USD/CHF: Swiss National Bank surprised investors. What's next?

Despite today's renewed dollar strength, the USD/CHF remains under strong negative pressure after yesterday's unexpected decision by the SNB to raise interest rates.

As the head of the SNB, Thomas Jordan, said yesterday, the Swiss franc (for the specifics of trading the franc in the EUR/CHF and USD/CHF pairs, see the articles EUR/CHF: currency pair (characteristics, recommendations) and USD/CHF: currency pair (characteristics, recommendations)) is no longer heavily overvalued, i.e. he accepts the possibility of further strengthening of the franc, which the SNB so consistently fought against recently, keeping the interest rate on deposits at a record low level of -0.75% and intervening in the market trading with the sale of the franc.

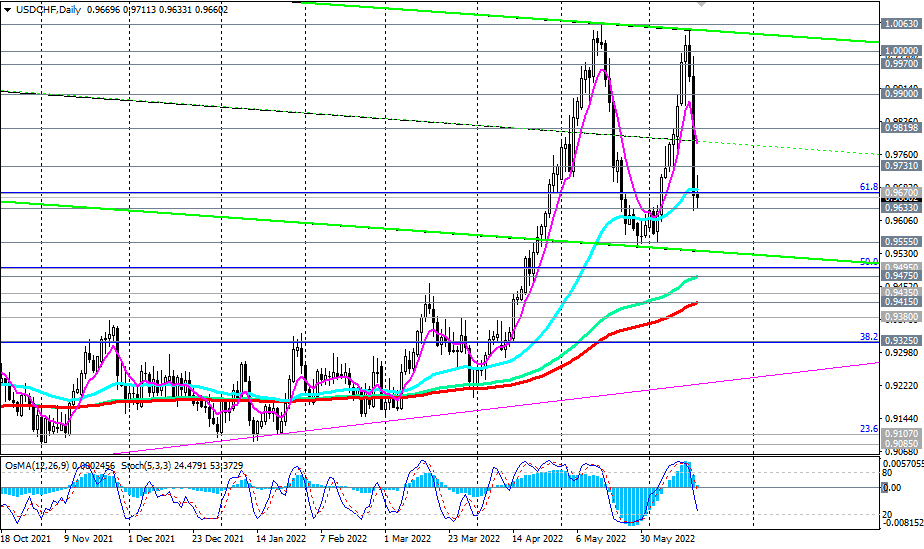

Yesterday, USD/CHF reached a local low of 0.9629, breaking through an important support level of 0.9670 (EMA50 on the daily chart and the Fibonacci 61.8% of the upward correction to the downward wave that began in April 2019 near 1.0235).

A breakdown of this yesterday's local low may become a driver of further decline in USD/CHF towards the local support level of 0.9555, the breakdown of which, in turn, will strengthen the negative dynamics of USD/CHF, sending it to the zone of key support levels of 0.9435 and 0.9415, which separates the long-term bullish trend of the pair from bearish (for more details, see "USD/CHF: technical analysis and trading recommendations for 06/17/2022").

It is likely that market participants will remain under the impression of yesterday's unexpected decision of the SNB for a long time, and the franc will maintain positive dynamics, at least until the end of next week: important macro data for Switzerland will appear only in the week from June 27 to July 3.

Support levels: 0.9630, 0.9555, 0.9500, 0.9495, 0.9475, 0.9435, 0.9415, 0.9380, 0.9325

Resistance levels: 0.9670, 0.9731, 0.9800, 0.9820, 0.9900, 0.9970, 1.0000, 1.0060

*) See also “Technical analysis and trading recommendations” -> Telegram

**) Get no deposit StartUp bonus up to 1500.00 USD

***) Promotion in InstaForex "Happy deposit": do not miss the opportunity to get your $9000. Promotion Terms HERE!

And also - "Bonus 100%" to each client!

Source: InstaForex