Master Point: Where to use Resistance/Support levels, and where SAR

Master Point: Exit strategies overview.

Today we will figure out which exit strategies work best for certain pairs, and select the most optimal ones for them.

What will help us. The Master Point indicator is one of the technical indicators that has a built-in profit calculator that calculates the profit from recommended entry points to recommended exit points (there are no deceptive techniques to improve the profit values). The indicator will easily make it clear what is more profitable and what is not.

First of all, be sure to check the user guide, if you still haven't done so (you can find it here).

EURUSD, GBPUSD, USDCHF and the other major pairs.

These pairs are highly volititle in nature. Given the sheer volume of news affecting these pairs, things can change in seconds. False reversals, deep pullbacks, new trends appearing at moments when it seems that nothing is really happening. Considering how much money is flowing in these markets, we know for sure that the big players (institutions, banks) like to cheat the small players.

Even a correct forecast can be destroyed by deep pullbacks, unexpected spikes, and so on triggering our stops. When there is usually a signal that the trend is about to change, our trades are already losing a significant part of the profits or even already in the red.

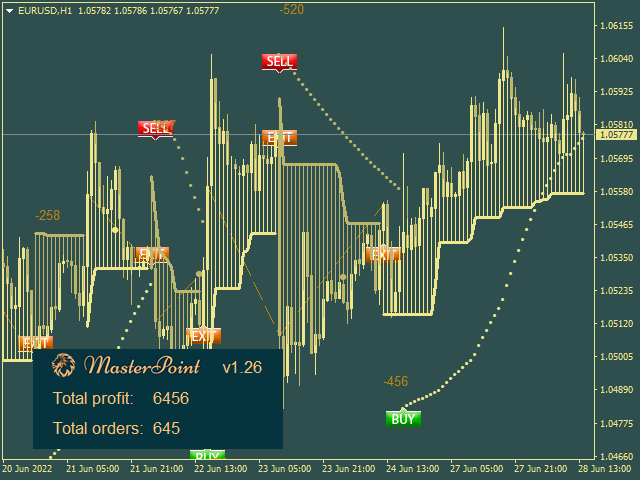

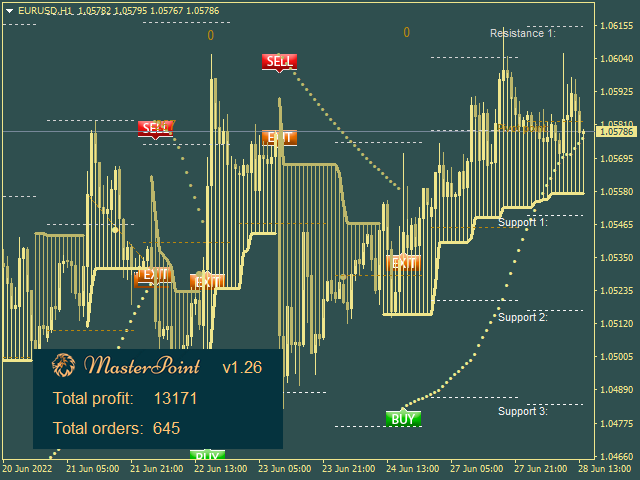

Examples:

We exit when SAR is opposite to our signal.

We exit on resistance/support level 3

As you can see, the profit increased by two times.

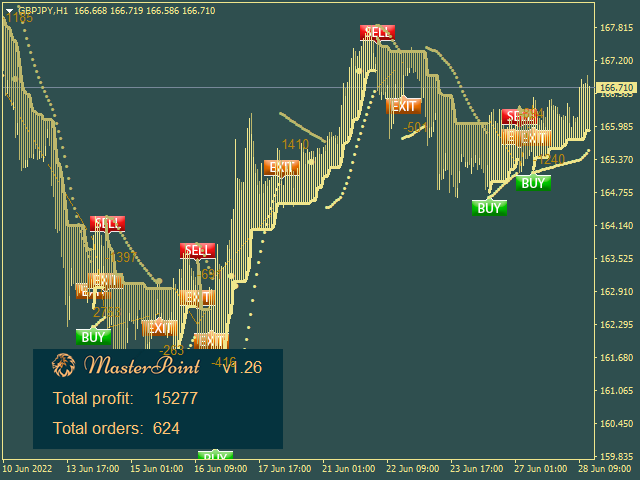

GBPJPY, EURJPY, XAUUSD and the other trendable pairs.

And in comparison with the majors, these pairs can trend without any corrections for long times. So limiting these pairs with fixed profit levels will limit our profits.

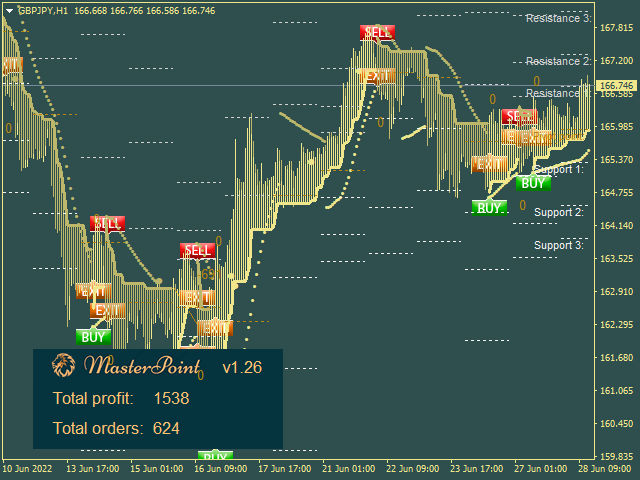

Example with GBPJPY pair where we exit on SAR or opposite signals.

Example with closing trades on the pivot levels.

By limiting our profit, the total profit is 1538 which is nothing.