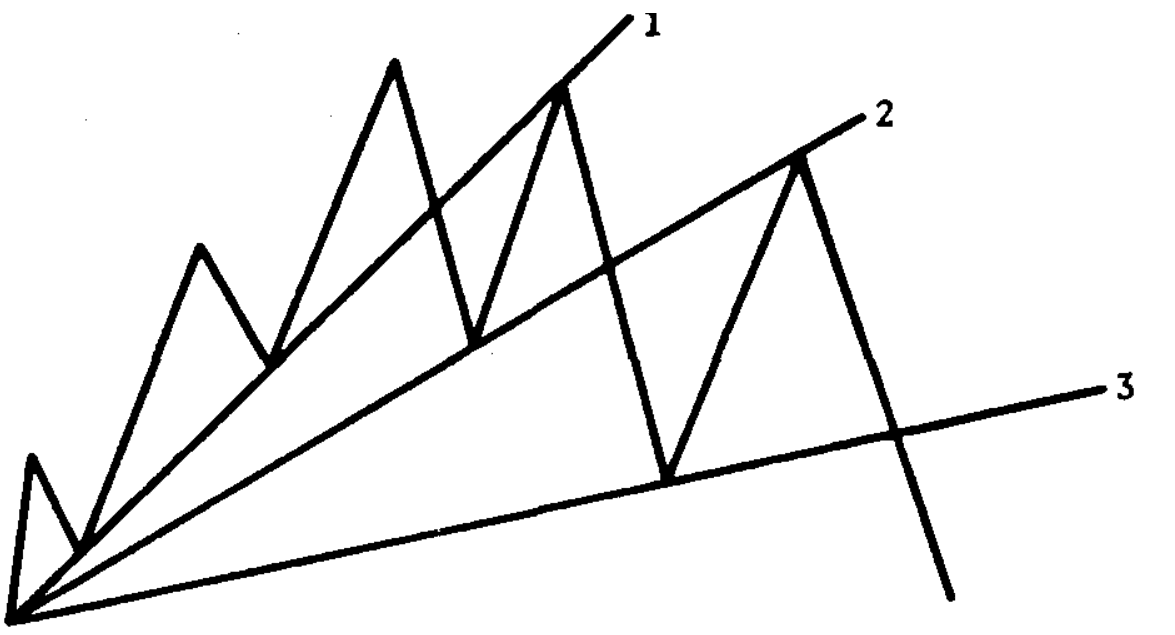

Fig. 4.116 The fan principle at the base of the market. A breakout of the third trend line gives a signal that the trend is going up. Note that trend lines 1 and 2 become support levels after breakouts.

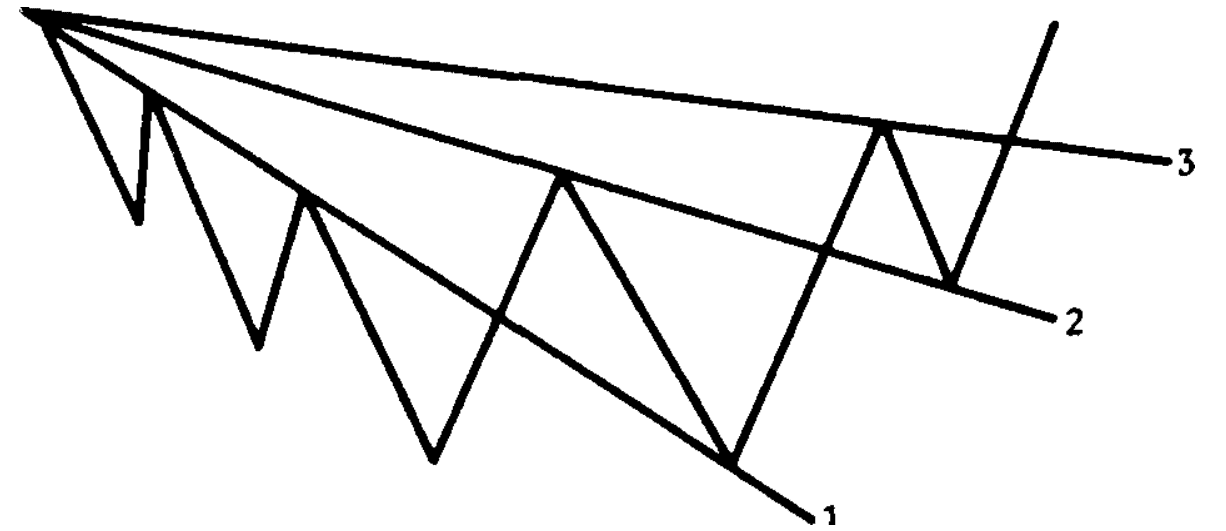

The fan principle is in action. The intermediate drop in prices from the April peak forms three consecutive fan lines. An upward breakout of line 3 is a signal of the resumption of the upward trend. Notice how all three lines became support lines after an upward breakout. It is also interesting how exactly the downtrend line from the November peak reflects the bearish trend. This is perfectly visible on the left half of the chart. The uptrend line, which originated at the base of the market in February-March, is also a very accurate reflection of the upward trend.

In Figure 4.116, a break of the third downtrend line (line 3) signals a renewed upward trend. Notice in these examples that after a breakout, the support lines become resistance lines, and conversely, the resistance lines become support lines. The term "fan principle" obviously comes from the fact that the trend lines diverging at a greater and greater angle begin to resemble an open fan. The main thing in this principle is that the break of the third trend line is an important signal of the break in the trend.

THE IMPORTANCE OF THE NUMBER 3

If you start looking at the three lines we used in the fan principle, you will immediately notice a curious pattern. The number "three" appears so often in technical analysis that it makes you wonder why. Judge for yourself: the fan principle uses three trend lines; according to Dow and Elliott Wave Theory, the main up trend and the main down trend have three phases; there are three types of "gaps" (this will be discussed later), many of the most famous break patterns, such as "head and shoulders" or "triple tops," have three main peaks; there are three types of trend (major, intermediate and minor), three trend directions (upward, downward and horizontal); among the most widely recognized trend continuation patterns are three types of triangles: symmetrical, ascending, and descending; and there are also three main sources of information for the technical analyst: price, trading volume, and open interest. Whatever the reason, the number "three," as we can see, plays a very significant role in any field of technical analysis.

RELATIVE STEEPNESS OF THE TREND LINE

The relative steepness of the trend line is also important. As a rule, the most important ascending trend lines go at an angle of approximately 45°. Some technical analysts simply draw a line from a clear peak or decline at a 45° angle and use it as a main trend line. The line at an angle of 45° was one of the favorite techniques of W. D. Gann. Such a line is a reflection of a situation in which prices are rising or falling at such a rate that price and time are in perfect balance. (Gann made extensive use of various geometric angles and attached particular importance to the 45° angle.