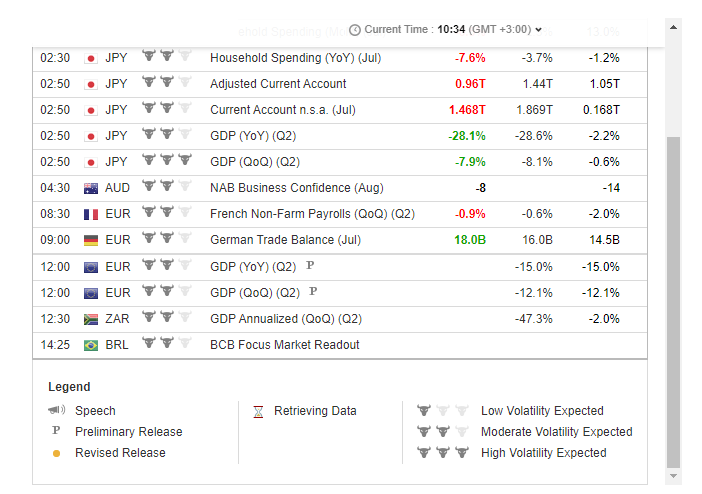

Morning Market Review for 08/09/2020 EURUSD, GBPUSD, AUDUSD, USDJPY, XAUUSD

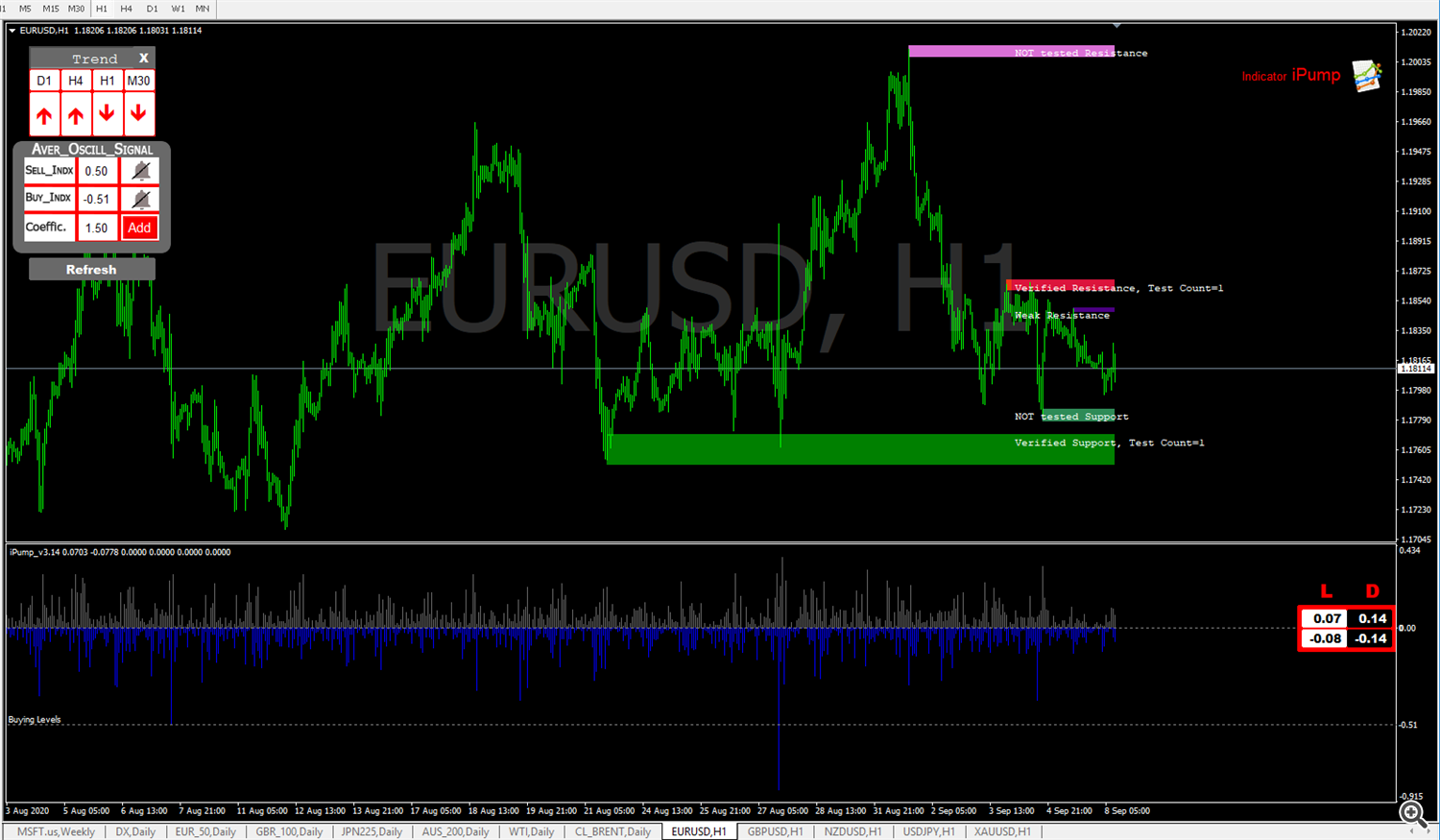

EUR / USD

The European currency has been declining against the US dollar during today's Asian session, developing uncertain bearish momentum from last week and testing the 1.1800 mark for a downside break. The decline in the instrument is facilitated by technical factors, which have increased slightly after the publication of the report on the US labor market at the end of last week. Recall that the data indicated a slowdown in the growth of new jobs, but pleased with the noticeable reduction in the unemployment rate. Statistics from Europe put additional pressure on the instrument's positions on Monday. Thus, the German data on the dynamics of industrial production in July reflected a decrease in the indicator from 9.3% m / m to 1.2% m / m, which turned out to be significantly worse than market expectations at 4.8% m / m. On an annualized basis, production declined 10% YoY after falling 11.4% YoY in June. The focus of investors' attention today is the updated statistics on the dynamics of GDP in the euro zone for the 2nd quarter of 2020.

GBP / USD

AUD / USD

The Aussie is trading near zero against the US currency during this morning session, consolidating after last week's corrective pullback. The instrument is moderately supported by strong statistics from China, which managed to support the markets with confident export growth on Monday. At the same time, the volume of imports in China decreased, which is associated with the rise in oil prices and a fall in the volume of its purchases for backup storage facilities. Data from Australia is often mixed. Released on Monday, the index of activity in the service sector from AiG indicated a decrease in the indicator in August from 44 to 42.5 points. Tuesday's data reflected a drop in the NBA business environment index from 0 to -6 points. The NBA business confidence index, on the contrary, grew from –14 to –8 points with a sharply negative forecast of a decline to –22 points.

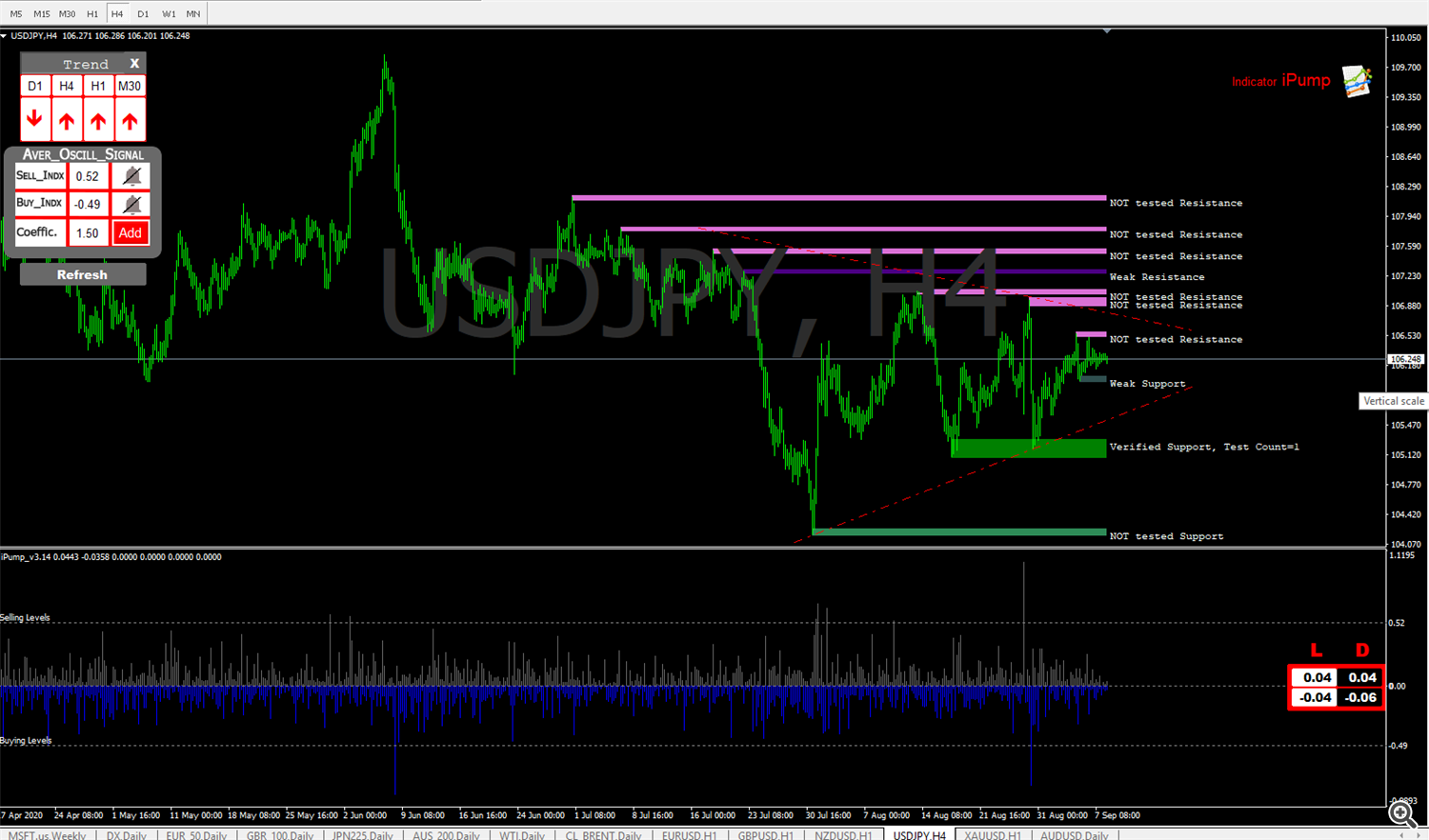

USD / JPY

The US dollar is flat against the Japanese yen during today's Asian session, holding close to local highs since August 28. The weakness of the US currency is compensated by the publication of uncertain data from Japan. Today, the focus of Japanese investors is on the updated statistics on the dynamics of Japan's GDP for the 2nd quarter of 2020. According to new estimates, the Japanese economy contracted by 7.9% QoQ and 28.1% YoY, which was worse than the previous indicators (-7.8% QoQ and -27.8% YoY). Household expenditures also came out significantly worse than market expectations. In July, it fell by 7.6% y / y after falling by 1.2% y / y in June. Experts had expected a reduction of only 3.7% y / y.

XAU / USD

Gold prices are slightly declining during today's Asian trading session, located near the local lows, updated at the end of last week amid the publication of the controversial report on the US labor market. The instrument is still under pressure from the attempts of the American currency to strengthen, however, the existing risks in the market, as well as the constantly growing uncertainty, keep gold at the current price levels. Bidders heard the Fed's position and are now focused on the ECB's interest rate meeting on Thursday. As before, analysts do not expect a sharp change in the vector of monetary policy, however, they note that the press conference of the regulator and the subsequent speech of the head of the ECB Christine Lagarde can significantly affect the balance of power in the market.

And at this the review came to an end. I wish you profitable trades, remember that your success should not depend on any one trade, you need to try to be in the black at the distance, and for this it is enough to earn only 3 out of 10 trades, how? - your reward to risk ratio should be more than one to three. Therefore, always remember about the 📈

risk (use forex calculator), consider it correctly and then your trading will be successful! Wish you a successful trading day your SeniorTrader.

In order not to miss the following market overview, as well as to be aware of the news of the project SeniorTrder Subscribe to our telegram channel 👉Telegram Channnel https://t.me/SeniorTrader_Channel

Tools that I use in trading

The iPump indicator was used for this analysis

https://www.mql5.com/en/market/product/39895

Indicator defining the trend, levels, overbought / oversold

EA Pump and Dump Pro

https://www.mql5.com/en/market/product/51395

https://www.mql5.com/en/market/product/51395

Multifunctional robot (averaging/piramiding/strategy for overclocking a deposit)

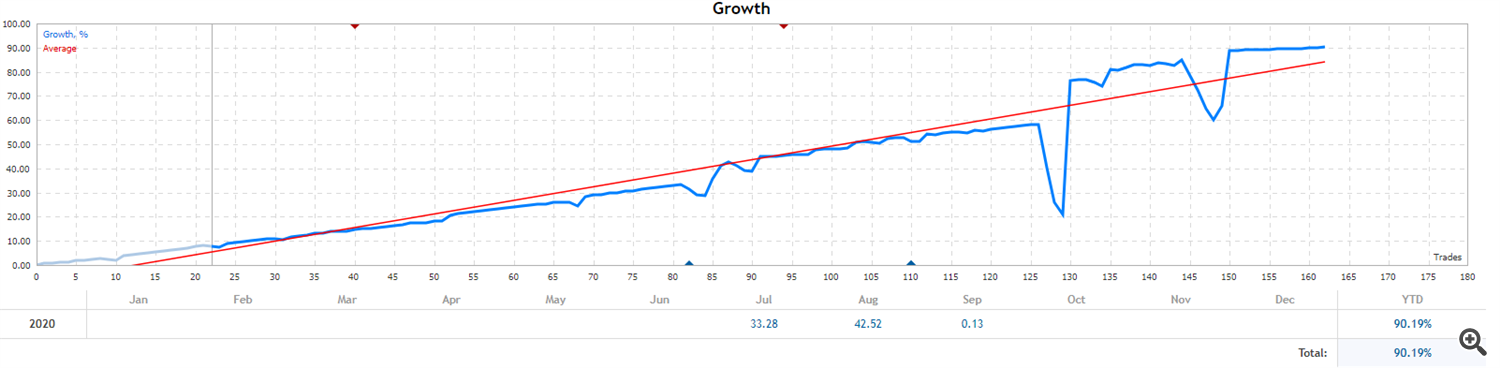

EA Long Term Strategy

https://www.mql5.com/en/market/product/35069

Trading strategy in the EA Long Term Strategy (fix stop loss, safe strategy)

#EURUSD #GBPUSD #NZDUSD #USDJPY #XAUUSD 08.09.2020analysis