Dear traders, in this blog I will try to explain in simple language the theory and the whole point that I made in my advisor AU Gold.

What is a cycle? A cycle is an interval of time for the complete passage of some periodic event.

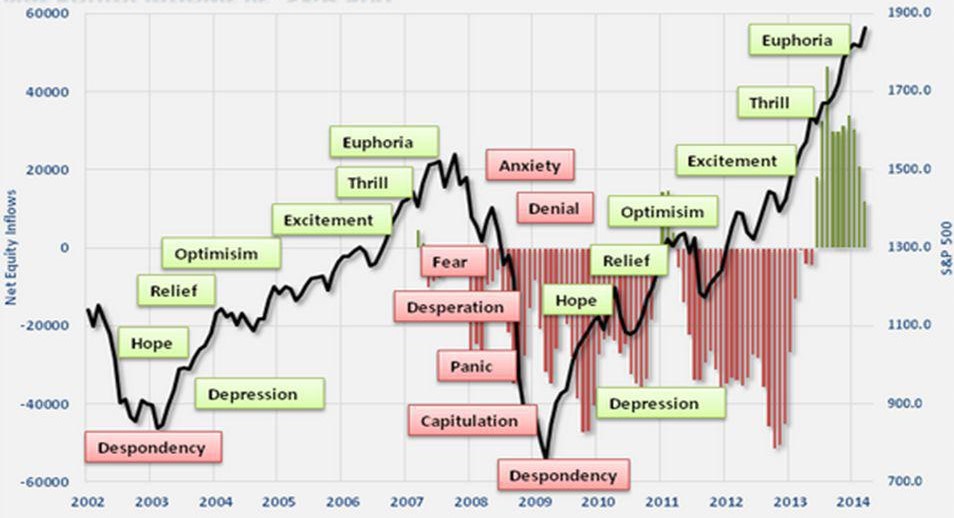

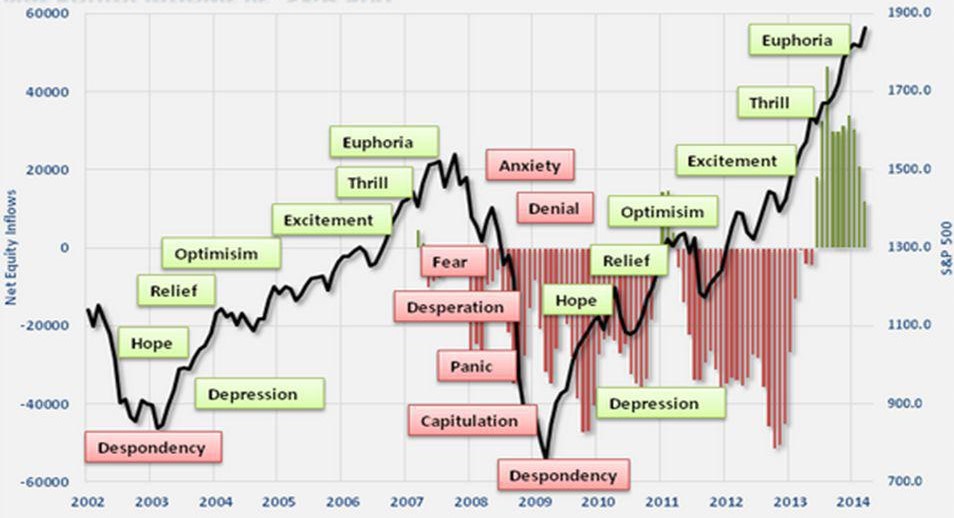

Cycles differ in duration - this is their first characteristic. Cycles can be very short, measured in fractions of a second, and very long, measured in...The simplest examples of cycles are a day, a calendar year. During each of these cycles, different periodic, repetitive events occur. For example, within a day, morning, afternoon, evening and night alternate. Over the course of the year, spring replaces winter, then comes summer, then comes fall, and then begins winter again. Each period of the year has its own peculiarities: it is colder in winter and warmer in summer. Therefore, the demand for ice cream is higher in summer than in winter. The same happens in financial markets: different financial instruments from year to year, from cycle to cycle (if we consider not only the annual cycle as a special case, but in general talk about cycles as such) have their seasonal periods of growth or decline, called the active phase of the cycle - this is the second characteristic of cycles.

I would like to elaborate on this point. Every cycle has an active phase (or period of time) during which the market behaves pretty much the same from cycle to cycle - predominantly rising or predominantly falling. And there is an inactive (or passive) phase of the cycle when the cycle "sleeps" and exerts minimal influence on the market. Depending on a financial instrument, it will be influenced by cycles of different strength. The stronger is the cycle, the more noticeably and for a longer period of time it will influence the quotes of a security, i.e. the longer is its active phase. There are cycles the active phases of which last a very long time - most of the cycle. There are cycles with short active phases.

As I mentioned above, cycles either "go to sleep or "wake up," which is true not only for the active phases. When studying cycles in financial markets, you encounter the phenomenon of an active and inactive cycle. What does it mean? An active or working cycle is a cycle that affects the quotes at the current moment in time. An active cycle will be active for some time - it can be very long, or it can appear just a few times in a row and then "fall asleep". After some time, the cycle may become active again. Simply put, cycles that had an impact, for example, 20-30 years ago may no longer work today, i.e. will not be active. And this is a question of how to determine the current activity of the cycle and how long it will affect the quotes. Thus, when dealing with cycles in financial markets, we face irregular cycles. And this is their third characteristic.

The ability of the market to remember past cycles, i.e. to remember its reaction to them in the past, is called market memory. And it is not a constant value. It changes from market to market, from instrument to instrument. And this is another difficulty in the study of cycles in financial markets.

By properly understanding cycles and how to work with them in conjunction with wave analysis and Fibonacci levels, you can achieve great results in the long run.

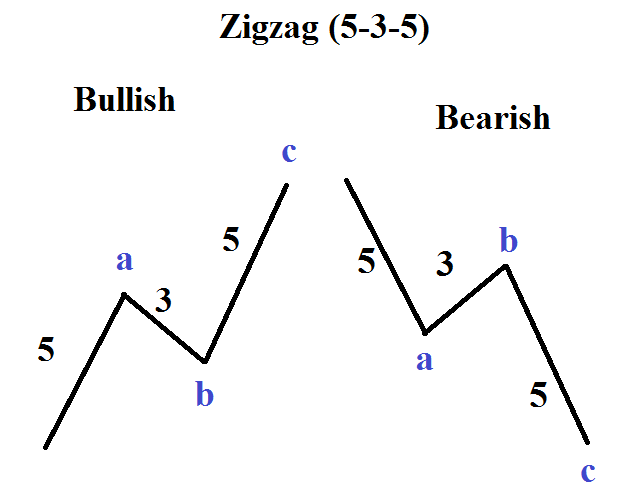

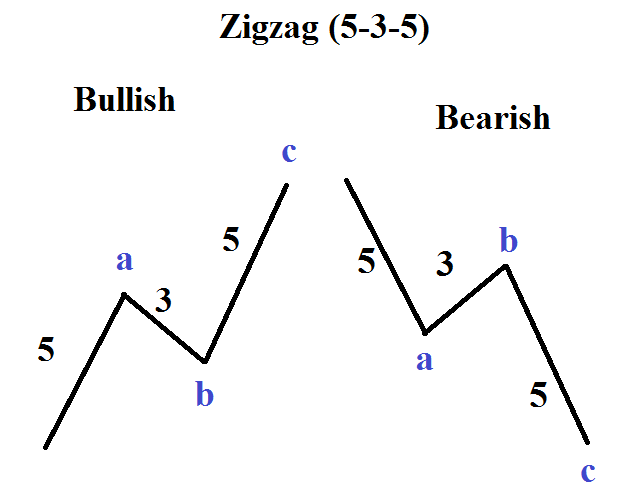

Trading strategy: "Elliott Waves".

Wave analysis is mainly used by professional traders in trading. Beginners prefer an easier strategy, and here's why. Pretty simple and straightforward wave analysis, in practice turns out to be very difficult to apply, because it is quite difficult to discern on a real chart, in real time, at what stage of the cycle the market is in. Learn to trade by this strategy is worthy only if you are serious about trading on the market. Just from myself I want to note that trade on the bare wave analysis is not worth it, it is best to combine this strategy with some indicators. For example: MACD. In my opinion, a good synergistic effect can be felt from the combination of wave analysis with the Fibonacci grid and extension

I have implemented all of these Trade Parameters in the AU Gold Expert Advisor, you do not need to learn how to recognize what phase of the wave we are in or look for cyclicality, this process will be fully responsible AU Gold EA. But I warn you, do not expect to get a mountain of gold dollars right away, the system is designed for the long term