Review of fundamental events for key economies of the world USA, Eurozone, Great Britain, Japan, Australia, Oil 03.09.20

United States of America

The focus of US investors is on yesterday's August US employment data from ADP. The indicator grew from 212 to 428 thousand, but seriously fell short of the forecast of 950 thousand. The service sector expanded the most, with 389,000 new jobs created. The day before, Treasury Secretary Stephen Mnuchin rejected a cutback economic stimulus plan from the Democratic Party in the amount of $ 2.2 trillion. Representative spokeswoman Nancy Pelosi said there are still serious differences of opinion between the parties over the support package for the US economy.

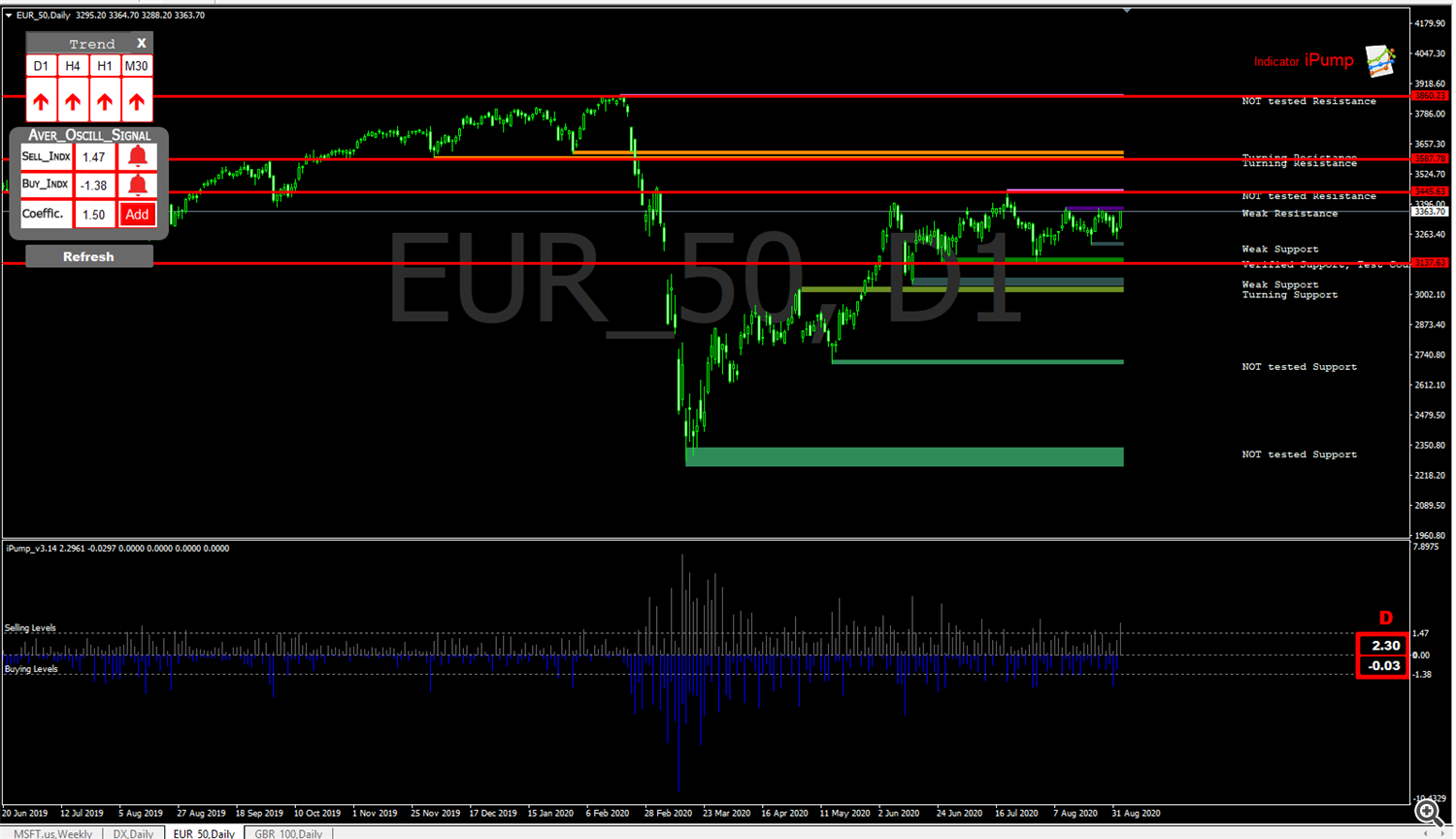

Eurozone

The euro is under pressure from the weak data on German retail sales for July. On a monthly basis, their volume, instead of the expected growth of 0.5%, decreased by 0.9%, and on an annualized basis - increased by 4.2%, which is less than the June growth of 6.7%. The decline in German retail sales has occurred for the second month in a row and may continue this trend in the event of a second wave of the coronavirus pandemic in European countries.

Great Britain

The British currency is weakening against the US dollar, but is strengthening against the euro and yen.

In the absence of significant economic releases, government actions remain the focus of British investors. Yesterday Boris Johnson reiterated that he wants to return the British to work, and therefore the job preservation program is likely not to be extended and it will end in October.

Japan

In the absence of significant economic releases, the movement of the yen is technical in nature. Bank of Japan Deputy Governor Masazumi Wakatabe said the regulator must continue to adhere to its 2.0% inflation target and respond to any price increases or decreases. He also noted that the Bank of Japan needs to further consider what kind of monetary policy should be pursued during the pandemic, while taking into account the actions of other central banks.

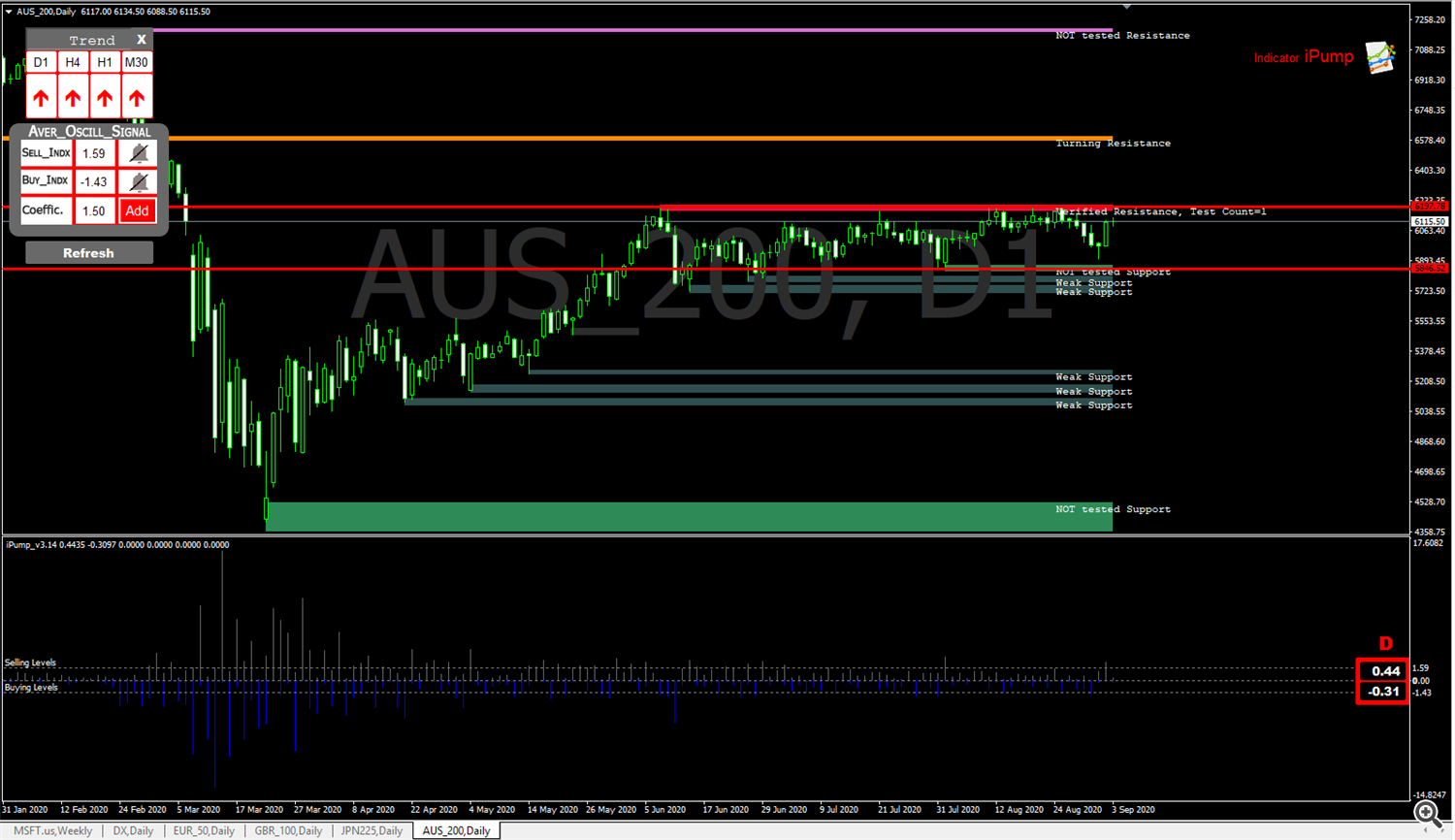

Australia

Oil

Oil prices are moderately correcting downward. The instrument is influenced by opposite factors. Its growth is facilitated by the decline in US oil reserves by 6.360 million barrels, according to API data. On the other hand, the positive dynamics is held back by the increase in the supply of "black gold" by the OPEC countries, which began in August. According to the latest data, the UAE exceeded the oil production quota last month by 100 thousand barrels per day, which was caused by the growth of energy consumption in the country. UAE Energy Minister Suheil al-Mazroui promised that the country would cut supplies of all grades of oil in October to offset overproduction. During the day, investors await the publication of the weekly report on the number of US oil reserves from the EIA. The figure is expected to decline by 1.887 million barrels, which may support quotes.

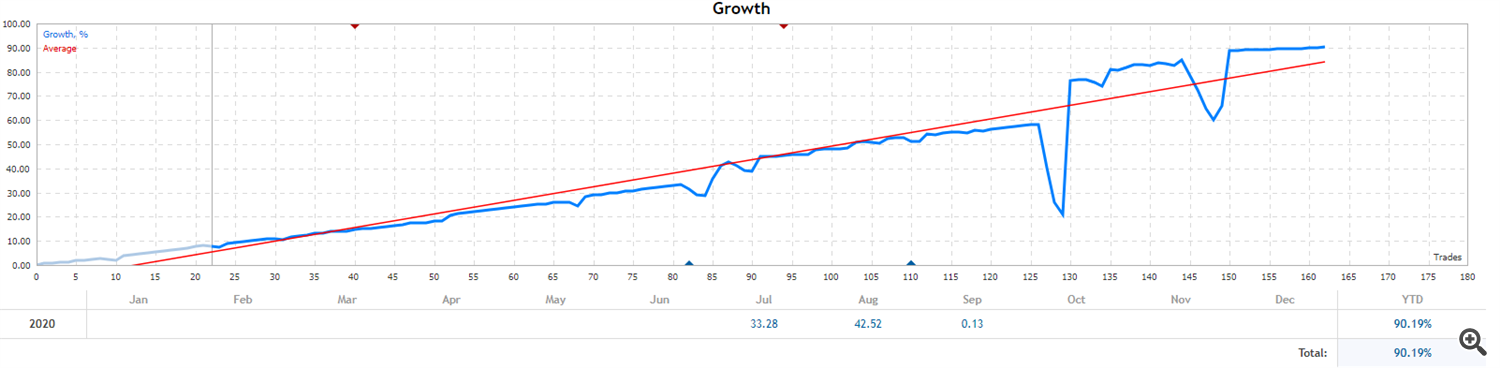

For this analysis I use iPump indicator

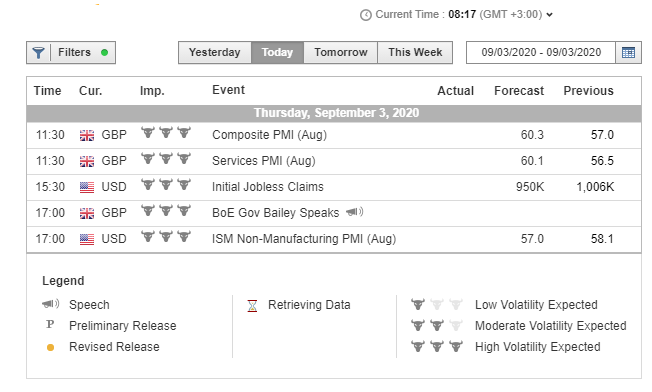

Important news for today

The iPump indicator was used for this analysis

https://www.mql5.com/en/market/product/39895

Indicator defining the trend, levels, overbought / oversold

EA Pump and Dump Pro

https://www.mql5.com/en/market/product/51395

https://www.mql5.com/en/market/product/51395

Multifunctional robot (averaging/piramiding/strategy for overclocking a deposit)

EA Long Term Strategy

https://www.mql5.com/en/market/product/35069

Trading strategy in the EA Long Term Strategy (fix stop loss, safe strategy)

#USA

#Eurozone

#Great Britain

#Japan

#Australia

# Oil

#03.09.2020analysis