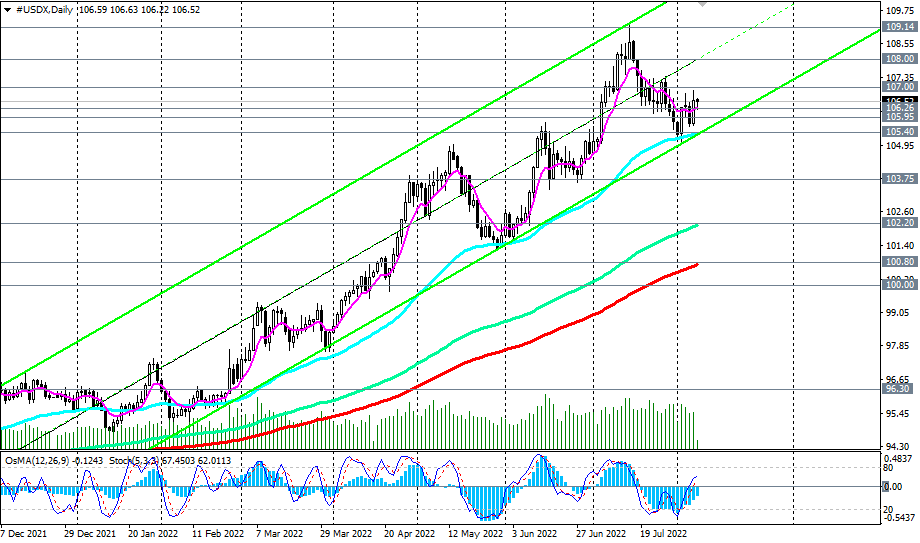

On strong data from the labor market, the DXY dollar index again exceeded 106.00, reaching a local intra-week high of 106.81. Today, futures for the DXY dollar index are trading near 106.38, maintaining a positive trend.

And yet, market participants will carefully analyze the macro data coming from the US in order to better understand the direction of the dollar's further dynamics.

And today there is no important news in the economic calendar. Most likely, major dollar currency pairs will spend today and tomorrow in ranges.

As for the dollar index, as we have already noted in our today's "Fundamental Analysis", early signals to buy DXY futures will correspond to the breakdown of local resistance levels at 106.00, 107.00, 108.00 (for more details, see "Dollar Index #USDX: technical analysis and trading recommendations_08.08.2022”). As you can see, the first resistance level of 106.00 has been taken. Now the breakdown of the levels of 107.00, 107.50, 108.00 will be a confirming signal for building up long dollar positions.

Support levels: 106.26, 106.00, 105.95, 105.40, 105.00, 104.00, 103.75, 103.00, 102.20, 100.80, 100.00

Resistance levels: 107.00, 107.50, 108.00, 109.00

*) See also “Technical analysis and trading recommendations” -> Telegram

**) Get no deposit StartUp bonus up to 1500.00 USD

***) Promotion in InstaForex "Happy deposit": do not miss the opportunity to get your $9000. Promotion Terms HERE!

And also - "Bonus 100%" to each client!