Market participants, who follow the dynamics of commodity currencies and, in particular, the Australian dollar, will be waiting for the publication tomorrow (at 03:30 GMT) of the decision of the RB of Australia on the interest rate. It is expected that it will be increased again (by 0.50% to 2.85%). Actually, this is a bullish factor for the national currency. AUD may also receive support amid a decrease in supply in the natural gas market due to the undermining of the Nord Stream gas pipelines. Australia is known to be a major supplier of commodities, including hard coal and liquefied natural gas.

However, the market's reaction to tomorrow's interest rate increase may not be very positive, and the rate increase may not become a growth driver for the AUD, given the growing recession risks for the Australian economy.

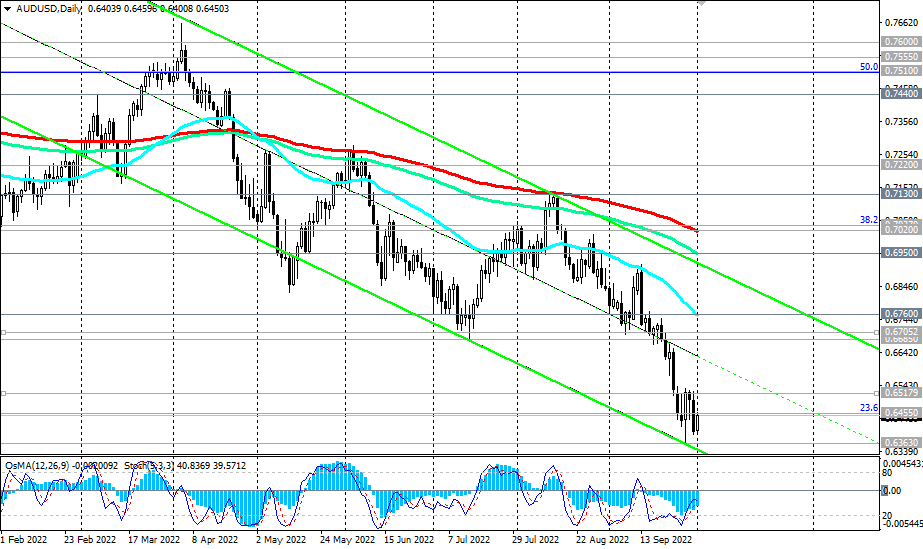

As we noted in our Fundamental Analysis today, at the time of writing this article, AUD/USD is trading near 0.6450, moving inside a descending channel on the weekly chart and staying below key resistance levels 0.7220, 0.7020.

In the main scenario, we expect a breakdown of the local support level 0.6400 and further decline. A breakdown of the local support level 0.6363 (the lowest level since May 2020) will be a confirming signal for our assumption. Today's movement may be driven by publication of important US macro statistics at the beginning of the American trading session (for more details, see the Most Important Economic Events of the Week 03.10.2022 – 09.10.2022).

Support levels: 0.6400, 0.6363, 0.6300, 0.6200, 0.6150, 0.5975, 0.5665, 0.5510

Resistance levels: 0.6455, 0.6518, 0.6700, 0.6760, 0.6950, 0.7020, 0.7037

see details ->https://www.instaforex.com/ru/forex_analysis/323244/?x=PKEZZ

signals -> https://www.mql5.com/en/signals/author/edayprofit

see also “Technical analysis and trading recommendations” -> https://t.me/fxrealtrading