Investors are interested in what the leadership of the US central bank will say about the prospects for monetary policy. Many economists believe that the Fed's interest rate will be raised again at the December meeting, and also by 0.75%, but what will happen next is still a kind of secret.

Despite the tightening of monetary conditions, the US manufacturing business manages to cope with the situation, also acting in the face of high inflation and the threat of a global crisis.

In an alternative scenario, and if market participants consider the decision and comments of the Fed's leaders on monetary policy soft, then the dollar may fall under a wave of sales, moreover, throughout the market.

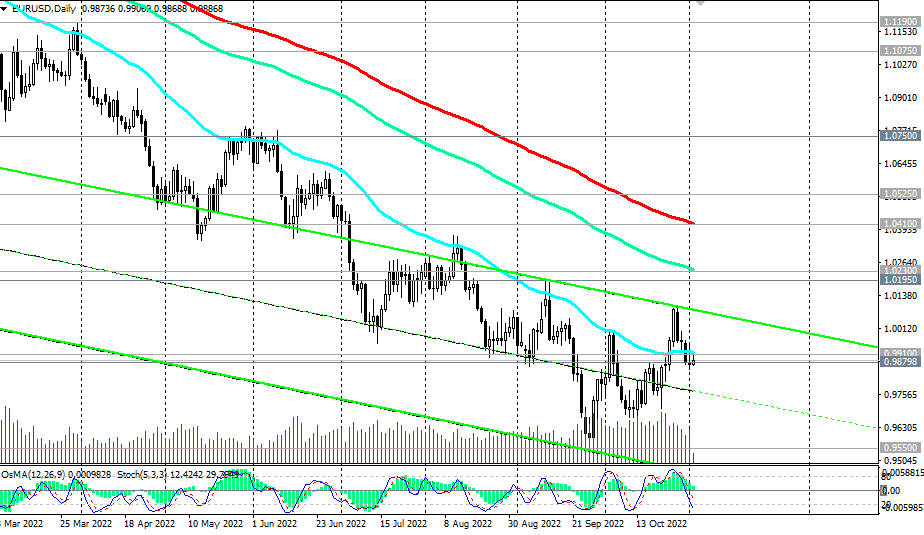

At the time of publication of this article, the EUR/USD pair is trading near the 0.9888 mark, waiting for new drivers to move in one direction or another. It is obvious that today's publication of the Fed's decision on rates will become such a driver.

At the same time, the likely growth of the EUR/USD pair will be fraught with significant difficulties, given the approaching winter and gas shortages”, and “from a fundamental point of view, we should expect a resumption of decline, at a minimum, and at a maximum, a further fall of the pair towards 20- summer lows when it traded around 0.8700, 0.8600.”

Support levels: 0.9880, 0.9853, 0.9800, 0.9700, 0.9600, 0.9535, 0.9500, 0.9400, 0.9300, 0.9200, 0.9000

Resistance levels: 0.9910, 1.0047, 1.0100, 1.0195, 1.0230, 1.0410, 1.0525

- see details -> https://www.instaforex.com/ru/forex_analysis/326040/?x=PKEZZ

- signals -> https://www.mql5.com/en/signals/author/edayprofit

- see also “Technical analysis and trading recommendations” -> https://t.me/fxrealtrading