After yesterday's decision and statements by the Fed leaders, the DXY dollar index dropped to a new local almost 3-year low of 90.05 and continued to decline today, reaching 89.80 mark.

At the same time, the main competitors of the dollar in the foreign exchange market have reached new multi-month highs against it today. Thus, the USD / JPY pair declined during today's Asian session, reaching 103.05 at the beginning of the European session, which corresponds to the levels of March 2020.

The dollar also continues to decline under pressure from the prospects for fiscal stimulus to the US economy and optimism about the future development of the economic situation in the country.

As for the prospects for the yen, investors are waiting for the outcome of the meeting of the Bank of Japan, which will be held on Friday. Its decision on the interest rate will be published at 03:00 (GMT), and at 06:00 a press conference will begin, during which the head of the Bank of Japan Kuroda will comment on the bank's monetary policy and its decision.

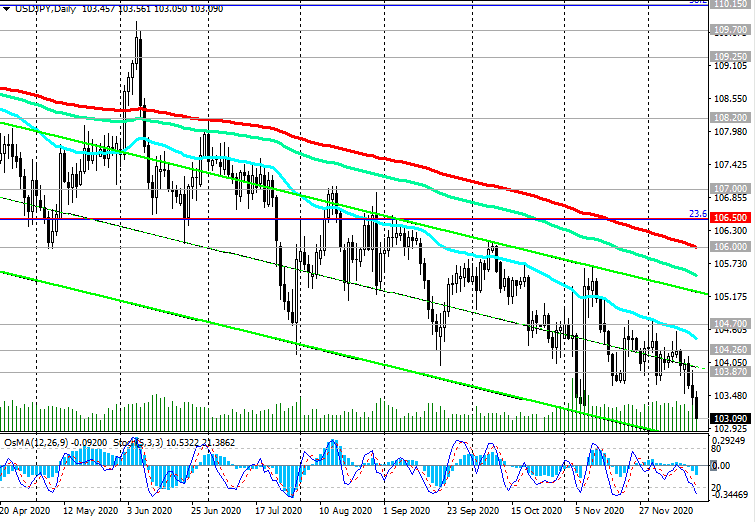

Since April 2020, there has been a steady downtrend in the USD / JPY pair, which continues to decline within the descending channels on the daily and weekly charts, the lower border of which passes near the 100.00 and 100.60 marks, which, in turn, corresponds to the lows of the wave of the pair's decline that began in June 2015 (0% Fibonacci level).

In case of further weakening of the dollar, these marks will become medium-term benchmarks for the USD / JPY pair.

At least below the resistance levels 103.87, 104.26 (see "Technical Analysis and Trading Recommendations"), short positions are preferred.

*) for trading, I choose THIS BROKER and use VPS (to receive a bonus, enter the promo code - zomro_17601)