Today there are no particularly important publications in the economic calendar. However, market participants will pay attention to speeches (at 17:00 GMT) by Cleveland Federal Reserve Bank President (and voting member of the FOMC) Loretta Meister and Bank of Canada Governor Macklem. From him, market participants are waiting for clarification of the situation around the plans of the Bank of Canada regarding the prospects for its monetary policy. The Canadian economy, as well as the entire global economy, slowed down in 2020 due to the coronavirus pandemic. It will now be interesting to hear Macklem's opinion on the stability of the labor market, the economy and the monetary policy of the central bank. Unemployment in the country rose to 6.5% in January from 6.0% in December, while employment declined sharply (the number of jobs in January decreased by 200,100 compared to the previous month after growth of nearly 55,000 in December). These are negative factors for CAD.

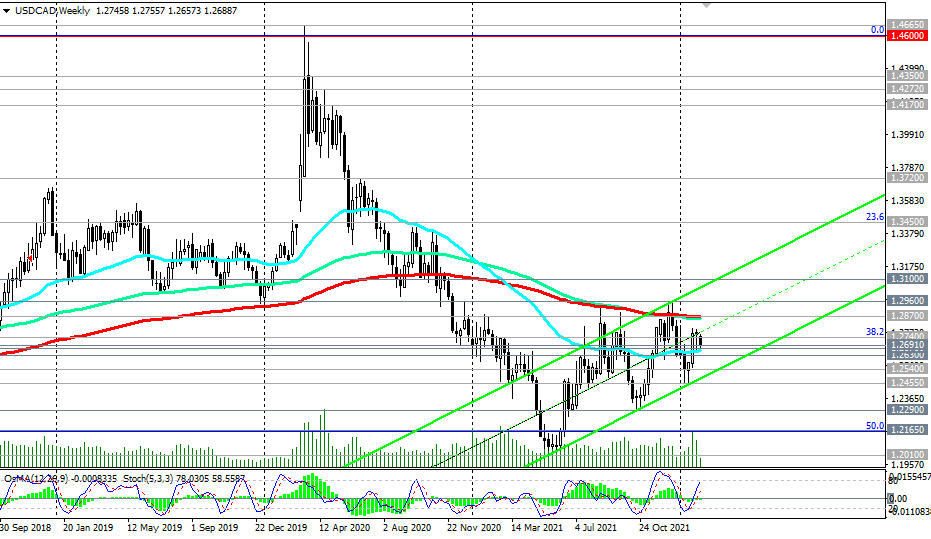

If Tiff Macklem touches upon the subject of the monetary policy of the Bank of Canada, then the volatility in the quotes of the Canadian dollar will increase sharply. The tough tone of his speech will help strengthen the Canadian dollar. Tiff Macklem's soft-spoken rhetoric will negatively impact CAD quotes, including USD/CAD, which is traded near 1.2693 at the time of writing this article, just above the important short-term support area of 1.2691, 1.2670. A breakdown of these levels may provoke a decline in USD/CAD to the key support level of 1.2630.

CAD may also receive support today from the publication (at 15:30 GMT) of the US Department of Energy's weekly report (oil market analysts predict a decrease in US oil inventories).

In the meantime, in general, the positive dynamics of USD/CAD remains with the prospect of growth towards the upper border of the ascending channel on the weekly chart, passing through the mark of 1.3100, with intermediate targets at the resistance levels 1.2740 (Fibonacci 38.2% of the downward correction in the USD/CAD growth wave from 0.9700 to 1.4600), 1.2870, 1.2960 (12-month highs and 2021 highs).

see also - > Trading Recommendations

Support levels: 1.2691, 1.2670, 1.2630, 1.2600, 1.2540, 1.2455, 1.2290, 1.2165, 1.2010

Resistance levels: 1.2720, 1.2740, 1.2870, 1.2900, 1.2960, 1.3100

**) the most up-to-date "hot" analytics and trading recommendations (including entries into trades "by-the-market") - https://t.me/fxrealtrading