Thank you traders for showing great support! The Omega Point indicator has been sold at rate of 4 copies for the last two days! So now only 3 copies has left for the 50% discount!

The yen has been showing huge weakness on all major currency pairs due to the intervention of the Bank of Japan in the bond market. Many pairs with JPY was trending without considerable corrections. Only recently the yen has shown the signs of oversold, hitting the important levels and then reversing from them. But there are still plenty of good scalping opportunities to sell the yen as the bulls need to show a good sign of strength in order to change direction.

The same as with the gold, the Omega Point indicator showed great results on the lower timeframes.

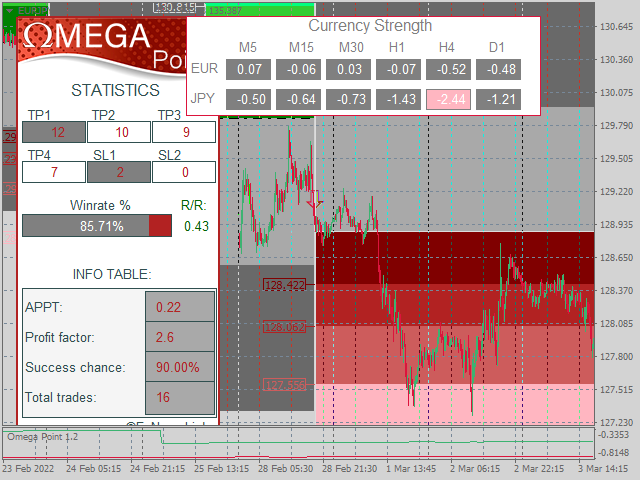

The scalping trading on the lower timeframe showed the 85.71% winrate with 0.43 R/R which gave us APPT 0.22 (Average Percent Per Trade).

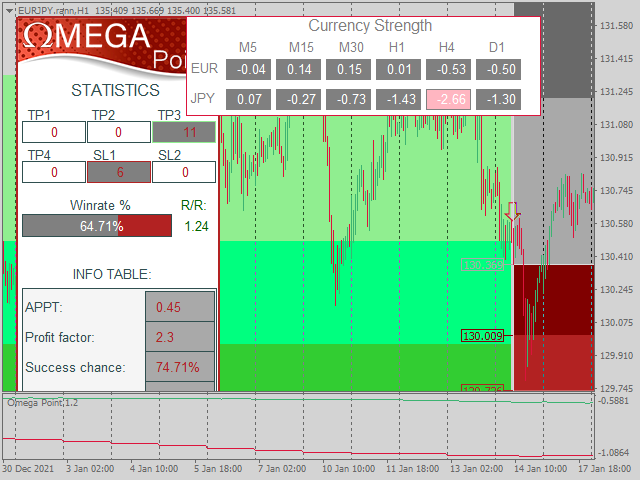

The more conservative approach on the higher timeframe H1 with a wider take-level gave us 64.71% winrate. And considering 1.24 R/R (risk/reward), the strategy gave us 0.45% of the expected profit in percent for each trade.

So it's recommended to wait for a good buy deal on the lower timeframes (like M5 with take-level 3 and stop-level 2.

UPD: 29.03 15.08

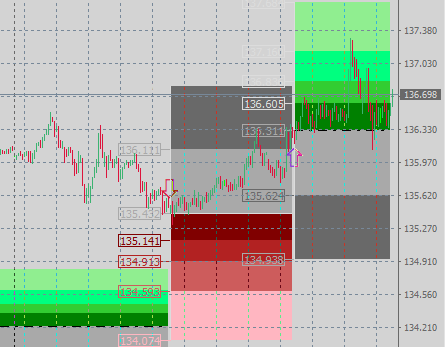

So the indicator showed a perfect scalping signal on the M5 timeframe with take-level 3 (round number 137.00) and stop-level 1. Take-level 1 was taken.