Ichimoku Assistant, multi timeframe panel and alert

Product Page MT5: click here

Product Page MT4: click here

You can download the demo versions from bottom of the page.

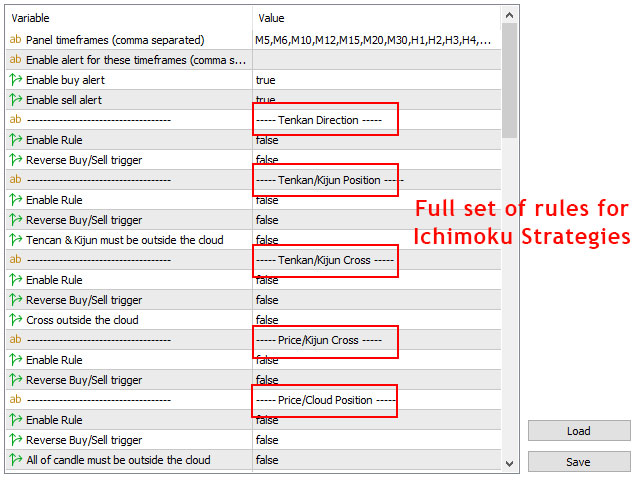

INPUT PARAMETERS:

- Timefrme List: Input comma separated list of timeframes for loading in the panel, like: M1,M15,H4,D1.

- Enable alert for these timeframes: For which timeframes alert must be active when you load the panel on the chart, like: M5,M15,H4. Also you can enable and disable alerts by clicking on timeframe cells on the panel.

- Enable buy alert: You can disable and enable buy and sell alerts separately.

- Enable sell alert: You can disable and enable buy and sell alerts separately.

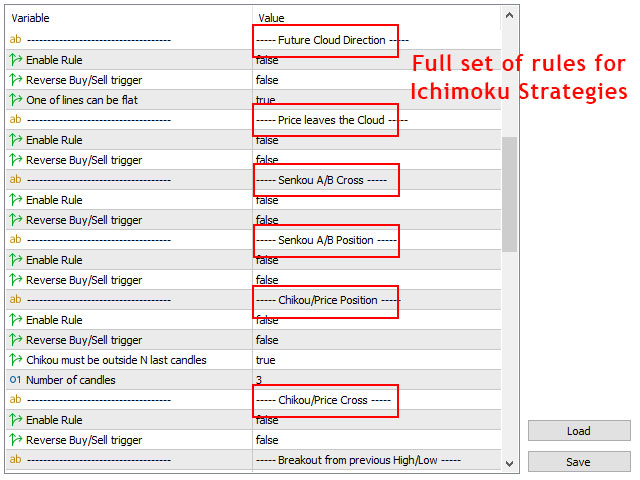

Rules:

Tenkan Direction:

- Enable rule: If the tenkan line goes up it is trigger for buy and if the tenkan line goes down it is trigger for sell.

- Reverse rule: If set to true, the above parameter is reversed (if the tenkan line goes up it is trigger for sell and if the tenkan line goes down it is trigger for buy).

Tenkan/Kijun Position:

- Enable rule: Enable tenkan above the kijun rule for buy and tenkan below the kijun rule for sell.

- Reverse rule: If set to true, the above parameter is reversed (tenkan above the kijun is trigger for sell and tenkan below the kijun is trigger for buy).

- Tencan & Kijun must be outside the cloud: If set to true, tenkan and kijun lines must be outside the cloud.

Tenkan/Kijun Cross:

- Enable rule: If the tenkan line crosses above the kijun line it is trigger for buy and if tenkan line crosses below the kijun line it is trigger for sell.

- Reverse rule: Reverse the above parameter (if the tenkan line crosses above the kijun line it is trigger for sell and if tenkan line crosses below the kijun line it is trigger for buy).

- Cross outside the cloud: Line crosses must be outside the cloud.

Price/Kijun Cross:

- Enable rule: If price line crosses above the kijun line it is trigger for buy and if price line crosses below the kijun line it is trigger for sell.

- Reverse rule: Reverse the above parameter (if the price line crosses above the kijun line it is trigger for sell and if price line crosses below the kijun line it is trigger for buy).

Price/Cloud Position:

- Enable rule: Enable price above the cloud rule for buy and price below the cloud rule for sell.

- Reverse rule: If set to true, the above parameter is reversed (price above the cloud is trigger for sell and price below the cloud is trigger for buy).

- All of candle must be outside the cloud: Instead of last price, all of the last candle should be outside the cloud to rule become true.

Future Cloud Direction:

- Enable rule: If both senkou lines are going upward it is trigger for buy and If both senkou lines are going downward it is trigger for sell.

- Reverse rule: If set to true, the above parameter is reversed (if both senkou lines going downward it is trigger for buy and if both senkou lines are going upward it is trigger for sell).

- One of lines can be flat: If set to true, one of the senkou lines can be flat.

Price leaves the Cloud:

- Enable rule: If the open of candle is inside the cloud and close of the candle is above the cloud it is trigger for buy and if the open of the candle is inside the cloud and close of the candle is below the cloud it is trigger for sell.

- Reverse rule: Reverse the above parameter (if the open of candle is inside the cloud and close of the candle is above the cloud it is trigger for sell and If the open of the candle is inside the cloud and close of the candle is below the cloud it is trigger for buy).

Senkou A/B Cross:

- Enable rule: If Senkou A line crosses above the Senkou B line it is trigger for buy and If Senkou A line crosses below the Senkou B line it is trigger for sell.

- Reverse rule: Reverse the above parameter (if Senkou A line crosses above the Senkou B line it is trigger for sell and if Senkou A line crosses below the Senkou B line it is trigger for buy).

Senkou A/B Position:

- Enable rule: If Senkou A line is above the Senkou B line it is trigger for buy and if Senkou A line is below the Senkou B line it is trigger for sell.

- Reverse rule: Reverse the above parameter (if Senkou A line is above the Senkou B line it is trigger for sell and If Senkou A line is below the Senkou B line it is trigger for buy).

Chikou/Price Position:

- Enable rule: Enable chikou above the price rule for buy and chikou below the price rule for sell.

- Reverse rule: If set to true, the above parameter is reversed (chikou above the price is trigger for sell and chikou below the price is trigger for buy).

- Chikou must be outside N last candles: If set to true, chikou price must be above/below the last candles (check following parameter).

- Number of candles: Number of candles for above parameter. For example if you set this parameter=3, then for buy rule chikou price must be above highest high of last 3 candles and for sell rule chikou price must be below lowest low of last 3 candles.

Chikou/Price Cross:

- Enable rule: If the chikou line crosses above the price line it is trigger for buy and If chikou line crosses below the price line it is trigger for sell.

- Reverse rule: Reverse the above parameter (if the chikou line crosses above the price line it is trigger for sell and If chikou line crosses below the price line it is trigger for buy).

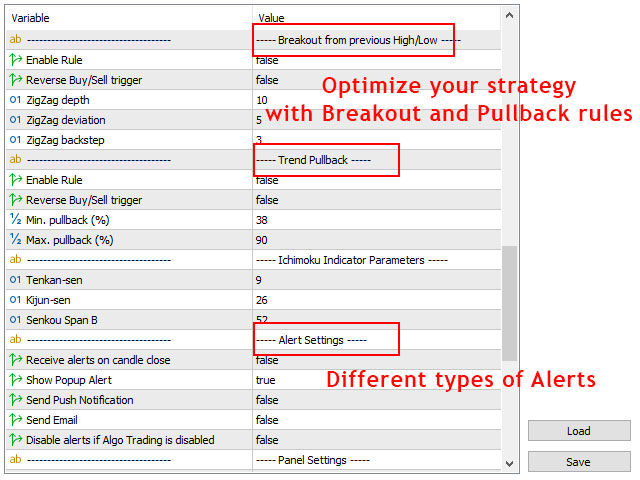

Breakout from previous High/Low:

This parameter uses zigzag indicator to find high and low points of the price moves in the chart.

- Enable rule: If price moves up and breaks the last high it is trigger for buy and if price moves down and breaks the last low it is trigger for sell.

- Reverse rule: Reverse the above parameter (if price moves up and breaks the last high it is trigger for sell and if price moves down and breaks the last low it is trigger for buy).

- ZigZag depth: Value of the "depth" parameter for the zigzag indicator.

- ZigZag deviation: Value of the "deviation" parameter for the zigzag indicator.

- ZigZag backstep: Value of the "backstep" parameter for the zigzag indicator.

Trend Pullback:

Like the previous rule, this one also uses zigzag indicator to find high and low of the price moves in the chart (and uses zigzag parameters from previous rule).

- Enable rule: If price pulls back (moves down) in a bull trend, it is trigger for buy and if price pulls back (moves up) in a bearish trend it is trigger for sell.

- Reverse rule: Reverse the above parameter (if price pulls back in a bull trend, it is trigger for buy and if price pulls back in a bearish trend it is trigger for sell).

- Min. pullback (%): Min percent of pullback, you can use fibonacci values like 23.6,38.2 etc.

- Max. pullback (%): Percent of pullback, you can use fibonacci values like 50, 61.8, 78.6 etc.

- Tenkan-sen: Value of the "Tenkan-sen" parameter for the ichimoku indicator.

- Kijun-sen: Value of the "Kijun-sen"parameter for the ichimoku indicator.

- Senkou Span B: Value of the "Senkou Span B" parameter for the ichimoku indicator.

- Receive alerts on candle close: If set to true you receive alert for a timeframe when it's candle closes. If set to false you can receive alert in each price tick. (In both cases panel cells will update on every price tick).

- Show Alert: Show popup alert for buy and sell signals.

- Send Push Notification: Send push notification to mobile phone for buy and sell signals (you should set metatrader Notifications options).

- Send Email: Send email for buy and sell signals (you should set metatrader email options).

- Disable alerts if AlgoTrading is disabled: Don't send alert if metatraders "AlgoTrading" button is disabled. This is useful when you have many charts open with this indicator on them and you want to disable alert for all of them.

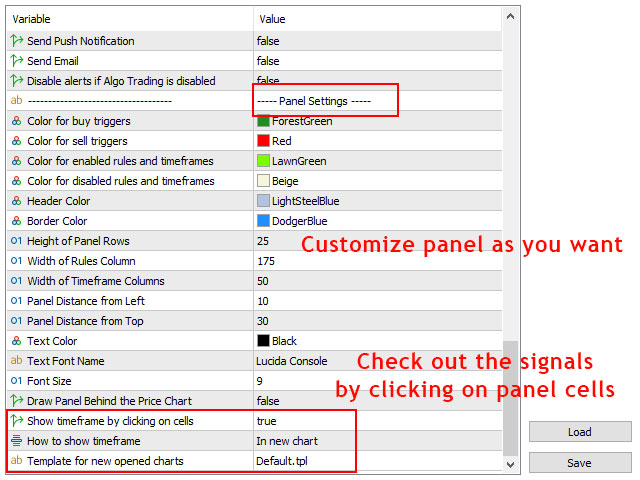

Panel Settings:

- Color for buy cells: Colors for cells that indicate buy rules.

- Color for Sell cells: Colors for cells that indicate sell rules.

- Color for Enabled rule: Color for enabled rules on the panel.

- Color for Disabled rule: Color for disabled rules on the panel.

- Header Color: Color of header of the panel.

- Border Color: Color of borders of the panel and its cells.

- Height of Panel Rows: Height of the panel rows.

- Width of rule column: Width of first column of the panel that shows the rules.

- Width of Timeframe Columns: Width of other columns of the panel.

- Panel Distance from Left: Panel distance from left of the chart.

- Panel Distance from Top: Panel distance from top of the chart.

- Text Color: Color of panel texts.

- Text Font Name: Font name of panel text.

- Font Size: Font size of panel text.

- Draw Panel Behind the Price Chart: If set to true, you can see the price chart in front of the panel.

- Show timeframe by clicking on table cells: If set to true, chart timeframe changes when you click on panel cells (based on the timeframe column), also check the following parameter.

- How to show timeframe: Show the timeframe in current window or in a new chart.

- Template for new opened charts: You can set a template for the new chart that opens from the previous parameter.

How to use Ichimoku Assistant:

For example, you have the following rules in your trading strategy that you want to receive alert when rules are confirmed in H4 to D1 timeframes.

For buy:

- Chikou Span line is above price line

- Price is above ichimoku cloud

- Tenkan line crosses above Kijun line

For Sell:

- Chikou Span line is below price line

- Price is below ichimoku cloud

- Tenkan line crosses below Kijun line

Now you just need to:

- Insert H4,H6,H8,H12,D1 timeframes in the timeframe parameter.

- Enable related rules in the indicator parameters.

When all 3 rules occur simultaneously for a selected timeframe, you will receive alert.

You can reverse any of the rules in the parameters, for example if you want tenkan crossing below kijun to trigger buy alert (and tenkan crossing above kijun for sell) simply reverse the rule in the settings.

How to use the Ichimoku Assistant Bridge in expert advisors:

This bridge is a fast and lightweight version of Ichimoku Assistant indicator (a separate file from the main indicator) that you can use in the code of your expert advisors and indicators to check different rules of ichimoku indicator for all metatrader timeframes.

Graphical objects are removed from the bridge but all necessary options are preserved so you can control the parameters like in the main indicator.

There are 13 buffers in the bridge that you can load them with iCustom function in your EA or indicator code. Each buffer is related to one of the rules in the main indicator and shows that rule is correct for which of the metatrader timeframes.

So in your EA you will have 13 buffers and each buffer has 9 value for 9 timeframe of MT4 (21 values for the 21 timeframe of MT5), the first value for M1 and the last value for the MN1 timeframe. For example, you can name buffers as:

- Tenkan_Direction[] // For Tenkan Direction rule

- Tenkan_Kijun_Position[] // For Tenkan/Kijun Position rule

- Tenkan_Kijun_Cross[] // For Tenkan/Kijun Cross rule

- Price_Kijun_Cross[] // For Price/Kijun Cross rule

- Price_Cloud_Position[] // For Price/Cloud Position rule

- Cloud_Direction[] // For Cloud Direction rule

- Price_Leaves_Cloud[] // For Price leaves Cloud rule

- Senkou_A_B_Cross[] // For Senkou A/B Cross rule

- Senkou_A_B_Position[] // For Senkou A/B Position rule

- Chikou_Price_Position[] // For Chikou/Price Position rule

- Chikou_Price_Cross[] // For Chikou/Price Cross rule

- Break_High_Low[] // For Breakout from H/L rule

- Trend_Pullback[] // For Trend Pullback rule

Each of the above buffers will have 9 (for MT4) or 21 (for MT5) values.

For MT4 the range of arrays will be from 0 to 8, 0 for M1 timeframe and 8 for MN1 timeframe. For example:

- Tenkan_Direction[0] shows the direction of the tenkan line for the M1 timeframe.

- Price_Leaves_Cloud[5] shows the price position relative to ichimoku cloud for H4 timeframe

- Break_High_Low[8] shows if the price breaks the previous high/low in the MN1 timeframe.

For MT5 the range of arrays will be from 0 to 20, 0 for the M1 timeframe and 20 for MN1 timeframe. For example:

- Cloud_Direction[0] shows the ichimoku cloud direction for the M1 timeframe

- Tenkan_Kijun_Cross[4] shows if the tenkan line crosses the kijun line (and the cross direction) in the M5 timeframe

- Trend_Pullback[14] shows if we have a pullback in the H4 timeframe

To see how to implement the bridge in your code, please refer to the sample EA you received with the bridge.

A few notes:

- After you set the parameters for a symbol, you can save the settings and use them for other symbols.

- Do not enable "Breakout from previous High/Low" and "Trend Pullback" rules together, these rules do not occur at the same time.

- In addition to the above parameters, you can also enable/disable rules and timeframes by clicking on their cells on the panel, and you can reset them to the above parameters by changing the chart timeframe.

DOWNLOAD DEMO:

Demo version works on GBPUSD and EURJPY symbols.