On July 31 of this year, the administration of US President Donald Trump announced that the popular social application TikTok, owned by the Chinese company ByteDance, could pose a serious threat to the country's national security, since it belongs to China and can transfer personal data of users in the United States. After that, at a press conference, Trump himself said that it was in his power to ban the application in the United States, and he was ready to do this in the near future. However, after the president noted that he would not mind if any American company acquired TikTok. At the moment, one of the main contenders for such a deal is Microsoft.

Now there is little official information on the structure of the purchase itself, but the procedure itself proceeds according to a scheme already familiar and tested in the United States, according to which the assets of the Chinese company Kunlun Tech were acquired. September 15th is the date for the final decision. It should be understood that this is not the moment of the actual purchase, but only the date by which Microsoft will have to send an official letter with the actual offer if a positive decision is made. According to the latest data from ByteDance itself, the value of the entire business is estimated at $ 30 billion. However, a number of US sources are already citing figures of $ 50 billion only for the American segment of the company. They are most likely only guesses, not supported by actual estimates. A number of other companies are applying for the purchase of the application, including Twitter. With a high degree of probability, this is done only in order to provoke the so-called "war of bids", thereby increasing the amount of the actual transaction. Twitter's capitalization is 28 billion, which means that it will not be possible to carry out such a deal at its own expense and will have to raise borrowed capital. Given that TikTok has not yet been monetized, the ROI for Twitter is close to zero.

With a high degree of probability, Microsoft is the only contender for the purchase of the service, and this acquisition will take place. However, the structure of the deal itself will affect the consequences. Microsoft recently said, “The new framework will build on the existing TikTok experience that users love and know, while adding top-notch security, privacy and enhanced security measures. The company's actions will be transparent to users, and the authorities of the respective states will be able to monitor the security of their citizens' data. " Thus, not a complete takeover is planned, but only the release of a special version of the application for US citizens. However, in any case, the very fact of acquiring this part of the business is a great success for Microsoft, which may ultimately lead to an increase in its shares. According to John Robert Dorfman's model, the value of the acquiring company's shares may increase by 10-30% depending on the prospects of the resulting business. According to leading analysts, TikTok is one of the most promising platforms.

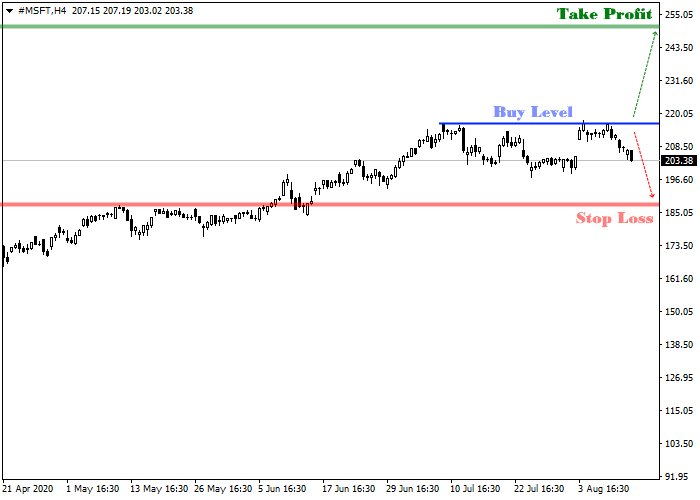

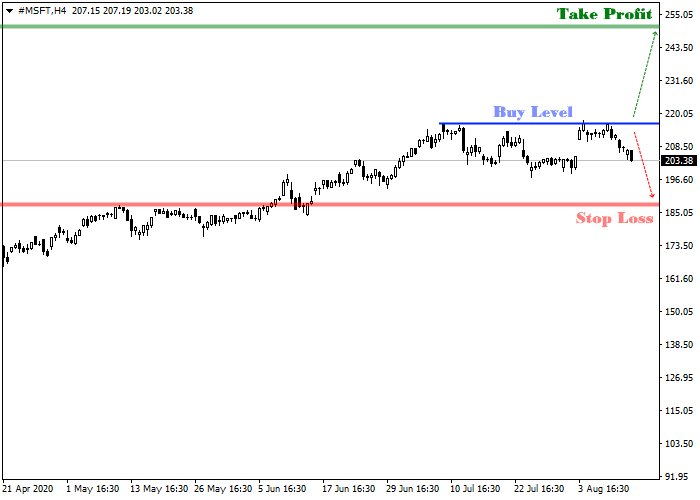

In addition to the underlying fundamental factors, the technical picture also speaks for the possible growth of the company's shares in the near future. On the global weekly chart, the price is in an uptrend and is slightly correcting downward.

As you can see on the chart, the price is moving within the global upward wedge pattern and is correcting to the support line. Around 187.00 there is a buy signal cancellation zone. If the support line of the “wedge” pattern is crossed, the upward scenario will be either canceled or significantly delayed in time, and open buy positions should be liquidated. The target zone is located around the 250.00 mark. If it is reached, profit should be taken on open buy positions. In the area of the local maximum from August 3 at around 216.00 there is an entry zone for buy deals. When these levels are reached, all the key markers of the continuation of the main trend will be fulfilled, and confidence in the further upward movement will be sufficient to open buy positions.

In more detail, trade entry levels should be evaluated on a 4-hour chart.

The entry level for buy deals is at 216.00, and a local signal can be received in the coming days. Technically, the breakdown of the local maximum is realized, after which the breakdown of the resistance line of the "wedge" pattern will take place. After that, there will be no significant resistance on the way of the price to the target level of 250.00, and the positions can be realized.

Given the nature of the underlying fundamental factors, the instrument can reach the target zone at any time during one trading session. However, in case of gradual growth, it will be necessary to take into account the average daily volatility for the last month, which is 212 points, and the movement of the rate to the target zone of 250.00 in this case may take about 27 trading sessions.

#Microsoft and TikTok