Minutes from the January meeting of the Fed ("FOMC minutes") will be published at 19:00 (GMT). Of the important macro data, which will also be published today, it is worth noting the publication at 13:30 (GMT) of information on retail sales in the US and consumer price indices in Canada, which reflect the dynamics of retail prices of the corresponding basket of goods and services. The inflation target for the Bank of Canada is in the range of 1%-3%. The rising CPI is a harbinger of a rate hike and positive for the CAD. The core consumer price index rose in December 2021 by +4.0% (annualized). Data better than previous values will strengthen the Canadian dollar. Forecast for January: +4.6% (annualized) for core CPI and +4.8% (annualized) for CPI. As we can see from the statistics, inflation in Canada is also accelerating, but not as much as, for example, in the United States.

If the expected data turns out to be worse than the previous values, then this will negatively affect the CAD, and the USD/CAD pair will grow in this case.

Market participants are also evaluating data from the American Petroleum Institute (API), released on Tuesday. According to these data, oil reserves in the US in the reporting week decreased by -1.076 million barrels. This is a positive factor for oil prices and CAD, and we see that in the first half of today's trading day, oil prices and CAD quotes are growing, including against the backdrop of a weakening USD.

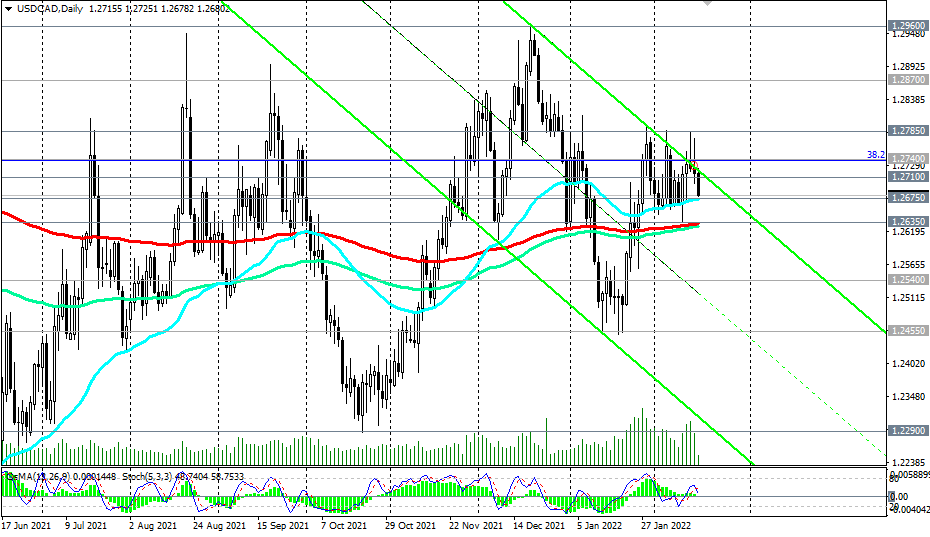

In the meantime, in general, the positive dynamics of USD/CAD remains. The pair remains in the bull market zone, trading above key support levels 1.2540, 1.2635.

Support levels: 1.2675, 1.2635, 1.2600, 1.2540, 1.2455, 1.2290, 1.2165, 1.2010

Resistance levels: 1.2710, 1.2740, 1.2785, 1.2870, 1.2900, 1.2960, 1.3100

see also -> Technical analysis and trading recommendations

*) the most up-to-date "hot" analytics and trading recommendations (including entries into trades "by-the-market") - https://t.me/fxrealtrading