Introduction

Instead of precedent

Description of signals

- The technical part of the consultant is fully built on the engine Trading engine 4.010, written by Mr. Karputov, who kindly provides access to his work.

- At the core of the trading signals and strategies lies the author's algorithm for the formation of figures (patterns) for forecasting prices. Let's use any instrument! The complementary management system is based on the MA 'Ninety-Fox' ®, the actualization and adjustment of the signal as accurately as possible under the market, the instrument and the period of operation.

- The advisor's signals did NOT pass optimizations, adjustments and improvements, but could be optimized.

- The advisor's signals are NOT used in the proposed variant of smoothing and alignment, but may be improved.

- Signal advisors DO NOT rely on oscillators and flats / trending follow-up calculations, so they react quickly to any changes in quotations.

- For the convenience of users in the advisor introduced fundamental components on the basis of slippery medium MA 'ninety-six foxes' ®, which allow to make a number of additions, changes and corrections to the changes in the list of entries. Averages are included in the base value (1) and do not affect the embedded characteristics until the moment of their change. What is answered by the average, described in the recommendations on the parameters.

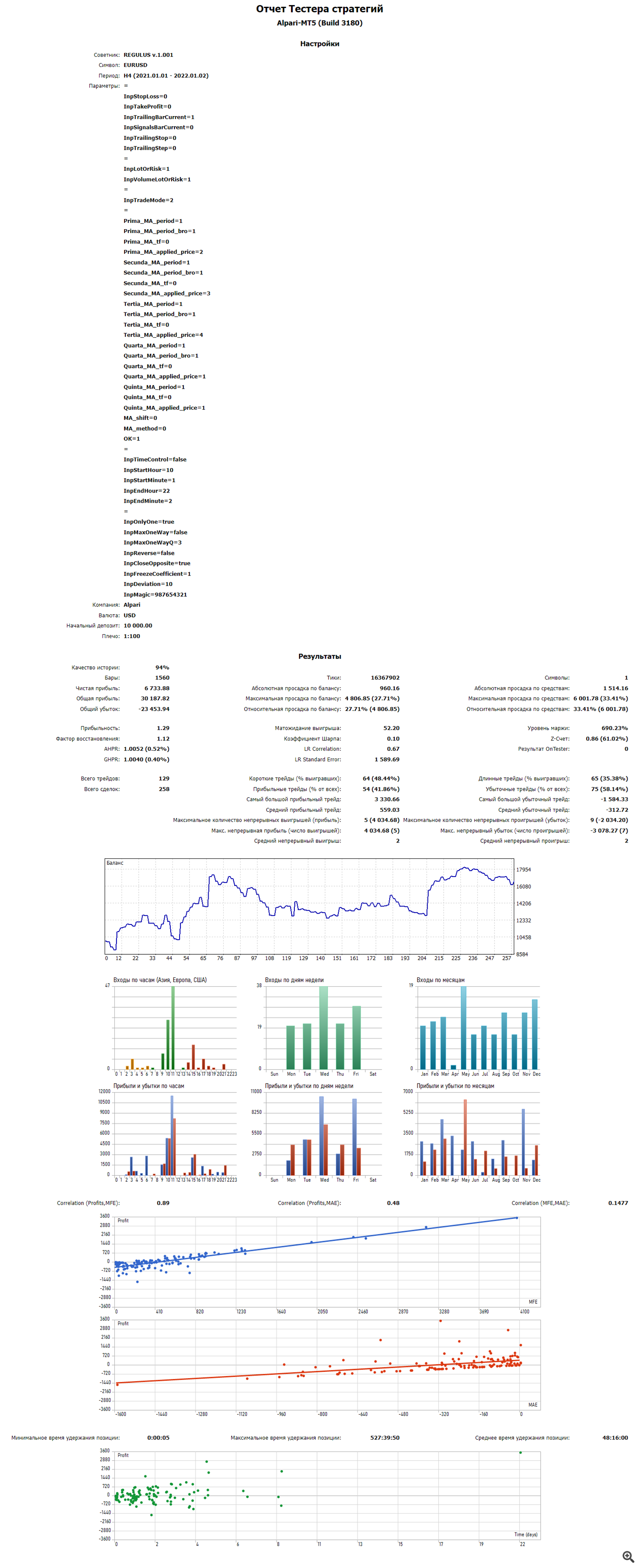

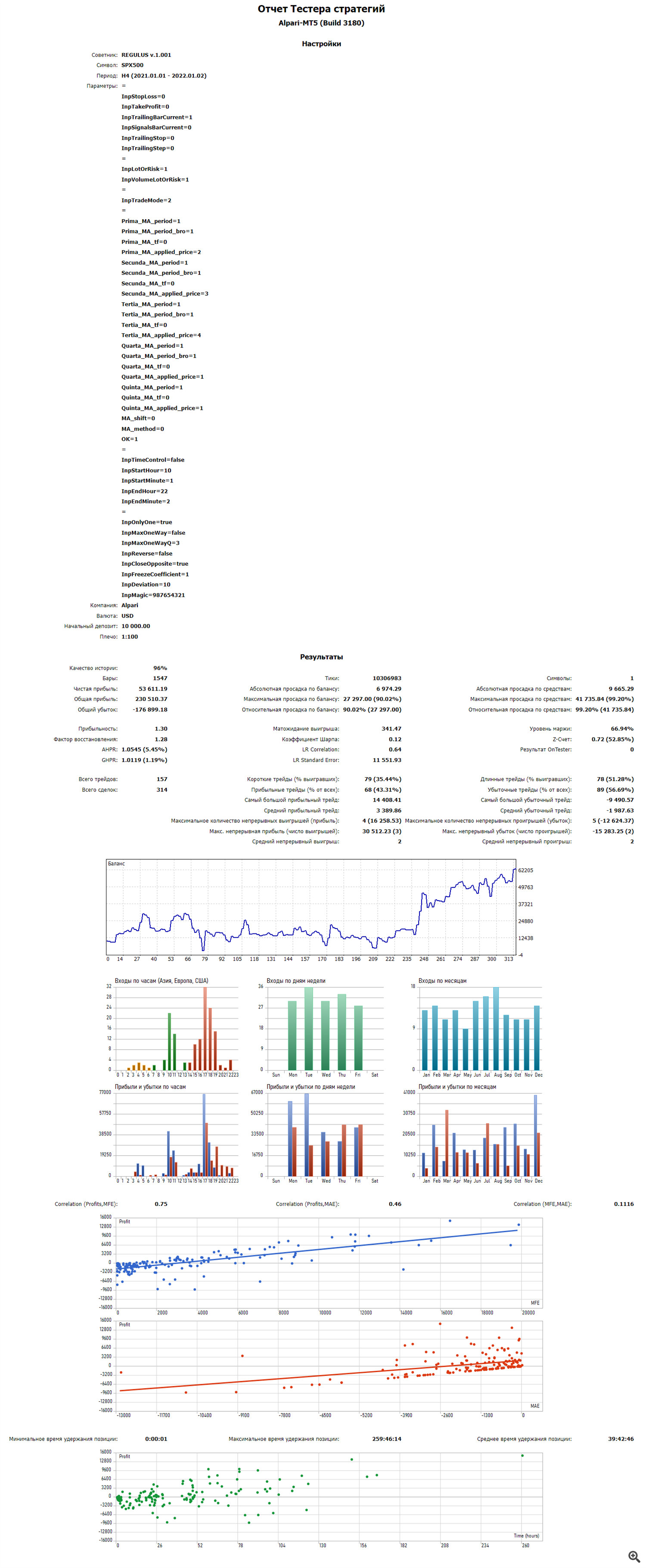

- The consultant was tested in real mode and in the strategy tester mode. This study was conducted on a test account according to all the classical rules, one lot, one instrument, for a period of one year. So, for cross-analysis, a few pairs were taken with the same topics. In this case, the tests were performed on independent instruments: a pair of EURUSD and SPX500 Tests are presented below.

Recommendations by parameters

MA "The Nine-tailed Fox" ®

input group "The nine - tailed fox (management block)"

| Prima_MA_period | 1 | Prima_MA_period Rounds(1), reduces volatility |

| Prima_MA_period_bro | 1 | from Prima_MA => place of initiation <= Prima_MA_period_bro(1) |

| Prima_MA_tf | PERIOD_CURRENT | Prima_MA_tf (PERIOD_H4) |

| Prima_MA_applied_price | PRICE_OPEN | Prima_MA_applied_price (OPEN, not recommended to change) |

| Secunda_MA_period | 1 | Secunda_MA_period Denominator(1), increase inputs. See numerator |

| Secunda_MA_period_bro | 1 | Secunda_MA_period_bro(1) expanding / narrowing the range |

| Secunda_MA_tf | PERIOD_CURRENT | Secunda_MA_tf (PERIOD_H4) |

| Secunda_MA_applied_price | PRICE_HIGH | Secunda_MA_applied_price (HIGH, not recommended to change) |

| Tertia_MA_period | 1 | Tertia_MA_period Numerator(1), decrease inputs. See denominator |

| Tertia_MA_period_bro | 1 | Tertia_MA_period_bro(1) expanding / narrowing the range |

| Tertia_MA_tf | PERIOD_CURRENT | Tertia_MA_tf (PERIOD_H4) |

| Tertia_MA_applied_price | PRICE_LOW | Tertia_MA_applied_price (LOW, not recommended to change) |

| Quarta_MA_period | 1 | Quarta_MA_period Support(1), part of the base 2/3 pow. |

| Quarta_MA_period_bro | 1 | Quarta_MA_period_bro, Slows(1) Reduces speed 1/2 pow. |

| Quarta_MA_tf | PERIOD_CURRENT | Quarta_MA_tf (PERIOD_H4) |

| Quarta_MA_applied_price | PRICE_CLOSE | Quarta_MA_applied_price (CLOSE, not recommended to change) |

| Quinta_MA_period | 1 | Quinta_MA_period Motion(1), point of initiation 1/3 pow. |

| Quinta_MA_tf | PERIOD_CURRENT | Quinta_MA_tf (PERIOD_H4) |

| Quinta_MA_applied_price | PRICE_CLOSE | Quinta_MA_applied_price (CLOSE, do not change) |

| MA_shift | 0 | |

| MA_method | MODE_SMA | |

| OK | 1 | ОК Oleg Konovalov's Orbit Koefficient(0...1...0) softening / hardness |

Each 'tail' ...MA_period_... is a control module that individually and/or jointly makes adjustments and/or changes the core environment, calculated position and activation points of the EA. The module does not directly affect the signal, but smoothes or sharpens, narrows or expands, reduces or increases the strength and / or range of the EA core, and thus corrects the output signal.

The core works in the same way in any combination of tools and changes.

The Orbital Ratio is common sense and in some way 'watches' for market fluctuations and provides easing/hardness.

What not to do!

- No need! buy robots for credit funds. When trading on credit, you have already morally lost, since you need to recoup. (read at your leisure 'Memoirs of a Stock Operator').

- No need! increase the lot in the trade flow. If you want to increase, stop, increase and move further with new data. 'Horses are not changed at the crossing'

- No need! decompile the document. Most quickly, you will not fully recreate the construction logic, and you will definitely feel disappointed in what you have done :)

- No need! think that you can do in a week what others took decades to do. But, there is a chance and there is a holding :) therefore, you must believe!

What to do if already done, what not to do? :)

- NOT in a hurry to earn!

- The market and the algorithm does it for you, delve into the system.

- Train yourself to work a constant lot.

- Do not think in trading, you need to think until the moment you press the button to open a deal or start the adviser.

- If you can earn $1, then you can earn more.

- Everything that was said many years ago is still relevant today. In my opinion, the best source of information on the psychology of trading is the work 'Memoirs of a Stock Operator'

- And of course, we never forget about the main rule of a trader. 'The market always thinks differently than you' You don't have to argue with it, move with it and you will be in the black, you will argue, it will crush you. Well, further warning about the risks of trading, the lack of guarantees that the past may repeat itself, and so on and so forth.

Пример:

| Screenshot of the FTSE100 index test on default settings for the period 01/01/2021-01/02/2022 |

|---|

|

What we see:

- a fast market that is ahead of the algorithm, i.e. transactions are poured in too active order, not allowing you to withdraw profit from them. It is necessary to 'slow down the market' or in other words, it is necessary to extend the holding period of the trade to an acceptable level for taking profit.

What we are doing:

- Basic parameter: Quarta_MA_period_bro =1; Increase to 30 (this was offhand, but the result came by itself)

| Quarta_MA_period_bro, Slows(1) Reduces speed 1/2 pow. | =30; | // Slows(1), reduces 'speed' |

Let's look at the result:

| Screenshot of the FTSE100 index test on default settings for the period 01/01/2021-01/02/2022 (with changes Quarta_MA_period_bro = 30 ;) | |

|---|---|

|

What can be useful NOT buying?

A set of high-quality and 'deeply' worked out settings, based on MA 'Nine-tailed Fox'® for a specific instrument, time interval and period, has a cost comparable to the cost of up to a third of the cost of an adviser, depending on the quality.

A properly configured system for a specific tool means painstaking and lengthy analytical work and hundreds of hundreds of test runs and optimizations. Here it is important to understand that each set can be either conservative or critically aggressive or have bright periods of repetitions (the so-called 'set of the sequence of events). Here you can learn how to read the test correctly.

The system allows you to configure the robot for quick / lightning-fast earnings, meticulously tailored to a specific set with an uncontrolled or controlled increase in transactions and a dynamic lot, you can drive the balance chart 'to the sky', but on the condition that the risks are in the 'hell' area :). (I strongly DO NOT recommend, very high risks). For some, this is a painstaking enumeration of parameters, and for someone, holding and a chance.

In general, there are many options, from direct purchase and earnings, to the sale of a ready-made set of settings for the system and the market.

Conclusion

Welcome to the magic of numbers.

Скрины тестовых листов.

| ReportTester REGULUS v.1.001_01012017_02012022 _EURUSD_H4_1L | ReportTester REGULUS v.1.001_01012017_02012022 _SPX500_H4_1L |

|---|---|

|  |